Beautiful Info About Income Statement Comparison

As a courtesy to the reader, the amounts from the most recent period are in the.

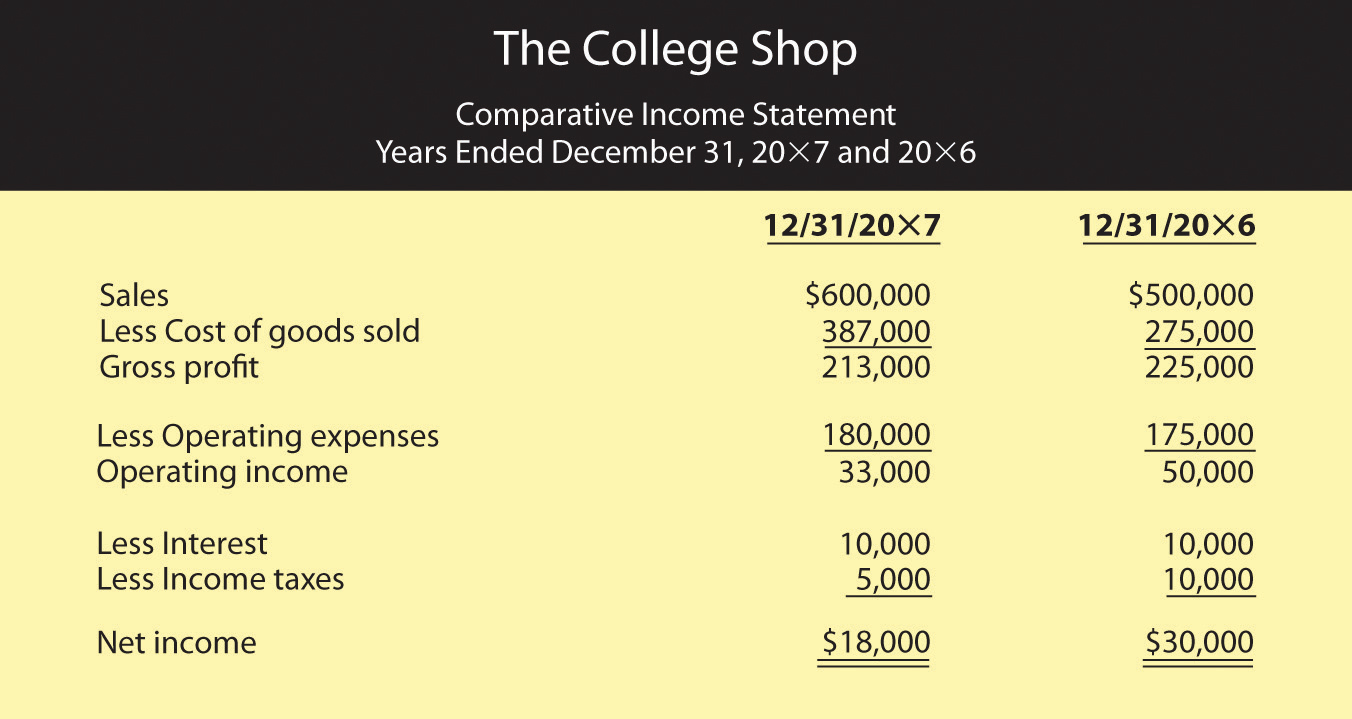

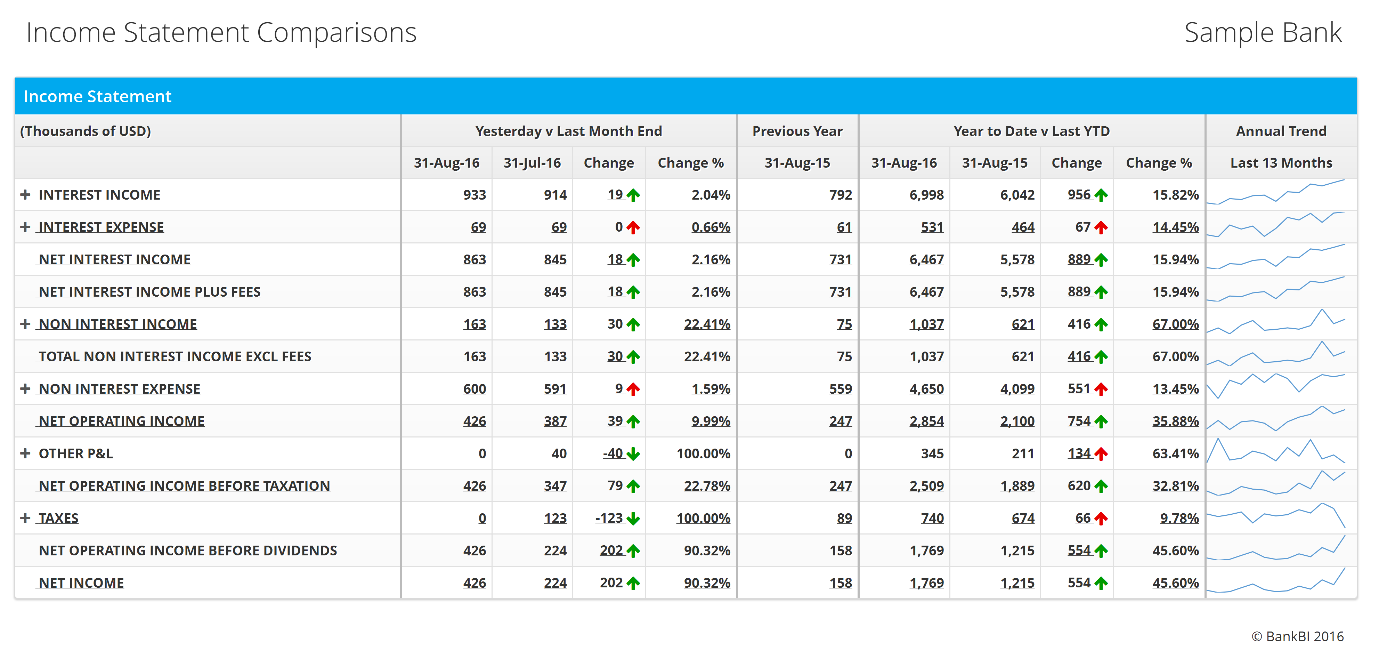

Income statement comparison. A balance sheet lists assets and liabilities of the organiz. Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for. When