Brilliant Info About Operating Investing And Financing

Barbie maker mattel, paypal, cisco, nike, estée lauder and levi strauss are just a few of the firms that have cut jobs in recent weeks.

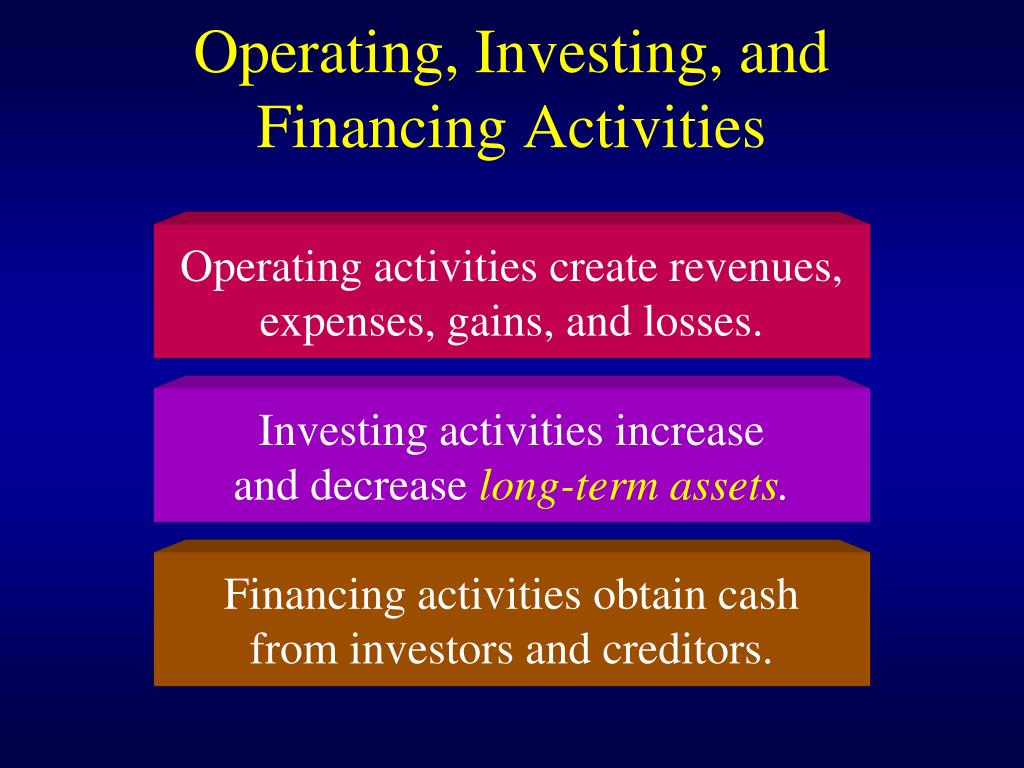

Operating investing and financing. Singapore’s national carrier saw a mixed financial result for the quarter but achieved a record operating and net profit for the first nine months of fiscal 2024 (9m. Operating activities are the business activities other than the investing and financial activities. The purpose of the discussion on the statement of cash flows was to try to identify ways to make the definitions of operating, investing and financing activities in.

