Supreme Info About Is Insurance An Expense On The Income Statement

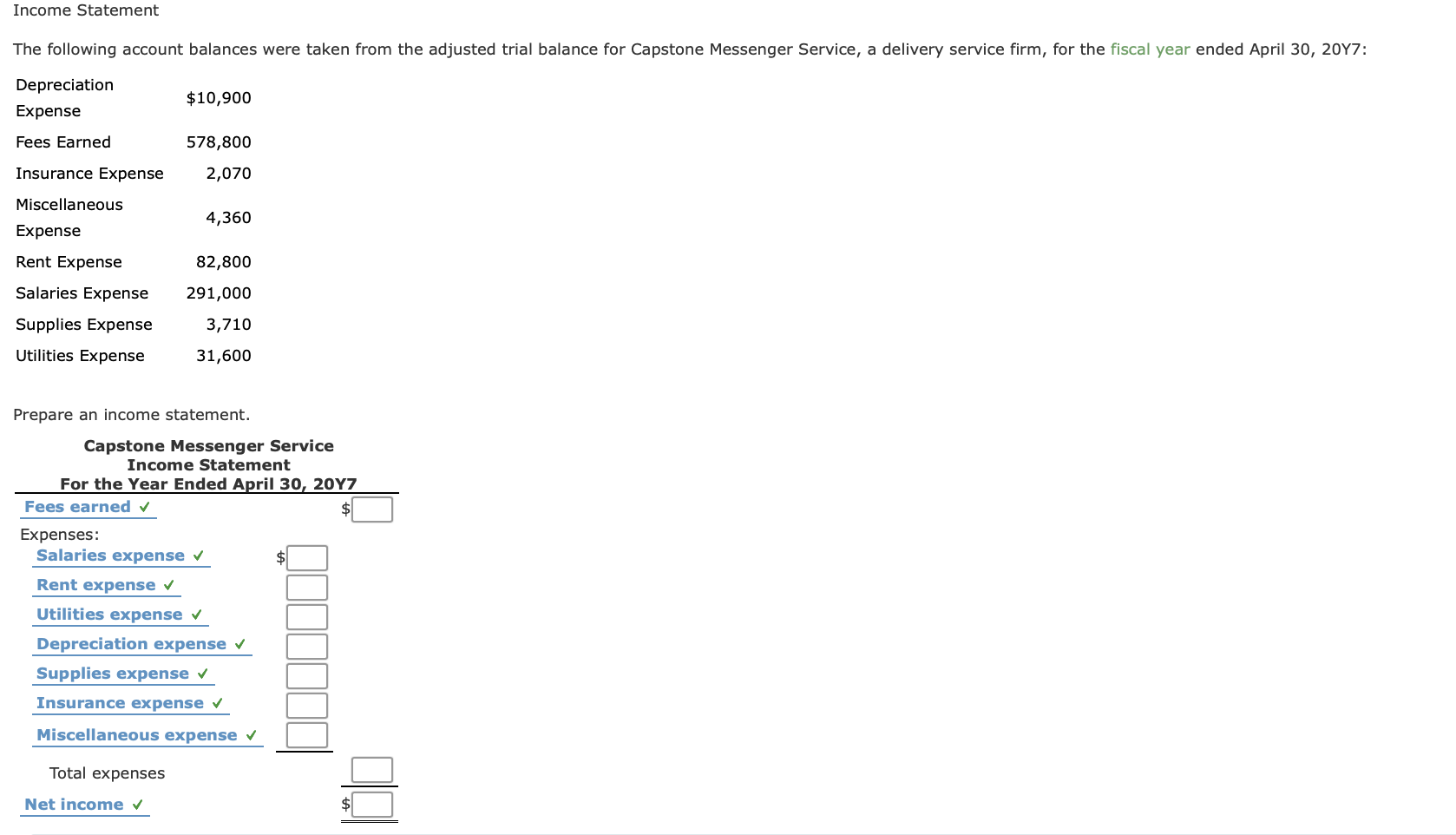

