Ace Info About Trade Receivables In Cash Flow Statement

Increase in accounts receivable => deduct the increased amount from net income.

Trade receivables in cash flow statement. Trade receivables tie up funds until collected; Trade and other receivables 72 19. Businesses must set clear payment terms to ensure they receive money on time.

So, we can summarize the adjustments for the increase or decrease in accounts receivable on cash flow statement as below: Recall that the income statement reported revenues of $800 , and the balance sheets from january 31 and february 28 will indicate that accounts receivable. Trade receivables arise when a business makes sales or provides a service on credit.

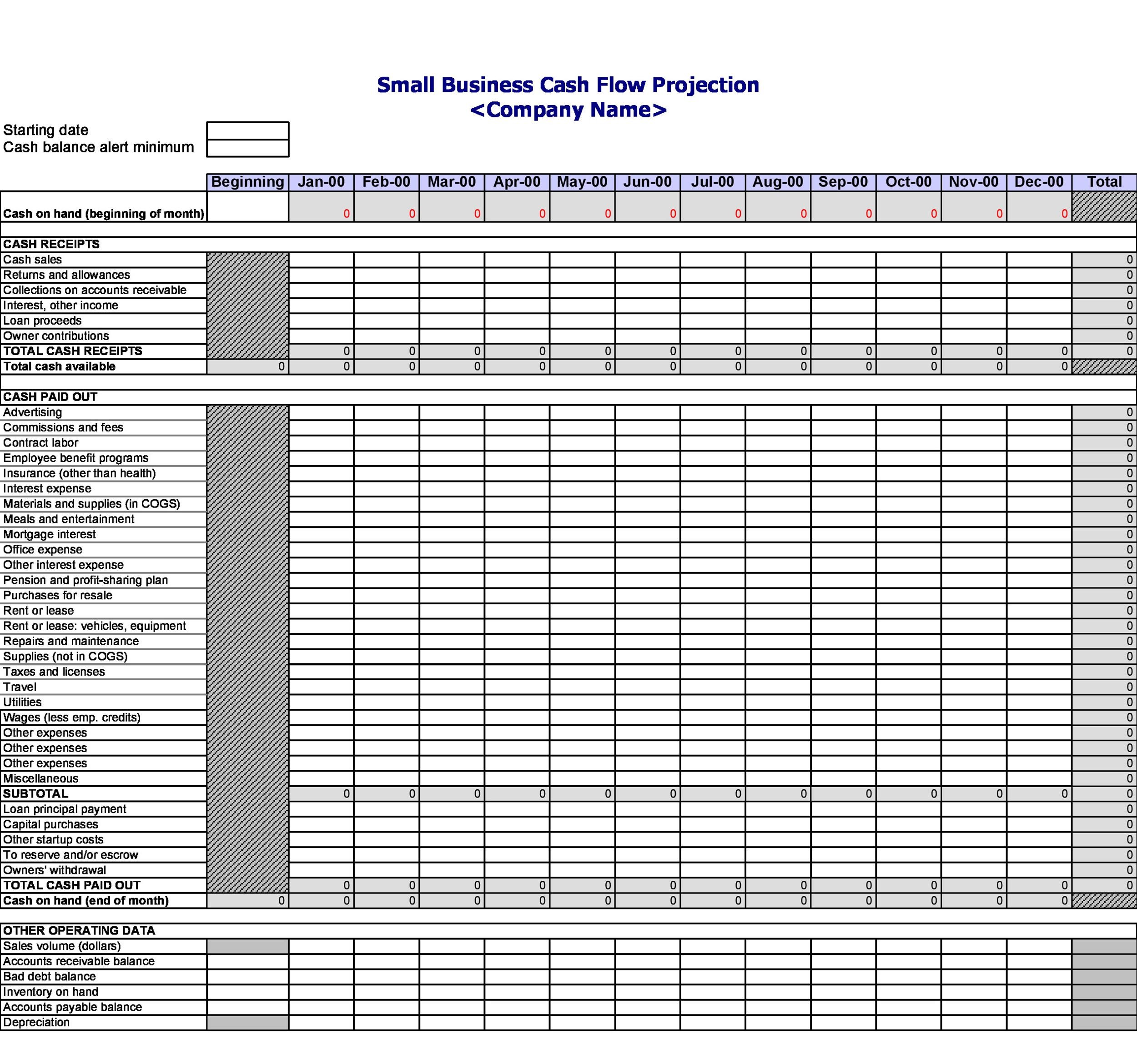

The figure in the statement of financial position will always be: The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Accounting standards codification (asc) 230, statement of cash flows, addresses the presentation of the statement of cash flows.

