Out Of This World Info About Notes Payable On Income Statement

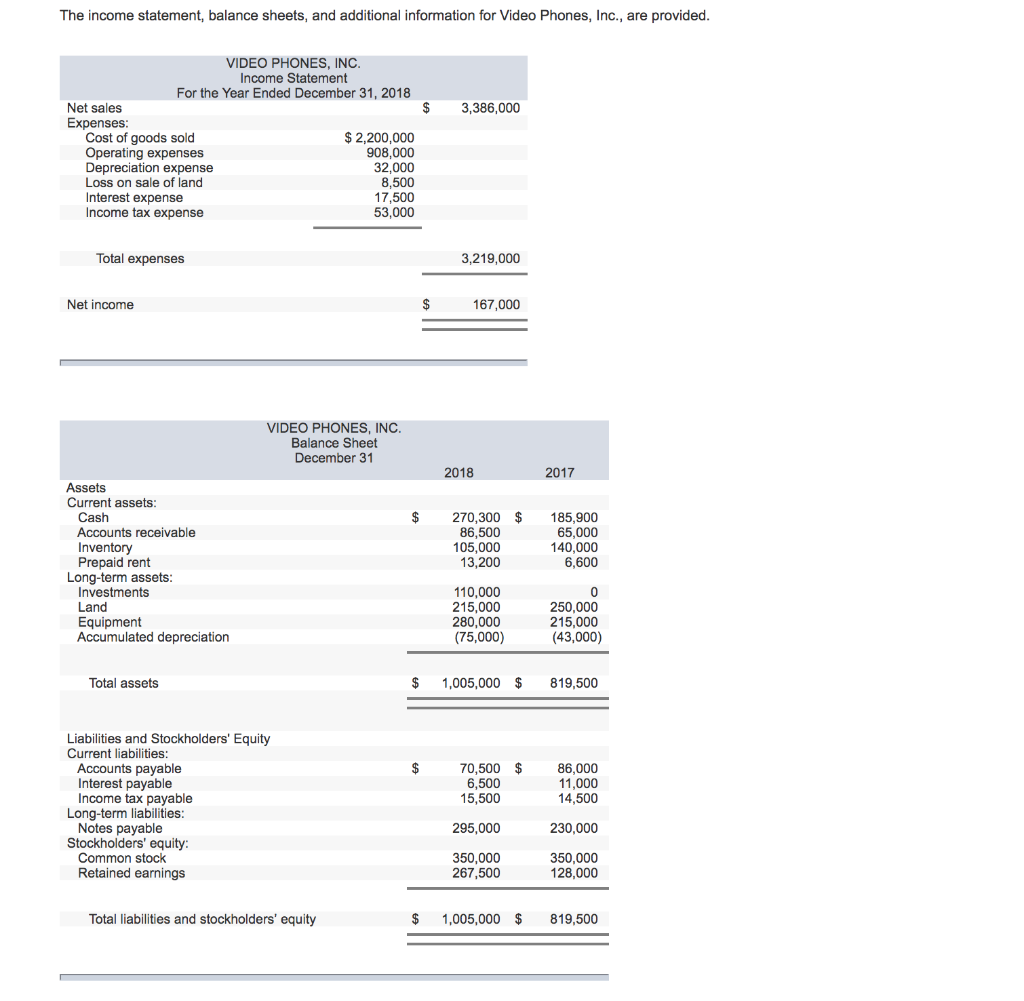

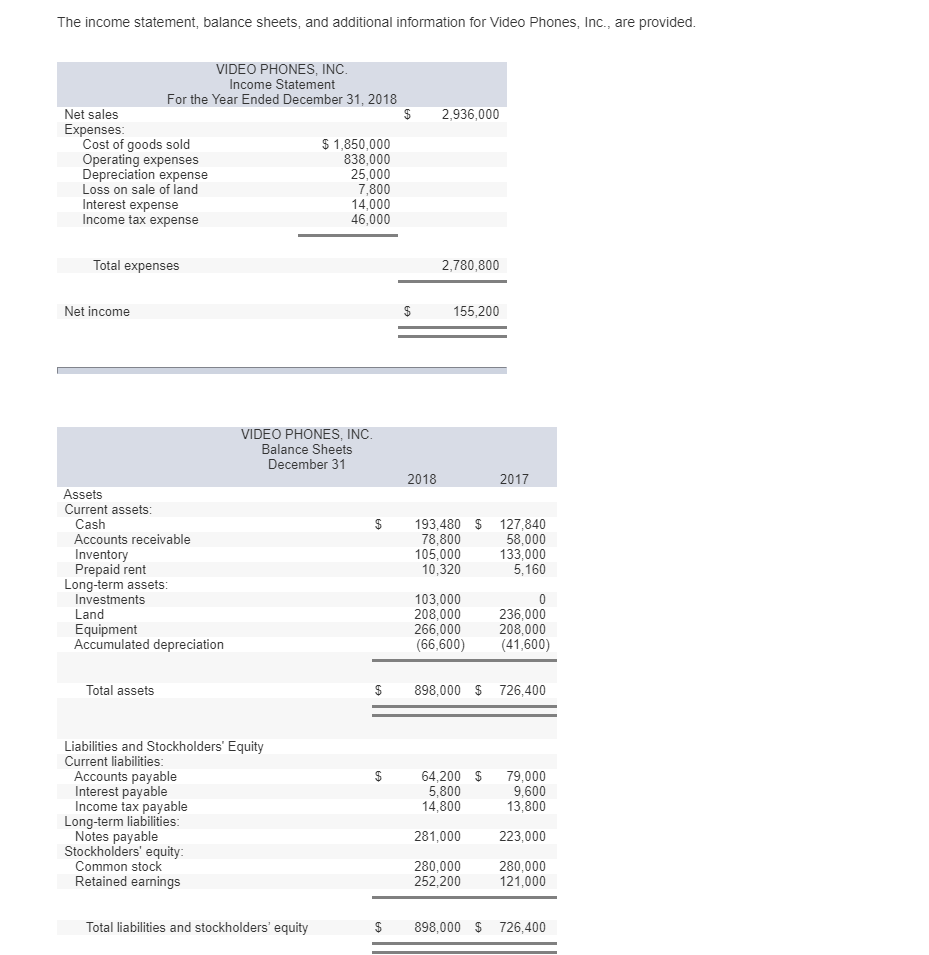

In accounting, notes payable is a general ledger liability account in which a company records the face amounts of the promissory notes that it has issued.

