Underrated Ideas Of Tips About Loss On Disposal In Income Statement

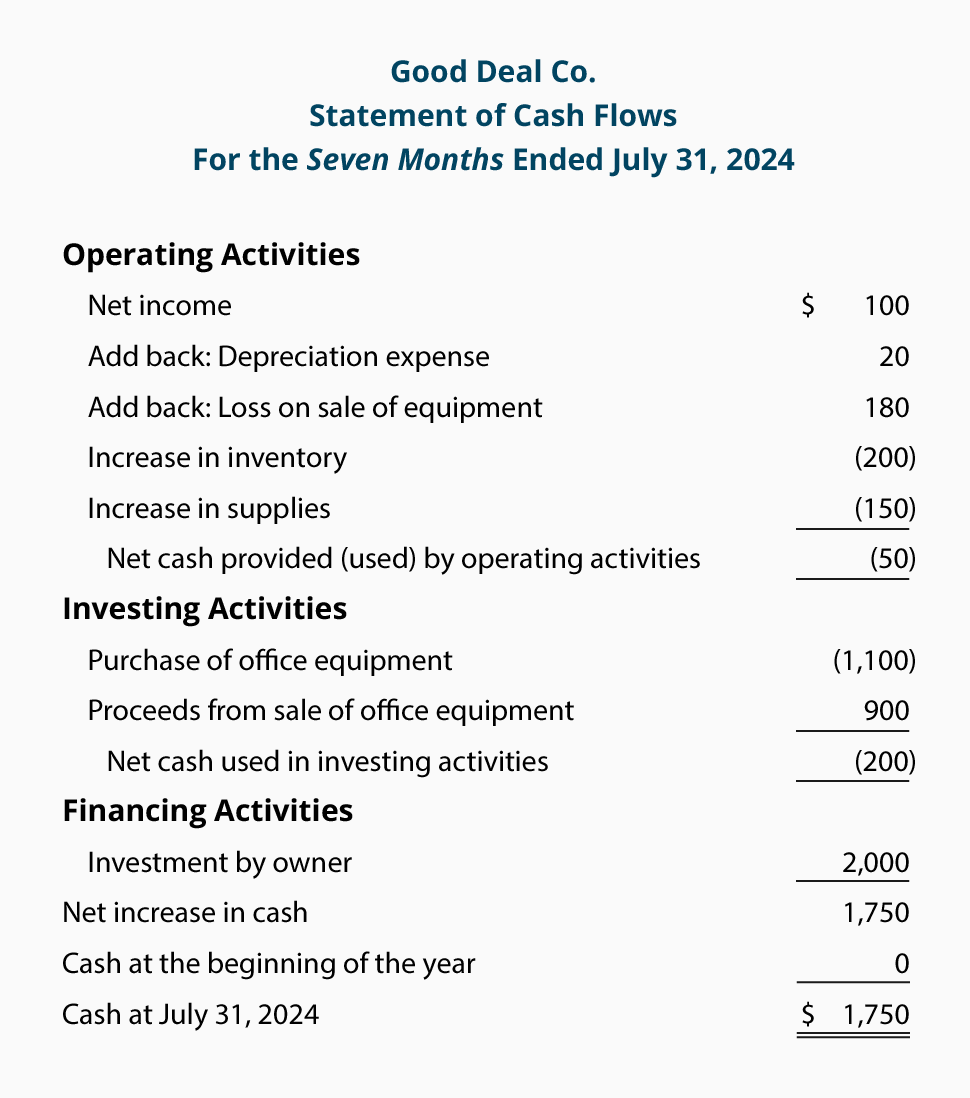

Profit or loss on disposal of asset the assets used in the business can be sold anytime during their useful life.

