Brilliant Strategies Of Info About Agriculture Balance Sheet Taxable Temporary Difference Example

For example, it is unclear how and to what extent an entity would allocate the reversal of the taxable temporary difference between the recognised and unrecognised portions of the deferred tax liability.

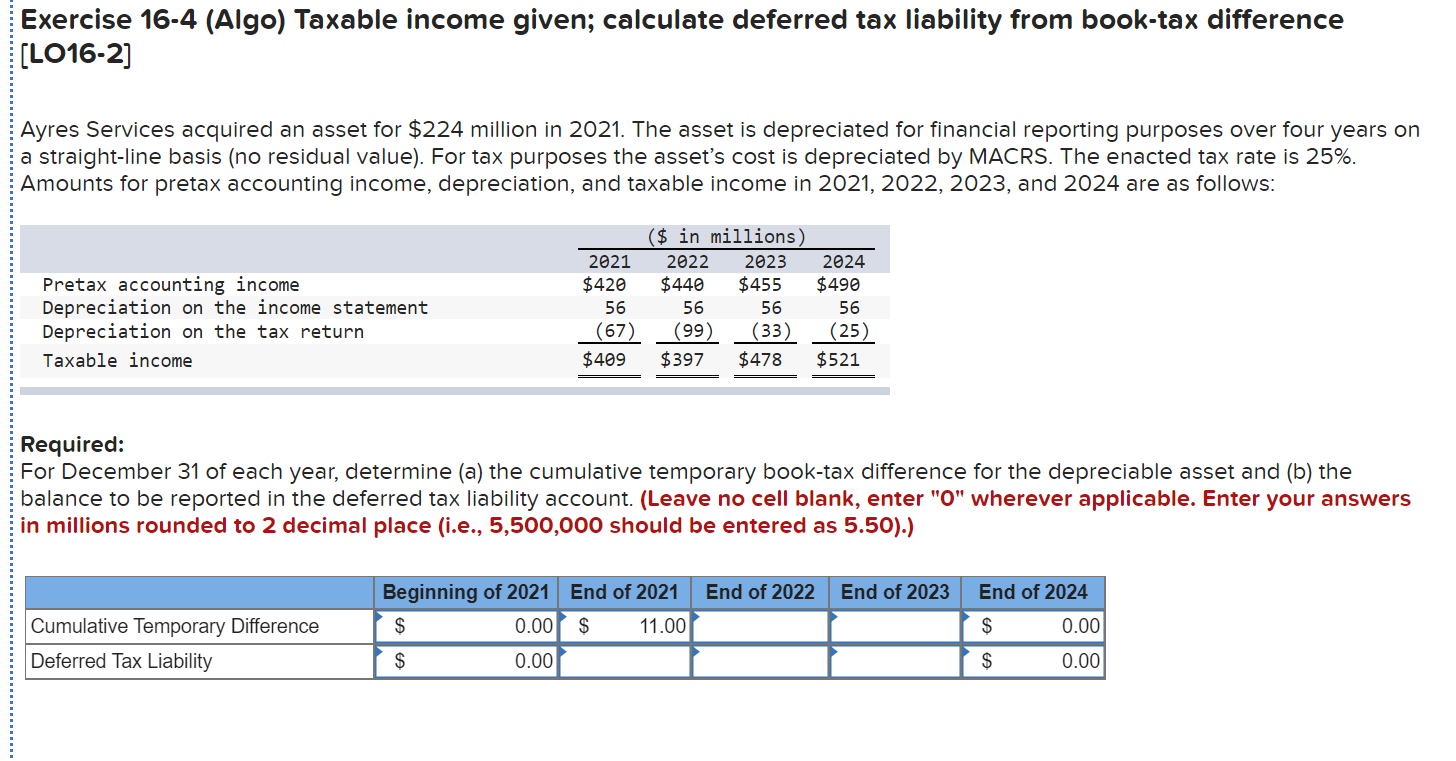

