Impressive Tips About Trial Balance Profit And Loss Account Sheet

Preparing trading and profit and loss and balance sheet.

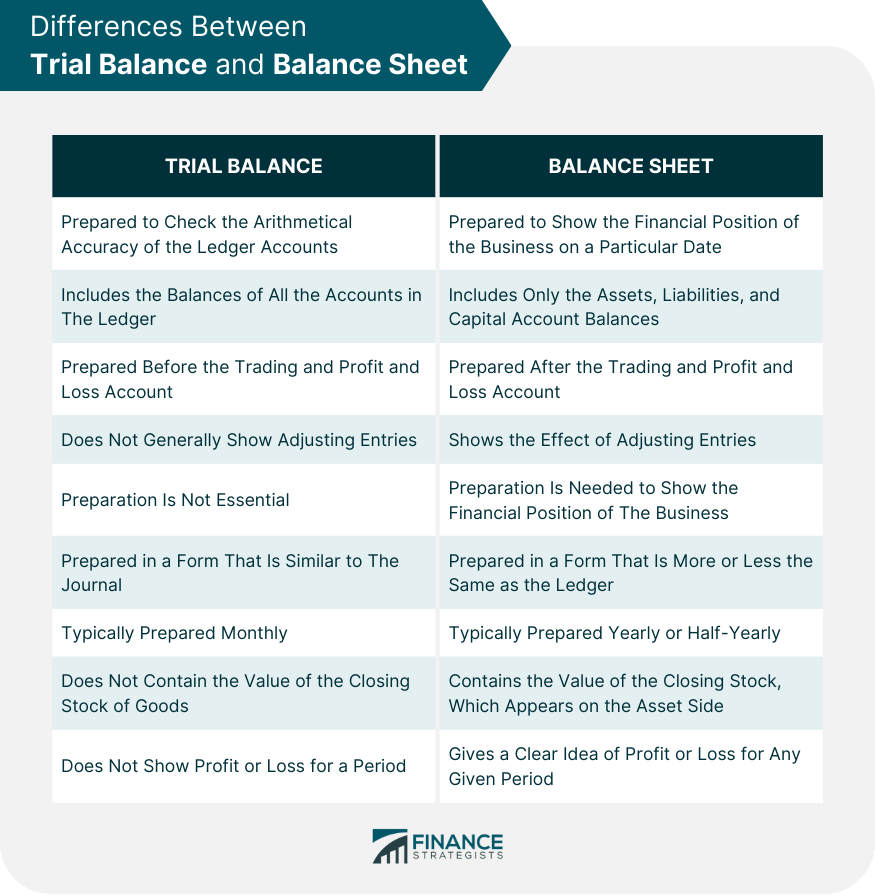

Trial balance profit and loss account and balance sheet. A trial balance is a listing of all accounts (in this order: In order to prepare the profit and loss account and the balance sheet, a business owner needs to set out the closing balances from the trial balance in the formats shown above in figs 7.1 and 7.2. As against, balance sheet presents the position of assets and liabilities of a company on a particular date.

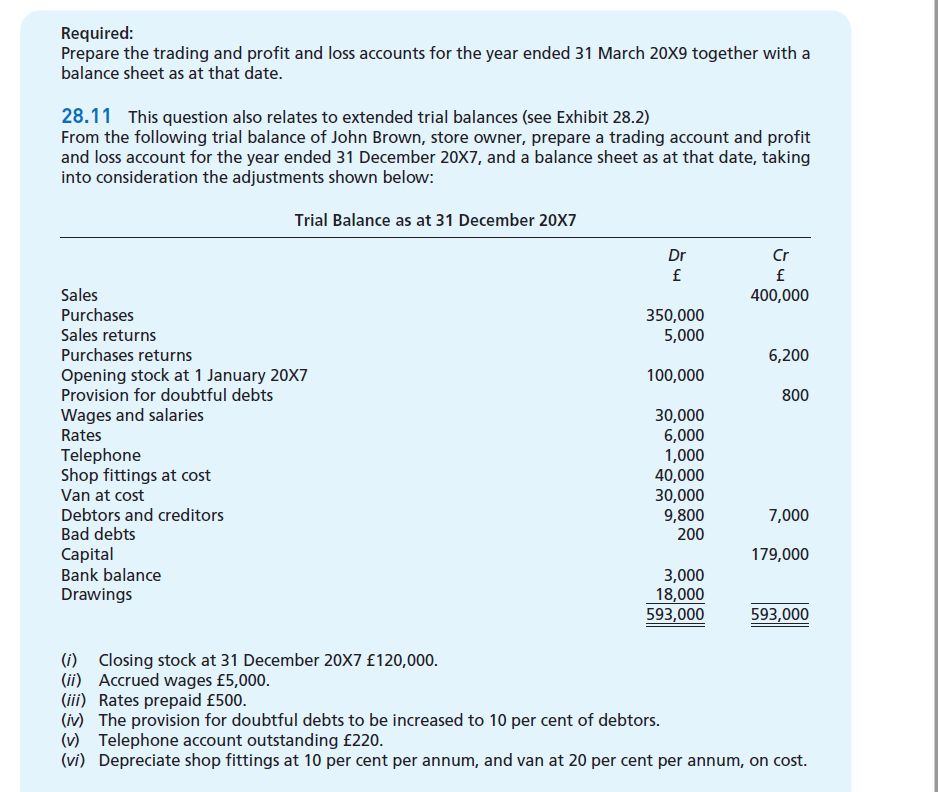

Thus, it serves as a link between the books of accounts and trading & profit and loss a/c and balance sheet. For determining the true result or the net result of the business, preparing the trading and profit and loss. Profit and loss account for mr.