preparing an income statement, first determine the period that the statement will cover, such as a month, quarter or year.

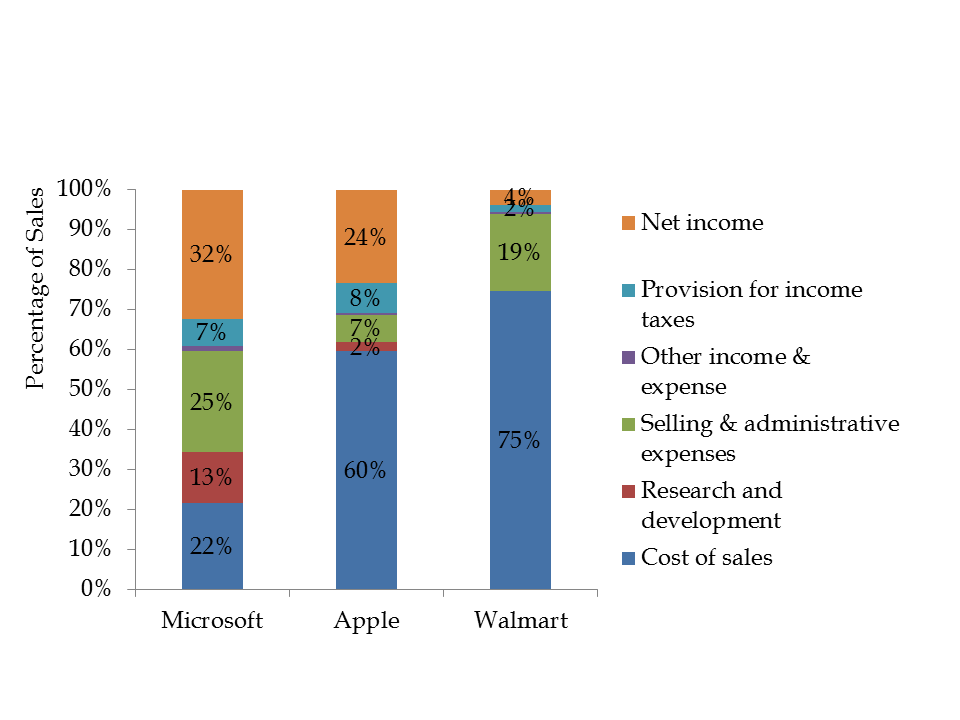

16, 2024 updated 9:59 a.m. On the income statement, each income and expense may be listed as a percentage of the total income. What's the difference between balance sheet and income statement?

