Brilliant Info About Lyft Financial Statements

Lyft financial statements. Lyft, inc (the “company” or “lyft”) started a movement to revolutionize transportation. Cl a annual stock financials by marketwatch. Cl a balance sheet, income statement, cash flow, earnings & estimates, ratio and margins.

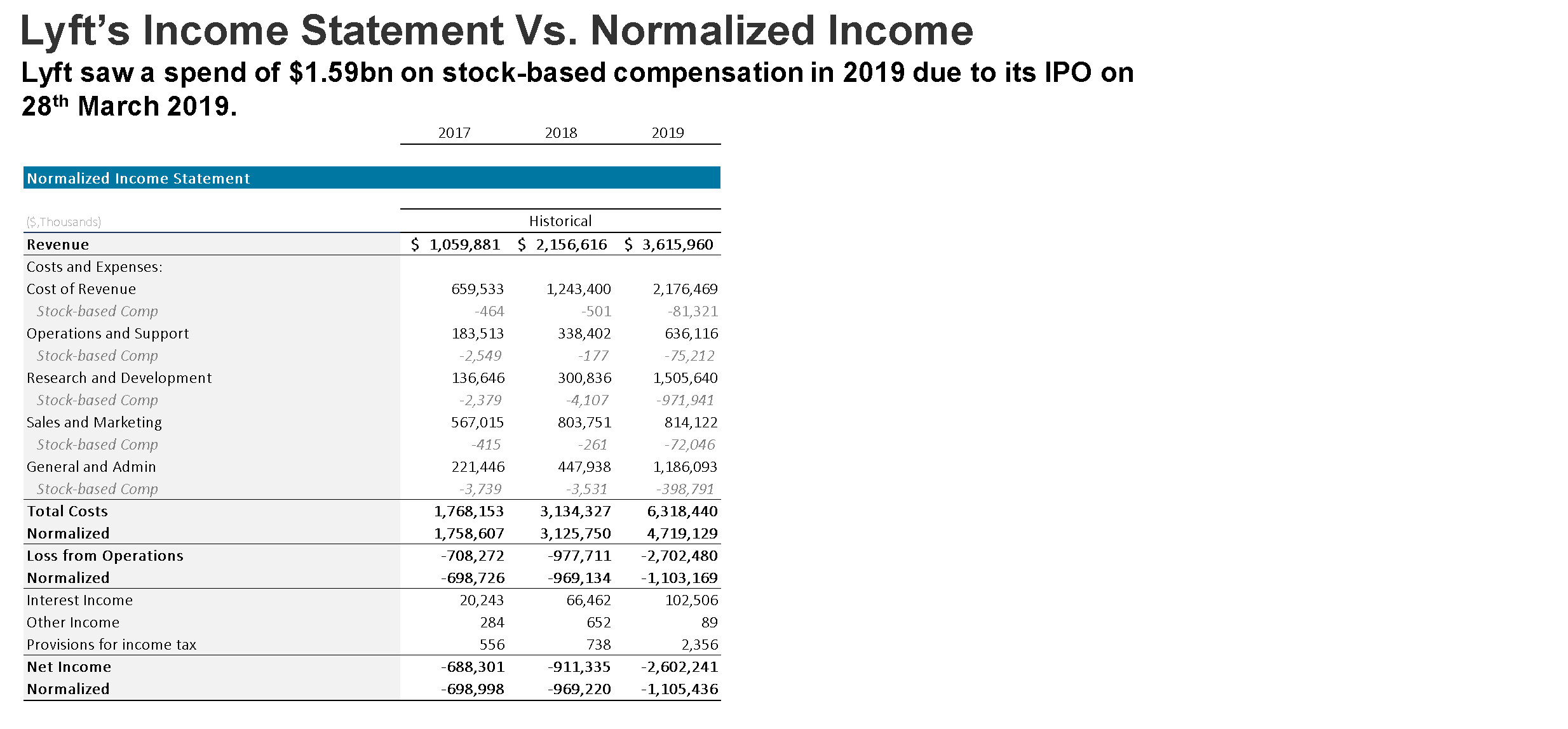

Get the detailed quarterly/annual income statement for lyft, inc. (nasdaq:lyft) today announced financial results for its first quarter ended march 31, 2021. However, the stock is still about 77% below its debut price.

Net loss for q2 2021 was $251.9 million versus a net loss of $437.1 million in the same period of. In the first two quarters of 2023, the company had released, opens new tab guidance on adjusted ebitda margin. Lyft said adjusted earnings before interest, tax, depreciation and amortization were $66.6 million in the fourth quarter, beating the $56 million estimated by analysts.

However, the stock is still about 77%. February 13, 2024 at 2:57 pm pst. It reported a net loss of.

(nasdaq:lyft) today announced financial results for the fourth quarter and fiscal year ended december 31, 2022. Markets never sleep, and neither does. Lyft is a leading multimodal transportation network that connects millions of riders and drivers in the us and canada.

Lyft beat estimates for quarterly profit on tuesday and said it would generate positive free cash flow for the first time in 2024, as it cut costs and became more competitive with larger rideshare. Created with highstock 2.1.8. View lyft financial statements in full, including balance sheets and ratios.

View lyft financial statements in full. Bloomberg daybreak europe, anchored live from london, tracks breaking news in europe and around the world. Changes in and disagreements with accountants on accounting and financial disclosure 127 item 9a.

Lyft said adjusted earnings before interest, tax, depreciation and amortization were $66.6 million in the fourth quarter, beating the $56 million estimated by analysts. In 2020, lyft had around 19 million active riders who spent an average of $51 per ride. (nasdaq:lyft) today announced financial results for its fourth quarter and fiscal year ended december 31, 2021.

The company expects gross bookings to reach up to $3.6 billion in the first quarter, topping analysts. Condensed consolidated statements of operations (in thousands, except for per. Learn more about lyft's vision, strategy, and financial performance in its 2021 annual report.

(lyft) including details of assets, liabilities and shareholders' equity. Changes in and disagreements with accountants on accounting and financial disclosure 127 item 9a. Issued a massive correction to its outlook for earnings margin in 2024, saying its margin is expected to expand by 50 basis points — not the 500 basis.

:max_bytes(150000):strip_icc()/ScreenShot2019-08-26at6.52.02AM-e419165e1a6b483ab06bfc8269cbcb5c.png)