Amazing Info About Simplified Profit And Loss Statement

How profit and loss statements work

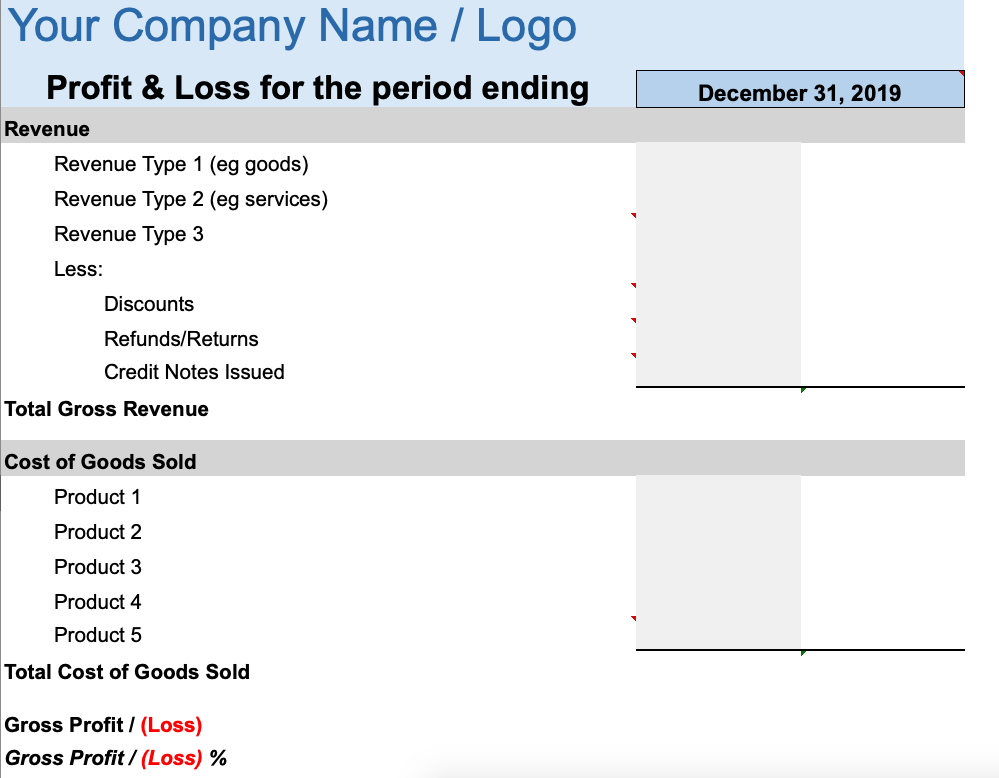

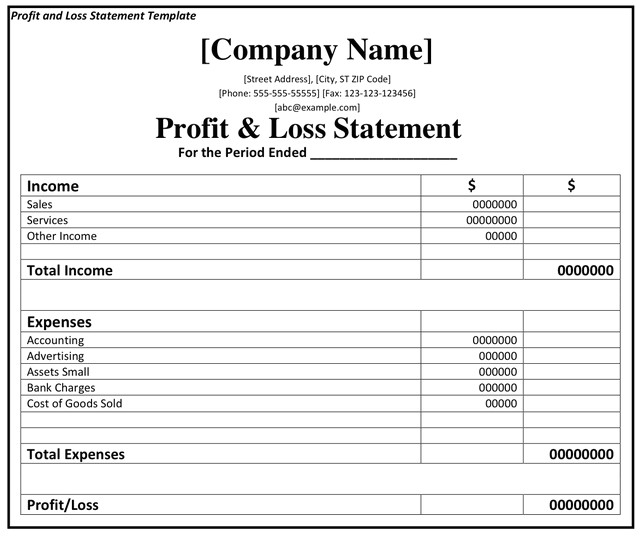

