Glory Tips About Meaning Of Common Size Balance Sheet

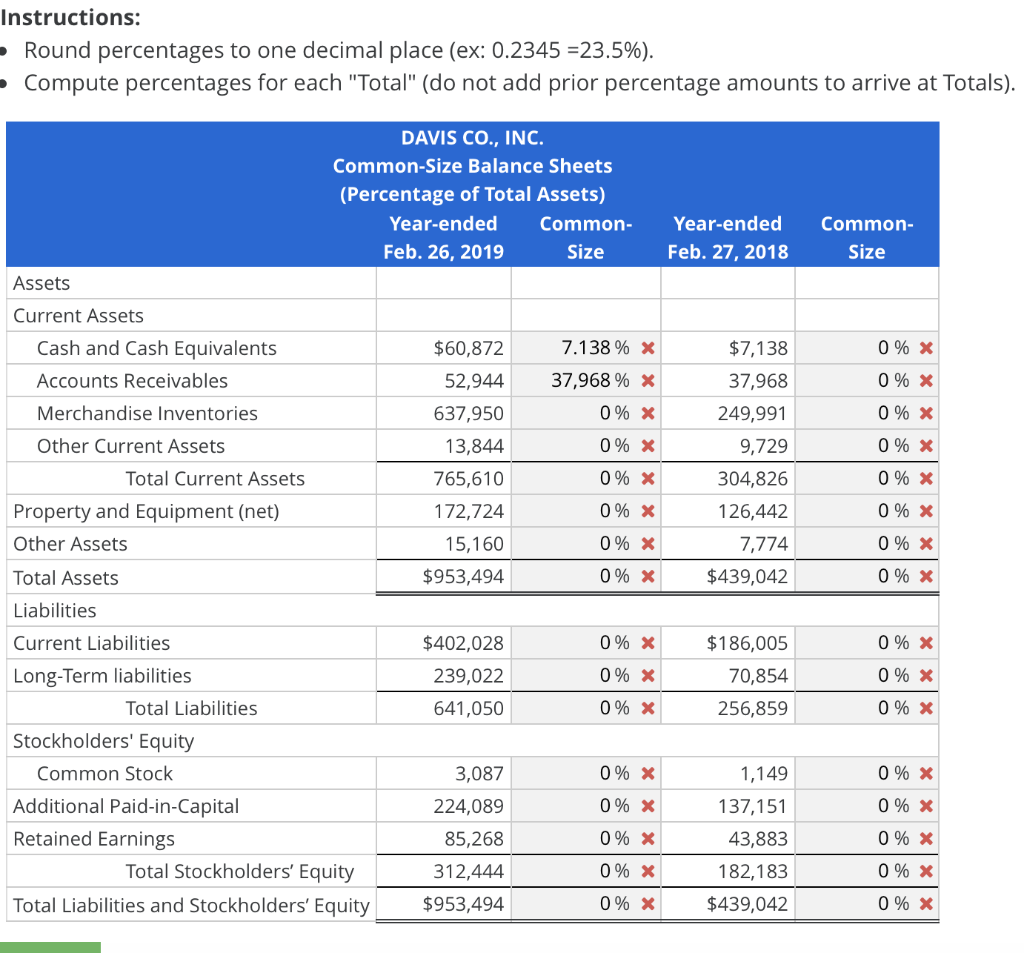

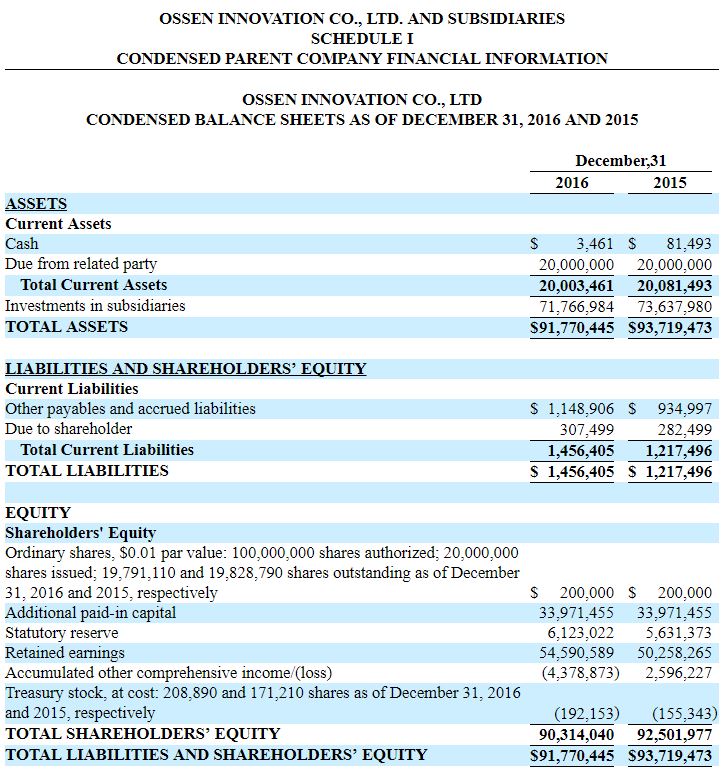

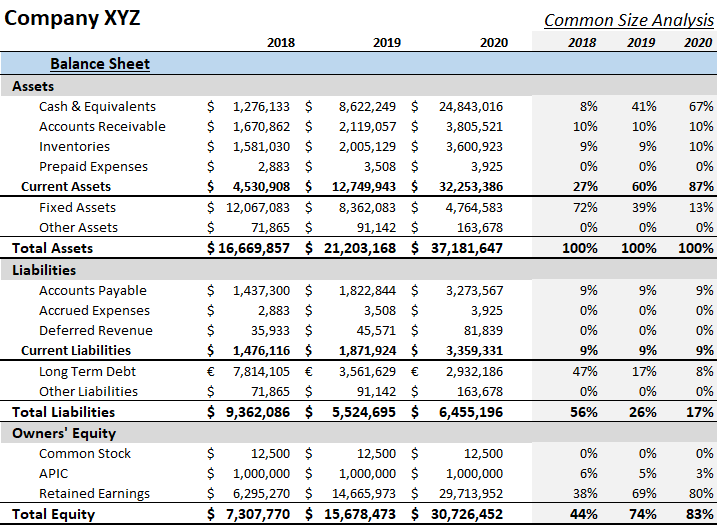

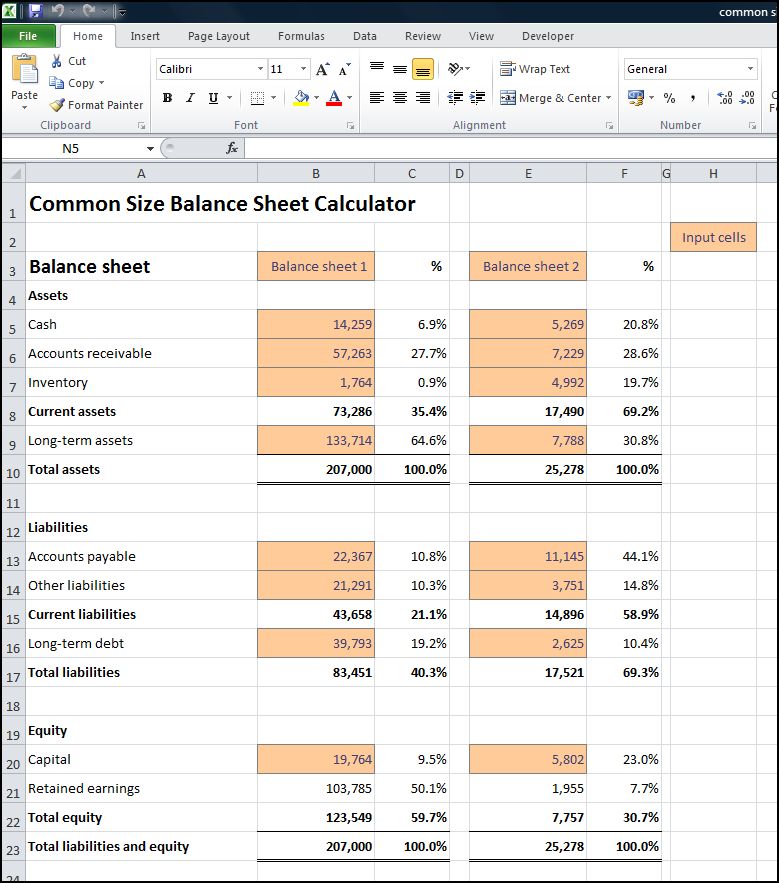

Common size balance sheet is the balance sheet that prepares by management to show both values of each item in assets, liabilities, and equity in currency (usd) and percentages (%) at the end of the accounting period.

