Ace Tips About Cash Flow Statement Model

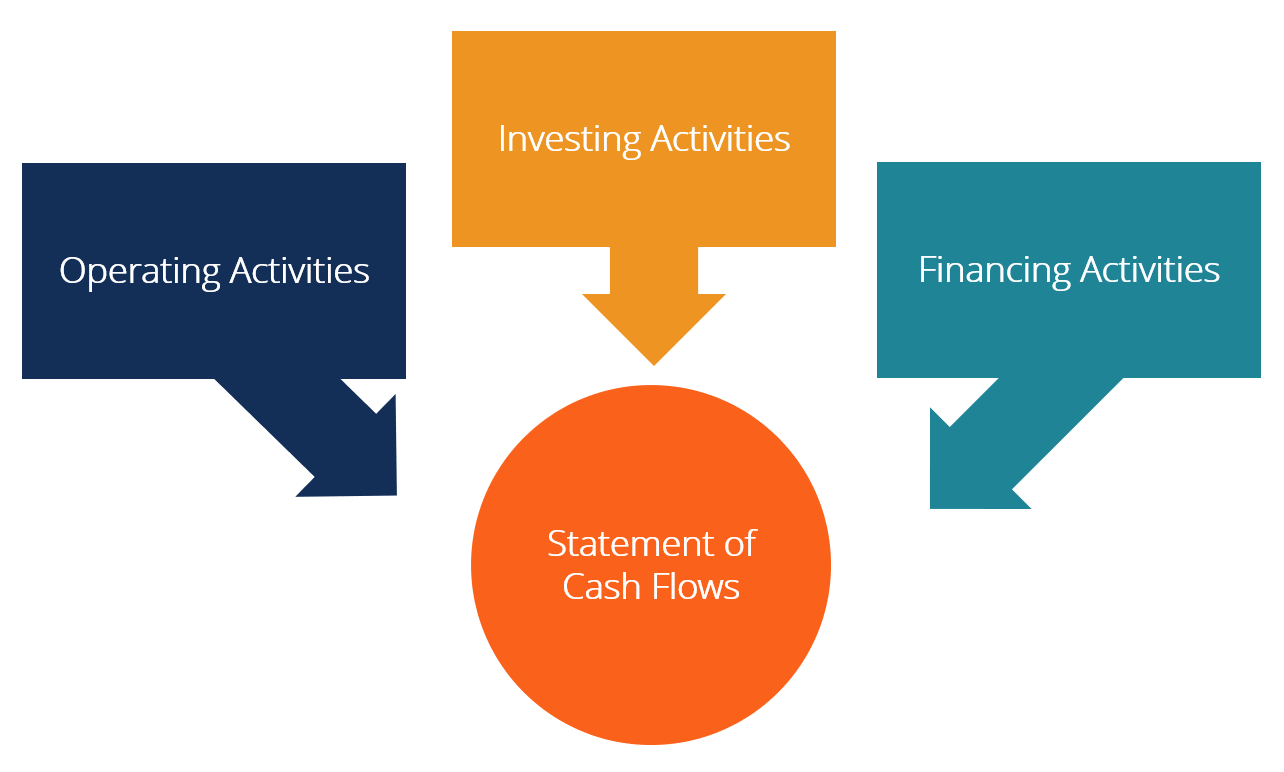

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements that report the cash generated and spent during a specific period of time (i.e.

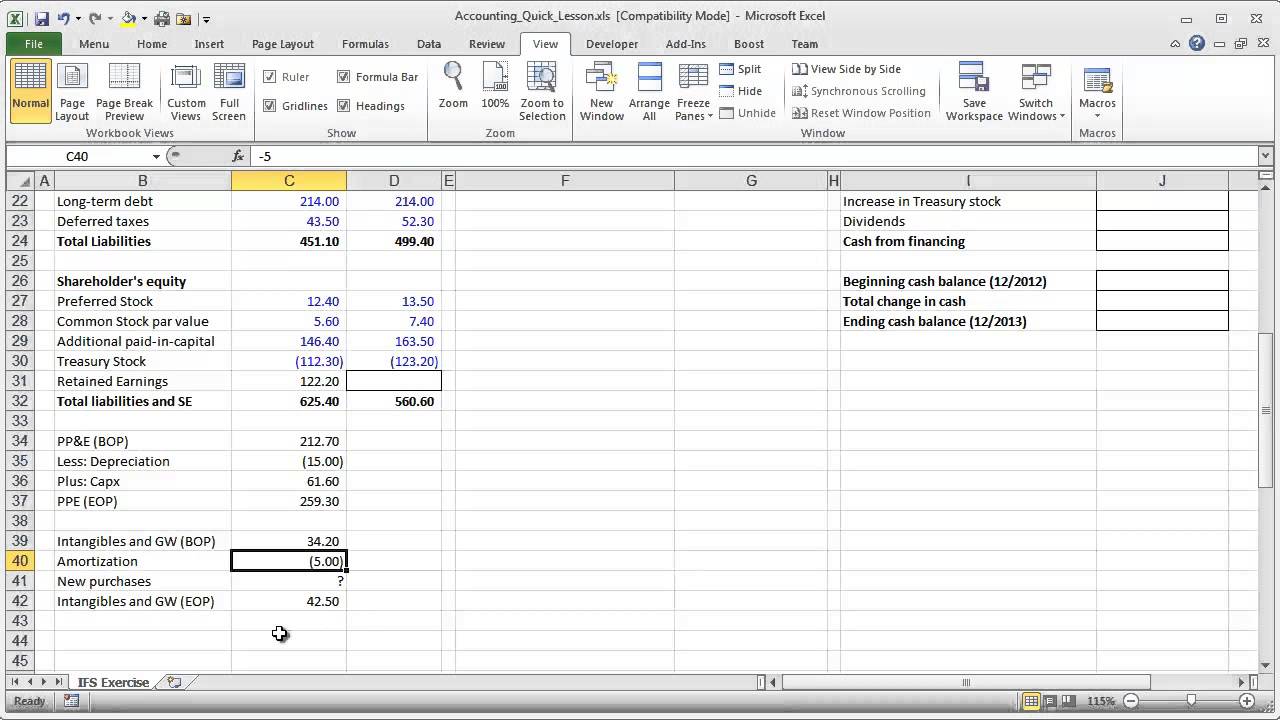

Cash flow statement model. Statement of cash flows definition a statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. Remember the interconnectivity between p&l and balance sheet. The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