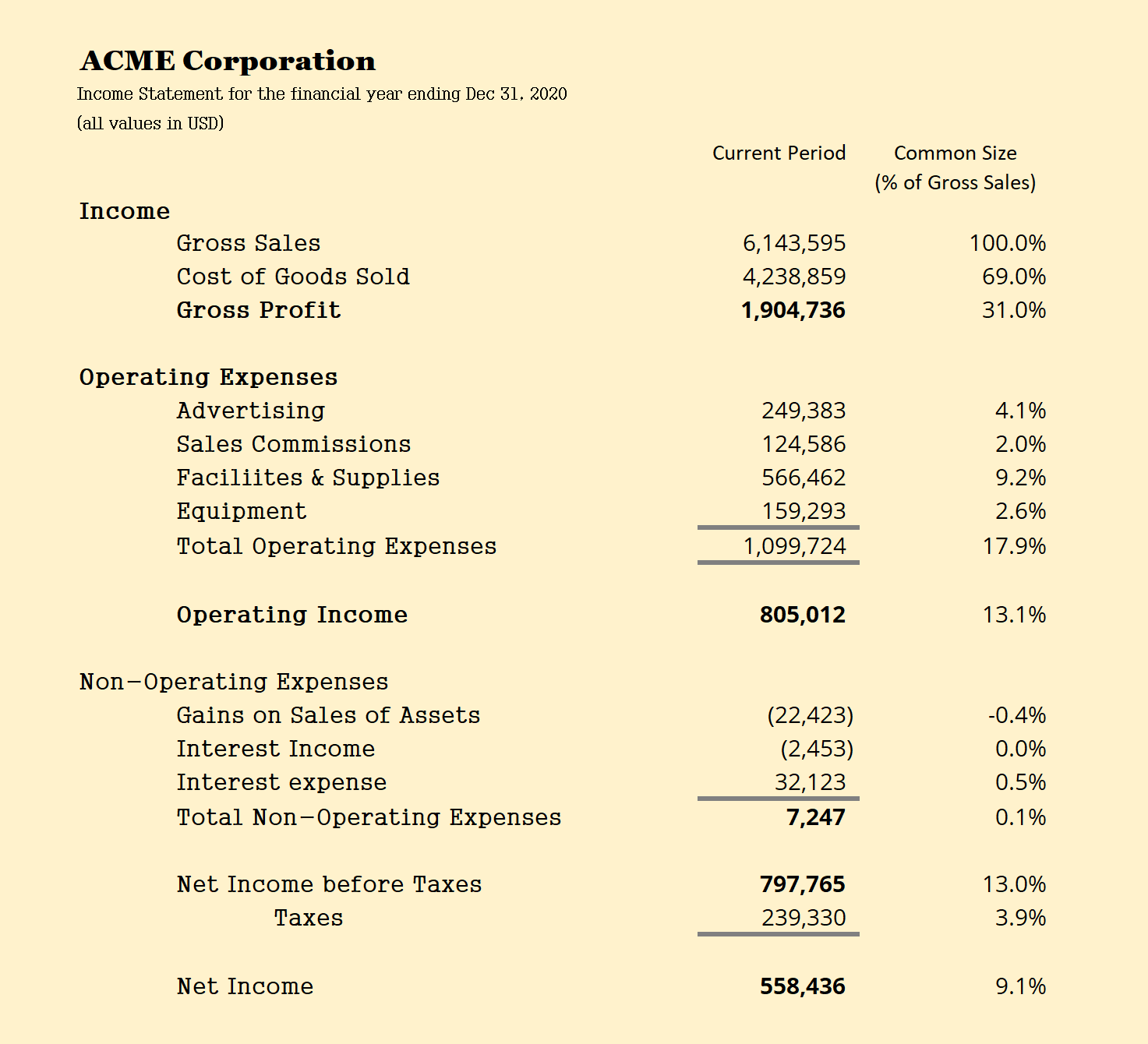

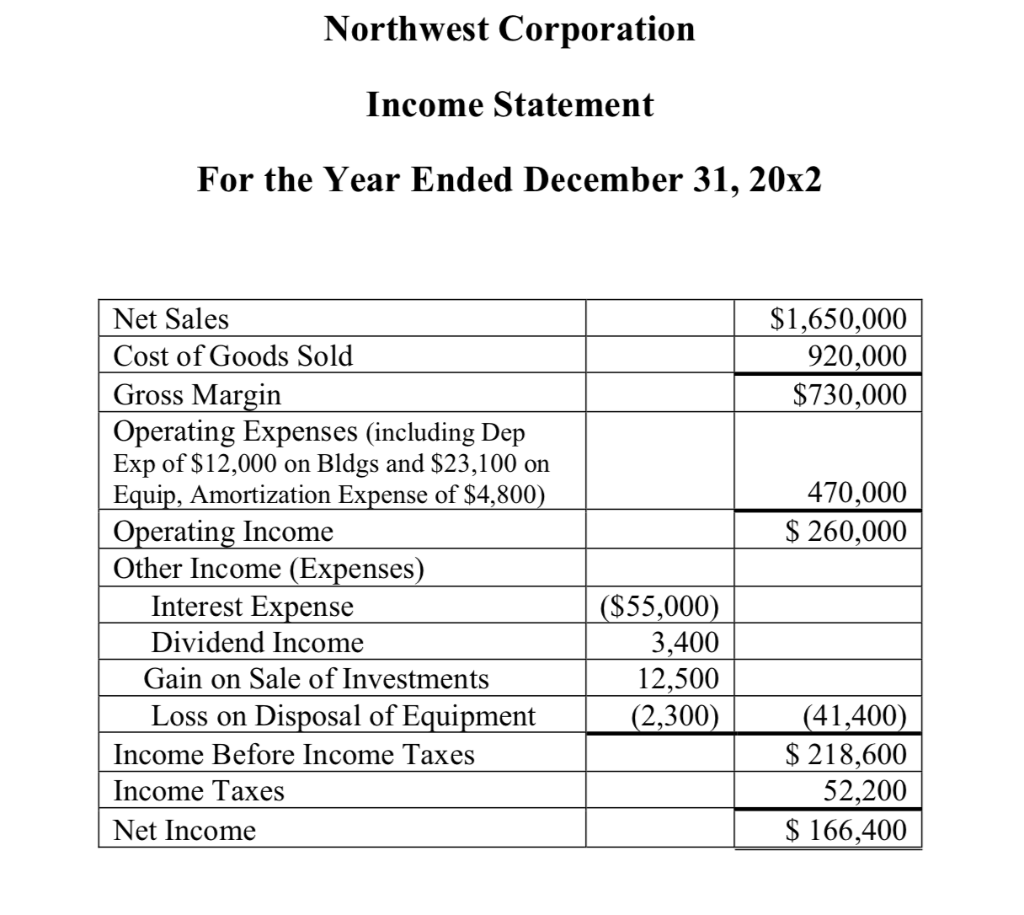

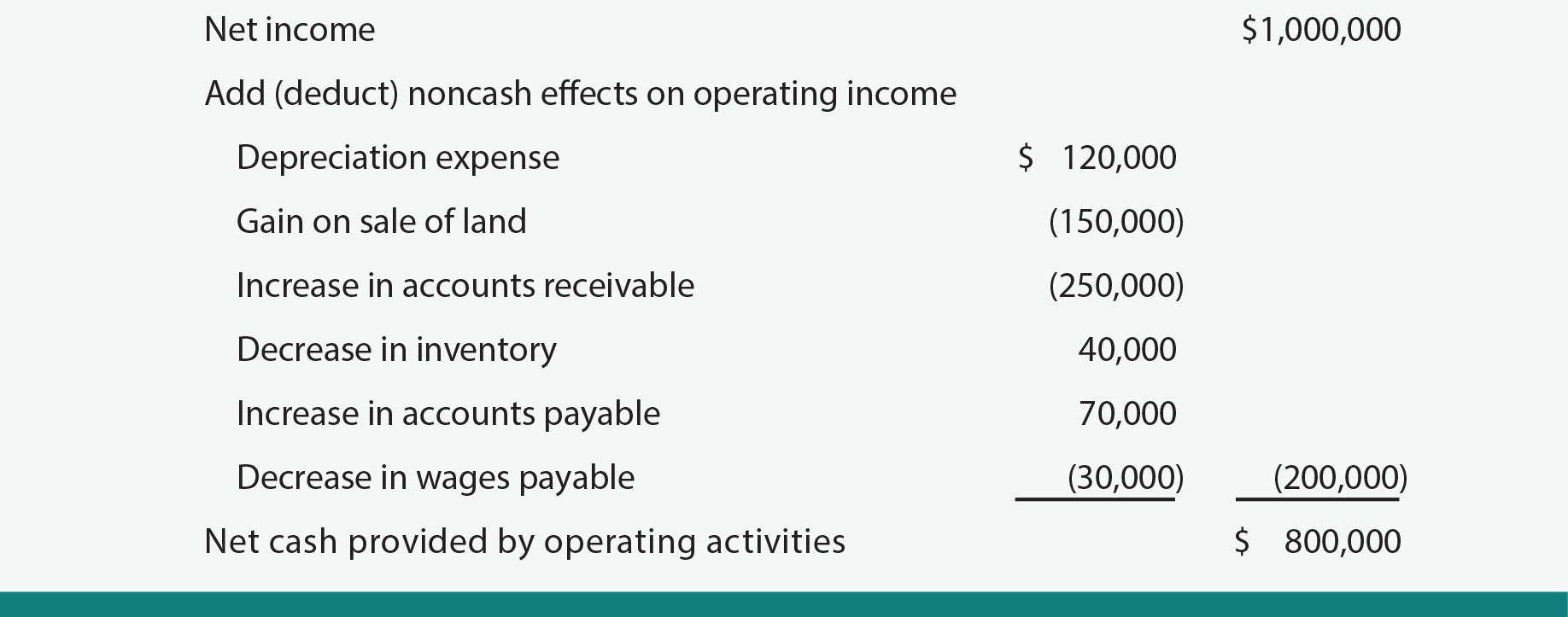

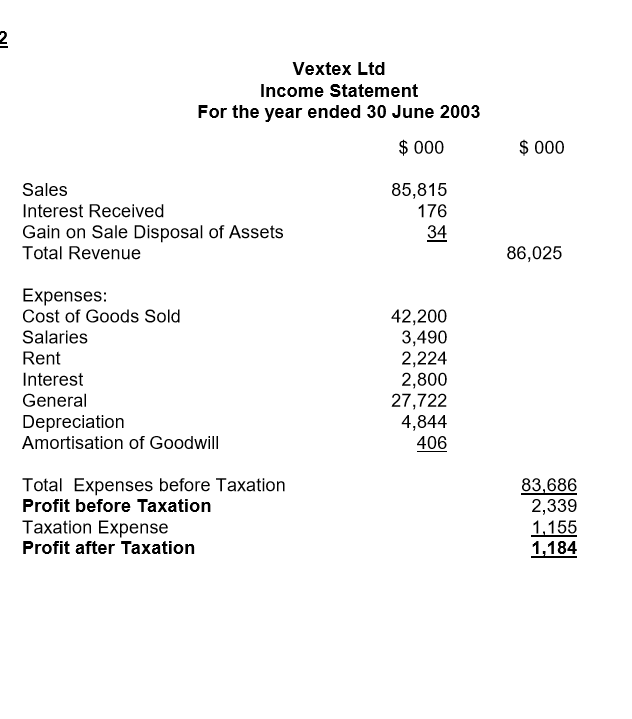