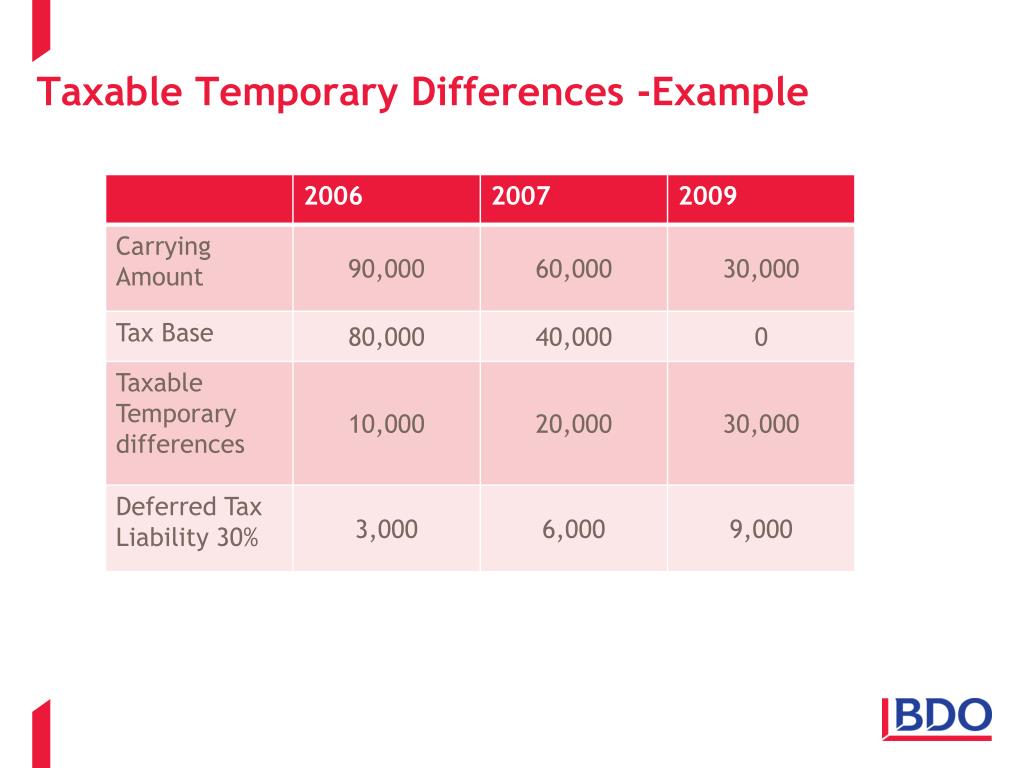

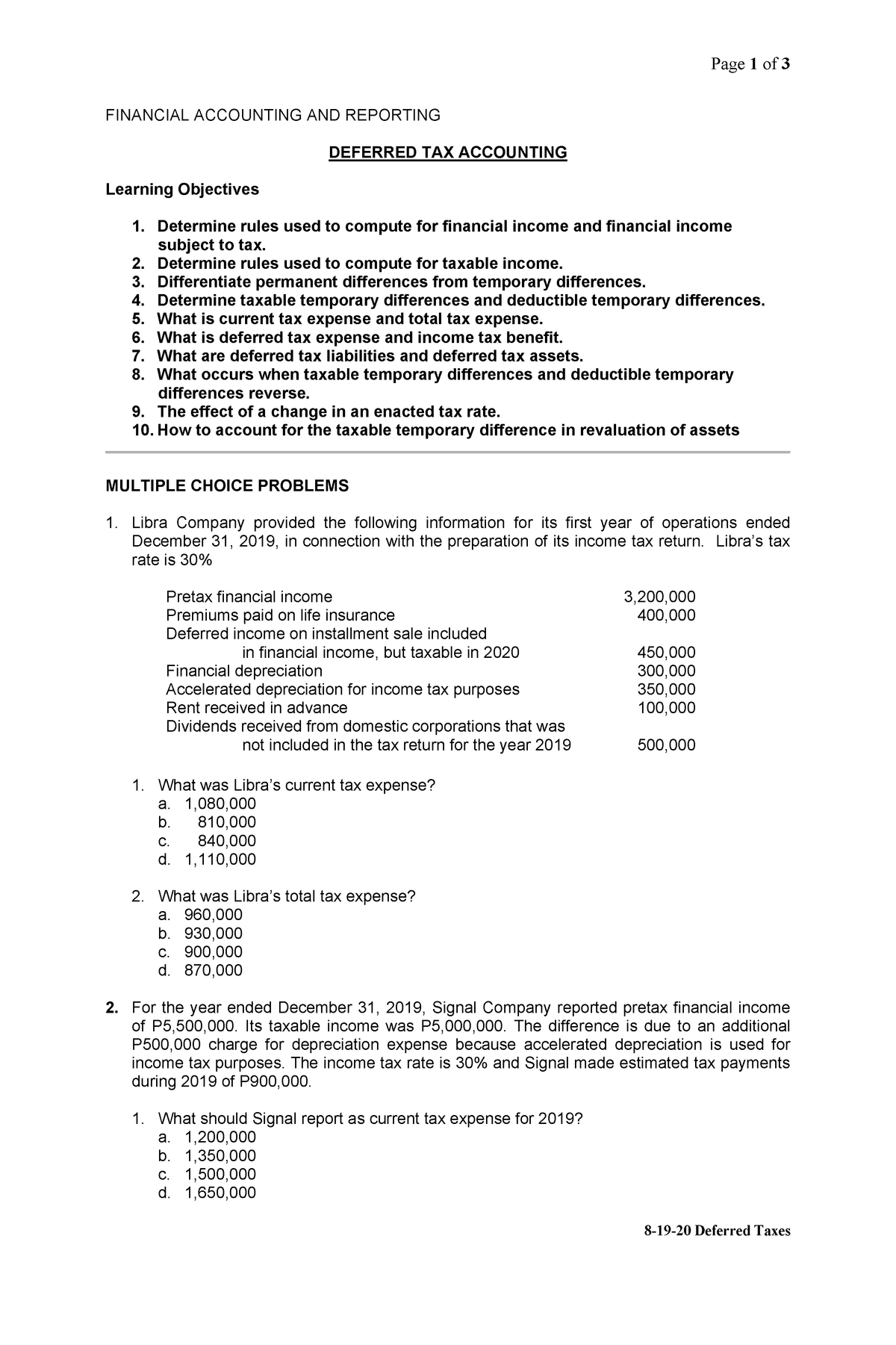

Agriculture balance sheet taxable temporary difference example. A temporary difference can be either of the following: Interim balance sheets often used/needed for loan applications. The tax base is $48,000 and there is a taxable temporary difference of $16,000 ( ).

