Outstanding Tips About Cash Flow For Owners

In this article, i will show you how to calculate and analyze warren buffett's owners earnings figure.

Cash flow for owners. With these etfs, cash flow is king. Guides cash flow: For example, say a shoe store owner spends $500,000 buying shoes every year.

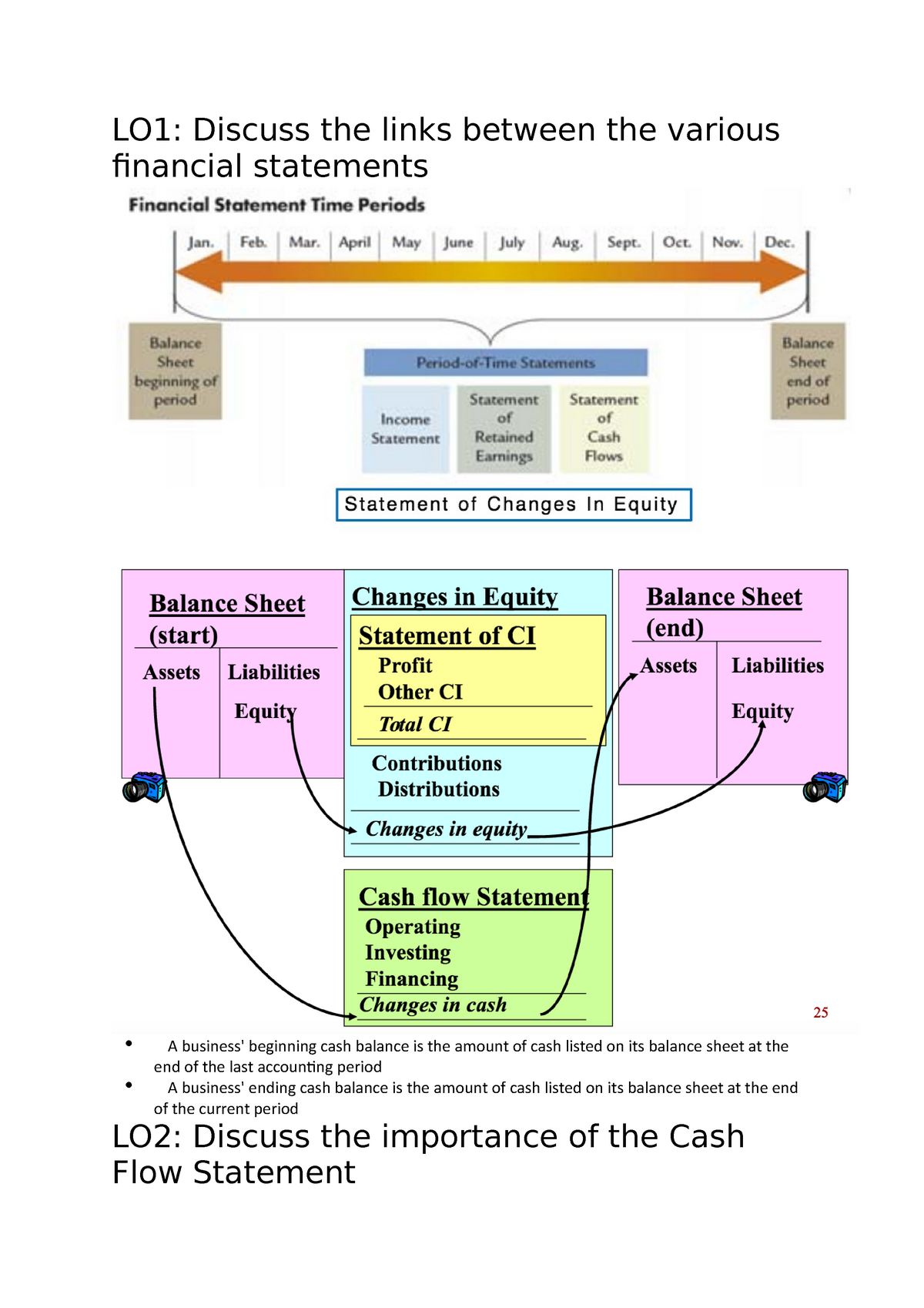

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Cash flow is the heartbeat of your business. Conduct credit checks on customers seeking credit to minimize.

