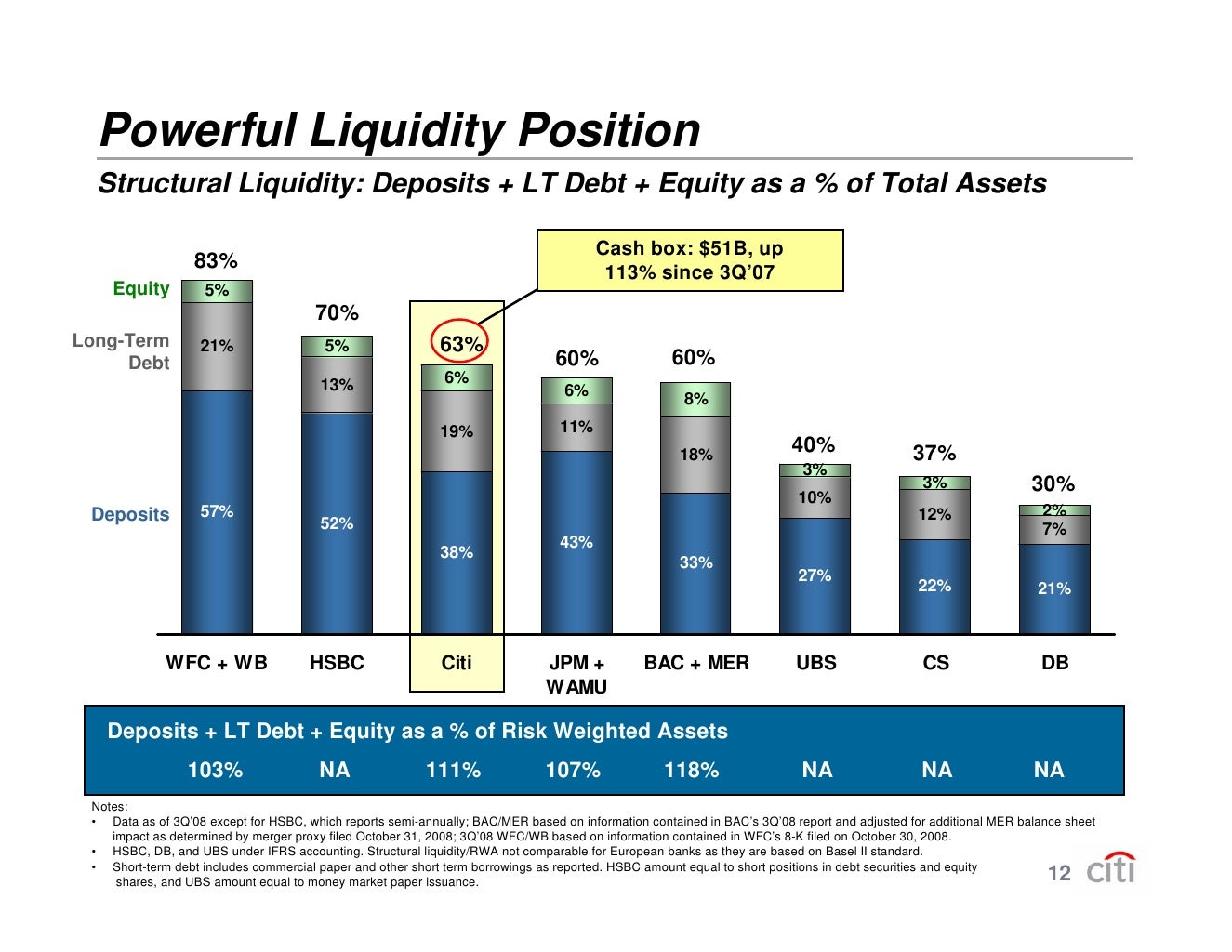

Looking Good Info About Liquidity Position Formula

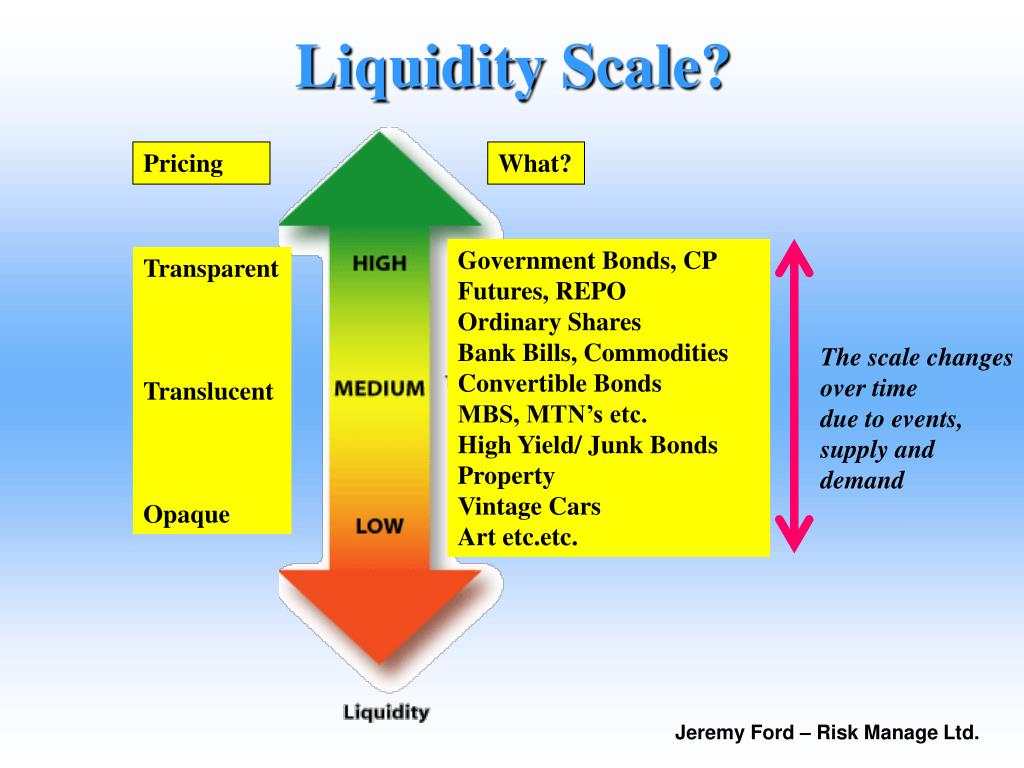

Some things you own such as.

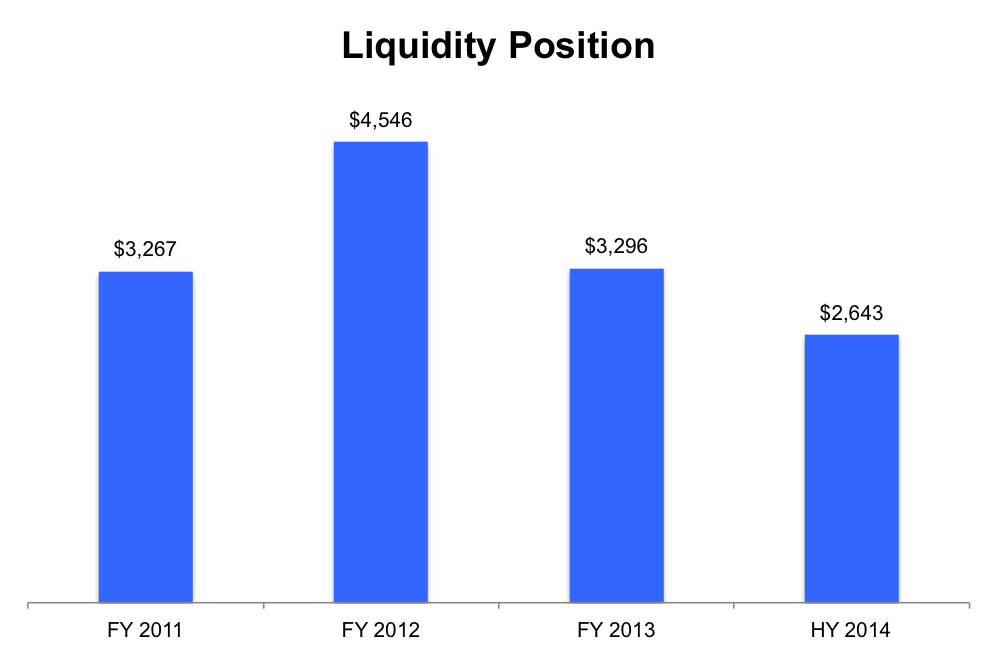

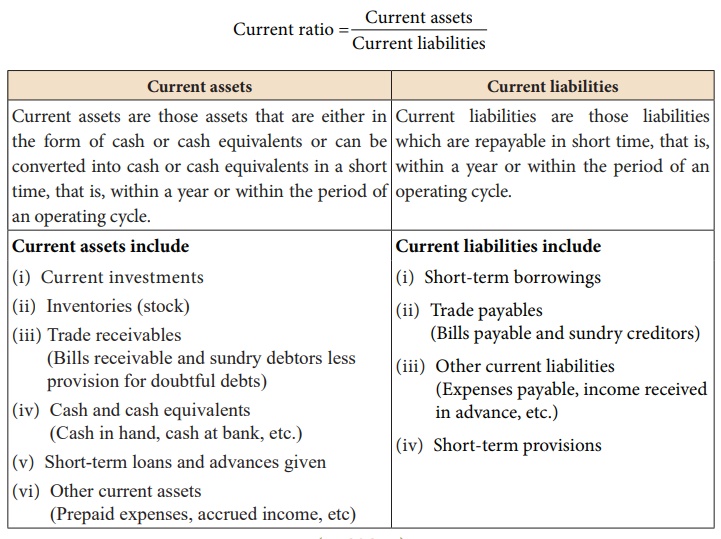

Liquidity position formula. Of the ratios listed thus far, the cash ratiois the most conservative measure of liquidity. Cash ratio = $100,000 / $150,000 = 0.67. The higher the current ratio, the better the liquidity position of a firm.