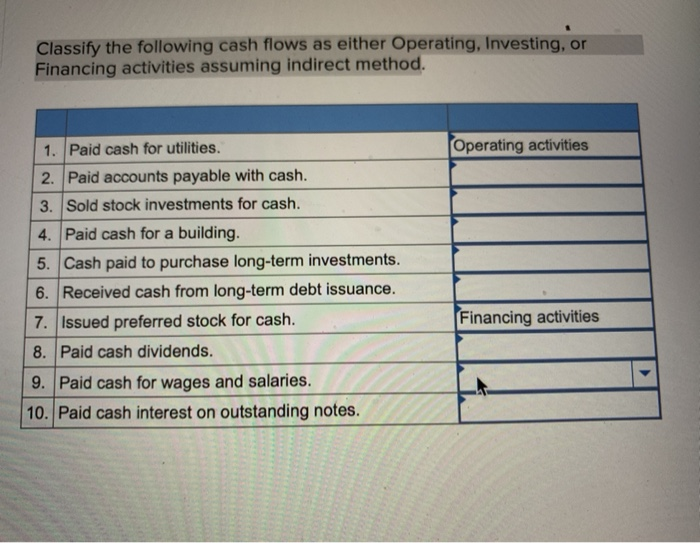

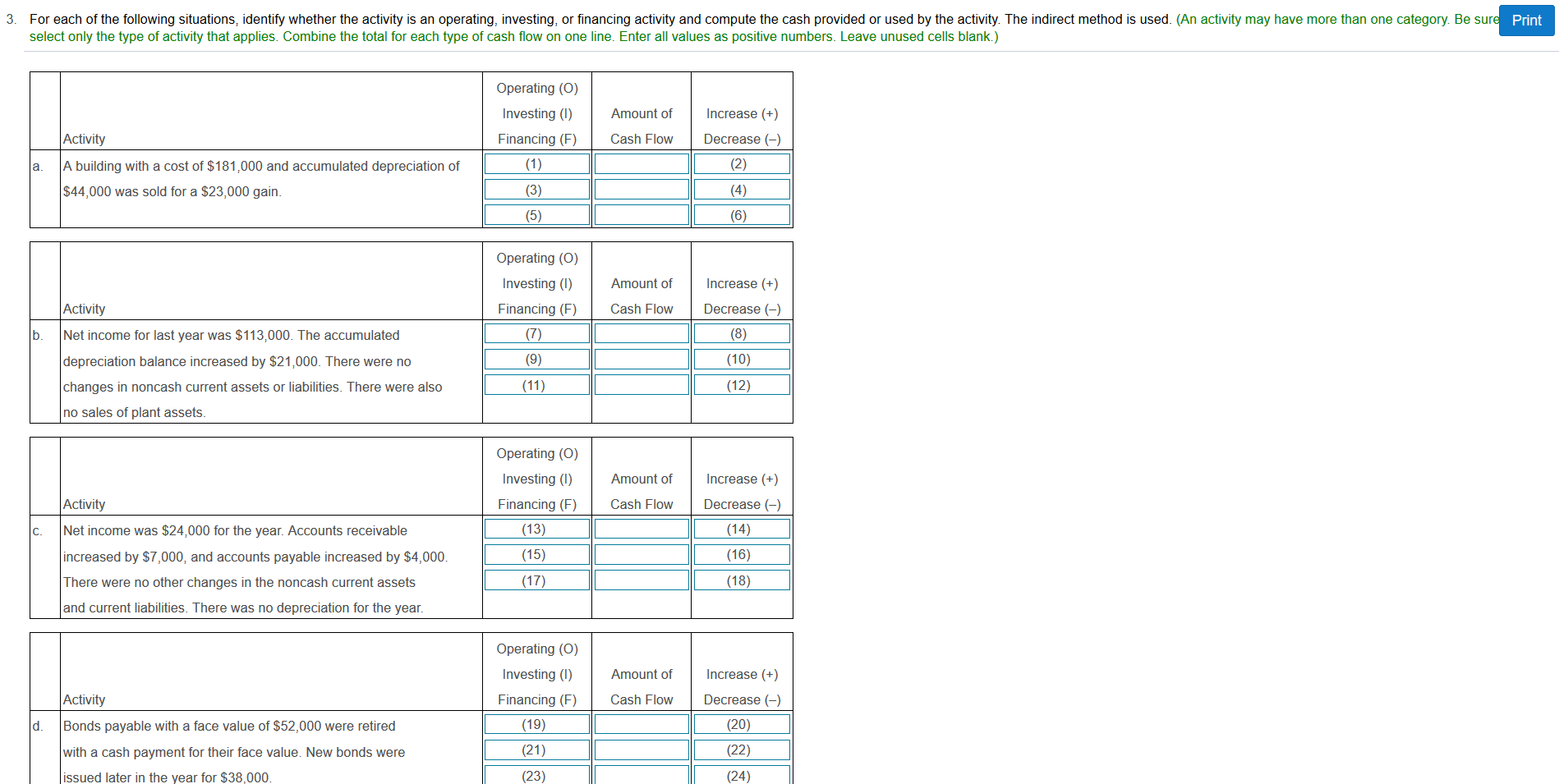

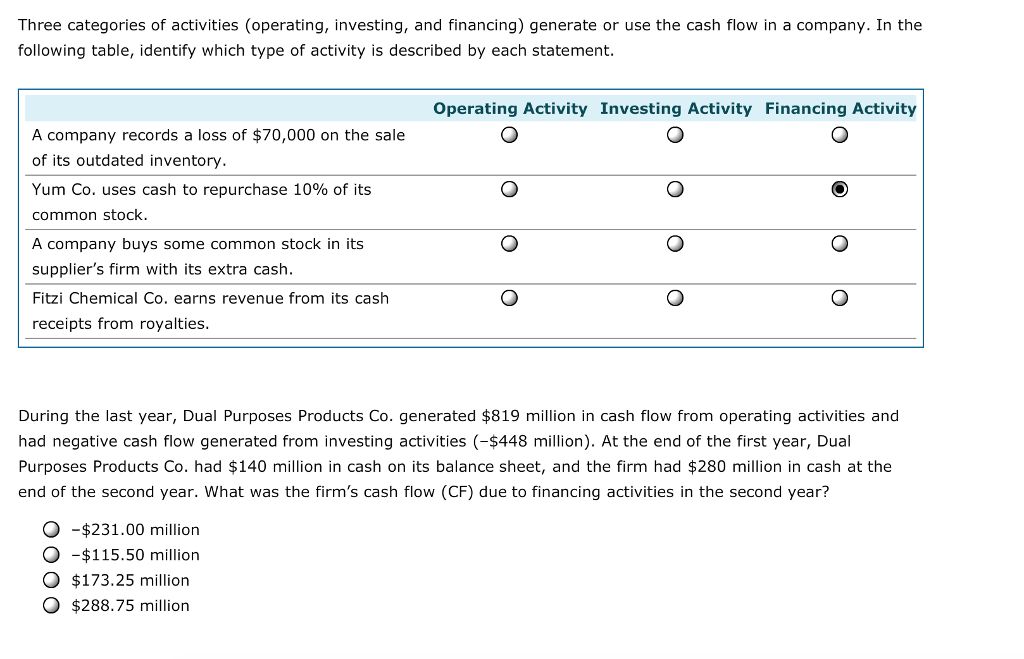

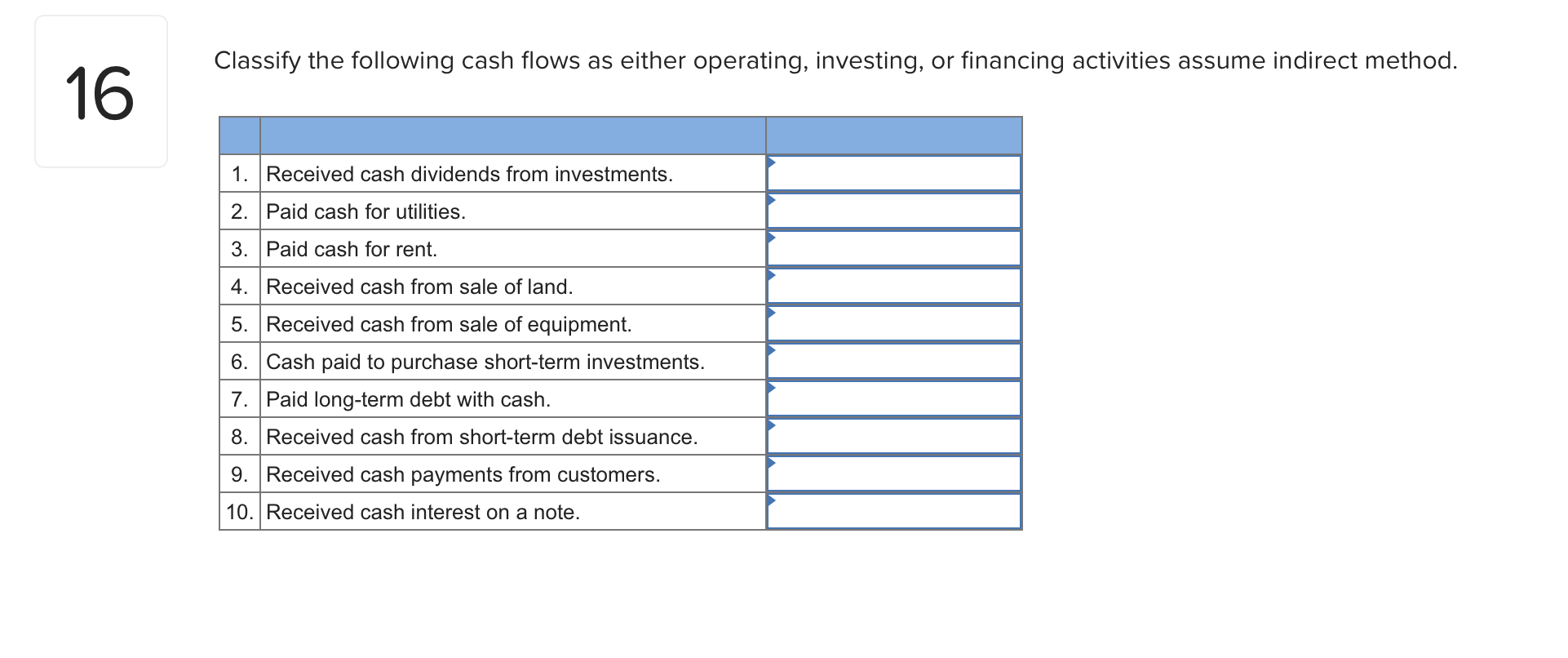