Ledger 6.1 points to be noted in the ledger 6.2 distinction between journal and ledger 6.3 ledger posting 6.4 balancing of. Journal 4.1 recording in journal 4.2 types of accounts 4.3 nominal account v. The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock.

Nominal account balances are accounted for through profit and loss a/c. Closing inventory depreciation accruals and prepayments irrecoverable debts and the allowance for receivables. The balance sheet will express the financial position of the firm.

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. It determines the gross profit or gross loss of the concern for that accounting year. The p&l account reveals the performance of the business finance.

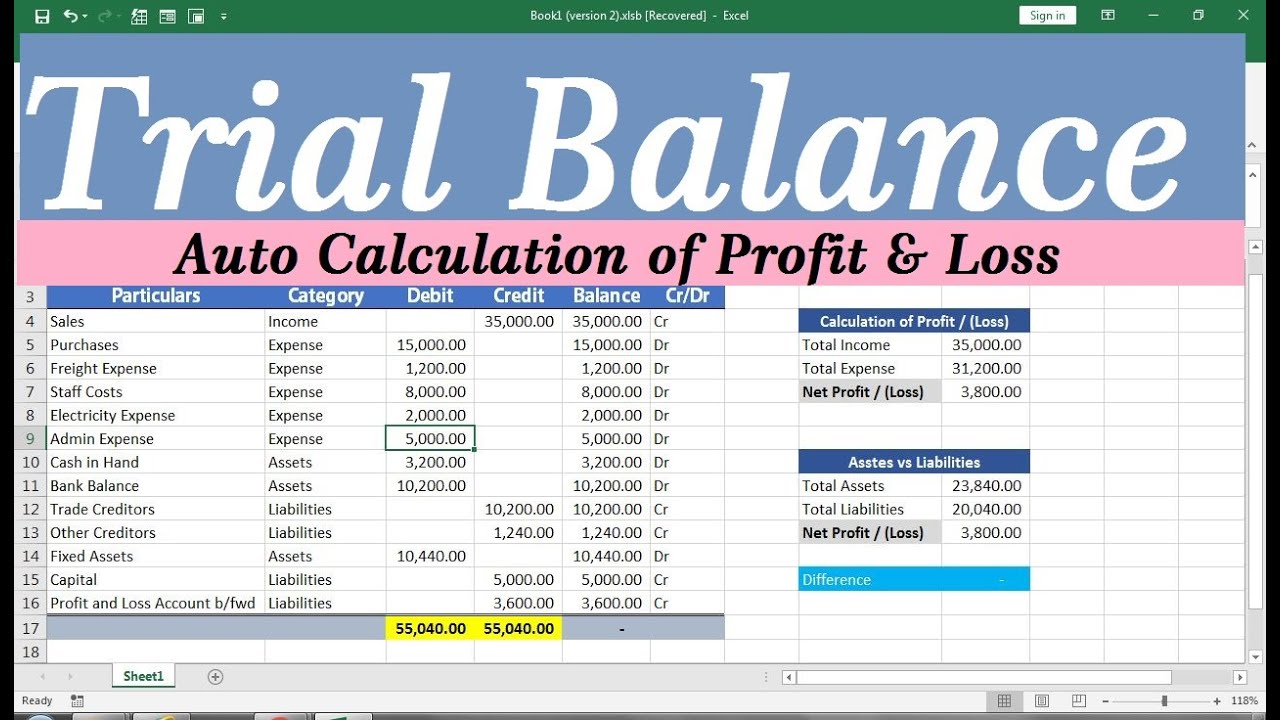

Trial balance, profit and loss (p&l), and balance sheet reports are essential financial statements that provide valuable insights into a company's financial performance and position. Undertrial balance, the debit balance, and the credit balance should be equal. From the following trial balance of john and co., prepare the trading and profit and loss accounts for the year ended 31st december 2024.

Trial balance is prepared in columnar format with debit balances in the left column and credit balances. Prepare a profit and loss account as on march 31, 2024. Profit & loss balance:

A balance sheet is divided into assets, liabilities, and shareholders’ equity. Balance sheet is a statement that a company prepares every year to present the assets, liabilities and equity on a particular date. 1 trial balance in this chapter we will bring together the material from theprevious chapters and produce a set of financial statements from a trialbalance.

A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. Here are steps to make a balance sheet from trial balance step 1) source documents step 2) journals step 3) ledgers step 4) balance day adjustments step 5) trial balance step 6) profit and loss statement step 7). A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year.

From the following trial balance, prepare trading account, profit and loss account for the year ended 31st march, 2018 and balance sheet as at the date:following adjustments are to be considered:i closing stock र 15,270. Steps in accounting process 3. We will illustrate this later in the chapter.