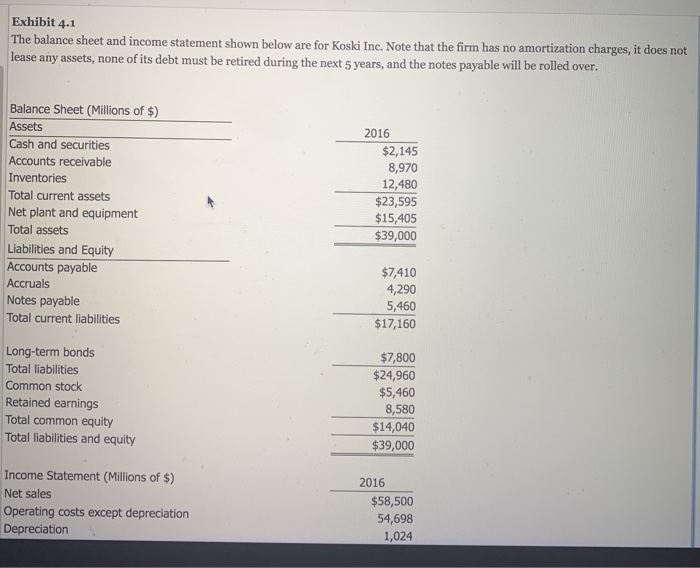

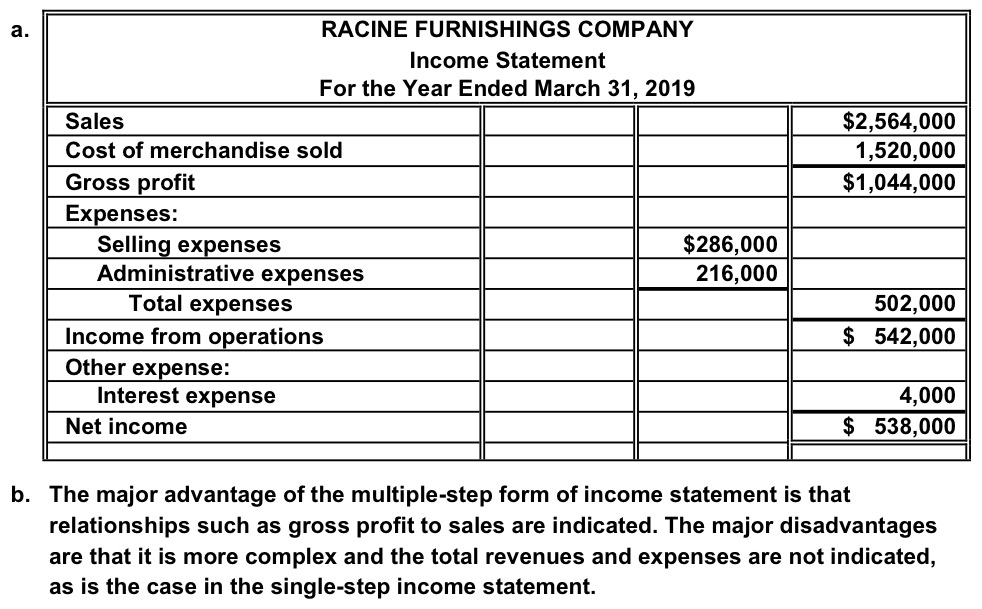

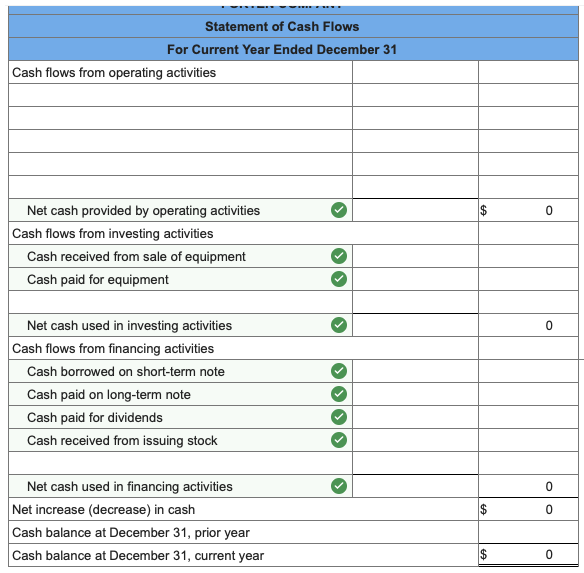

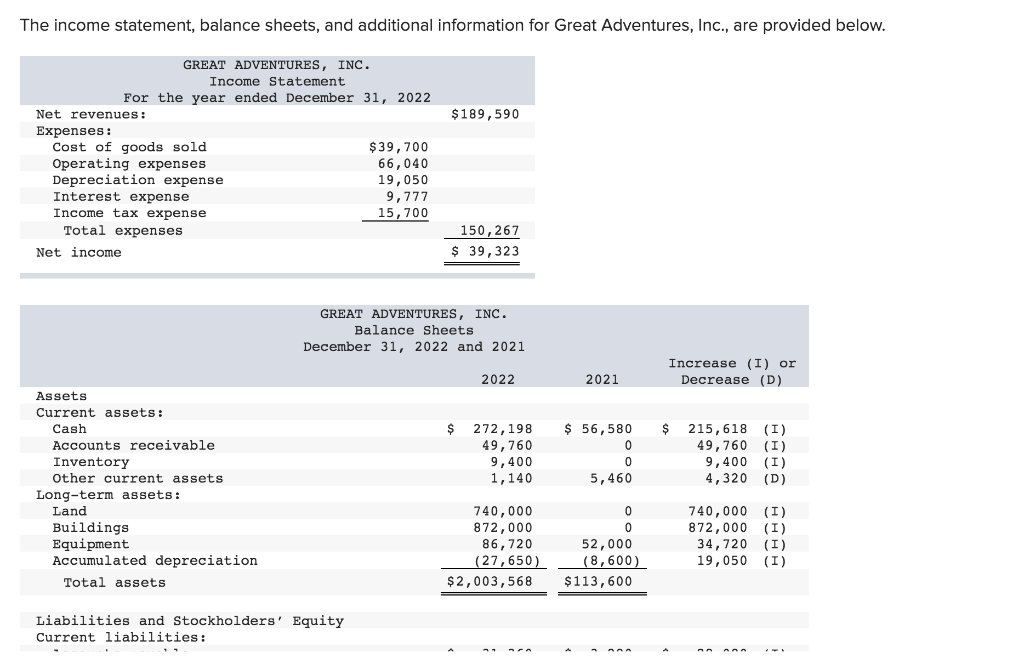

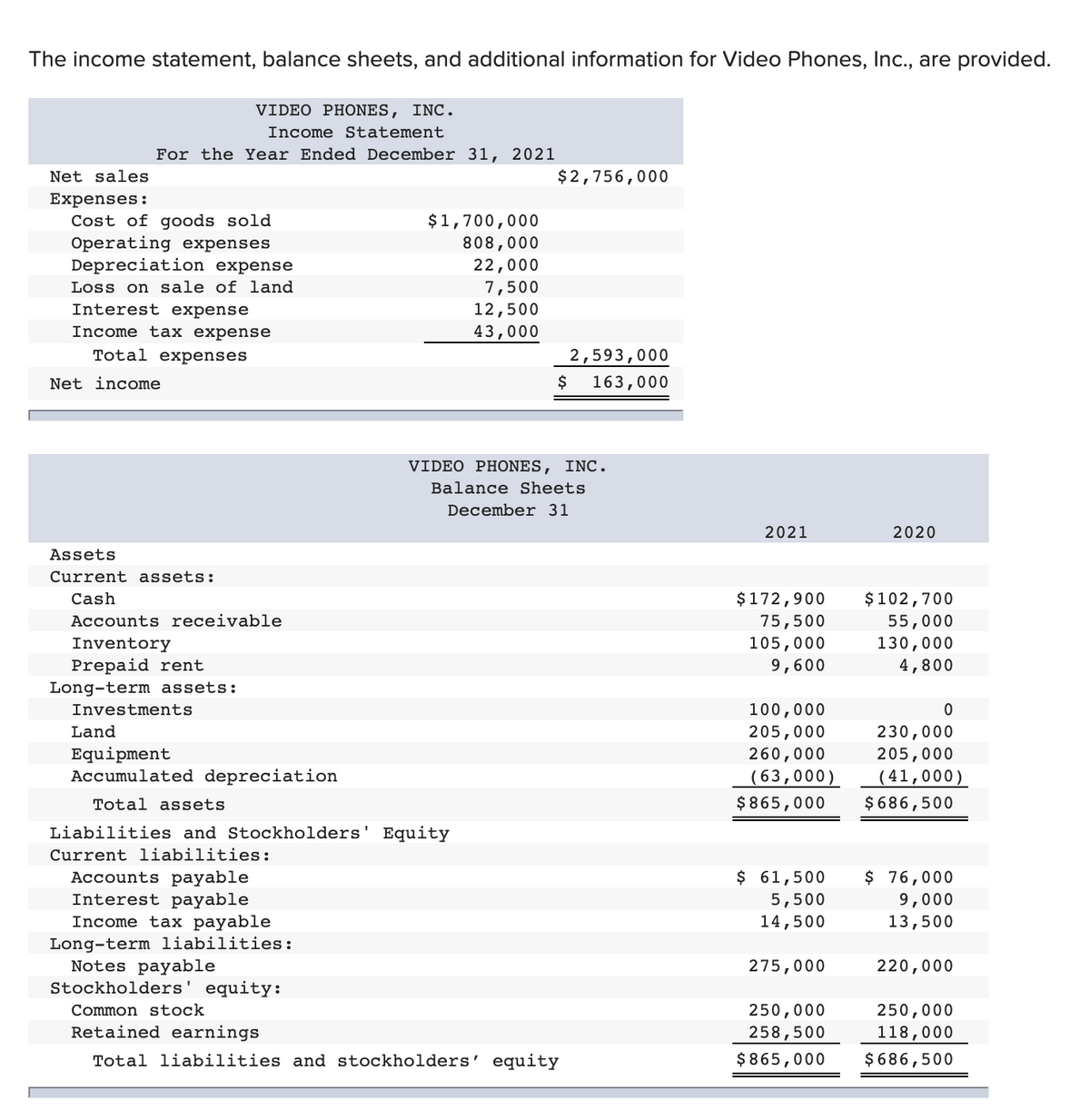

Notes payable on income statement. Total liabilities and owner's equity A note payable is included in the balance sheet of the business. Learn all about notes payable in accounting and recording notes.