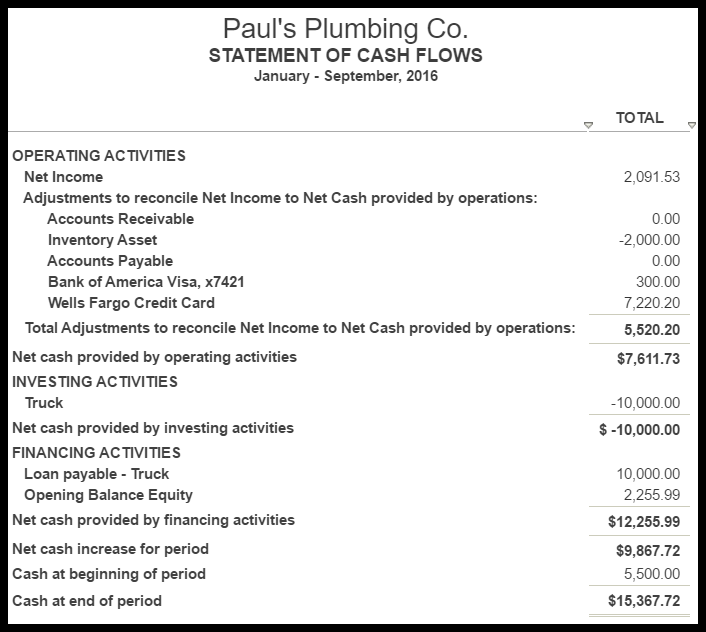

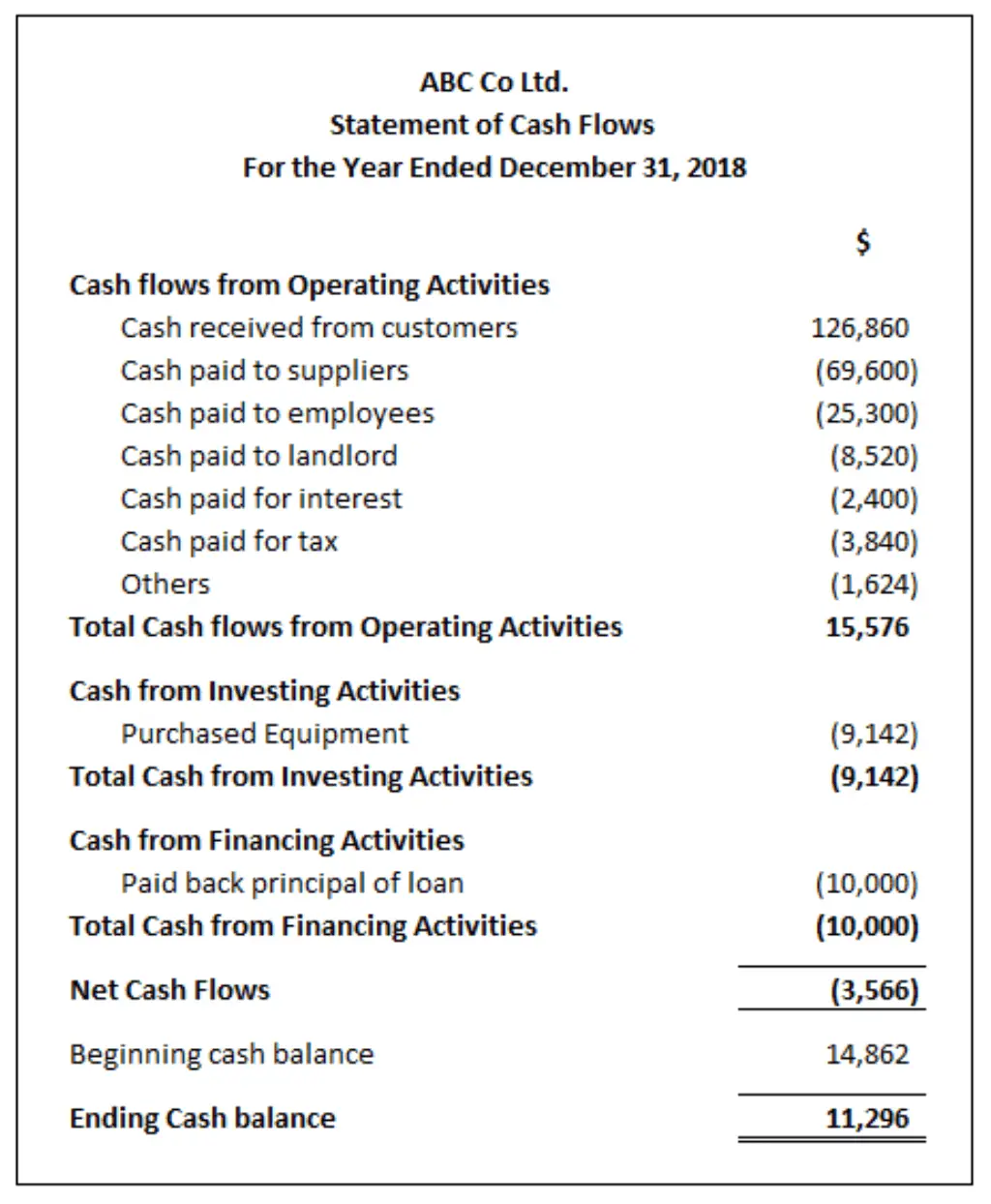

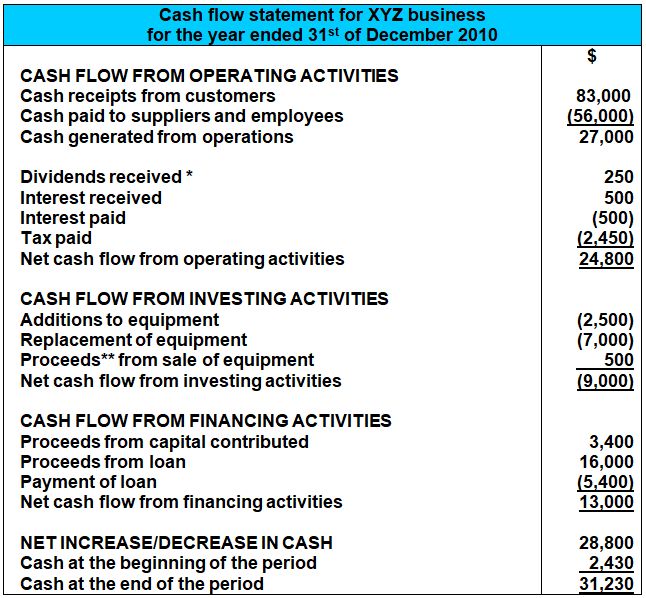

The increase in accounts receivables is deducted from net profit and the decrease in accounts receivables is added to net profit. A cash flow statement consists of three sections: Operating activities investing activities financing activities operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses.

Statement of cash flows, also known as cash flow statement, presents the movement in cash flows over the period as classified under operating, investing and financing activities. The changes in working capital (i.e. For example, an increase in the levels of inventory and receivables will not impact profit before tax but will have had an adverse impact on the cash flow of.

Cash flows are usually calculated as a missing figure. This publication is designed to assist professionals in understanding the statement of cash flows. Future cash inflows that can be used for paying expenses, buying inventory, and investing in growth opportunities.

When ar increases, it gets deducted from net earnings because it is not cash even though they are in revenue. Example following is an illustrative cash flow statement presented according to the indirect method suggested in ias 7 statement of cash flows: When the indirect method of presenting the statement of cash flows is used, the net profit or loss for the period is adjusted for the following items:

Consolidated statement of cash flows 24 notes to the consolidated financial statements 26 appendices i new standards or amendments for 2020 and. There are two methods for cash flow statement preparation: They can represent good cash flow on an income statement that contributes to the business's profitability or, if poorly managed, could leave a business with unacceptable levels of bad debt.

Increase in trade receivables – deducted because this is part ofthe profit not yet realised into cash but tied up in receivables. This is an alternative way of updating the allowance for trade receivables at the end of each accounting period. Disposal group held for sale 74 21.

The statement of cash flows (scf) for the month of february begins with the accrual accounting net income of $300, which must be converted/adjusted to the net cash from operating activities. We’ll begin by defining ar, cash flow, and the cash flow statement. Hence, efficient collection processes are vital.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)