What is a comparative income statement? 2023 cash from operating activities of $4.320 billion and free cash flow* of $2.756 billion ; The data also showed its gross income.

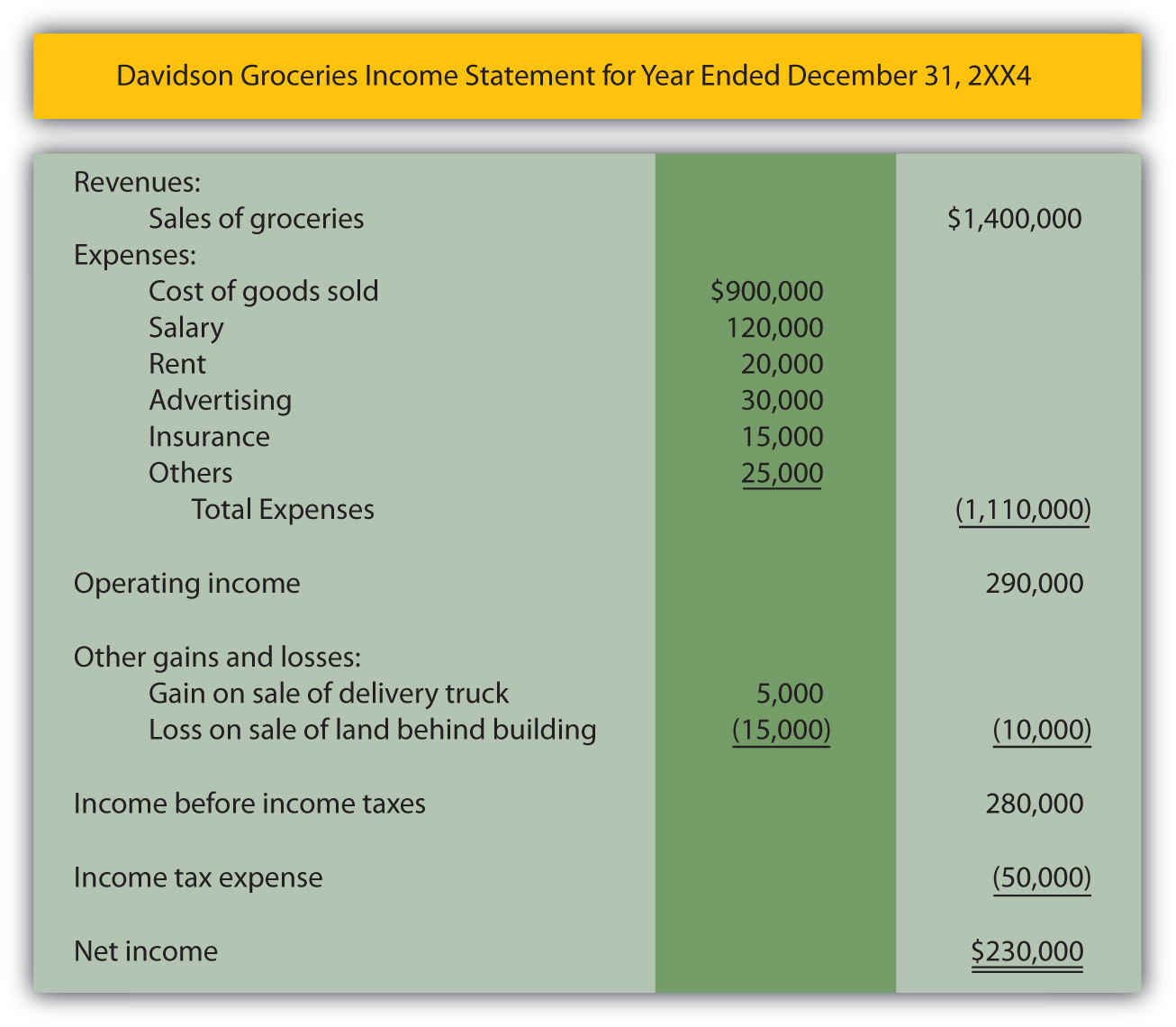

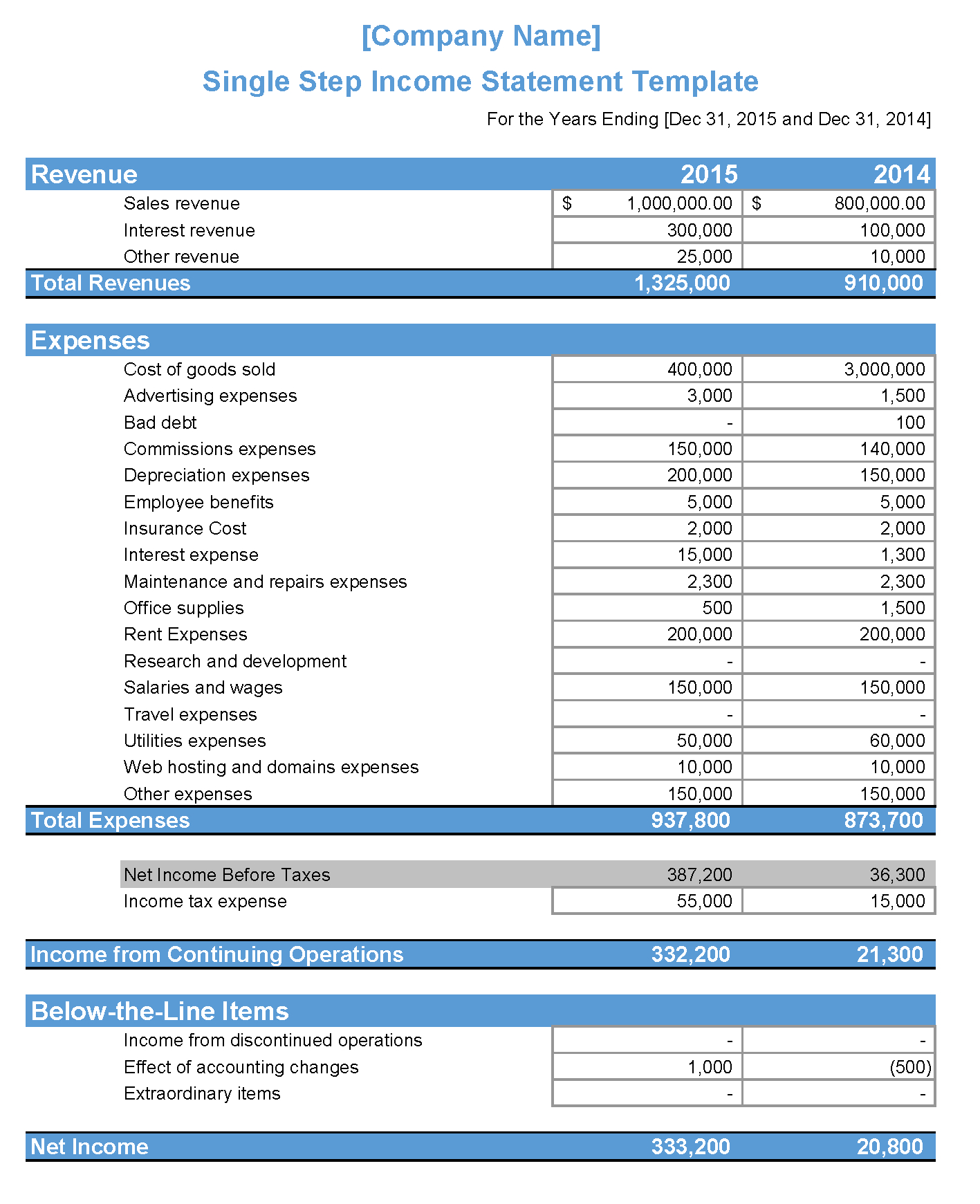

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. 9 steps to prepare an income statement. The income statement focuses on four key items:

Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions. Income statement analysis. Revenue, expenses, gains, and losses.