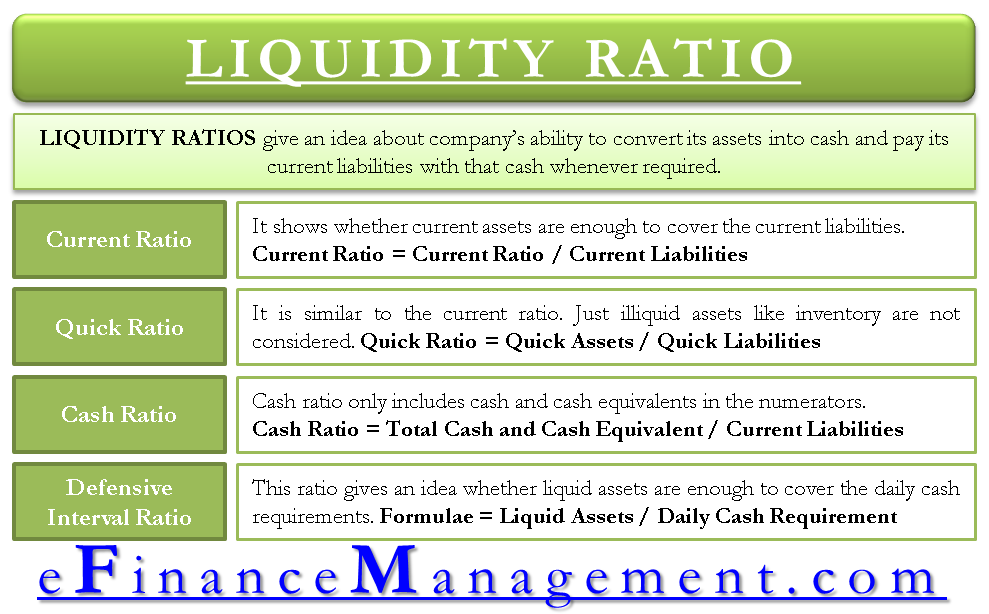

Assess organizational performance using liquidity ratios. As the numerator, we use the total current assets or several. So, depending on what you are.

Its liquidity ratios would be: Current ratio = current assets / current liabilities also known as the working capital ratio, this metric is the easiest to calculate and interpret. Current ratio = ($100,000 + $200,000 +.

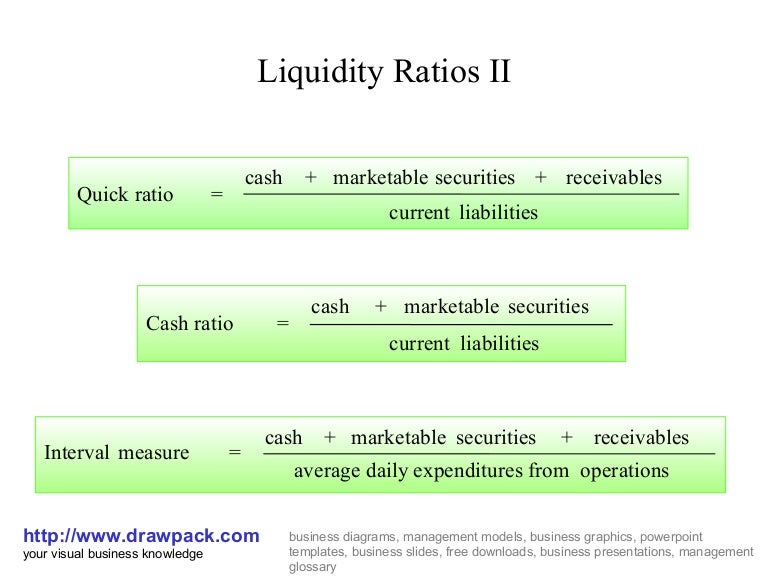

Financial metrics are indicative of a company’s financial. Quick ratio = (cash + marketable securities + accounts receivable) / current liabilities the ideal quick ratio should be one (1) for a financially stable company. If the cash ratio equals 1.0x, the company has exactly enough cash and cash.

Current ratio we calculate them by comparing the components in current assets with current liabilities. It measures the company's liquidity. Quick ratio = ($100,000 + $200,000) / $150,000 = 2.0.

Consider all of the assets you own. Current liabilities using its current assets. This ratio must be 100% or higher for.

Updated july 19, 2022 reviewed by amy drury fact checked by katrina munichiello what is financial liquidity? The three main liquidity ratios are the current ratio, quick ratio, and cash.

/Balance-Sheet-56a0a31d5f9b58eba4b25300.gif)