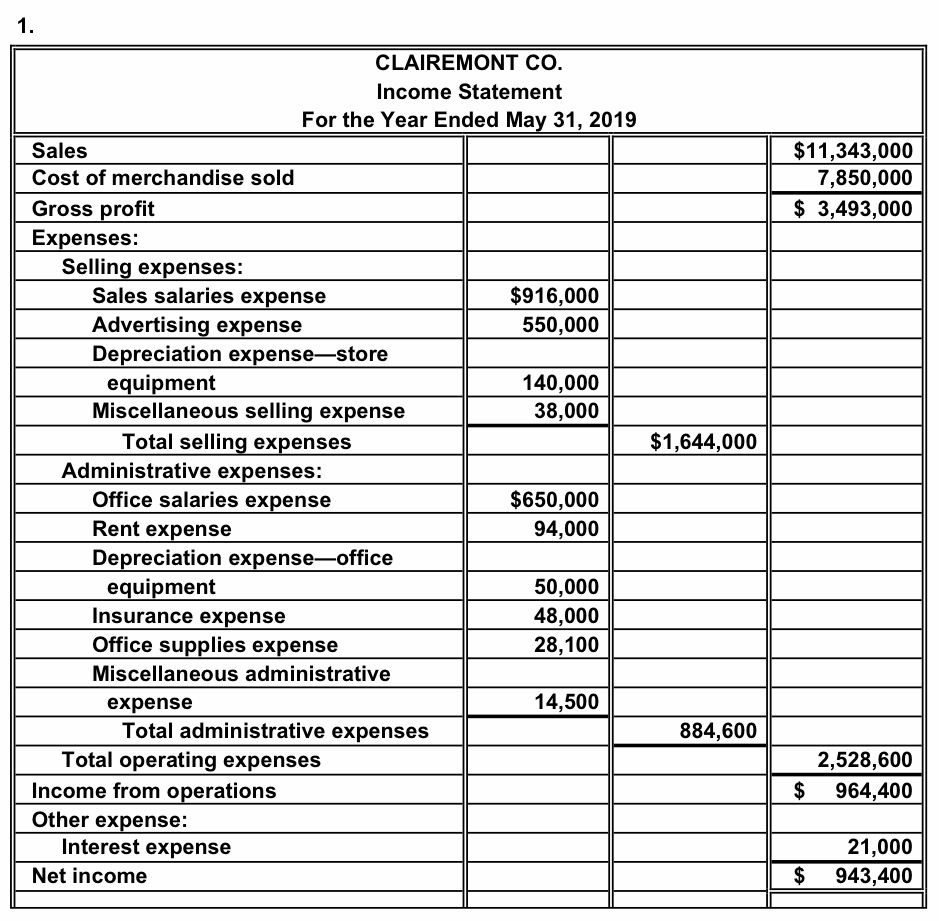

Insurance expense is part of operating expenses in the income statement.