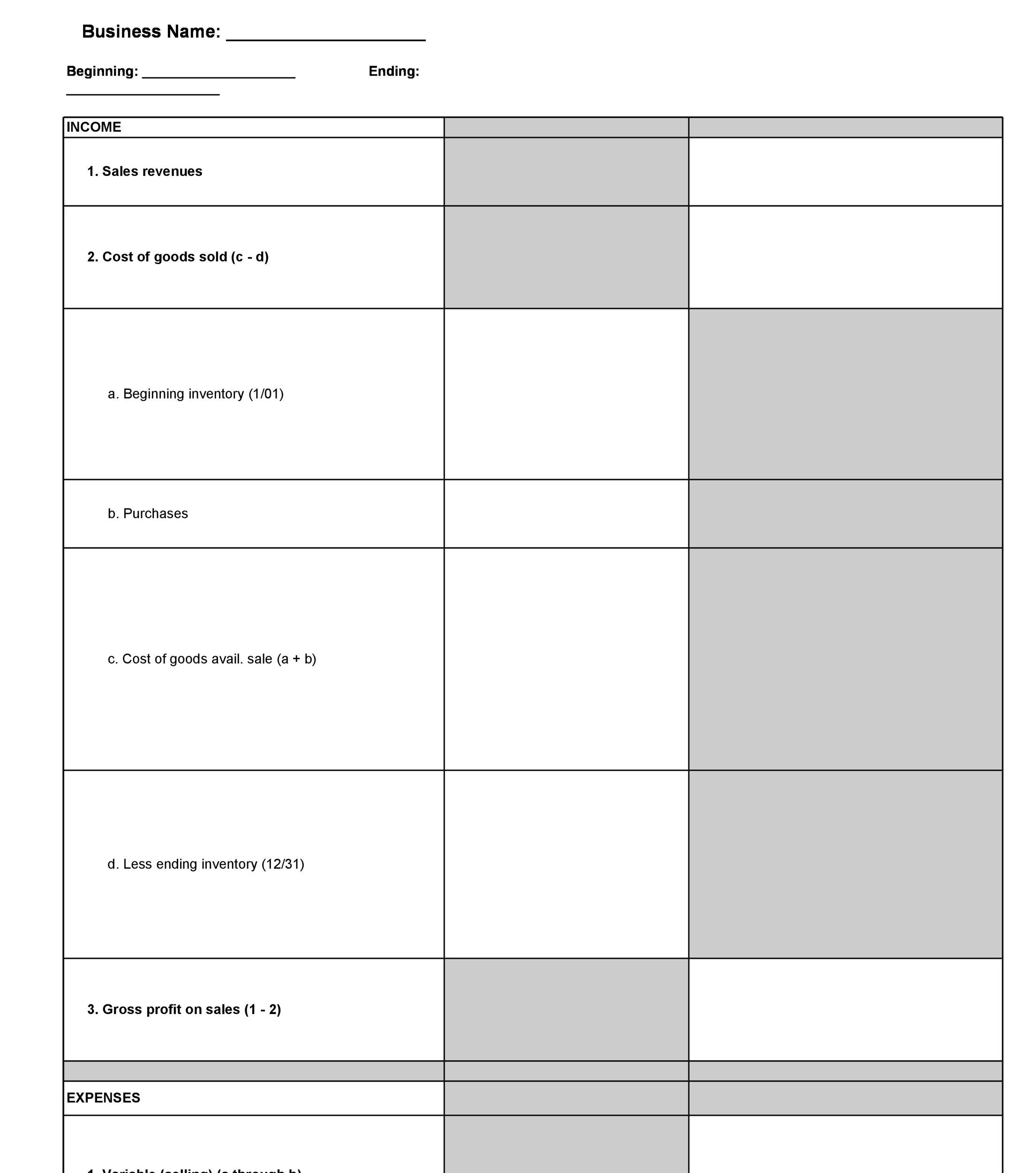

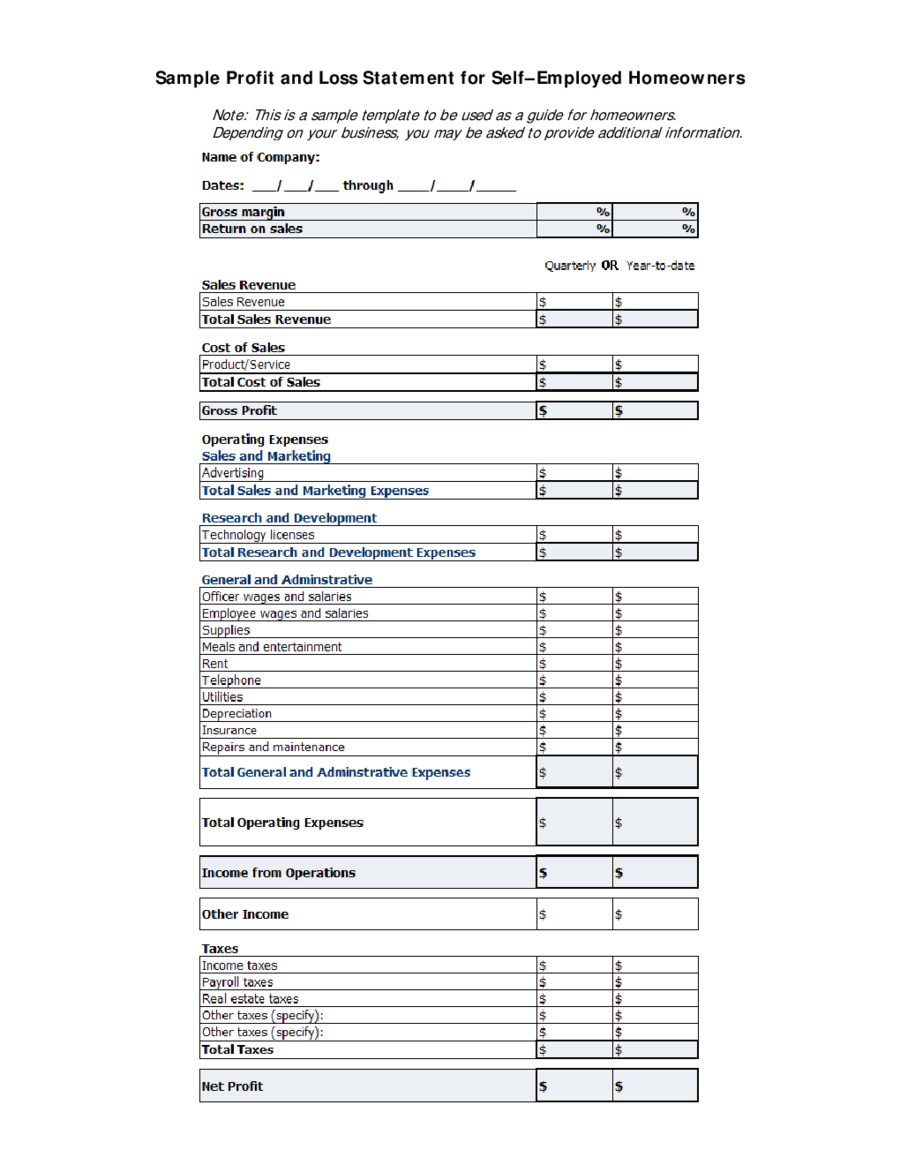

Simplified profit and loss statement. The single step profit and loss statement formula is: Example expenses include staff wages, office rent, utilities, insurance costs, supplies, and taxes. The outcome is either your final profit or loss.