What is a cash flow statement? While basic, it’s worth reminding ourselves that. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a.

Income from operations of $652 million; Ordinary operations of the business are based on sales and its operating expenses.

The cash account can be expressed as a sum and subtraction of all other accounts. In this video, we’ll build a cash flow statement model given an income statement and balance sheet in excel. This is the type of math you.

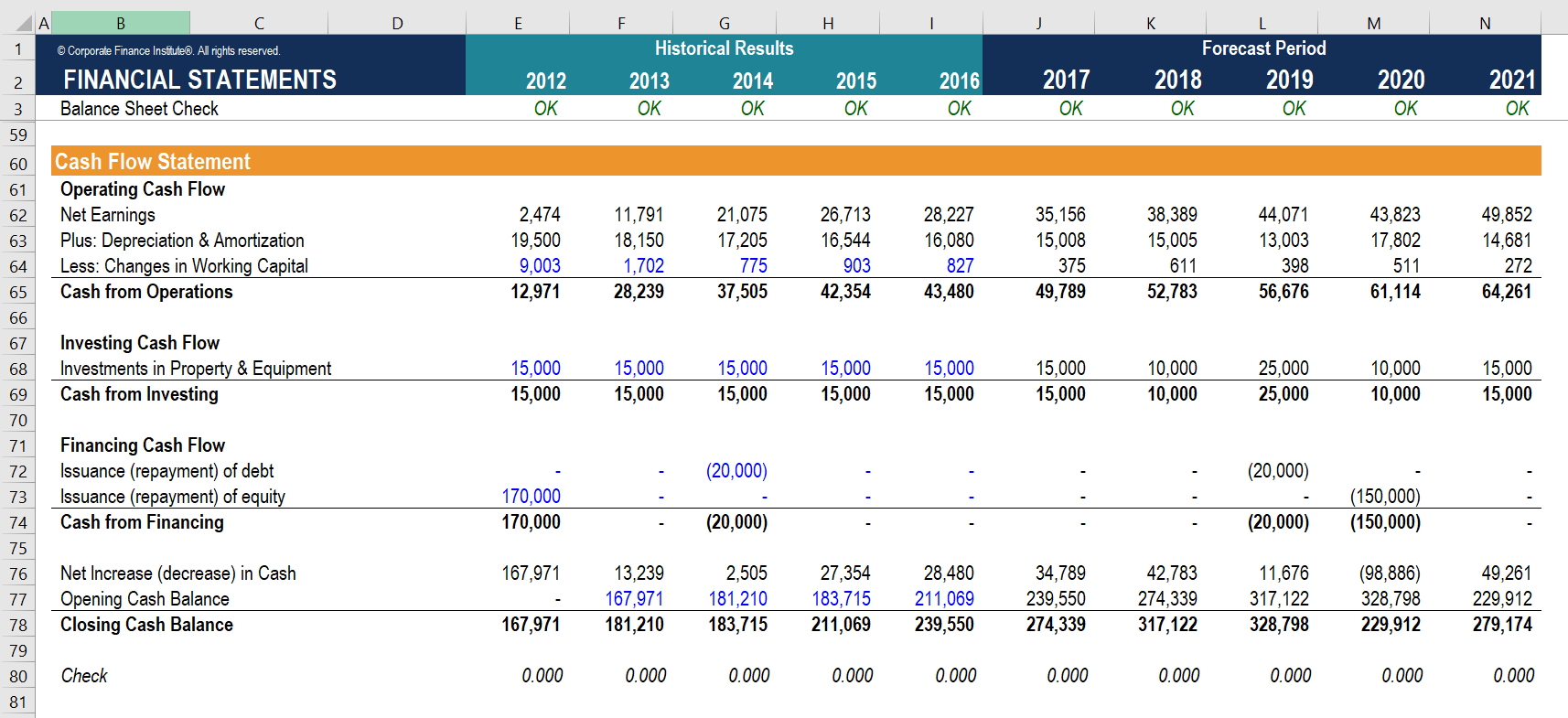

It frequently serves as the foundation upon which other analytical models are built. Income statement and free cash flow. This is one of the most important models as it serves as a base for other complex models, such as the leveraged buyout (lbo) model or the discounted cash flow (dcf) model.

The starting cash balance is necessary when leveraging the. This value can be found on the income statement of the same accounting period. This is the type of math you will be doing when building financial models.

From the income statement, we use forecast net income and add back the forecast depreciation. It is designed for a startup or existing coffee shop business, generating revenue through. The model is built by first entering and analyzing historical results.

Cash flows from operations is the cash moment linked with the ordinary operations of the business. It's easy to lose track of past and future cash flows. This video introduces the cash flow statement, which is possibly the most straight forward of the three primary financial statements.

A month, quarter, or year). While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. It helps identify the availability of liquid funds with the organization in a particular accounting period.

By cash we mean both physical currency and money in a checking account. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Record adjusted ebitda margin fourth.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)