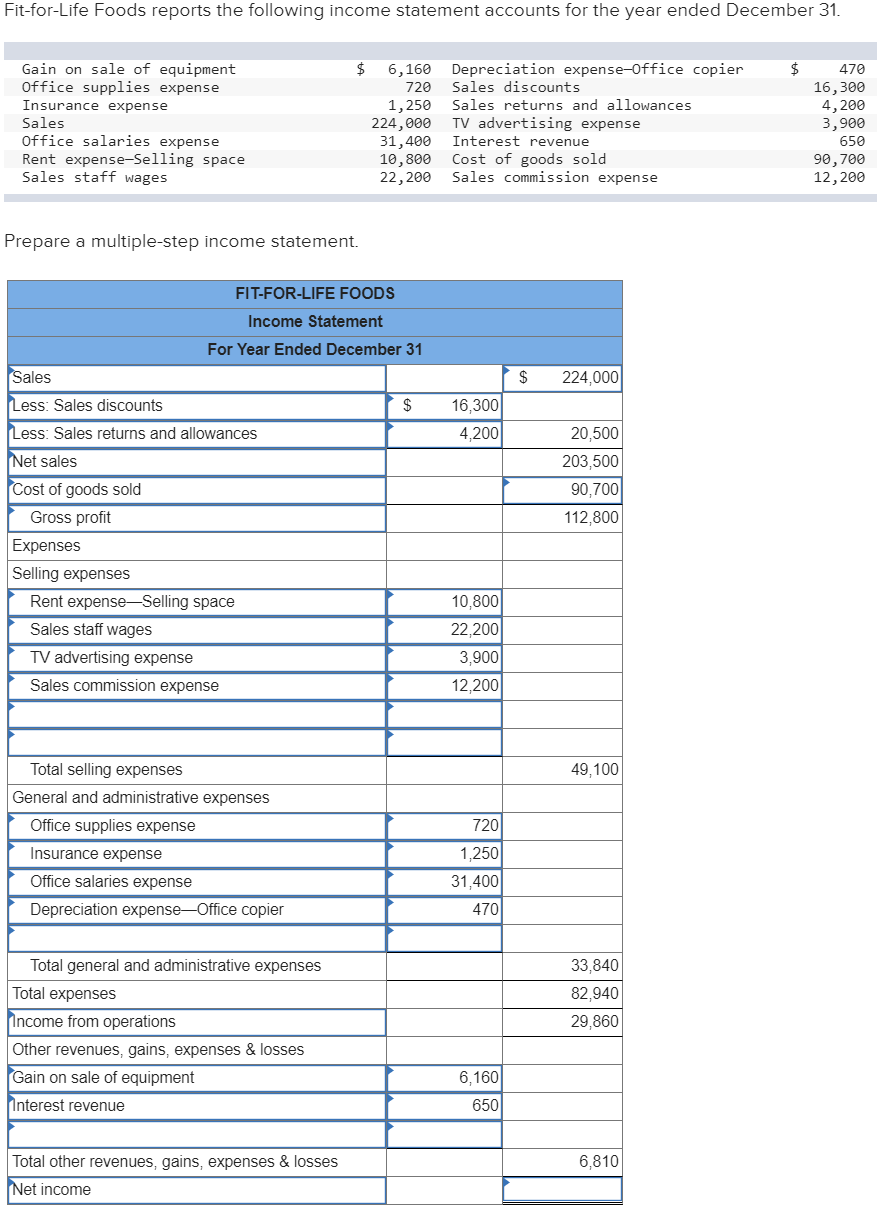

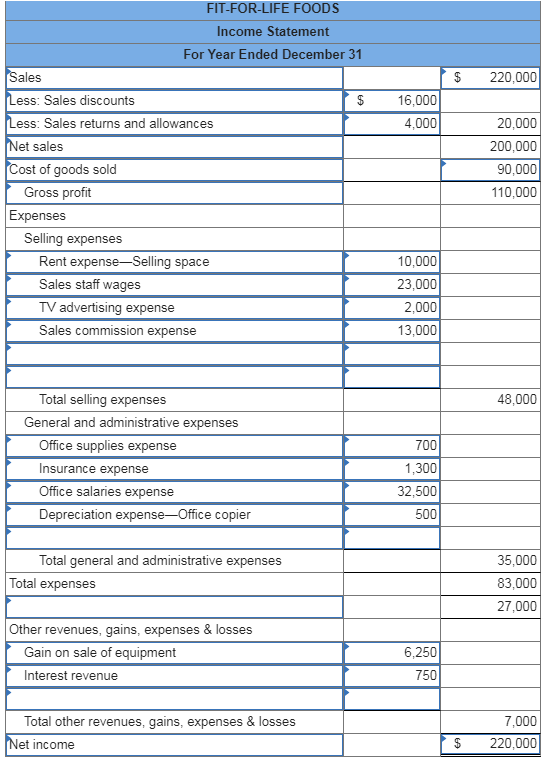

Is insurance an expense on the income statement. Insurance expense does show up on the balance sheet. For example, say that you make $100,000 in taxable income and have $10,000 in combined medical expenses. The costs that have expired should be reported in income statement accounts such as.