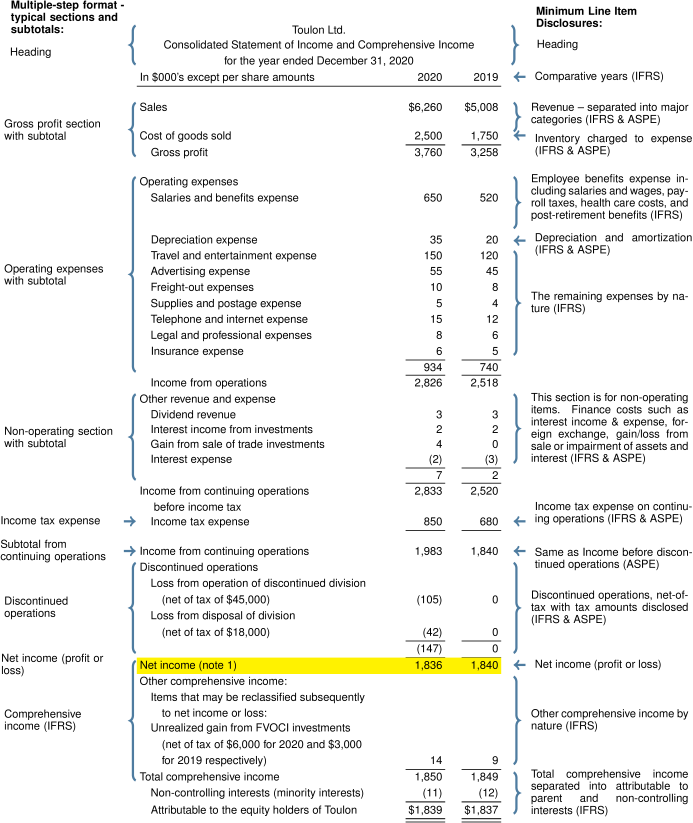

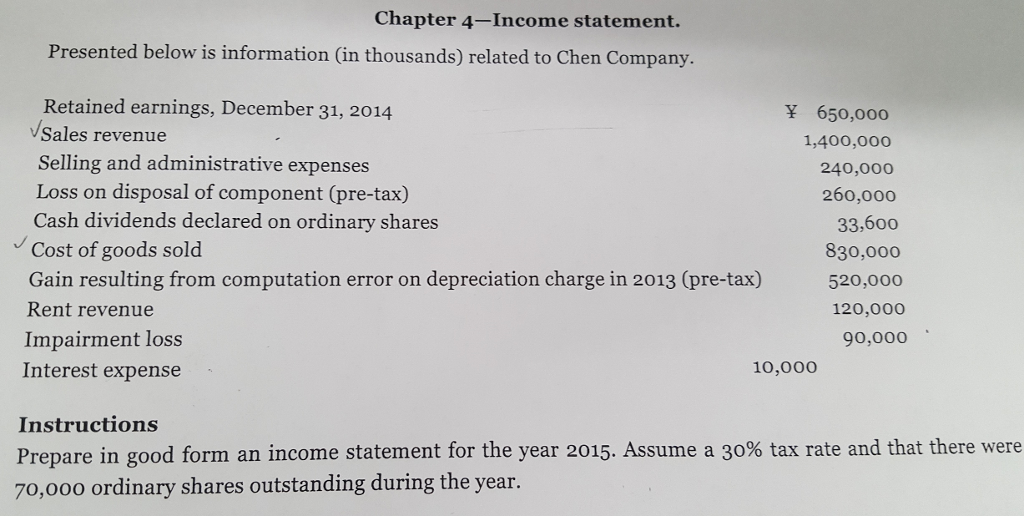

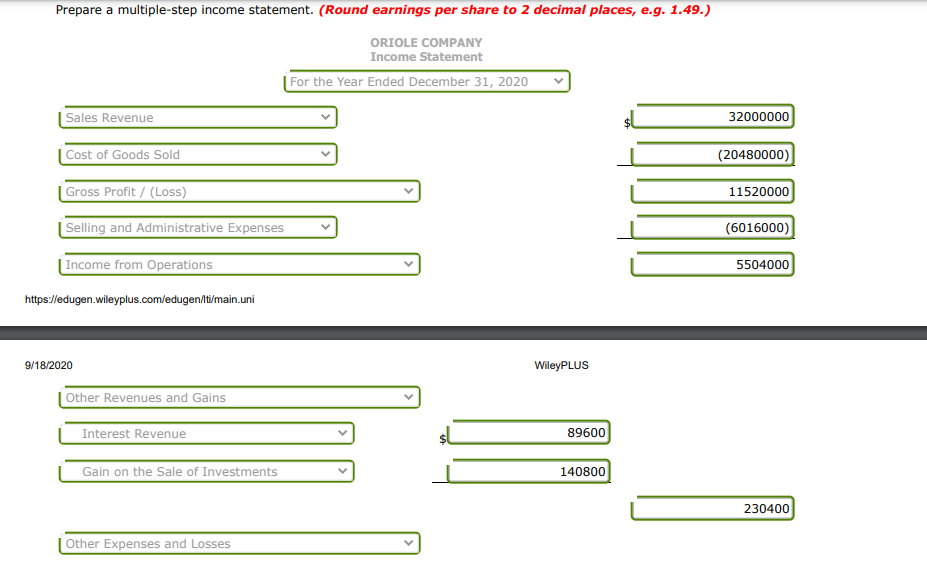

Loss on disposal in income statement. Asset disposal is accounted for by removing the asset. A disposal account is a gain or loss account that appears in the income statement, and in which is recorded the difference between the disposal proceeds and. Gains or losses on the disposal of an investment property are included in profit or loss in the statement of comprehensive income in the period in which the.

