The Secret Of Info About Profit Loss Income Statement

Profit and loss are two financial terms that are probably the most common in the world of finance and business.

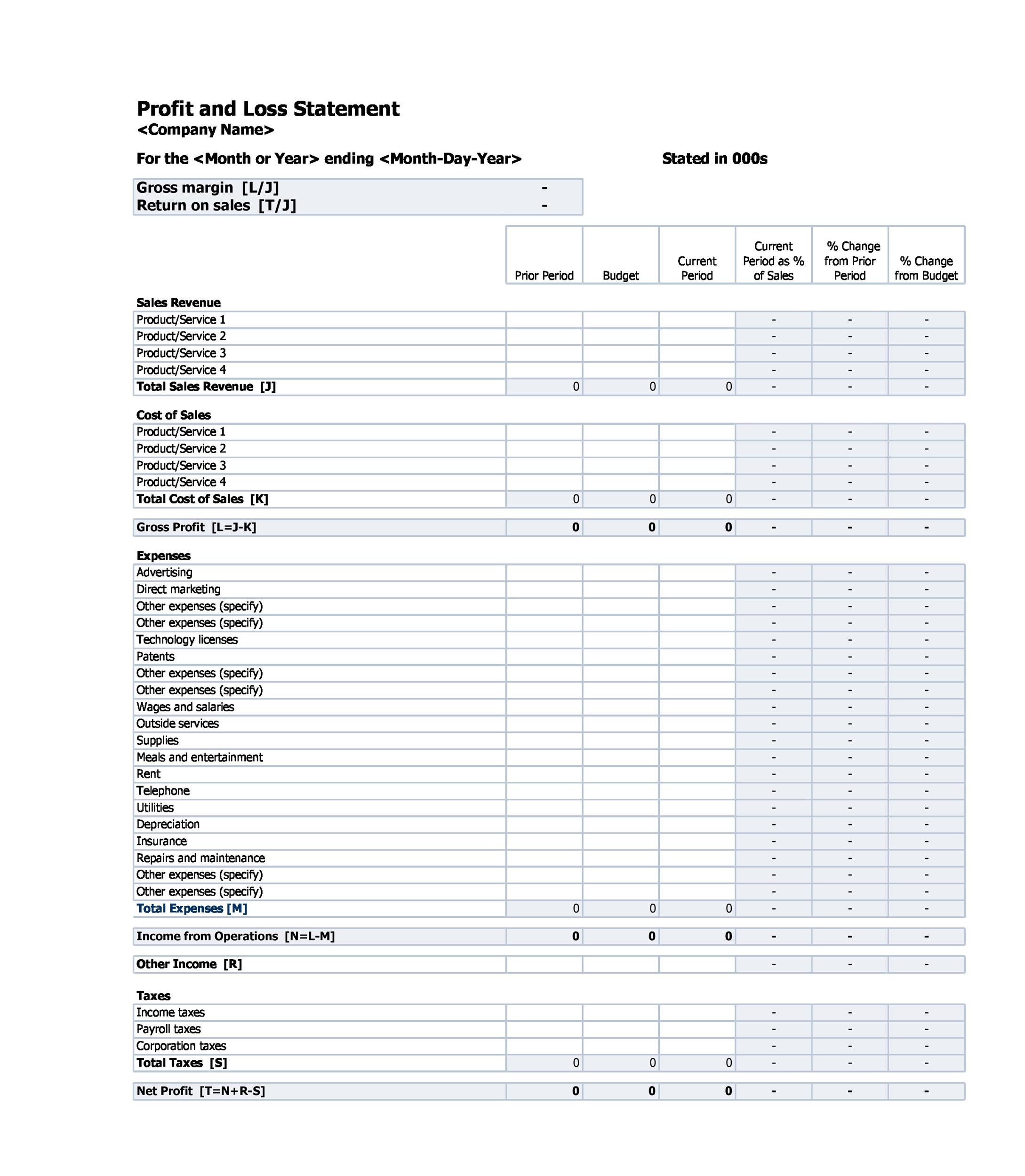

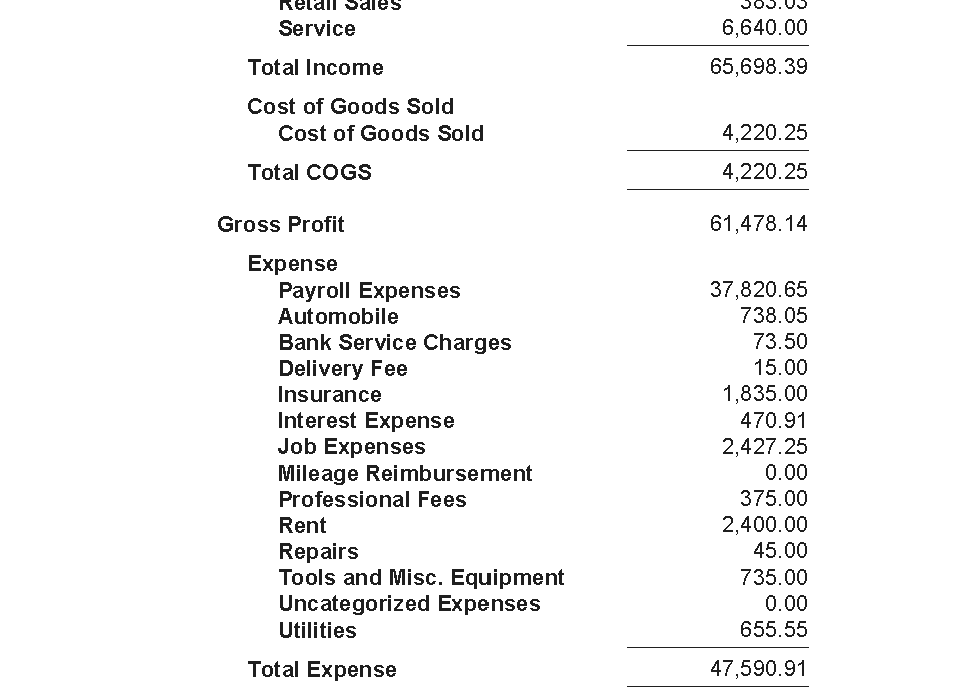

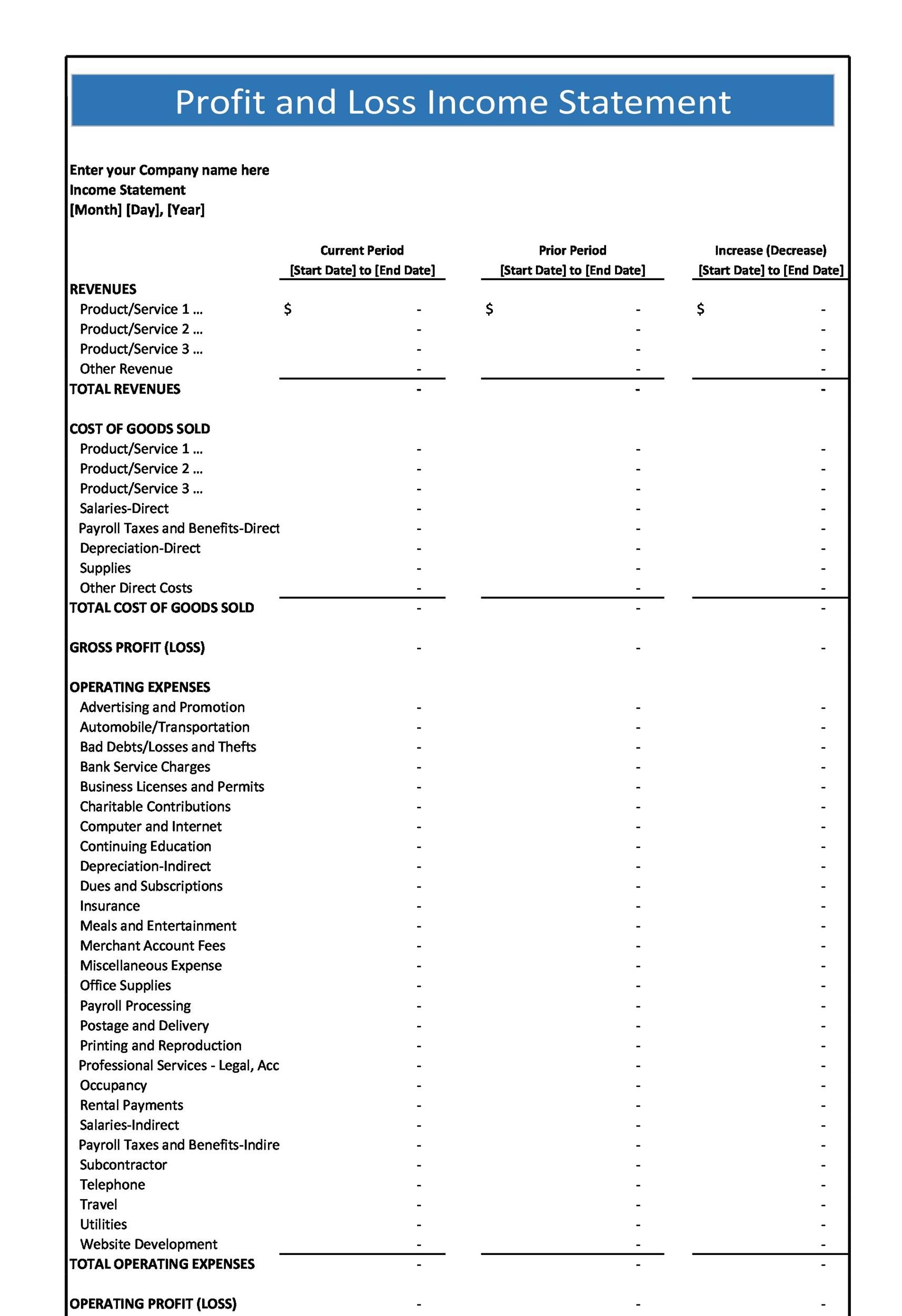

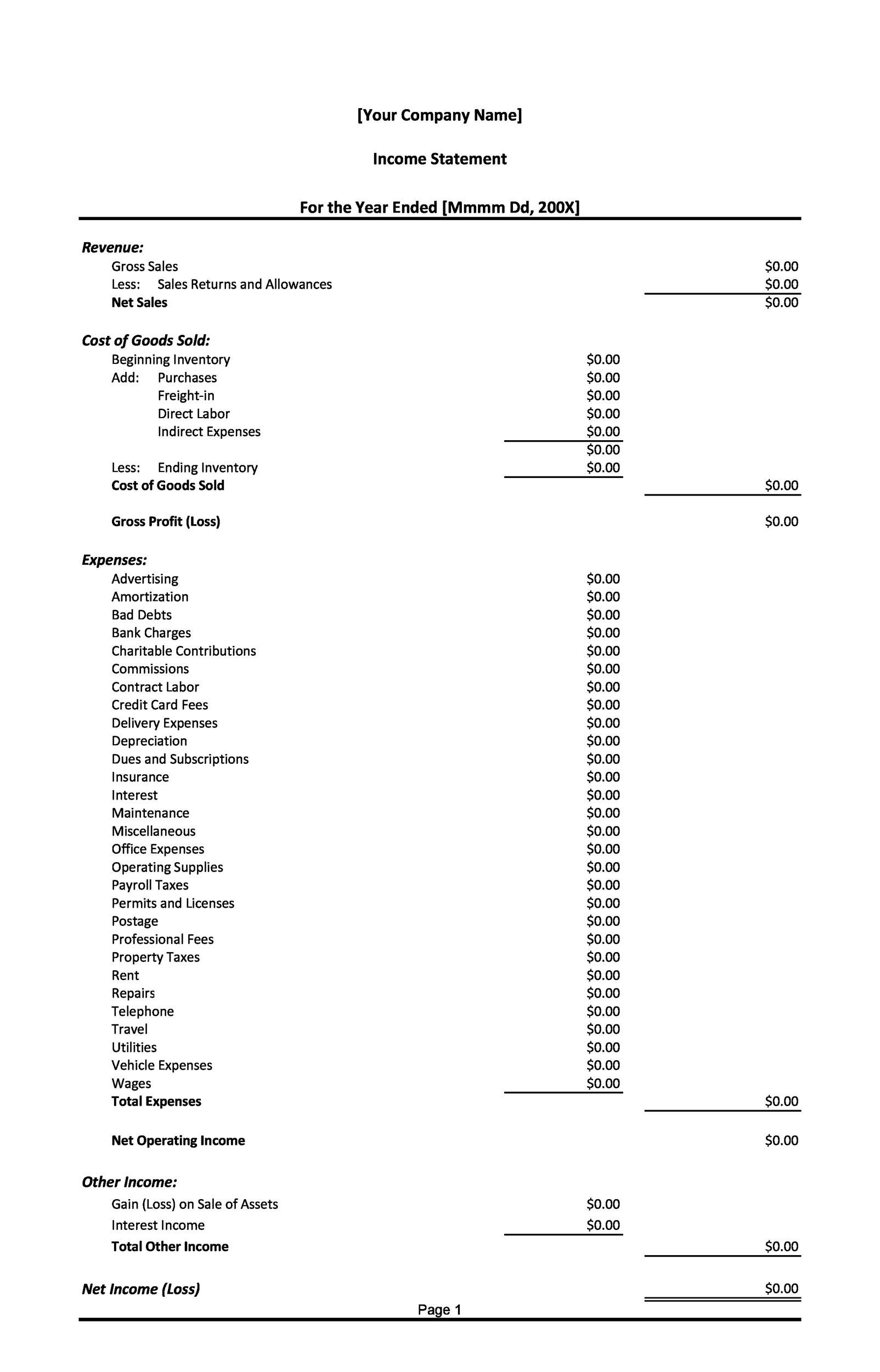

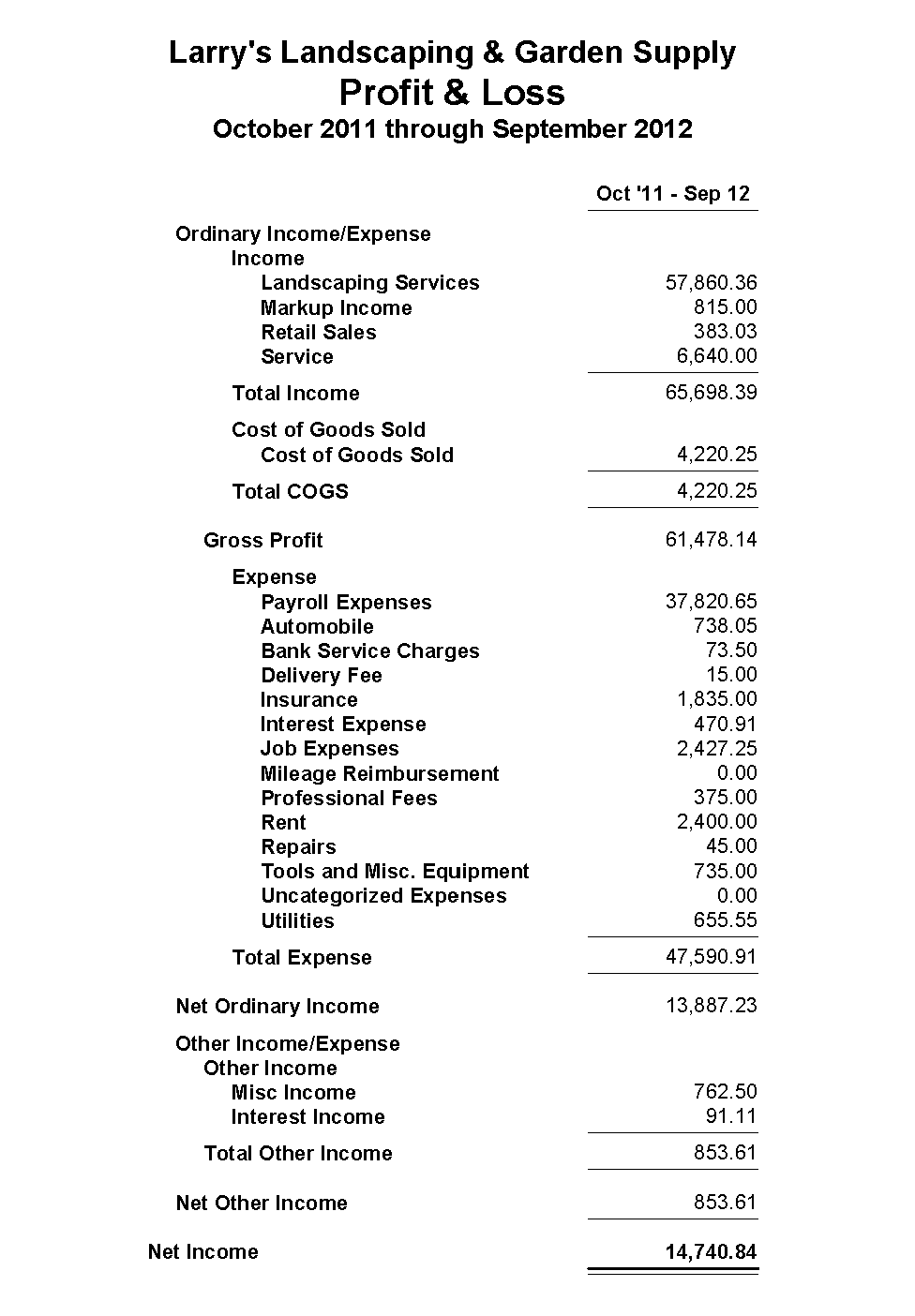

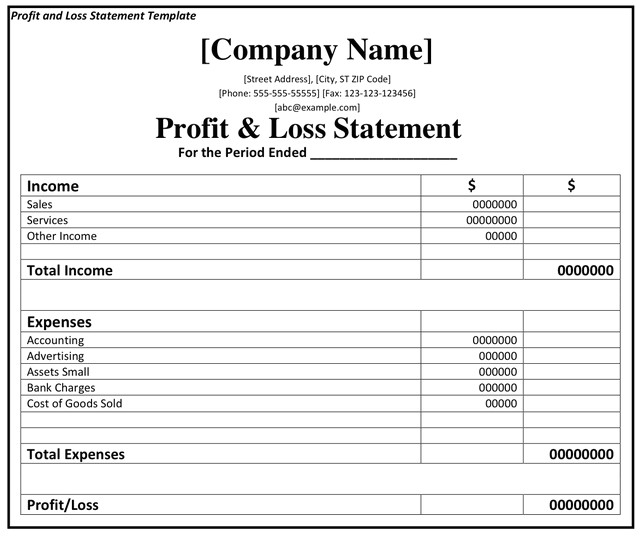