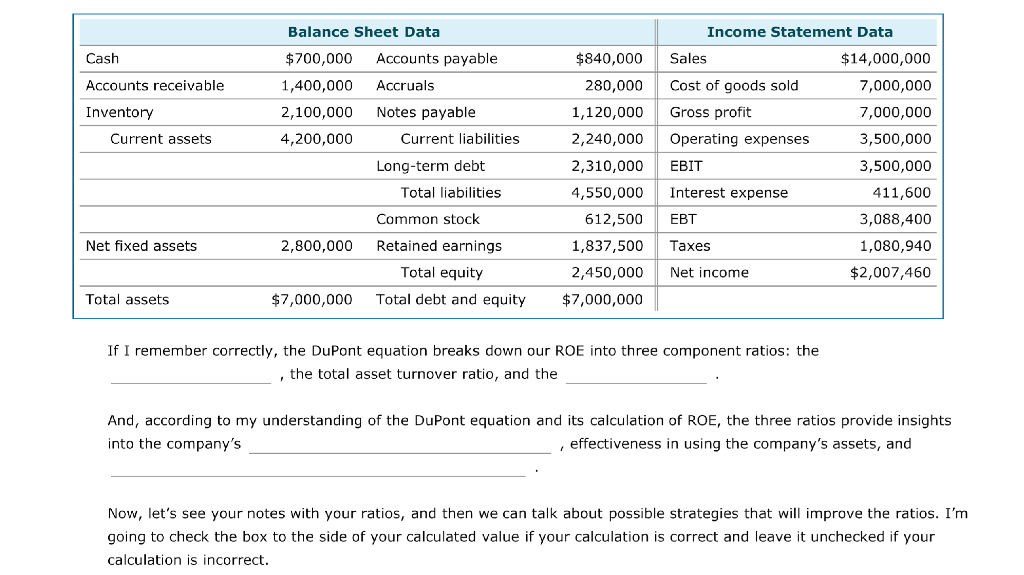

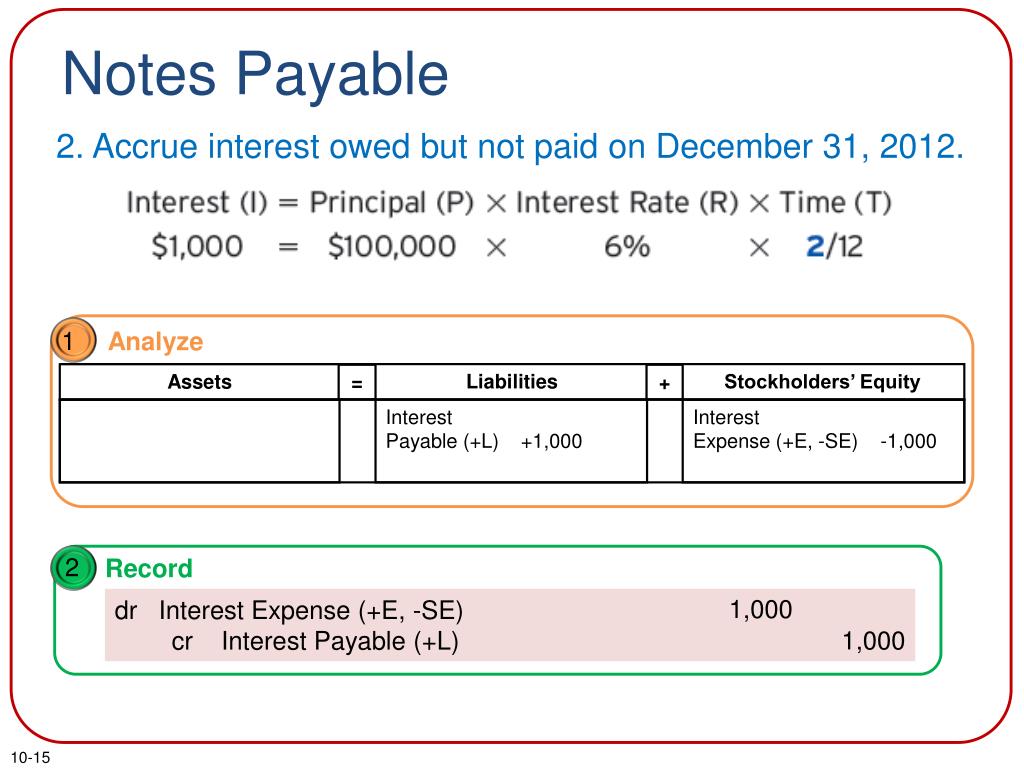

9.6 explain how notes receivable and accounts receivable differ; Interest expense goes on the income statement and increases expenses and reduces net income. Accounts payable (ap) is an account in a company's general ledger.