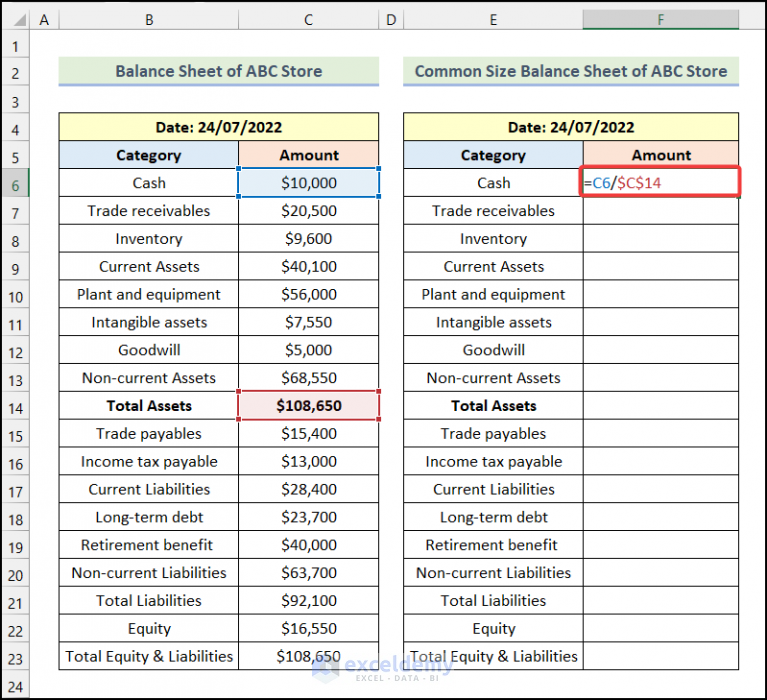

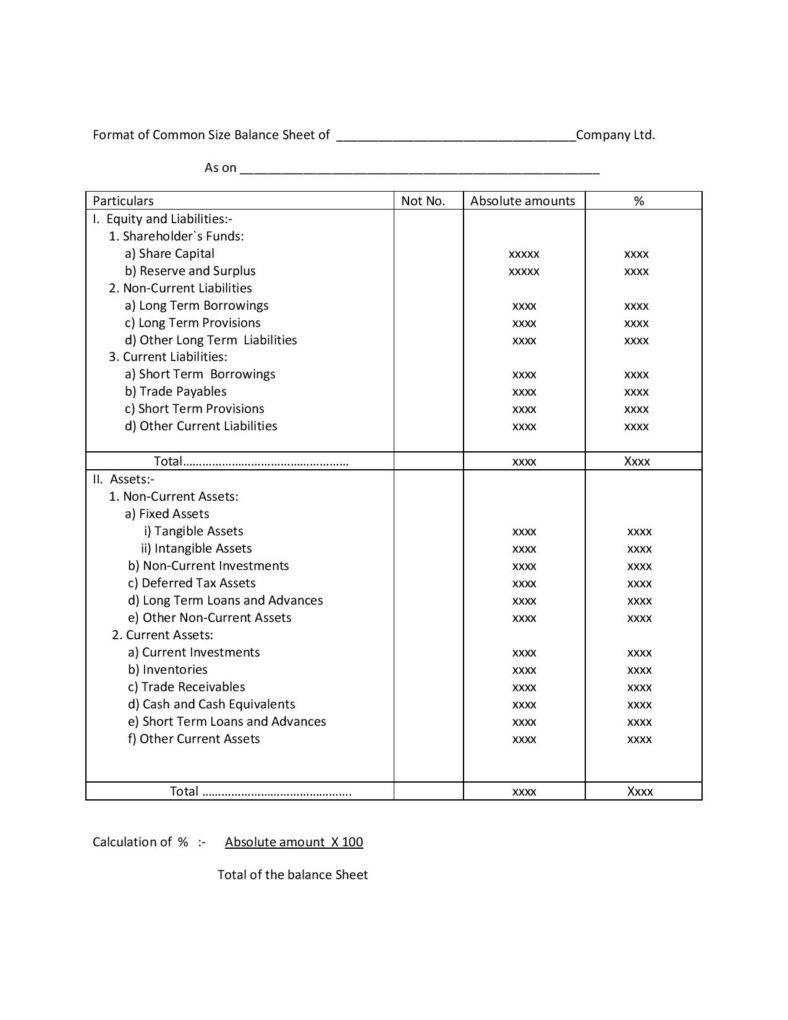

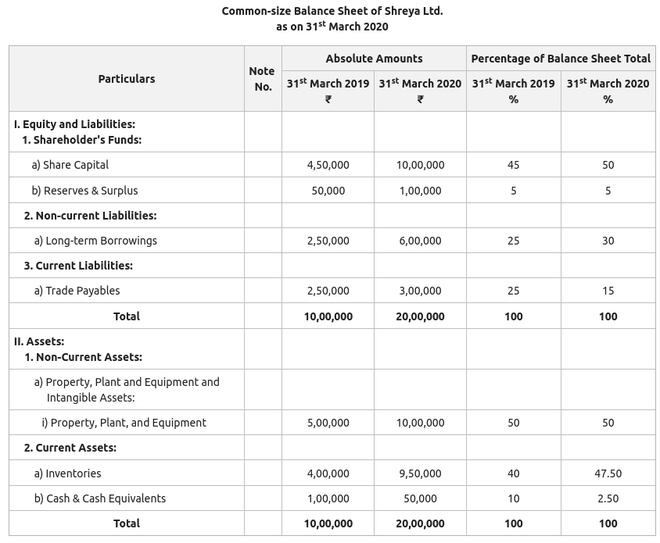

Meaning of common size balance sheet. In a common size balance sheet, every balance is reported as a proportion of the total assets of a business. A common size balance sheet is a financial statement that presents the assets, liabilities, and equity of a business with each line item shown as a percentage of the total