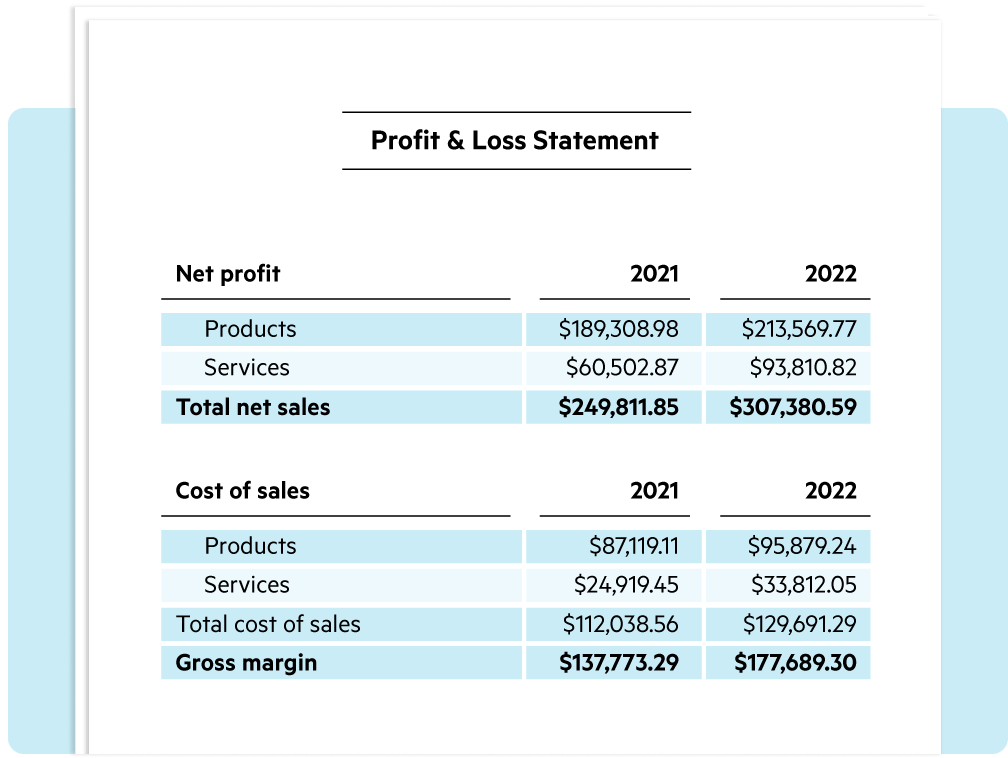

More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). Ultimately, it helps show whether a company is making a profit or losing money. The p&l statement is one of three.

You usually complete a profit and loss statement every month, quarter or year. The final figure will show the financial performance and show if the business has made a profit or loss. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

