Ideal Tips About Objectives Of Common Size Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

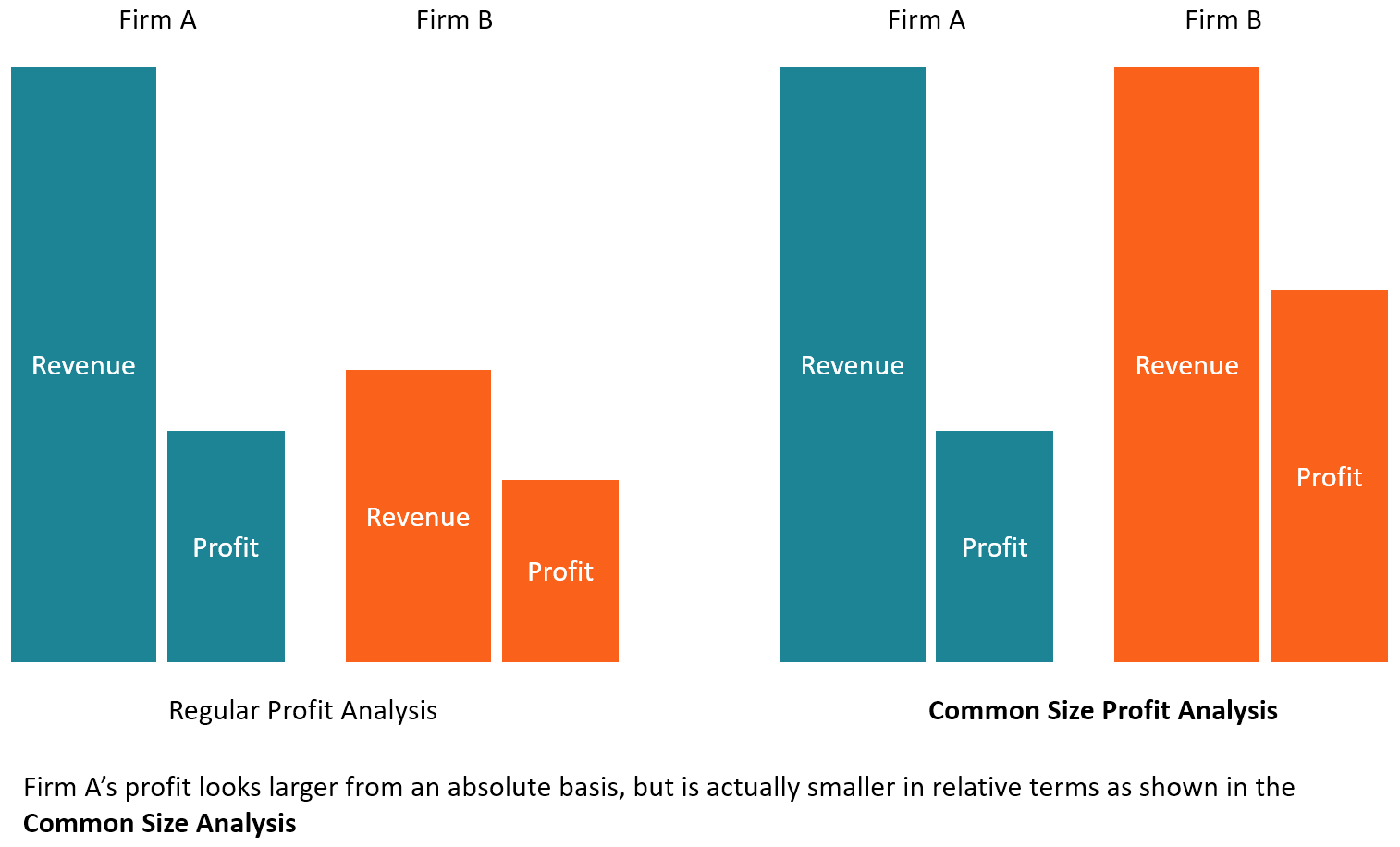

This differs compared to traditional financial statements that would use absolute numerical figures.