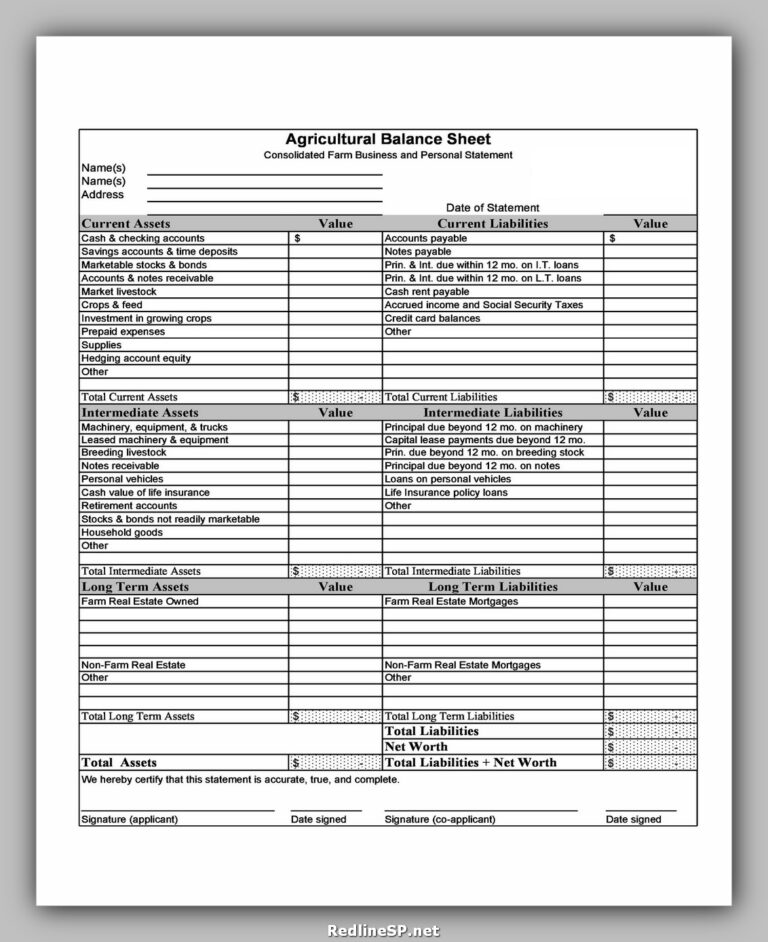

Temporary differences can be said to be taxable temporary differences. Income or expense items that are not allowed by tax legislation; Typically for end of accounting period, such as end of year for taxes.

All permanent differences result in a difference between a company’s effective tax rate and statutory tax rate. December 17, 2020 what are temporary differences? Taxable and deductible temporary differences.