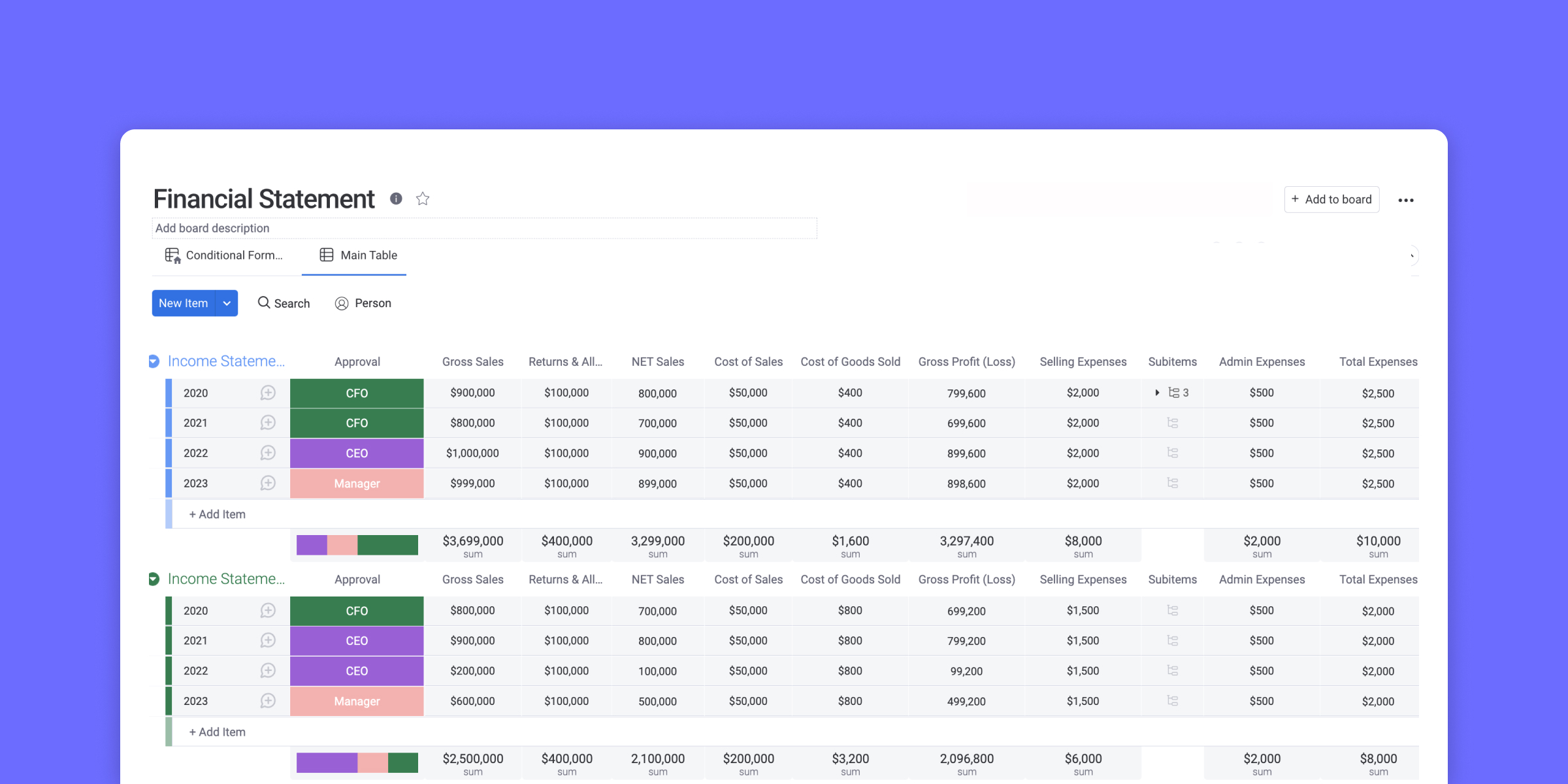

A profit and loss statement contains three basic elements: Your p&l statement shows your revenue, minus expenses and losses. Easily track your revenue, expenses, margins, and profitability.

A sample profit and loss statement demonstrates a company’s ability to make money, drive sales, and control costs. It shows your revenue, minus expenses and losses. What is a profit and loss statement?

Basic income statements contain the following elements: A p&l statement tells you how much money you’re making,. A profit and loss (p&l) statement is a type of financial statement covering a specific period and revealing a company’s revenues, costs, and expenses.

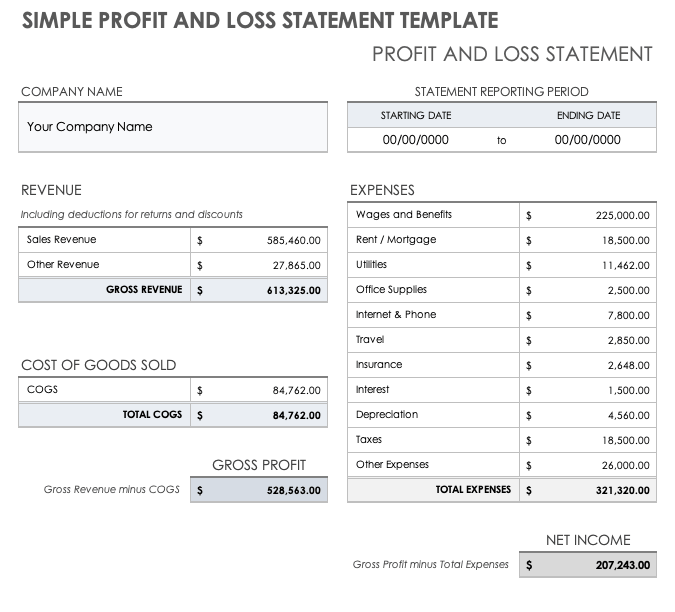

Year to date profit and loss statement template. Download simple profit and loss statement microsoft excel | microsoft word | adobe pdf use this simple p&l statement template to calculate your organization’s total revenue compared to your costs and expenses. Interest expense = $5 million;

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Profit and loss statement explained. A p&l statement compares company revenue against expenses to determine the net income of the business.

Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or. A profit and loss (or income) statement lists your sales and expenses. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

The result is either your final profit (if. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Download our p&l templates for efficient business management.