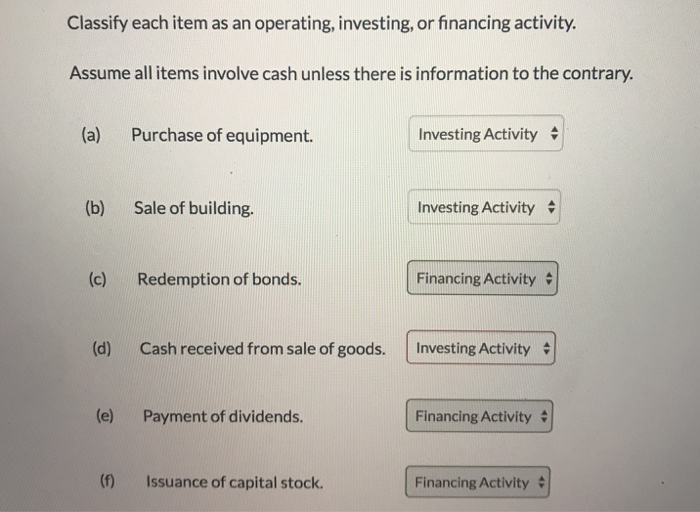

Classified by operating, investing and financing activities. Here is the operating activities section of example corporation's scf which. Transactions must be segregated into the three types of activities presented on the statement of cash flows:

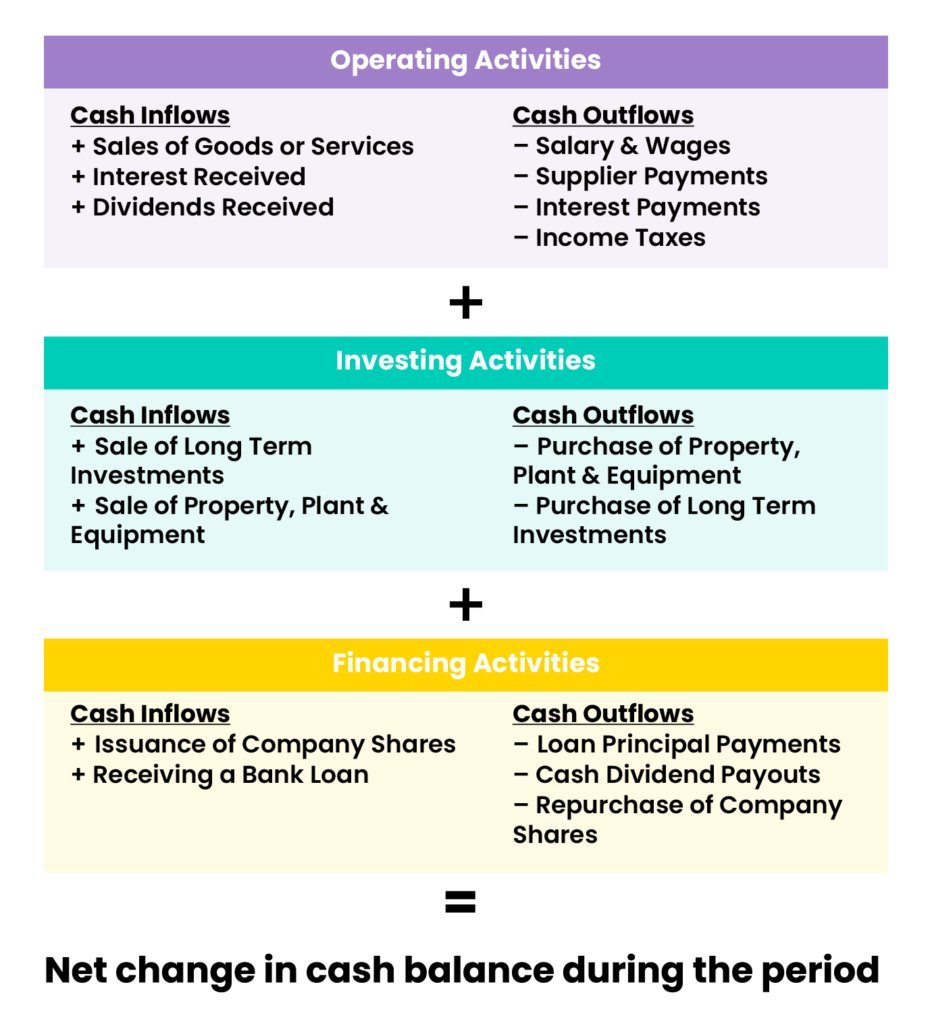

Operating cash flows refer to the cash flow generated by a company’s primary operations. Any investing and financing transactions are excluded from the operating cash flows section and reported separately, such as borrowing, buying capital. Operating, investing, and financing activities are the three main categories of a company’s cash.

Brock is a cfa and cpa with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and. Operating activities involve cash flows directly related to a company's core business. Operating cash flows also include cash flows.

Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing. The basics of operating, investing, and financing cash flows. Financial statement users are able to assess a company’s strategy and ability to generate a profit and stay in business by assessing how much a company relies on operating,.

Statement of cash flows example. It's typically broken down into operating, investing, and financing activities. The company recorded an annual net income of $48.4 billion and net cash flows from operating activities of $63.6 billion.