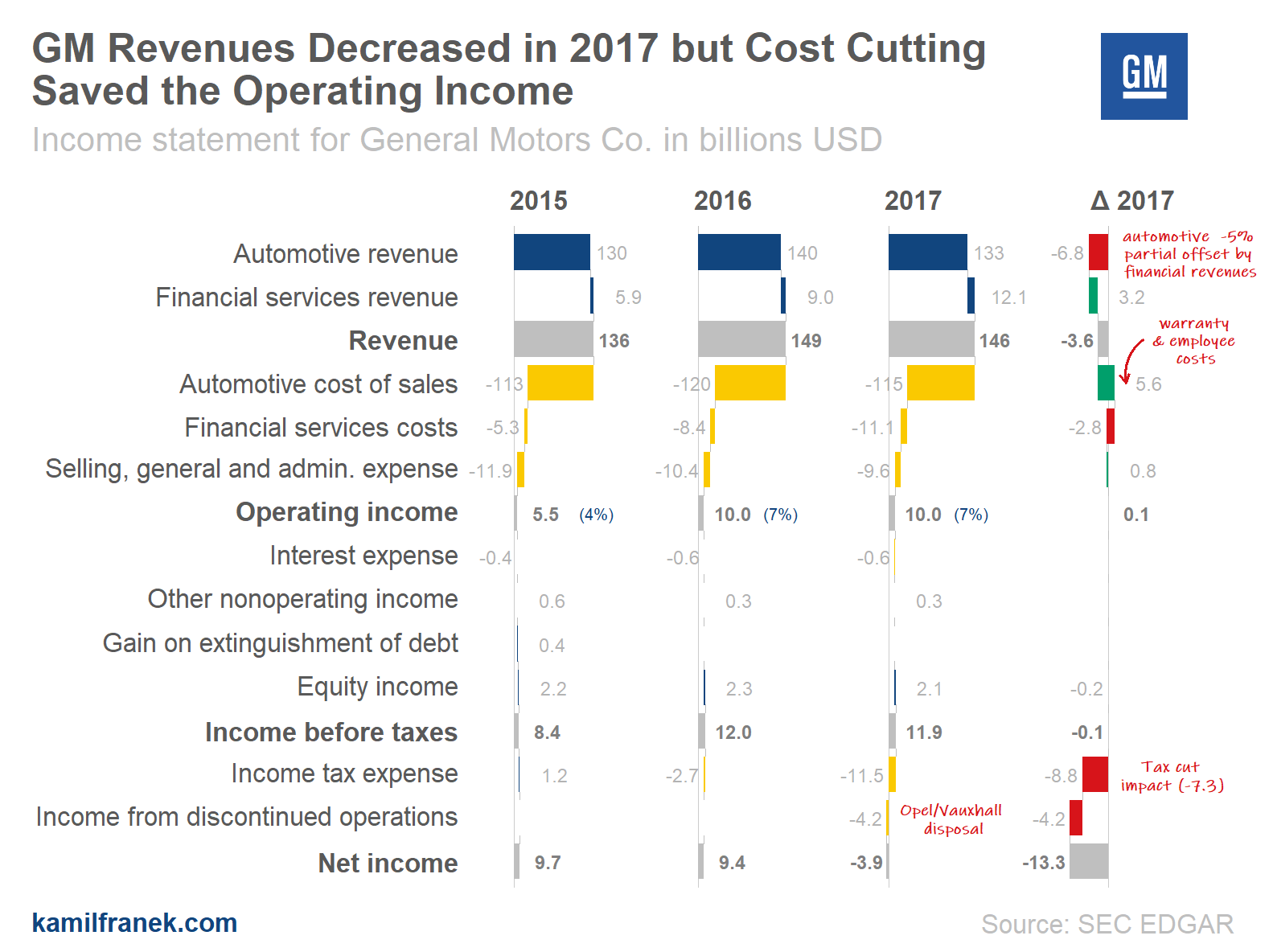

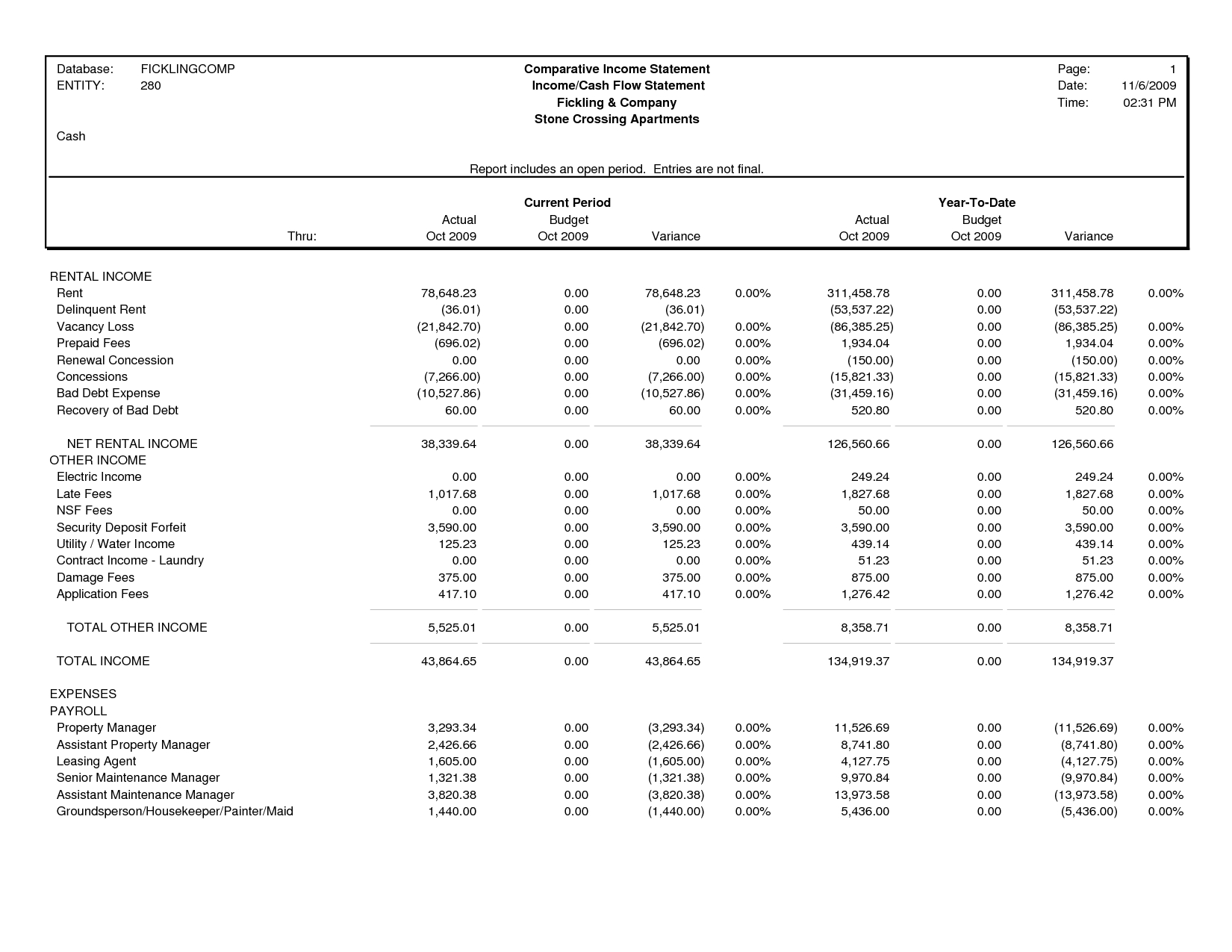

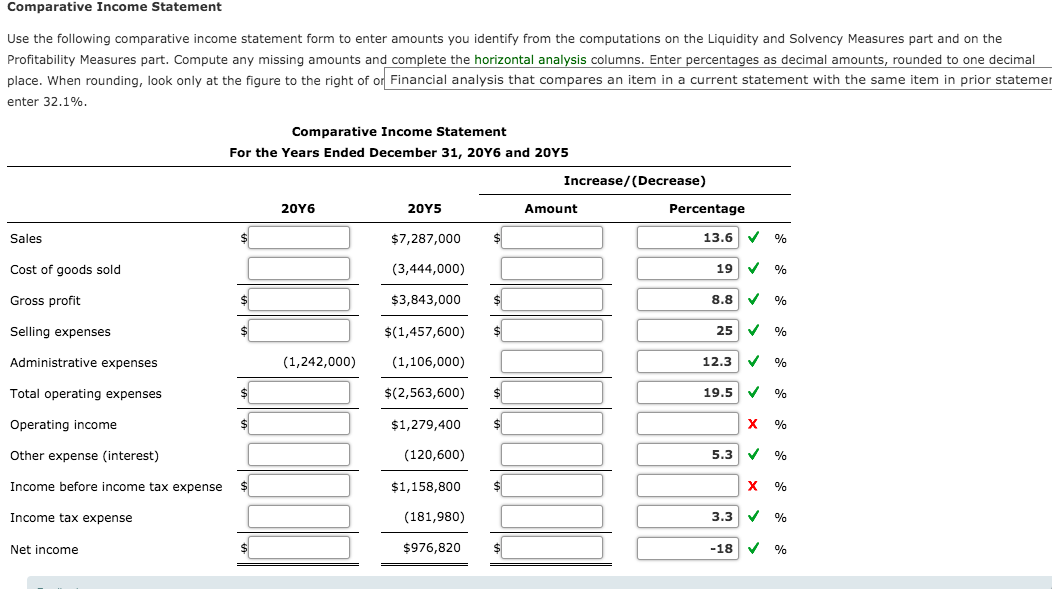

It helps the business owner to compare the results of business operations over. Common size income statement facilitates easy comparison. Horizontal analysis horizontal analysis is one of the popular techniques of comparative income statements demonstrating the financial change in both absolute and percentage terms.

