Brilliant Strategies Of Tips About Notes Receivable Cash Flow Statement

An increase in the notes receivable does not necessarily do anything on the cash flow statement unless it is accompanied with a cash outflow due to a credit.

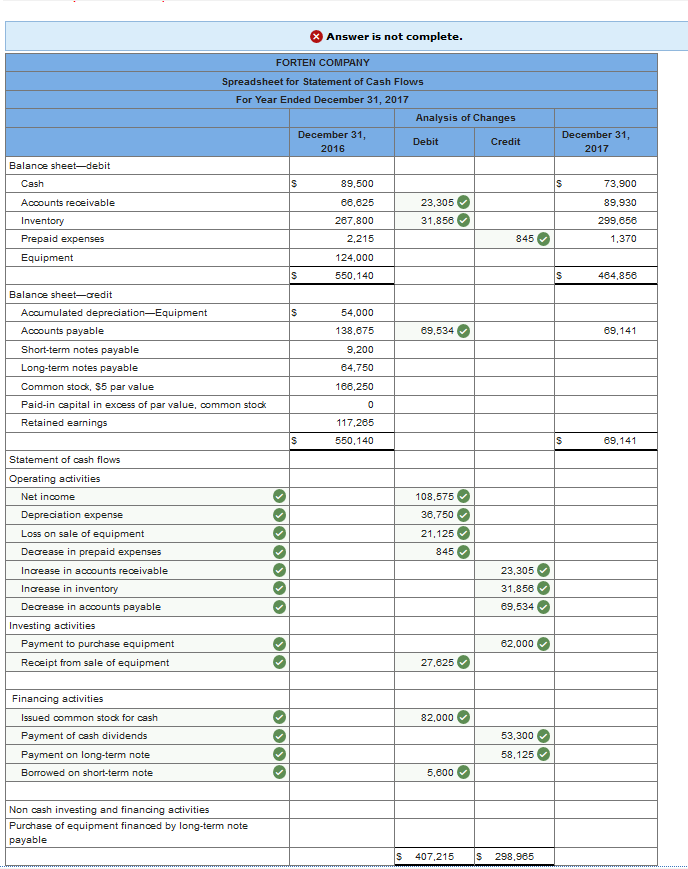

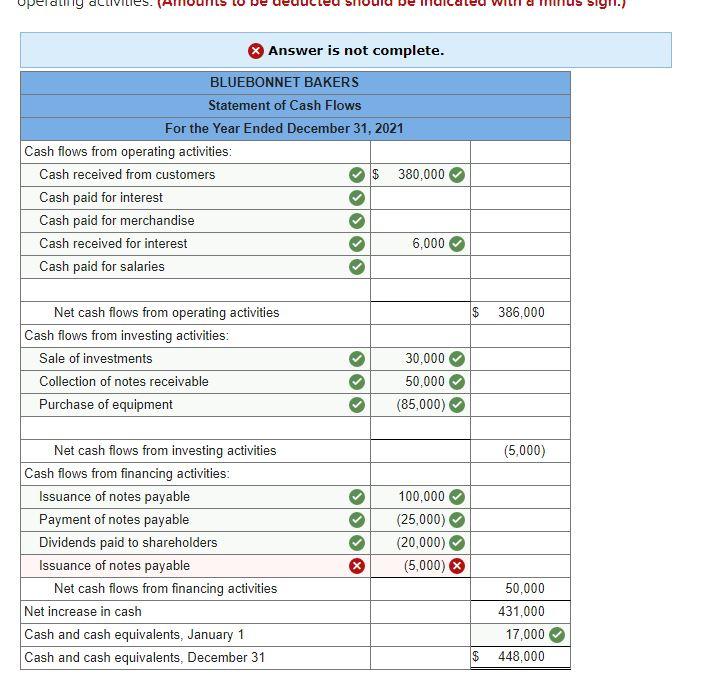

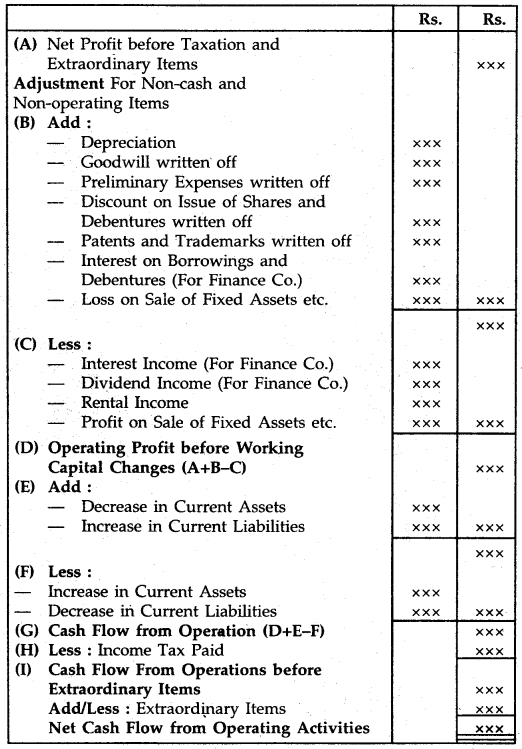

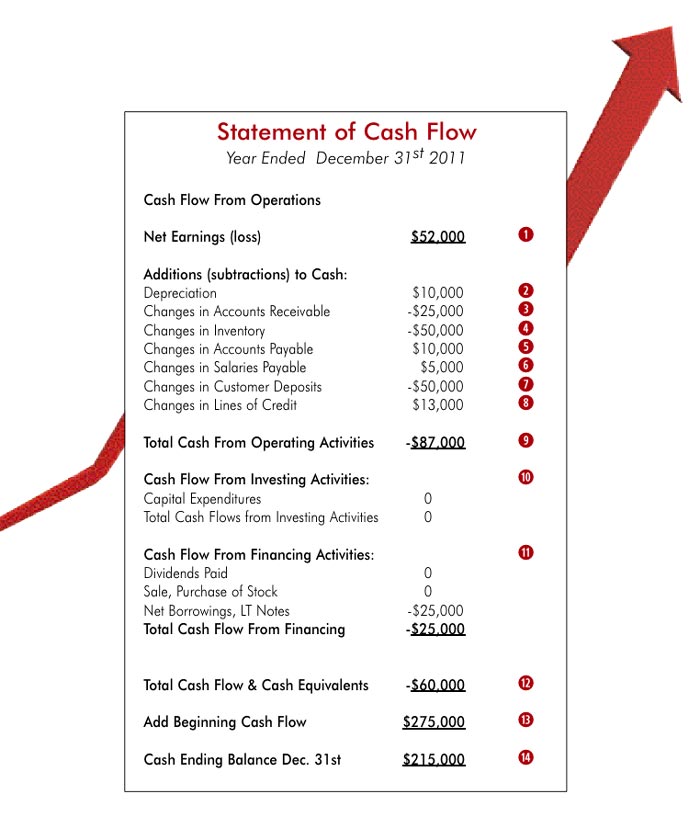

Notes receivable cash flow statement. For the entity doing the lending, also known as a payee or creditor, notes receivable can improve cash flow. Cash flows from investing and financing are prepared the same way under the direct and indirect methods for the statement of cash flows. The statement of cash flows has four main sections:

This is because preparation of. Cash flow definitions cash flow: Many entities use centralized treasury.

16.1 explain the purpose of the statement of cash flows; Cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period. 16.2 differentiate between operating, investing, and financing activities;

To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories: The note receivable maturity date is january 31, 2021, and was for a sale. Three are used to classify the types of cash inflows and outflows during the period and the fourth reconciles the total cash.

Presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows from operating. In this case, when we make the credit sale of goods or services on. Fundamental principle in ias 7.

Notes receivable are recorded as an asset account. This is treated as an asset by the holder. 16.3 prepare the statement of cash.

Executed notes receivable/payable with affiliates would typically result in investing or financing activities, respectively. The statement of cash flows is the most complex statement to prepare. A note receivable is a written promise to receive a specific amount of cash from another party on one or more future dates.

To put it simply, if we receive. Asc 230 allows a reporting entity to prepare and present its statement of cash flows using either the direct or indirect method (see fsp 6.4.2), though asc. Likewise, the accounts receivable occurs when we make the sales of goods or services on credit.

Inflows and outflows of cash and cash. Accounts receivable is the amount that customers owe us for goods or services that we have provided but have not received cash payment yet. What is a cash flow statement?

All entities that prepare financial statements in conformity with ifrss are required to present a statement of cash flows.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)