2.3 prepare an income statement, statement of owner’s equity, and balance sheet highlights one of the key factors for success for those beginning the study of accounting is to understand how the elements of the financial statements relate to each of the. These notes are negotiable instruments in the same way as. Accounts payable are liabilities on the balance sheet.

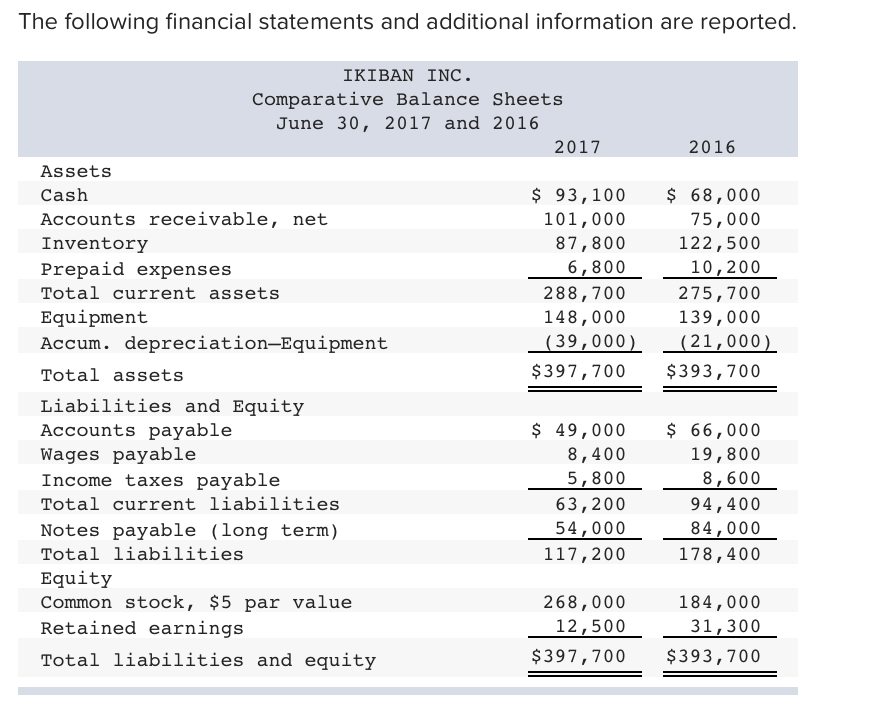

When the debt is long‐term (payable after one year) but requires a payment within the twelve‐month period following the balance sheet date, the amount. What is a note payable? The balance in notes payable represents the amounts that remain to be paid.

The portion of the note receivable due to be repaid within one year is classified as a current asset and. It is supported by a formal written promissory note. A real example of an income statement.

A note payable is a formal promise to repay a debt, usually with interest, at some future date. This initial payment is then recorded as an expense on the company’s income statement. Additionally, they are classified as current liabilities when the amounts are due within a year.

