Divine Tips About Accounting For Dividends Received Projected Profit And Loss Account Balance Sheet In Excel

When i issue a dividend to reduce my directors overdrawn loan account the reduced net profit is not reflected in the trial balance of my accounts but it is reflected.

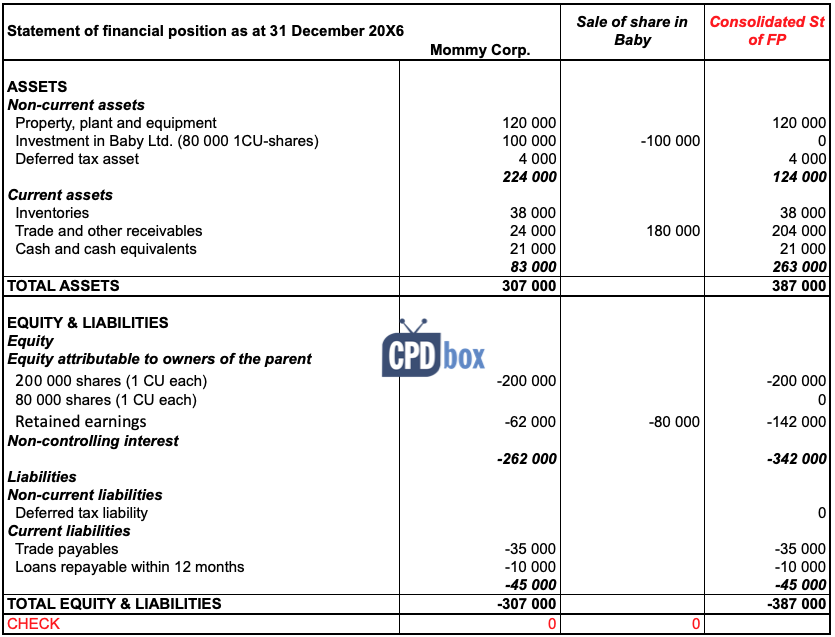

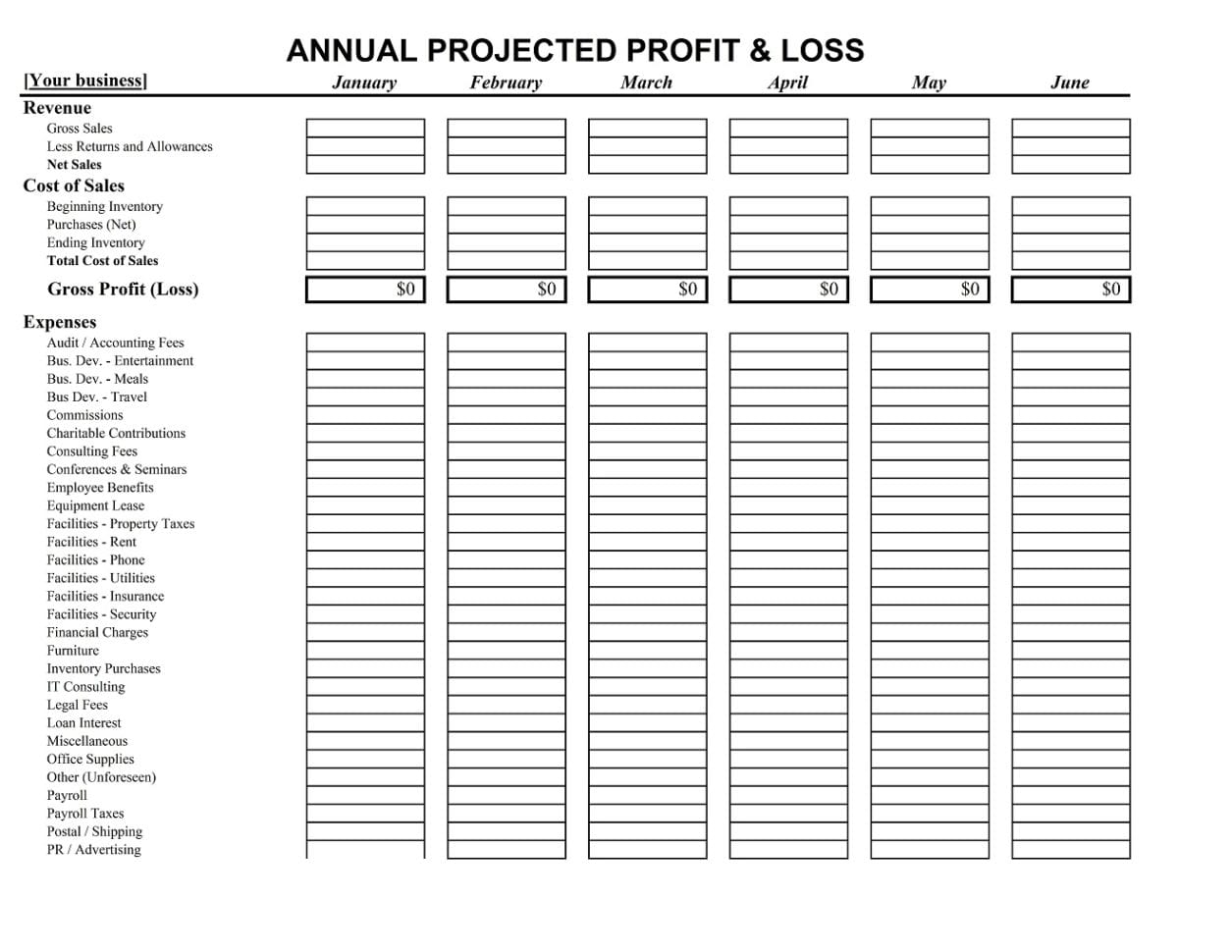

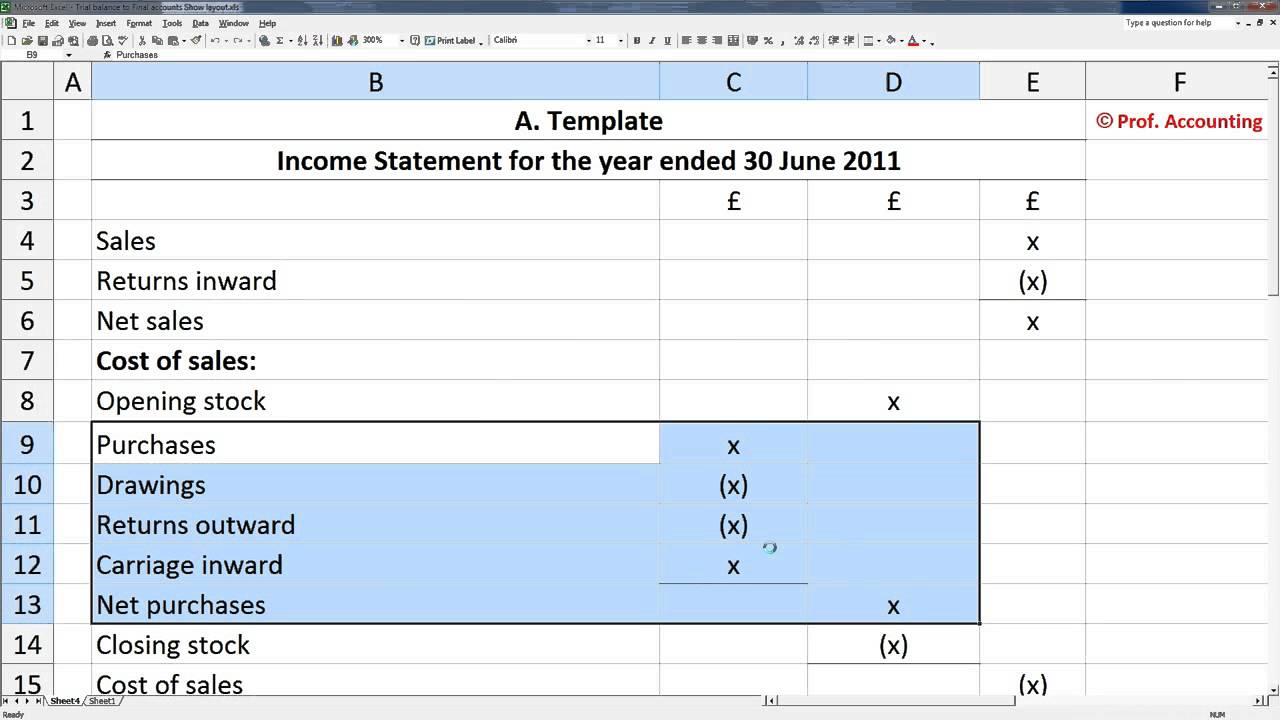

Accounting for dividends received projected profit and loss account and balance sheet in excel. The balance sheet follows the accounting equation: > income tax filing details to be considered while preparing projected financial statements kaushal soni financial statements income tax p&l statements. Record income & expenses and the template produces a trial balance, trading profit and loss accounts, cash flow.

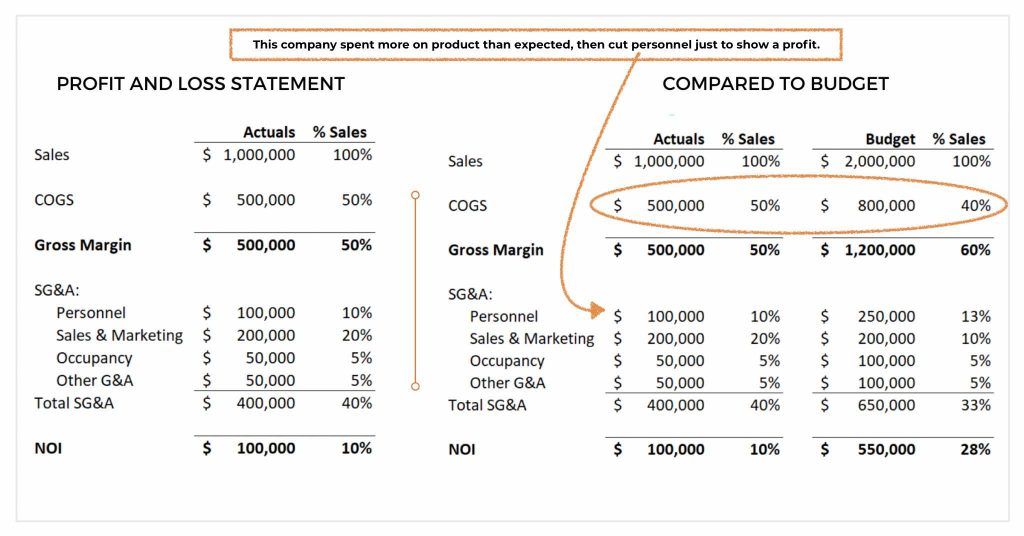