category. Based on the accounting equation, this also equals total liabilities and shareholders’ equity, making either term.

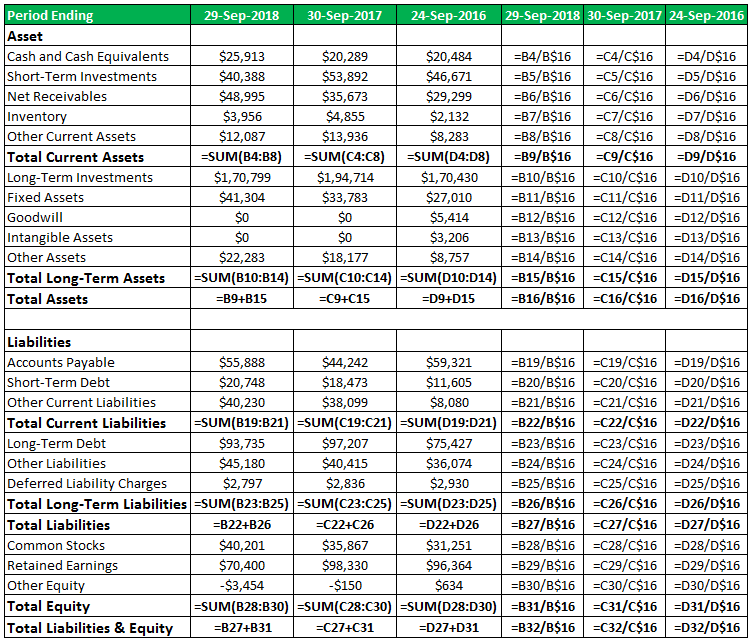

What does common size balance sheet mean? A common size balance sheet displays the numeric and relative values of all presented asset, liability, and equity line items. As a result, it becomes easier to compare companies of various sizes and track changes within a company over time.