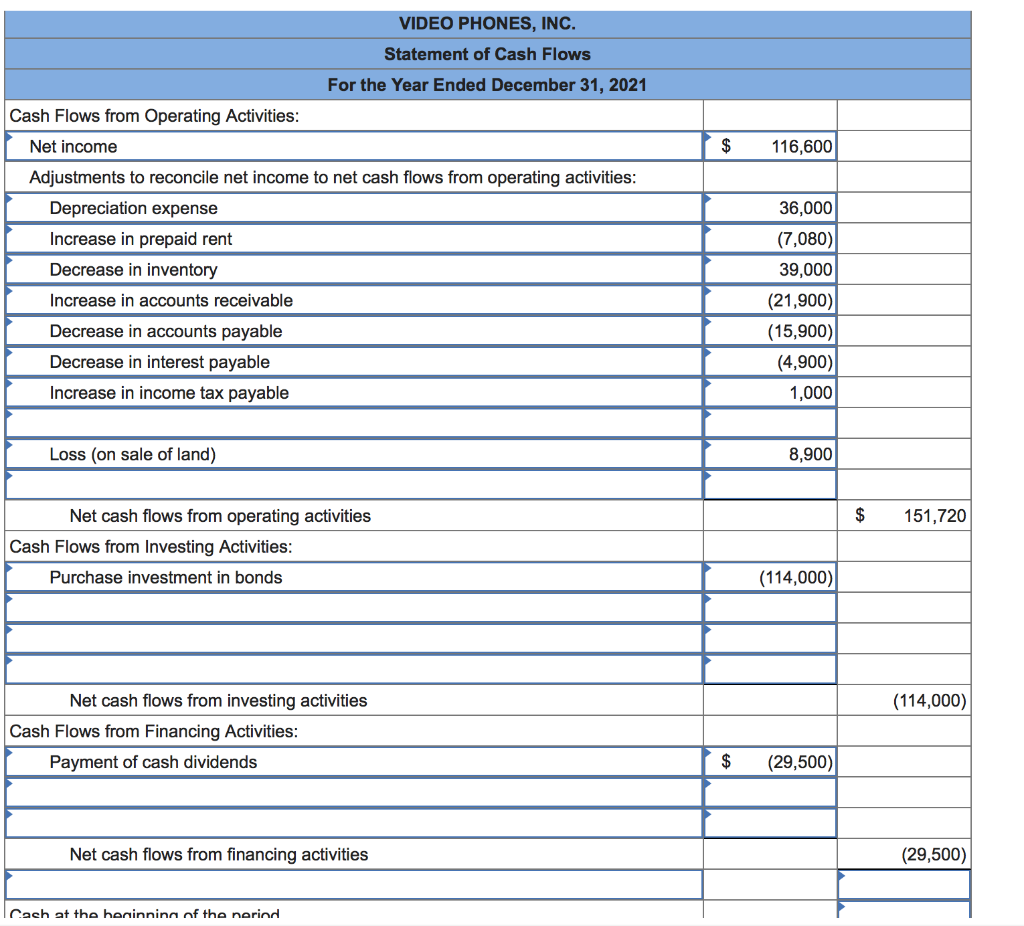

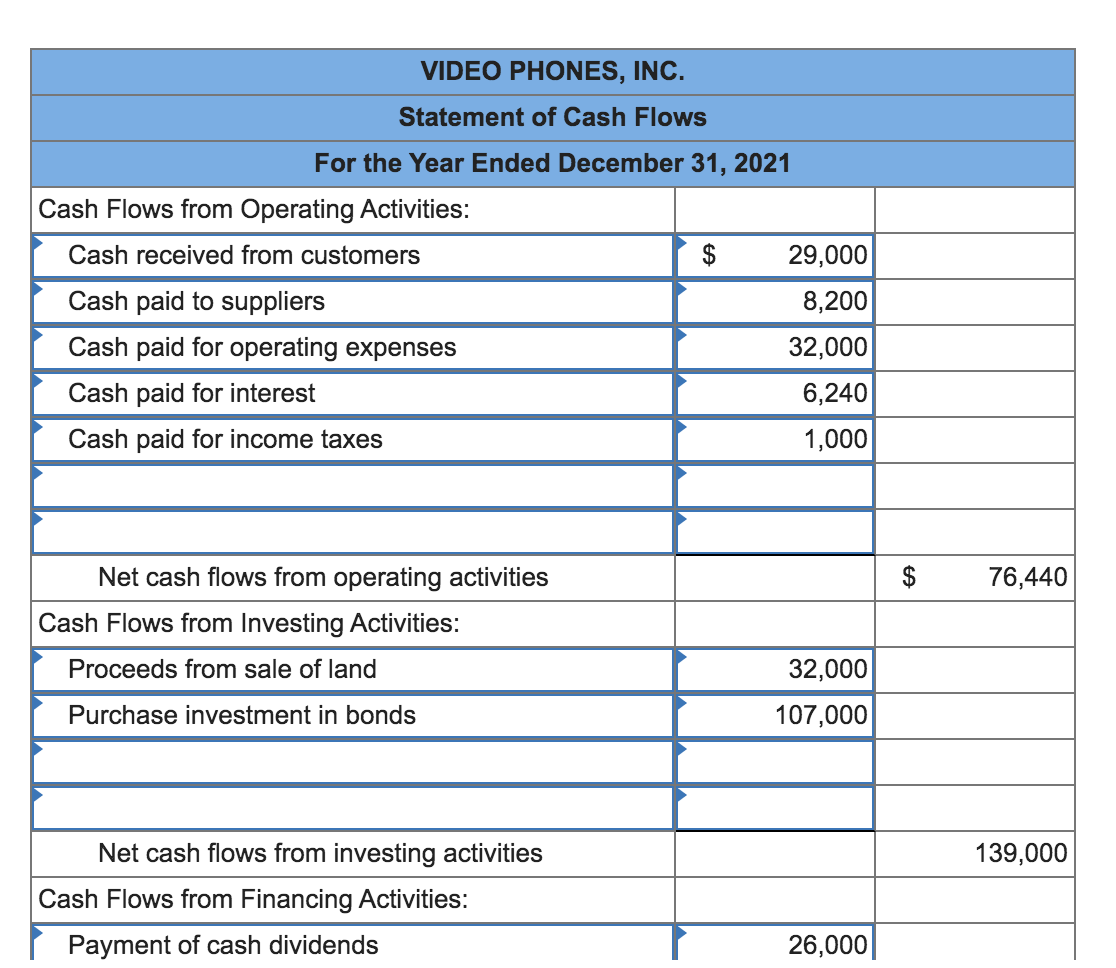

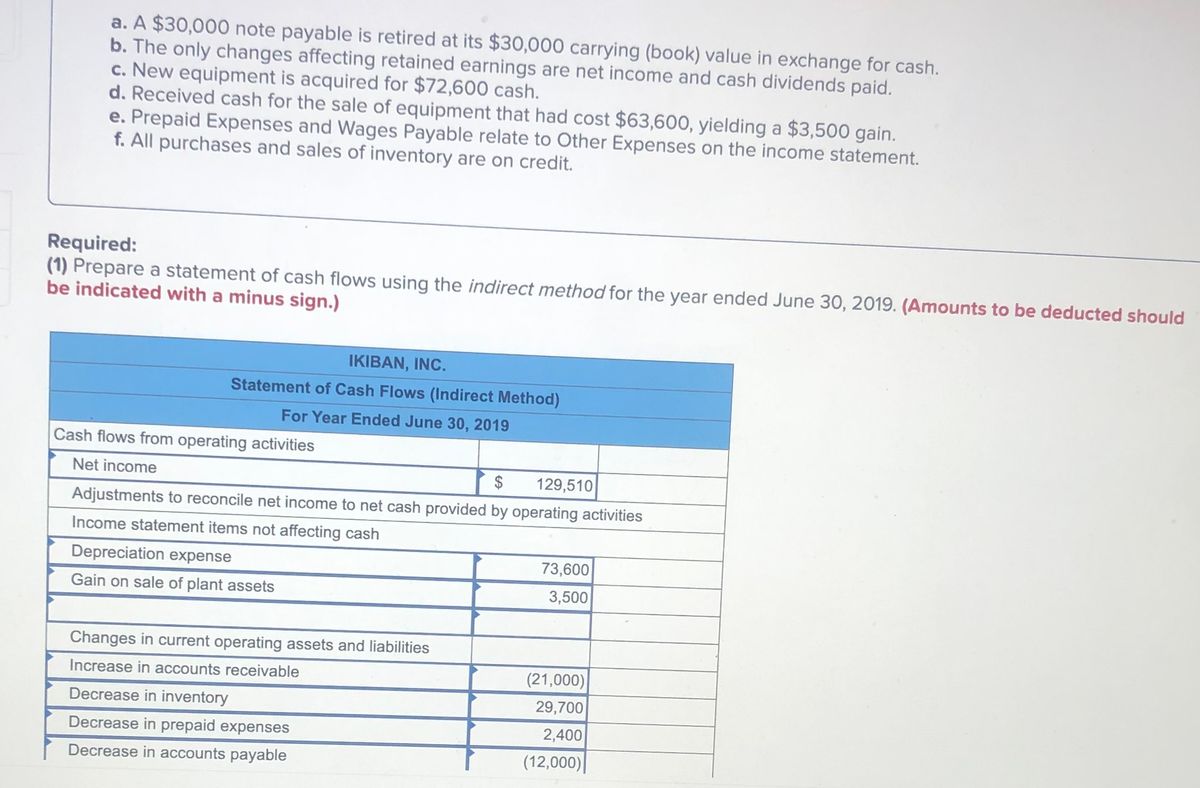

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: 2.1 describe the income statement, statement of owner’s equity, balance sheet,. A draft is an order to pay a certain sum of money.

Notes payable is a written promissory note stating a borrower’s payment obligation to a lender along with the associated borrowing terms (e.g. Add back noncash expenses, such as depreciation, amortization, and depletion. What is the definition of notes payable?

Do notes payable go on an income statement? As described above interest on notes payable is simple interest calculated on. An example of different accounts on a balance sheet:.

For the second month this is the new balance that will be. Notes payable appear as liabilities on a balance sheet. How do you calculate interest on a note payable?