In order to estimate the retained earnings, it makes sense to first create the forecast for the income statement in order to have an expected value for the net profit. In this case, the dividend received journal. Make payments to all shareholders who owned qualifying stock on the payment date ratified by the company board.

Assets = liabilities + equity. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a. May 28, 2022 at 8:16am sure, but it looks to be impossible to add dividends, an equity account, to p&l.

Accounting for dividends is complicated and requires time to understand for. It provides a clear view of a company's financial resources and how those. The dividend refers to the earnings or portion of the profit that a company pays to its investors or shareholders.

Dividend is a return on the investment where the dividend represents a return on a parent’s investment in a subsidiary (rather than a return of its investment), the dividend. A trading account is a financial statement that shows the revenue, cost of goods sold, and gross profit or loss of a business for a given period of time. It does not affect any.

A p&l statement provides information. A dividend is distributed among the shareholders when the company generates a profit or accumulates the retained earnings. The dividend account acts as part profit and loss account and part balance sheet account.

Companies are not required to issue dividends on. It is because dividends, as mentioned above, are a decrease. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

Paying the dividends reduces the amount of retained. Dividends are paid out of profit after tax. I assume a debit entry would be cash/bank and.

My dividends accounts are in my coa, but don’t appear in. To record the accounting for declared dividends and retained earnings, the company must debit its retained earnings. A dividend is a method of redistributing a company's profits to shareholders as a reward for their investment.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)