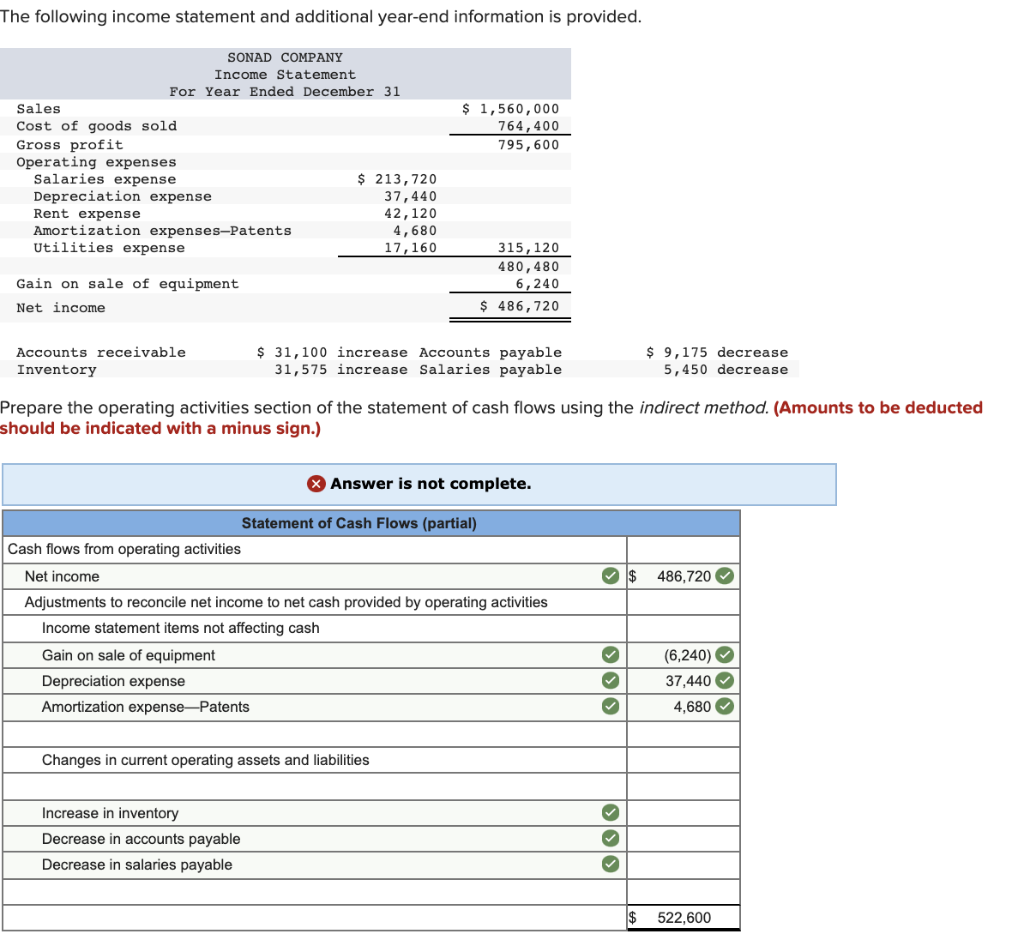

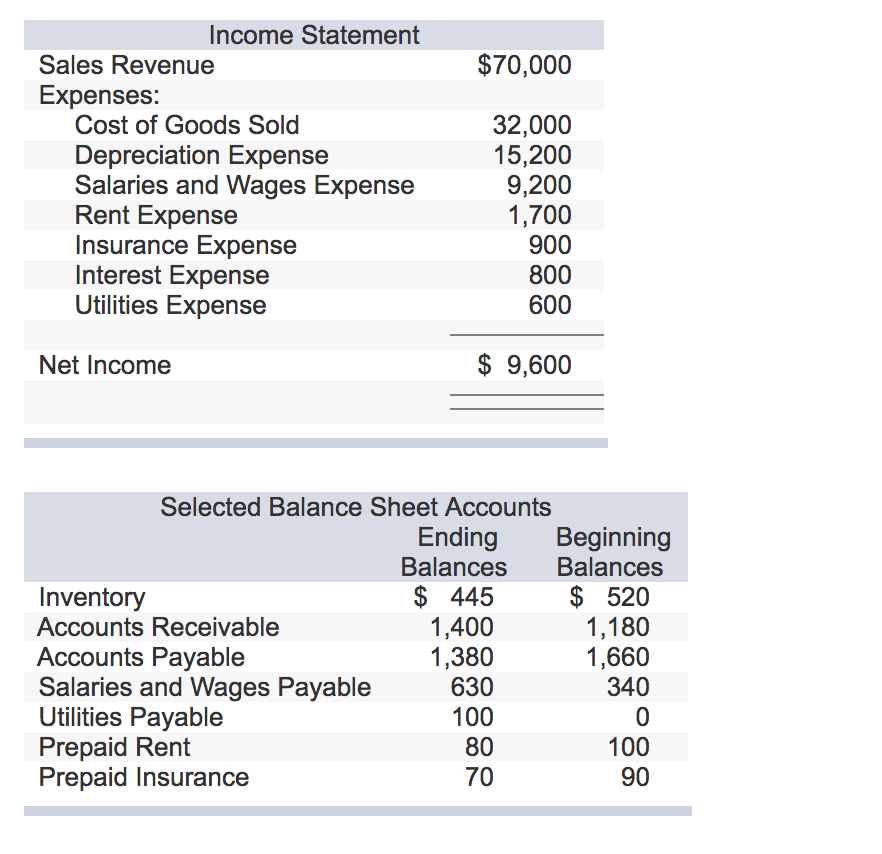

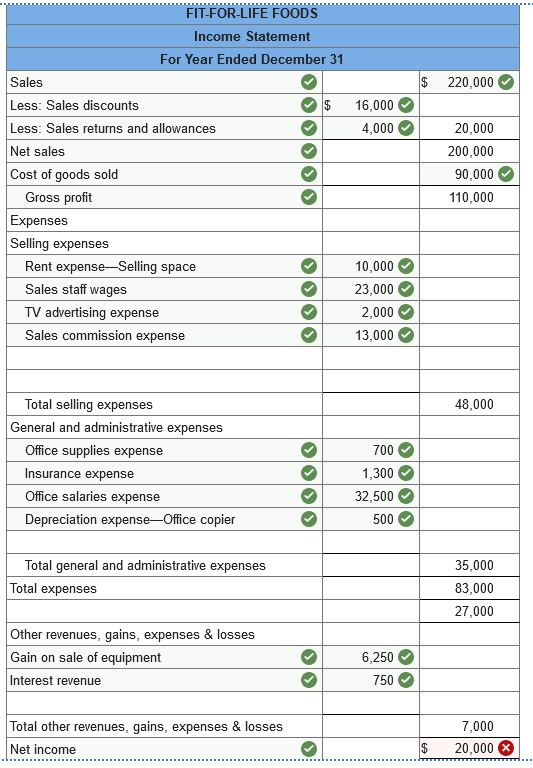

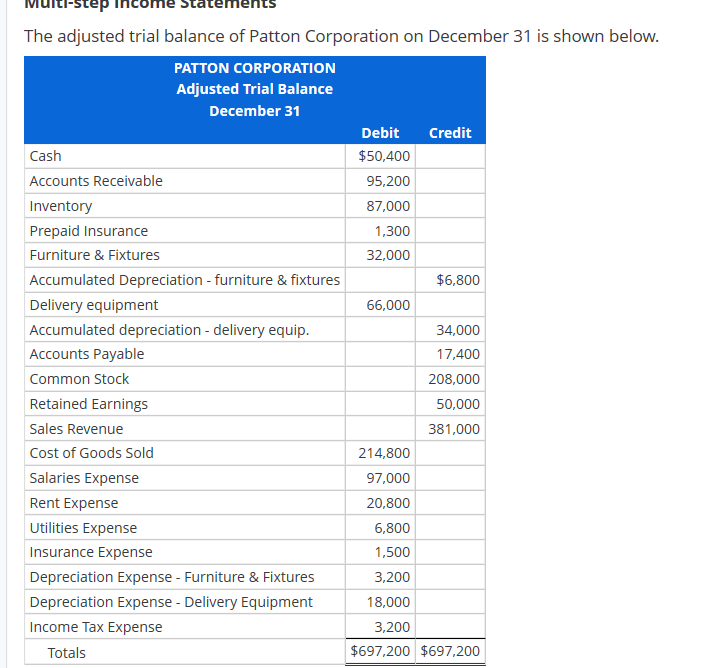

What type of expense is insurance? This includes salaries and wages, rent and office expenses, insurance, travel expenses, and sometimes depreciation and amortization, along with other operational expenses. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue.