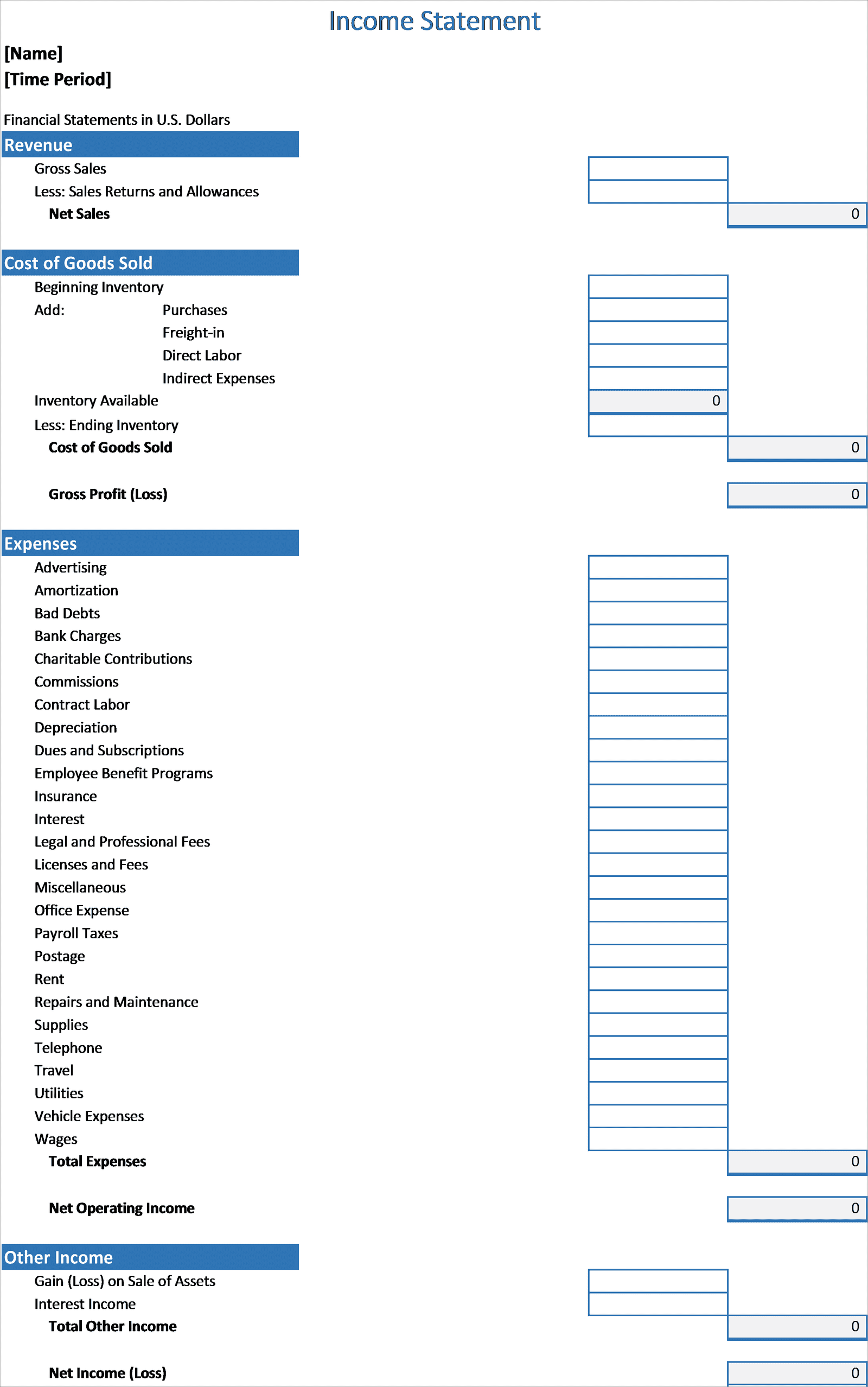

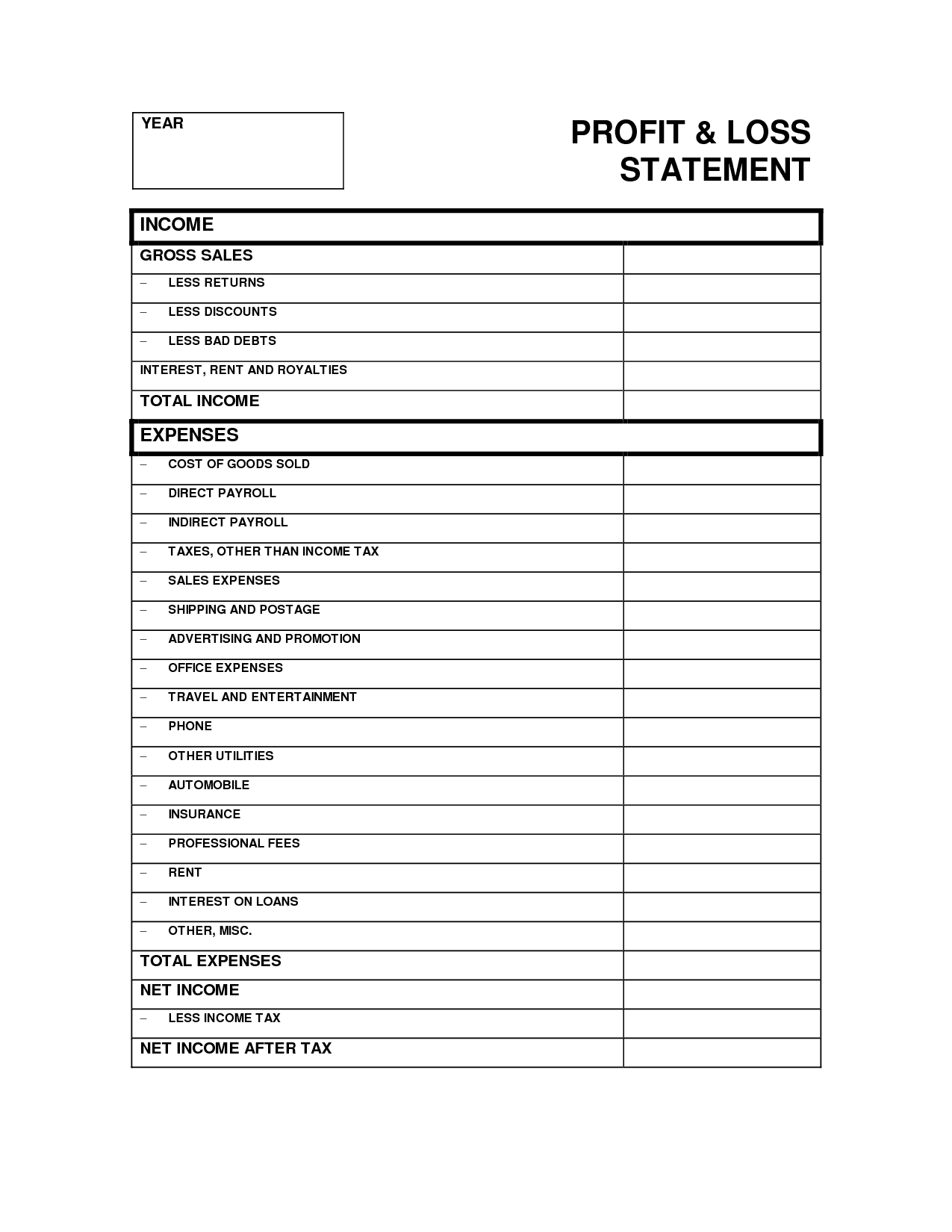

Profit loss income statement. It shows your revenue, minus expenses and losses. A profit and loss statement contains three basic elements: A profit and loss (or income) statement lists your sales and expenses.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. Many key fundamental ratios use information from the income statement.