Know about common size balance sheet definition, analysis, format and. Using this statement, users could quickly see the percentage of each item, cash or account receivable, compared to total assets. The common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure.

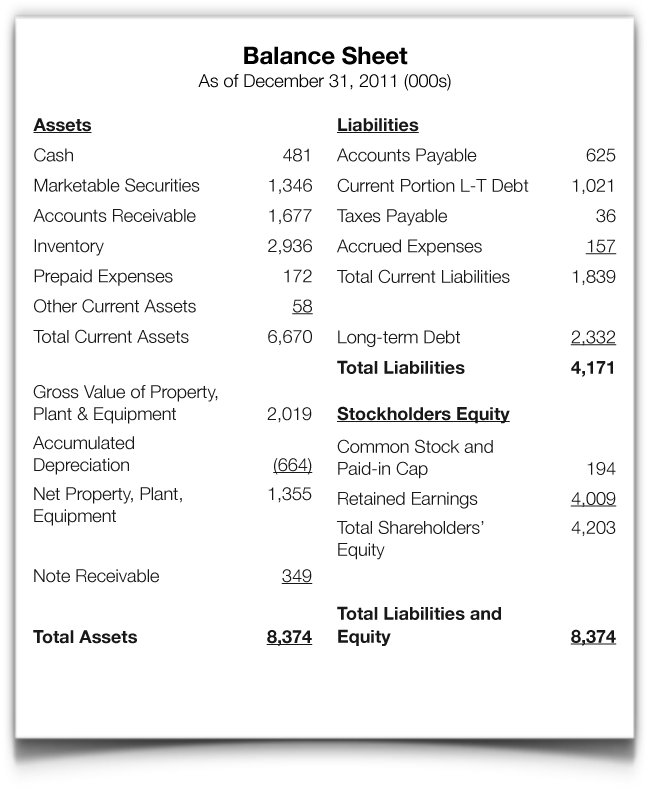

A common size balance sheet is a statement in which balance sheet items are being calculated as the ratio of each asset in relation to the total assets. A balance sheet is a financial statement that reports a company's assets, liabilities and shareholder equity at a specific point in time. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts.

Common size balance sheet is the presentation of all the line items in a balance sheet in a separate column in the form of relative percentages of total assets, primarily. A common size balance sheet is a financial statement that presents the percentages of each line item relative to the total assets of a company. What is a common size balance sheet?