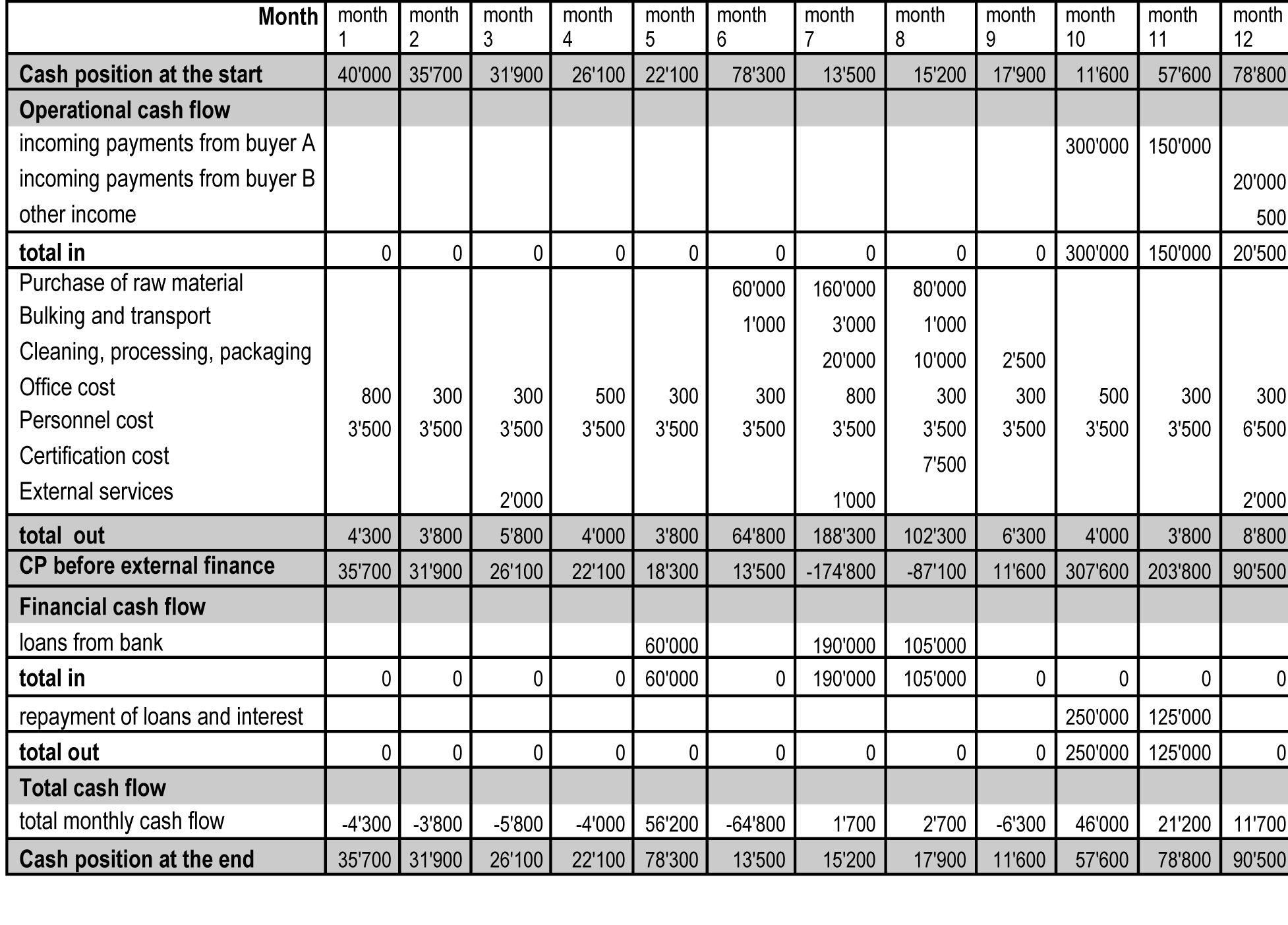

Businesses analyze cash inflows from sales, investments, and loans. Strategies like paying bills strategically, cutting unnecessary overhead expenses, and carefully tracking monthly cash inflows and. The cash flow statement is a financial statement that reports a company's sources and use of cash over time.