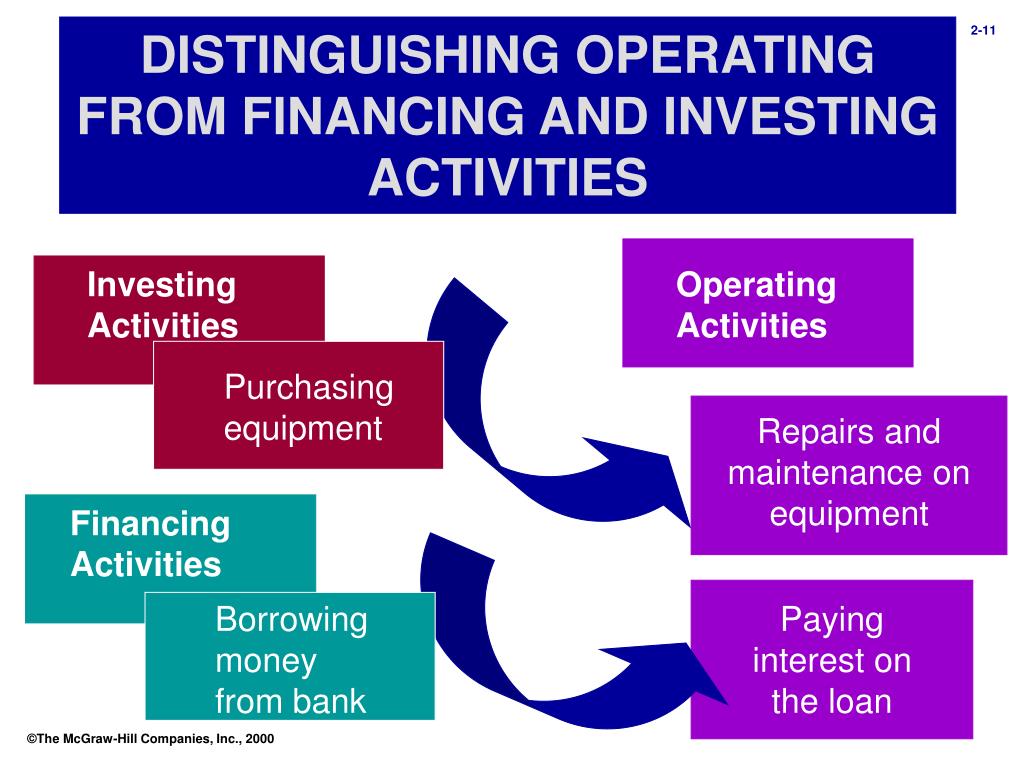

There are three cash flow types that companies should track and analyze to determine the liquidity and solvency of the business: In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income. Differentiate between operating, investing, and financing activities mitchell franklin;

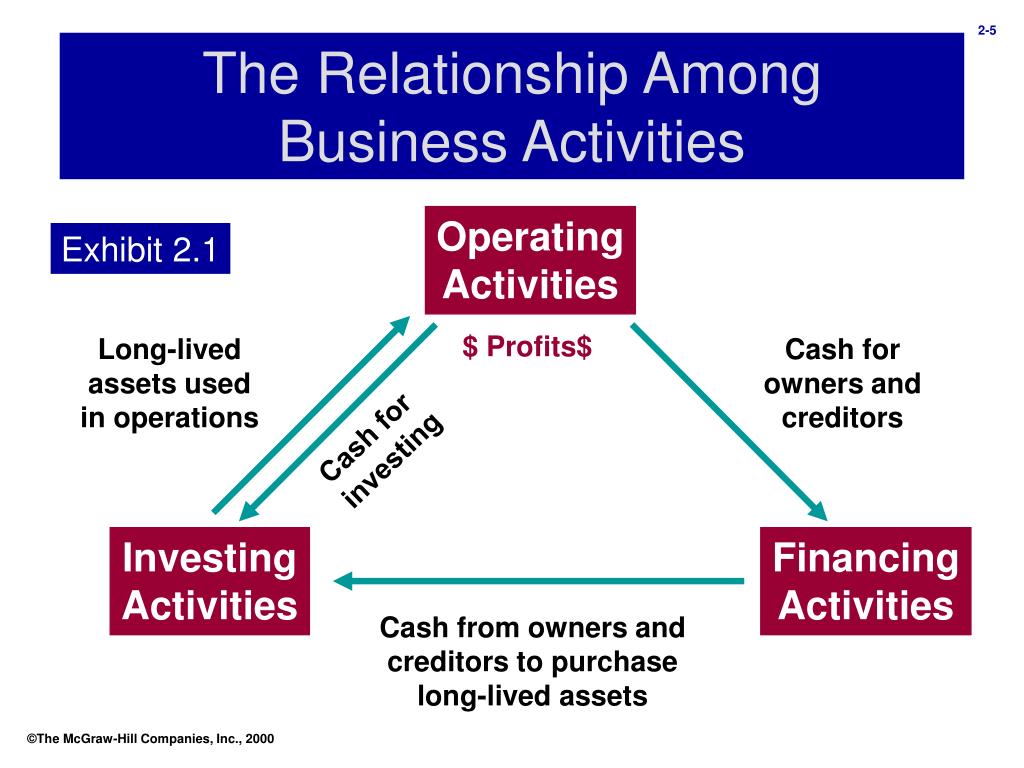

For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries and utilities. The relationship between operating, investing, and financing activities. The business brought in $53.66 billion through its.

For example, receipts of investment income (interest and dividends) and. With a robust $14 billion in cash from operations and $13.1 billion in cash and equivalents in 2023, ibm's financial health is a testament to its. Some cash flows relating to investing or financing activities are classified as operating activities.

Cash flows from operating activities arise from the activities a business uses to produce net income. Cash flow is broken out into cash flow from operating activities, investing activities, and financing activities. And dixon cooper the statement of cash flows presents sources and.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)