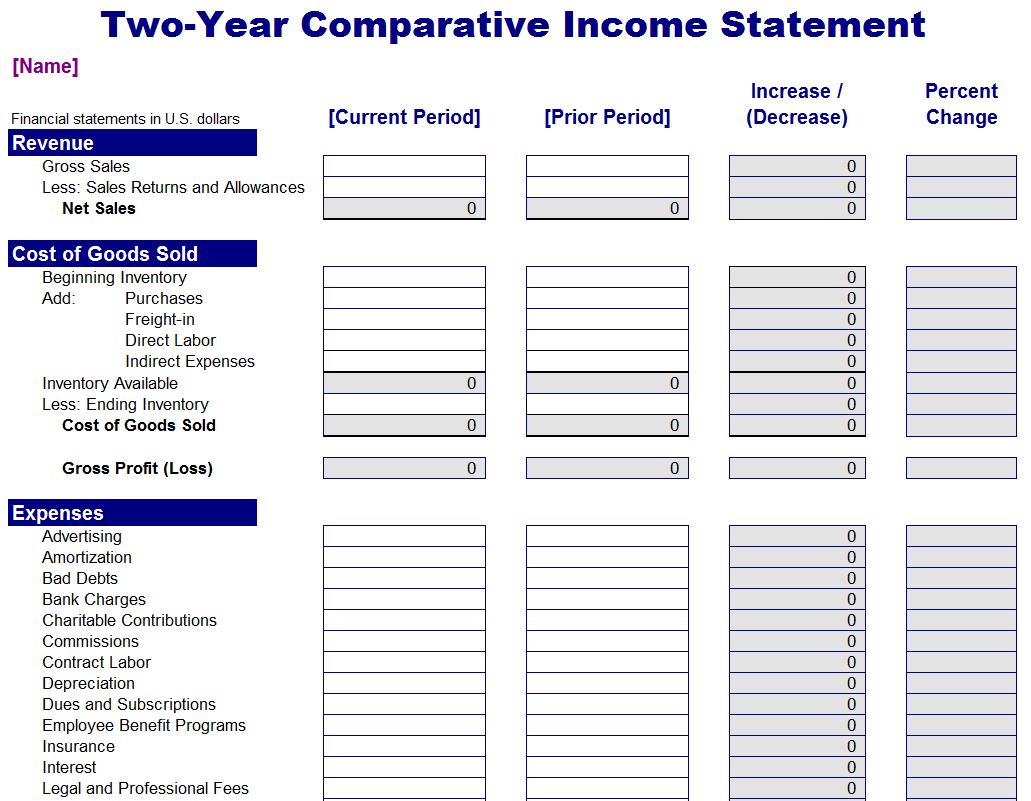

A comparative income statement will consist of two or three columns of amounts appearing to the right of the account titles or descriptions. The comparative income statement is defined and illustrated including two different formats, the horizontal and vertical analysis statements. It makes analysis much easier such that the analyst can see what is actually driving the profit of a company and then compare that performance to its peers.

Horizontal analysis comparative income statement definition approach depicts the change in quantity in both absolute. A net profit of 3.2 million euros in january is a positive indicator. Leverage ratio * of 1.1 at december.

Gross profit is then often analyzed in comparison to. The difference between the two is in the way a statement is read and the comparisons you can make from each type of analysis. Compare current amounts to past years see if performance has improved over time figure out patterns in high and low sales months calculate percentages of changes show how your company compares to others when securing outside capital information on a comparative income statement helps you make smart business.

It helps in observing seasonality and growth patterns in an easy way. These differences can make it difficult to compare the income statements of different companies—or even the statements produced by the same company in different periods. In this type of analysis, income statement metrics such as total revenue growth and gross profit margin are calculated for similar companies within an industry and compared to one another.