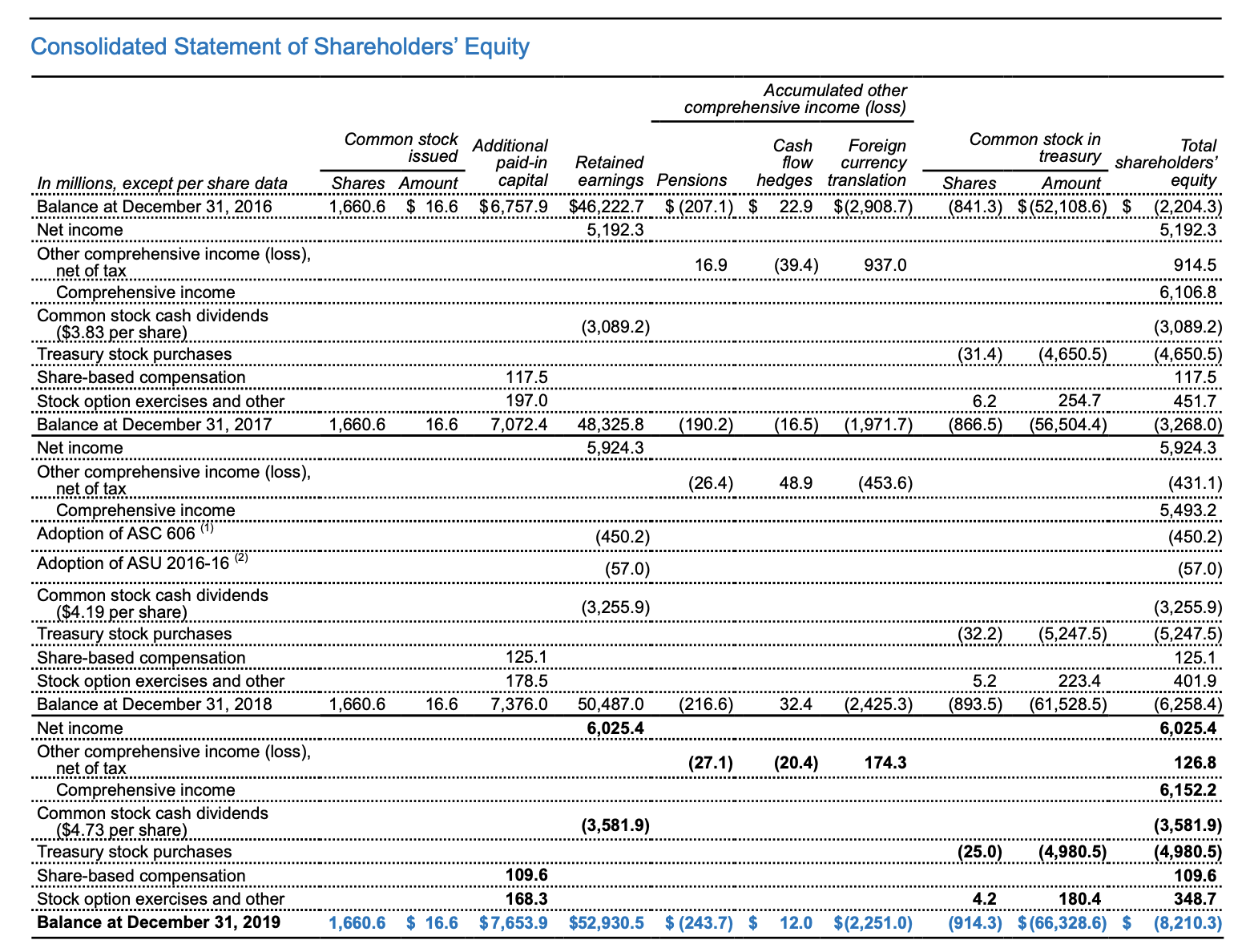

You need to calculate parent’s gain or loss on the disposal of shares and recognize it in profit or loss, which will have effect on retained earnings: Learn how to distinguish between gains and losses and revenues and expenses. You report unrealized losses and gains on the balance sheet as other comprehensive income. the balance sheet includes three sections:

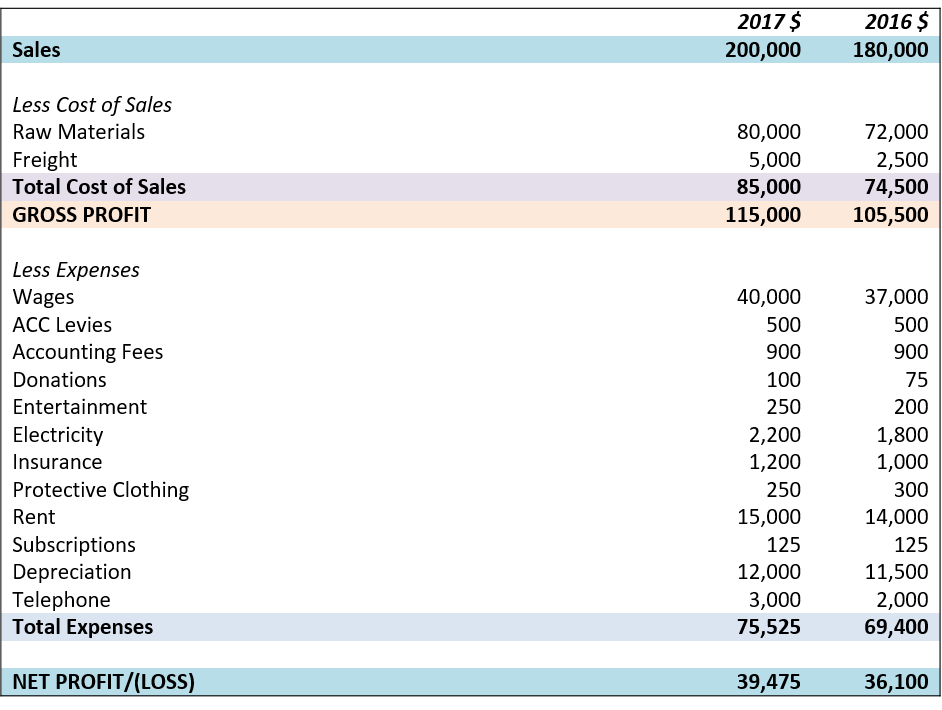

Selling an asset for its. Take a look at how accountants record each category on an income. What goes into the income statement (with examples) profit and loss 24 march 2020 before we dive into a profit and loss example, t he profit and loss report,.

It is not necessary to keep an asset until it is scrapped. The goal of recording your gains, losses or full depreciation is to show all monetary values related to the sale or disposal of your asset.

If there is a difference between disposal proceeds and carrying value, a disposal gain or loss occurs. In this lesson we focus on income statement. The company also experiences a loss if a fixed asset that still has a book value is discarded and nothing is.

In accounting, the gains and losses such as gains and losses on disposal of fixed assets or gains and losses on the sale of investments that we record to the. Get full access to crash course in accounting and financial statement analysis, second edition and 60k+ other titles,. The asset disposal results in a direct effect on the company’s financial statements.