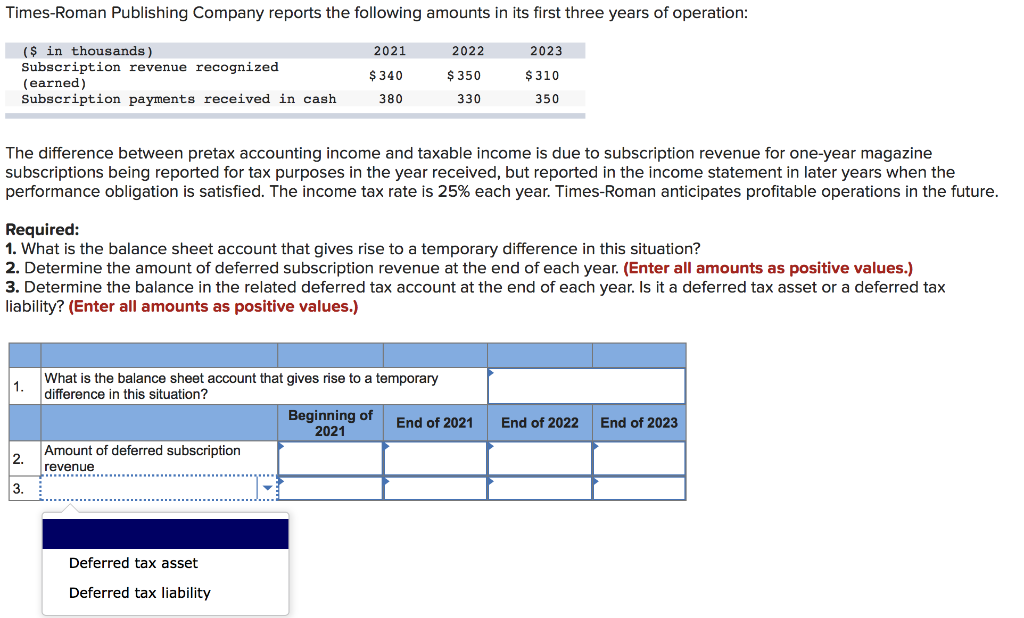

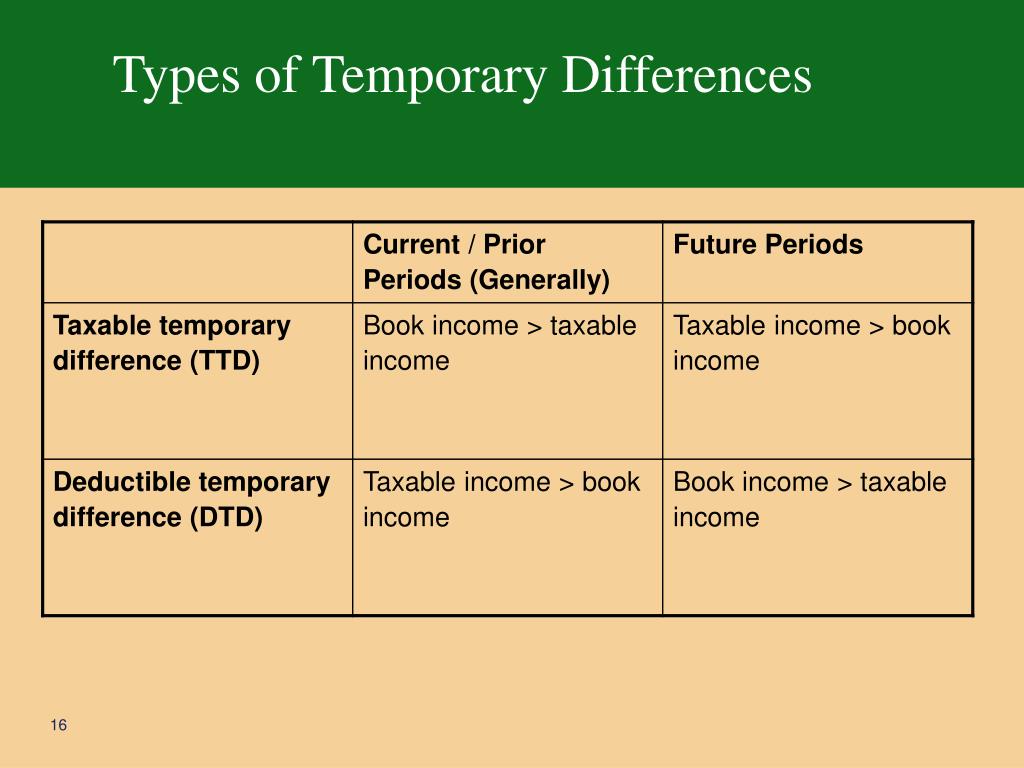

Or (b) deductible temporary differences, which are temporary. Temporary differences arise when the treatment of an income statement line item is the same for both tax and accounting purposes, but the timing of this treatment is different.