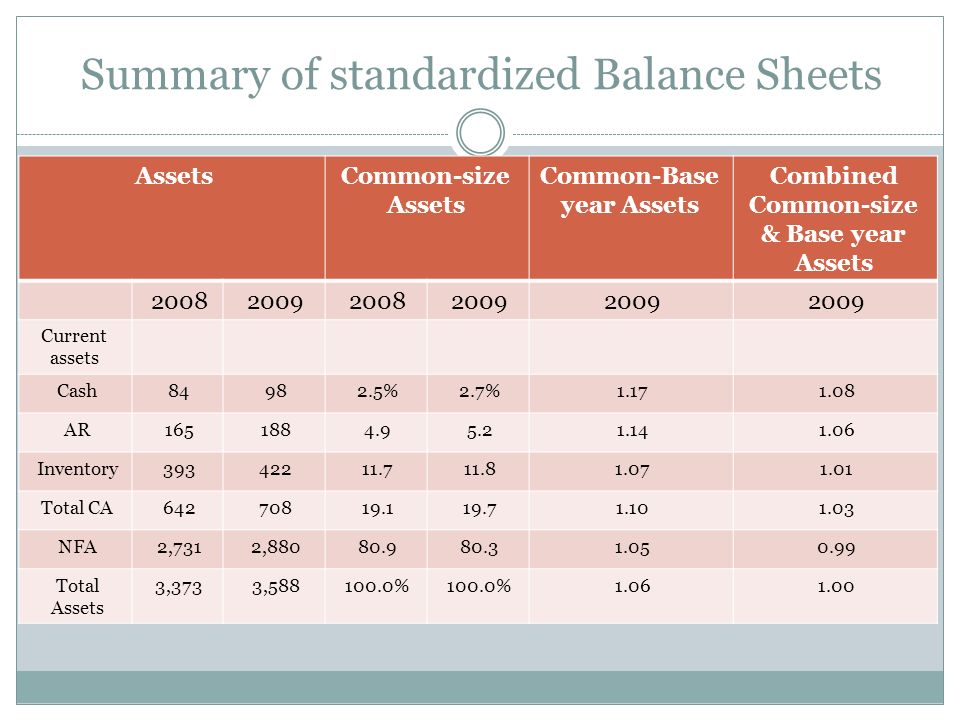

The balance sheet common size analysis mostly uses the total assets value as the base value. Assets are classified into categories such fixed assets, investments, current assets and fictitious assets for two years under consideration. To express the amounts as the percentage of the total, the total assets or total equity and liabilities are taken as 100.

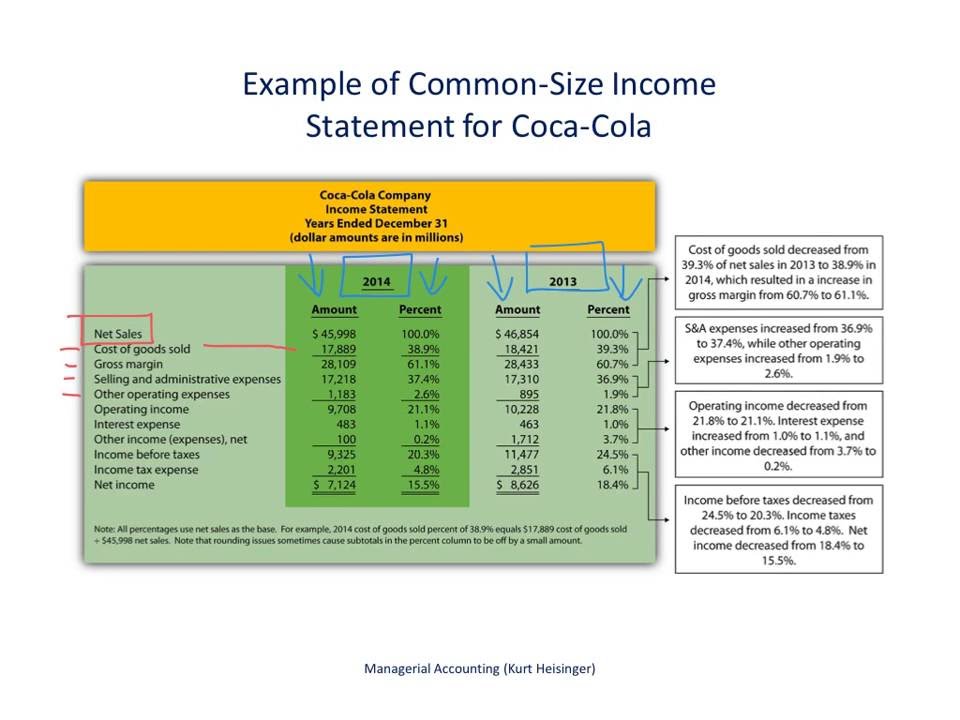

A common size balance sheet is set up with the same logic as the common size income statement. Common size balance sheet chapters00:00 introduction01:00 what is common size balance sheet02:00 what is common size balance sheet03:52 common size balance s. Balance sheet common size analysis.

For the liabilities, each liability is being calculated as a ratio of the total liabilities. A common size balance sheet is a financial statement that displays each balance sheet item as a percentage of total assets. A financial statement or balance sheet that expresses itself as a percentage of the basic number of sales or assets is considered to be of a common size.

This will allow comparisons between companies of different size. Therefore, the total assets and owners’ equity plus total liabilities can be used interchangeably. A financial manager or investor can use the common size analysis to see how a firm’s capital structure compares to rivals.

By expressing all the elements as a proportion of total assets, it allows for better comparison between companies of different sizes and industries. In other words, current assets will be shown as a percentage of total assets. Owner equity, assets, and liabilities are shown in the.

:max_bytes(150000):strip_icc()/Commonsizebalancesheet_final-63f083ed70e64e9da232560ae41429ce.png)