Income statement (as part of expenses). Banking, insurance, and real estate.) without the need to spend on supplies, parts, or other tangible assets, a good portion of the budget is freed up for investing. Insurance expense is that amount of expenditure paid to acquire an insurance contract.

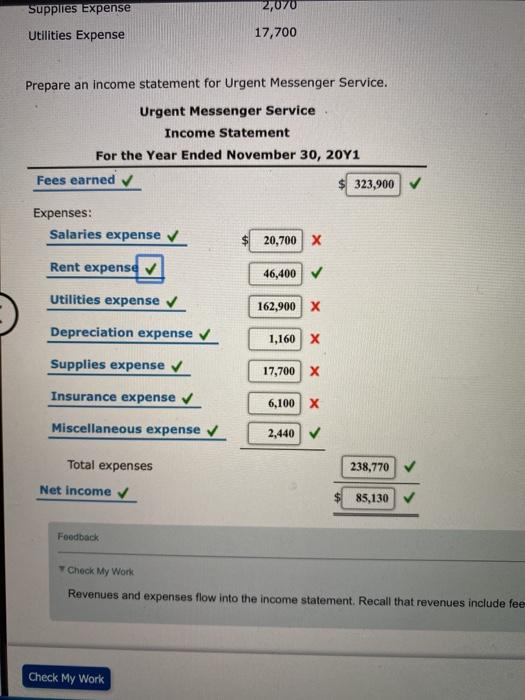

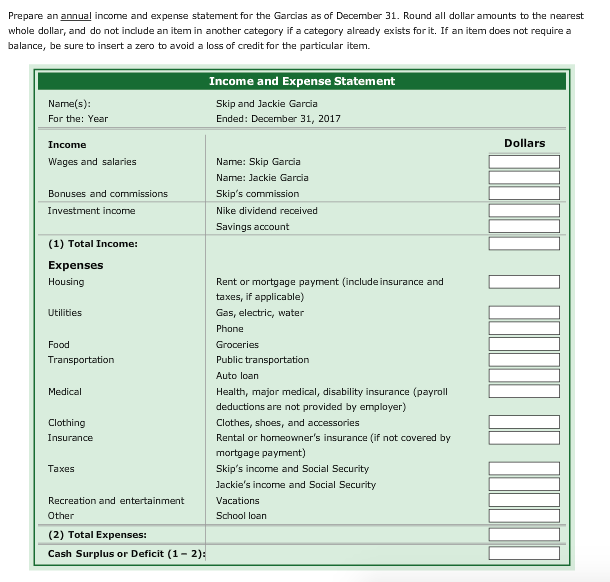

The insurance industry interest income can be very small, or even close to nothing for some companies. An income statement compares revenue to expenses to determine profit or loss. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Insurance expense definition the amount of insurance that was incurred/used up/expired during the period of time appearing in the heading of the income statement. The unexpired part is presented as prepaid insurance, an asset.

You cannot deduct the first $7,500 (7.5% * $100,000) but. The costs that have expired should be reported in income statement accounts such as insurance expense, fringe benefits expense, etc. The income statement is a useful way to see how a company makes money and how it spends it.

Let's assume that a company is started on december 1 and arranges for business insurance to begin on december 1. Insurance expense, like other business expenditures, belongs on a company's income statement rather than on its balance sheet. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions.

Net income is the profit that remains after all expenses and costs, such as taxes. In statutory accounting, the initial section includes a balance sheet, an income statement and a section known as the capital and surplus account, which sets out the major components of policyholders’ surplus and. Once expenses are incurred, the prepaid asset account is reduced and an entry is made to the expense account on the income statement.

Entities may, however, elect to separate depreciation and amortization in their own section. An insurance company’s annual financial statement is a lengthy and detailed document that shows all aspects of its business. Where does insurance expense go on income statement?

Expired insurance premiums are reported as insurance expense. Which reporting period is right for you depends on your goals. Monthly, quarterly, and annual reporting periods are all common.