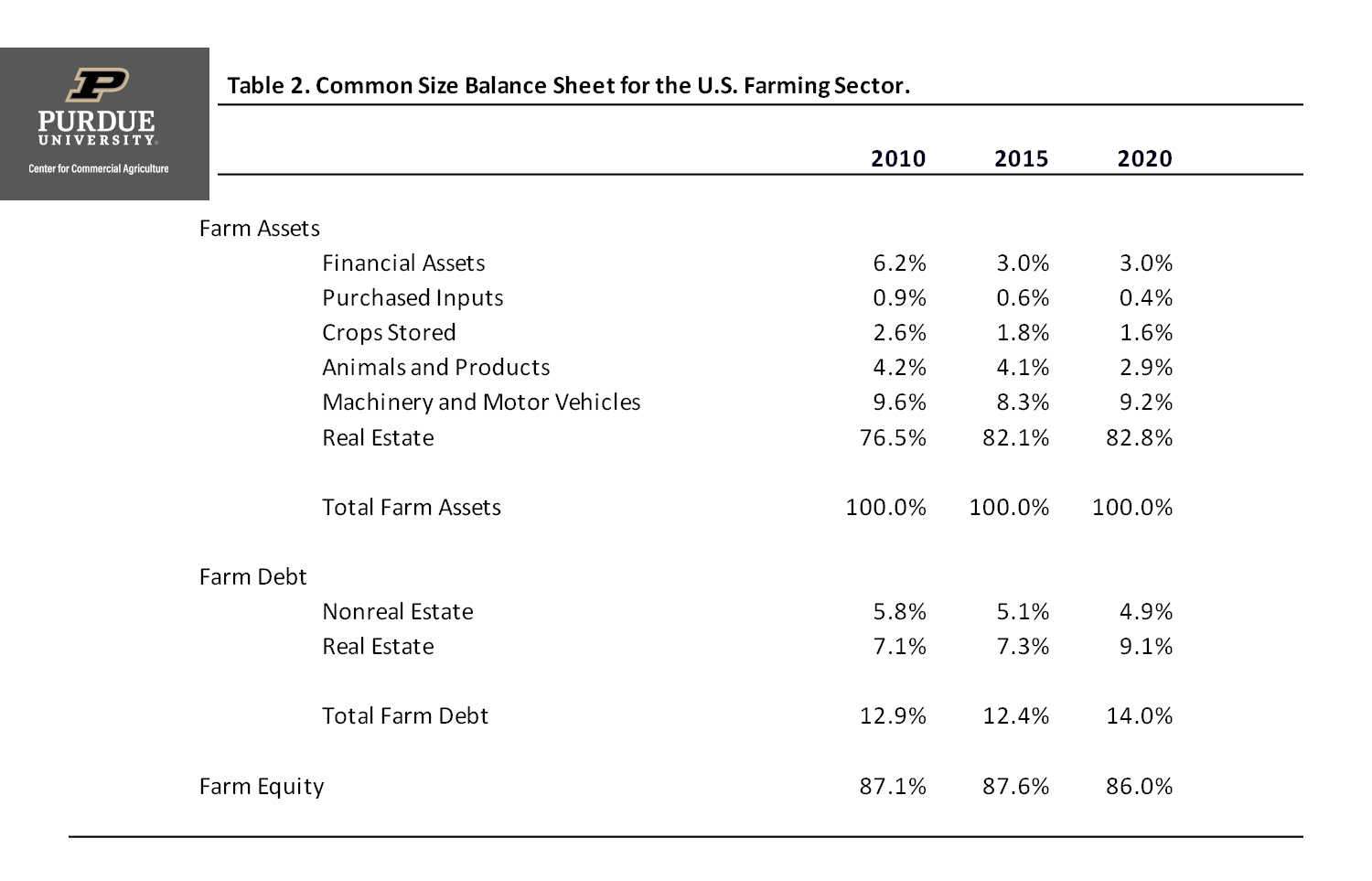

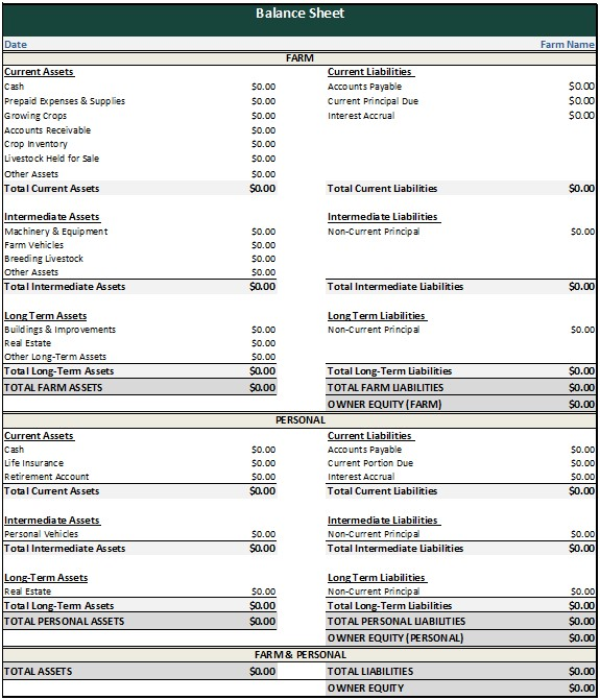

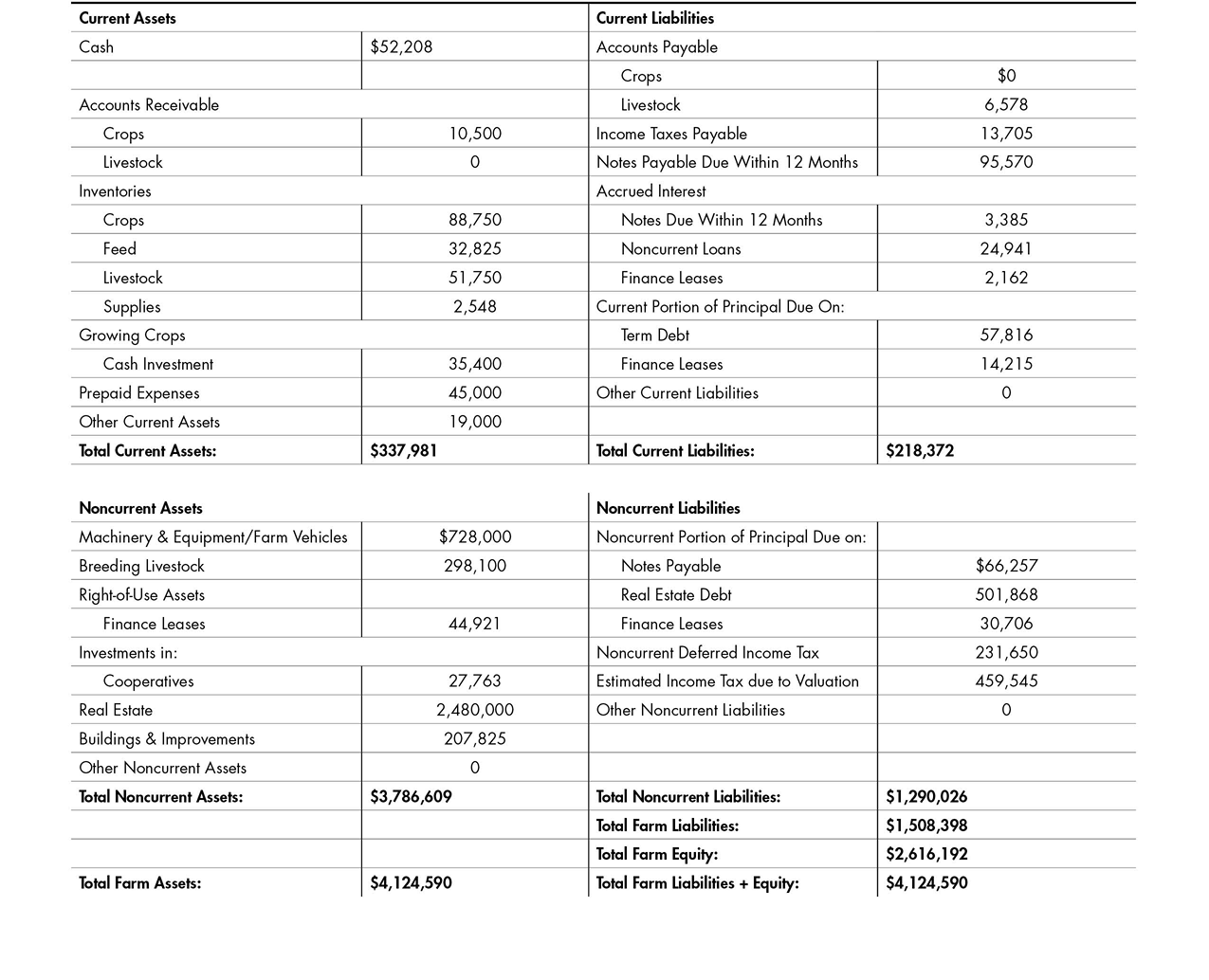

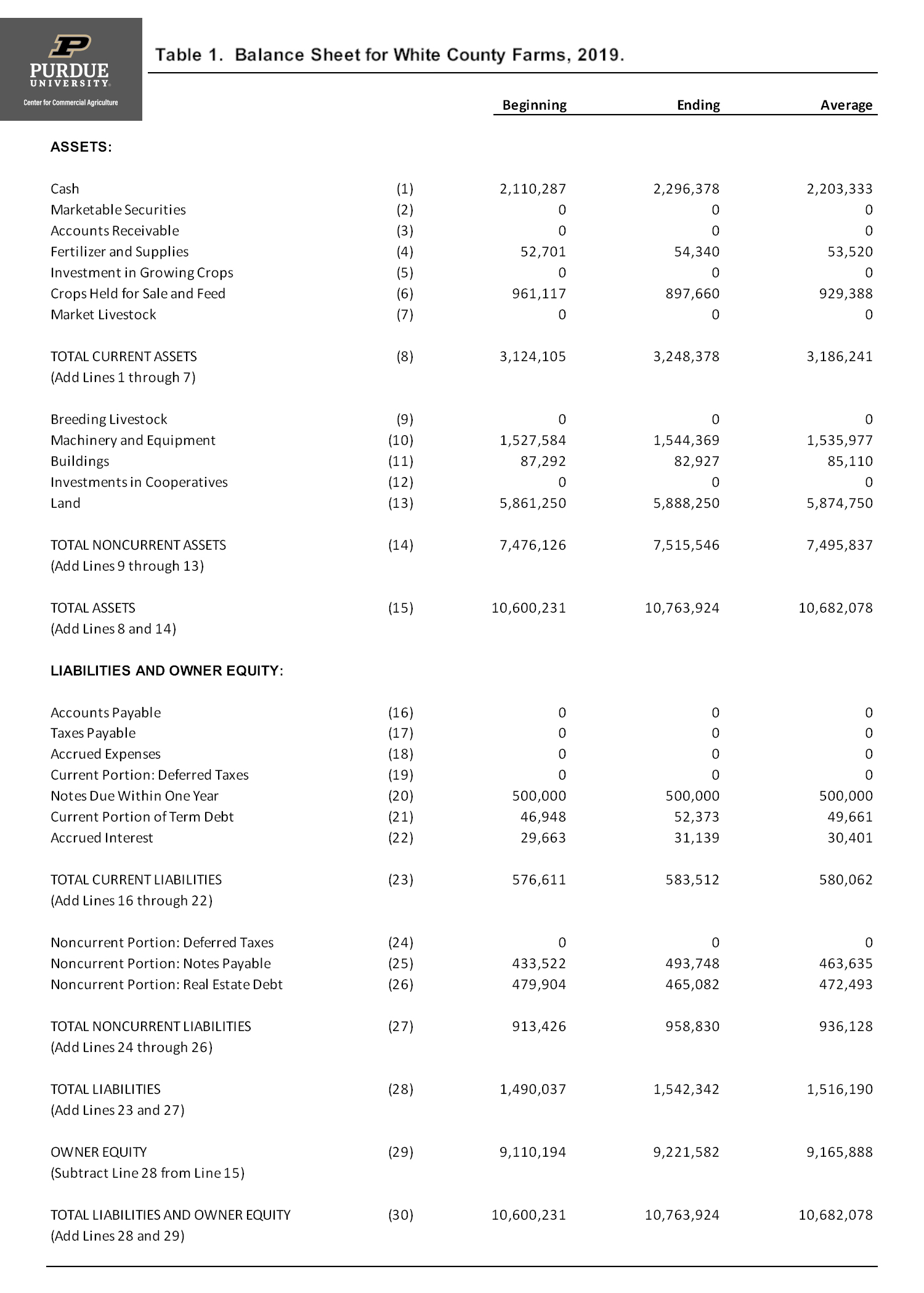

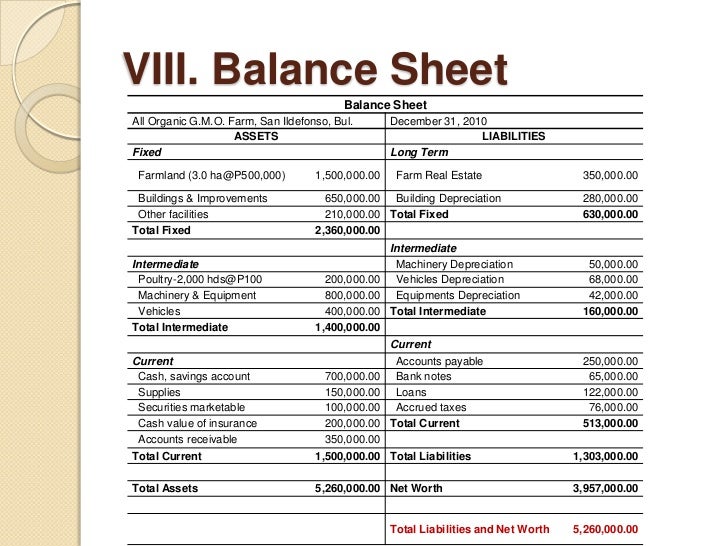

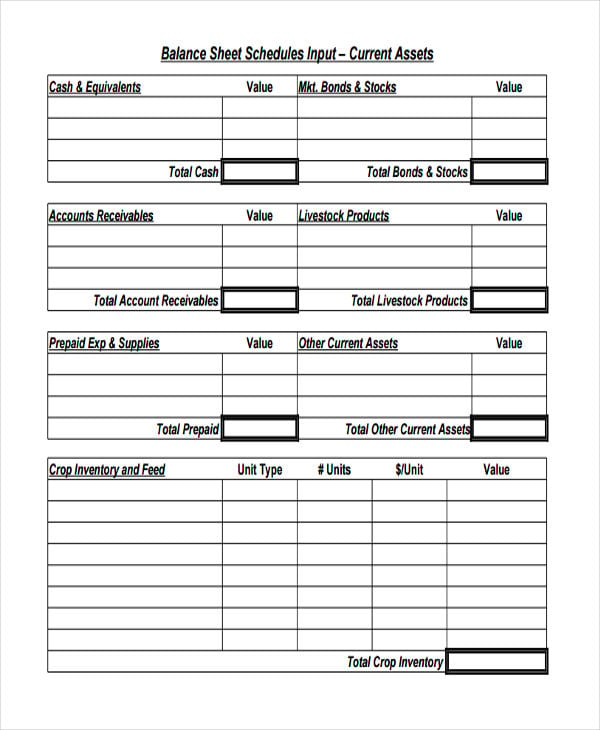

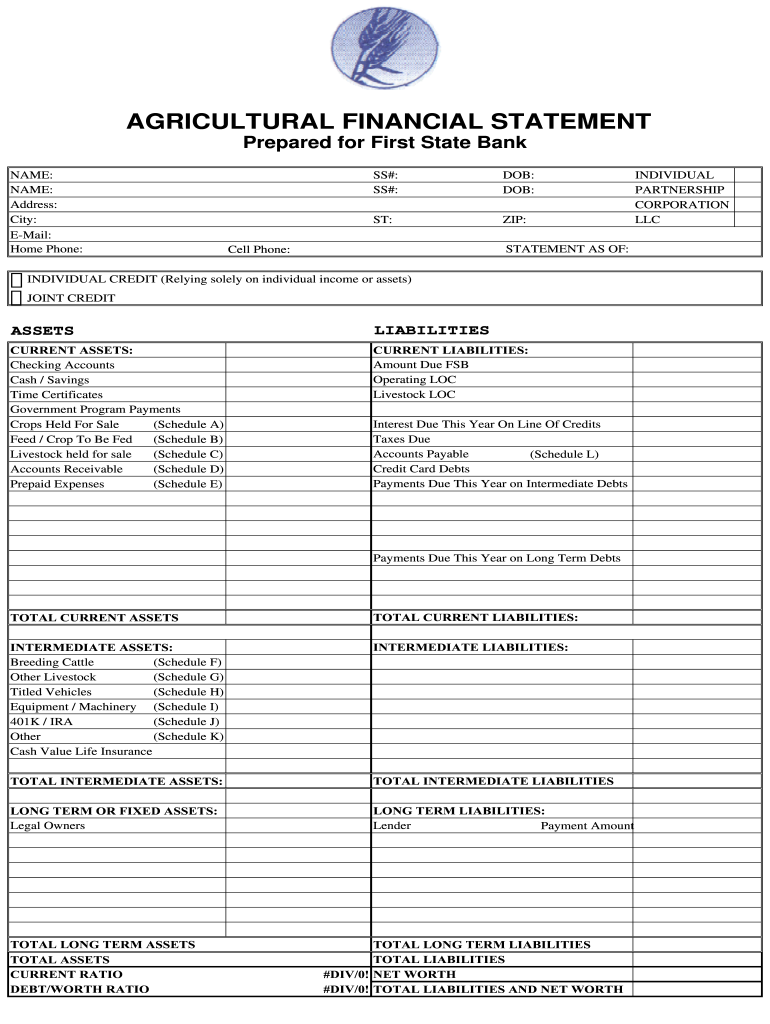

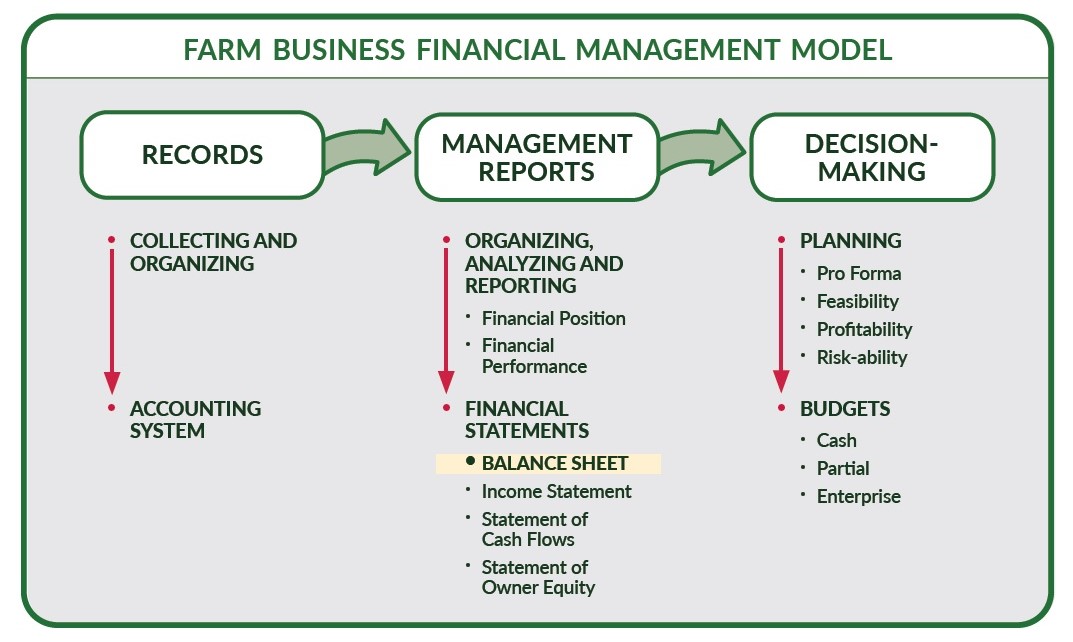

Temporary differences are differences between the carrying amount of an asset or liability in the balance sheet and its tax base. This means the income tax payable is lower than the accrual income tax expense, creating a deferred tax liability. It lists what