It tells you how much profit you're making, or how much you’re losing. A profit and loss statement provides businesses with a view of revenue, expenses, and income over a specified time frame. A business profit and loss statement shows you how much money your business earned and lost within a period of time.

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. Income statements are often shared as quarterly and annual reports, showing financial trends and comparisons over time. The income statement focuses on four key items:

An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). On the bottom of the income statement is the net profit or loss.

The rising costs overshadowed a decent holiday quarter. Revenue is money a business generates through its primary activities, such as selling products. The income statement is also known as statement of income or statement of operations.

Use your profit and loss statement to help develop sales targets and an appropriate price for your goods or. The most common intervals are monthly, quarterly and annually. It shows both turnover and profitability for the company over that length of.

The profit and loss (p&l) statement (also known as an income statement) is one of the four basic financial statements that presents the revenues, expenses, and net income of a business. Expenses are outgoings, such as the cost of buying products. Revenue, expenses, gains, and losses.

Analysts had forecast a loss. You are free to use this image on your website, templates, etc, please provide us with an attribution link. The income statement shows a company or individual’s money.

The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services. Net income was $273 million, or $1.04 a share, compared with a loss of $557 million, or $2.46, a year earlier, coinbase said in a shareholder letter thursday. This is the origin of the.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Quarterly-Profit-Loss-Statement-Template-TemplateLab-790x1102.jpg)

.png)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Yearly-Profit-Loss-Statement-Template-TemplateLab-scaled.jpg)

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-Loss-Gross-Profit-Net-Operating-Income.jpg)