Make tracking cash flow a habit 🧐. Cash flow analysis helps business owners, managers, executives, lenders, and shareholders understand if a company is generating cash or using cash, and the breakdown of where those cash movements are happening in the company. Here are some effective strategies to boost cash flow:

Cash flow analysis typically begins with the statement of cash. Owners earnings, or cash flow for owners, is a figure that is commonly used for intrinsic value calculations, and is one of the best figures to depict how much cash one can get out of an investment. Things like rent, payroll, contractors, and inventory.

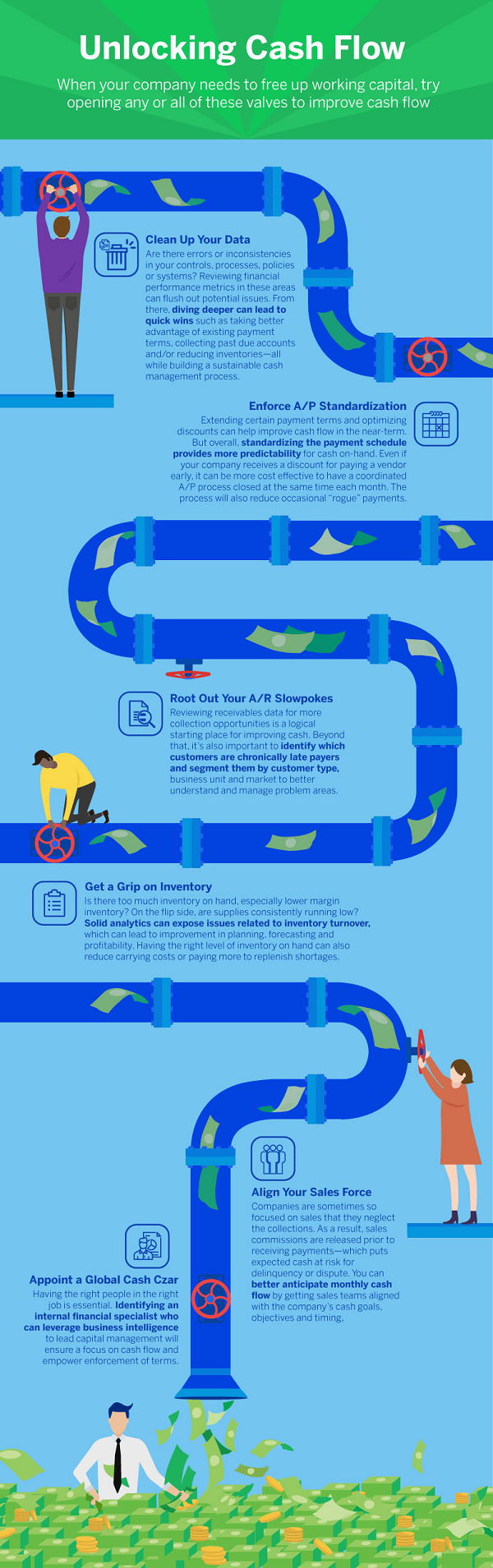

These five cash flow management strategies will help you stay on the money and boost your business’s financial health. Educate yourself on cash flow and its impact. Managing the ups and downs of running a business.

Improving cash flow is a top priority for small business owners. F ree cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a. Opt for leasing instead of purchasing equipment or real estate to reduce upfront costs and enhance cash flow.

Having good employees is key to business growth, and in 2024 business owners say it's a top priority, even ahead of cash flow. Don’t freak out if they look complicated! How do you analyze cash flow?

Cash flow forecasting always specifies a period of time, and the first step is choosing your forecasting period. March 17, 2023 as a small business owner, cash flow is king. The cash flow quadrant.

Cash flow is money that comes into the business through sales and money that goes out. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The most important strategy for cash flow management is to simply keep a close eye on how much money is coming in and going out of your business.

/https:%2F%2Fblogs-images.forbes.com%2Fallbusiness%2Ffiles%2F2019%2F02%2Fcash-low-1200x840.jpg)