you own (assets) and what you owe (liabilities) with the difference between them indicating how much the farm business is worth (owner equity/net worth).

Taxable temporary differences will result in taxable amounts in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled. And tax credits for some expenditures directly reduce taxes. Accrued revenue by an entity, taxable upon cash collection,

(a) taxable temporary differences, which are temporary differences that will result in taxable amounts in determining taxable profit (tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled; Temporary difference is the difference between the value of an asset or liability in the balance sheet following the accounting base and its tax base. Ey says it is unclear whether the application of the capping proposal reduces the taxable

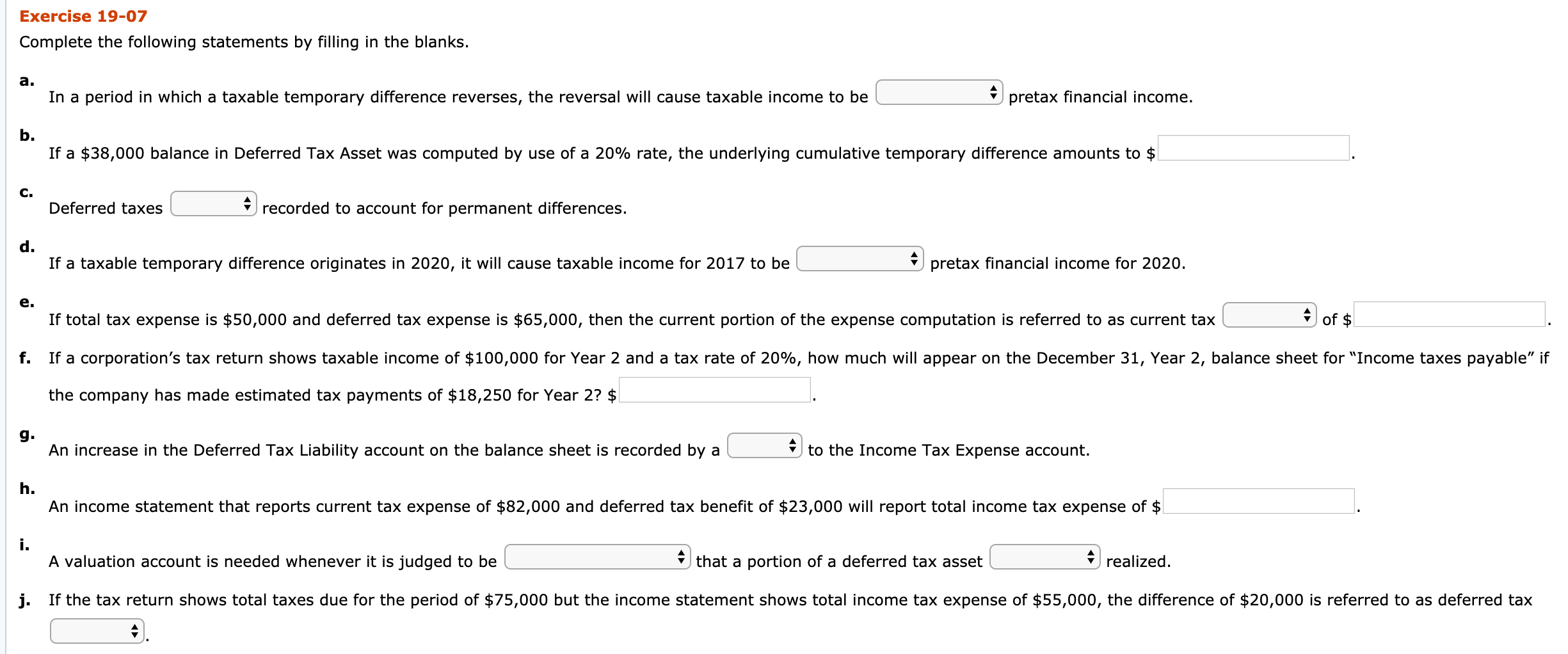

The method of accounting for such a temporary difference depends Identify temporary and permanent differences and operating loss and tax credit carryforwards abc company reviewed its trial balances and noted the following items that were treated differently for Taxable temporary differences:

Examples of the items which give rise to permanent differences include: The balance sheet, income statement and cash flow projection. Temporary differences may be either:

A balance sheet is a “snapshot” of the financial health of your farm business at a single point in time. Current liabilities include $21,000 of unearned subscription revenue that was paid in advance and the revenue was taxed in the current period when it was received. A temporary difference may arise on initial recognition of an asset or liability, for example if part or all of the cost of an asset will not be deductible for tax purposes.