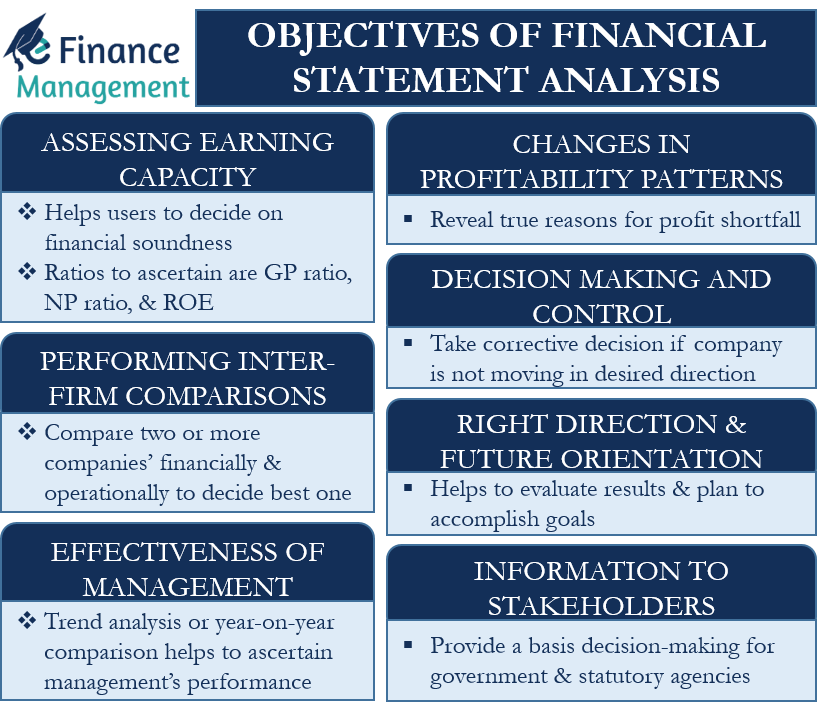

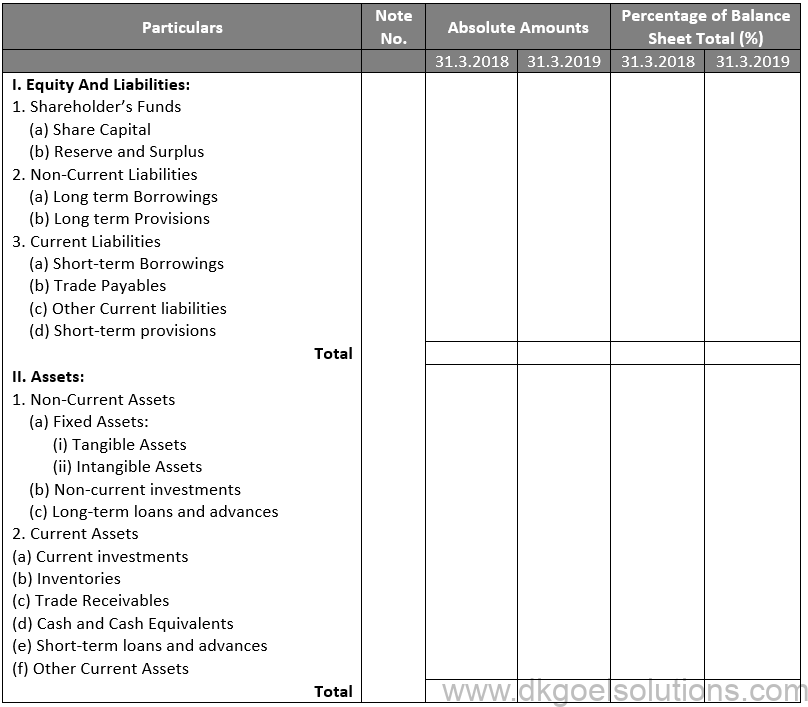

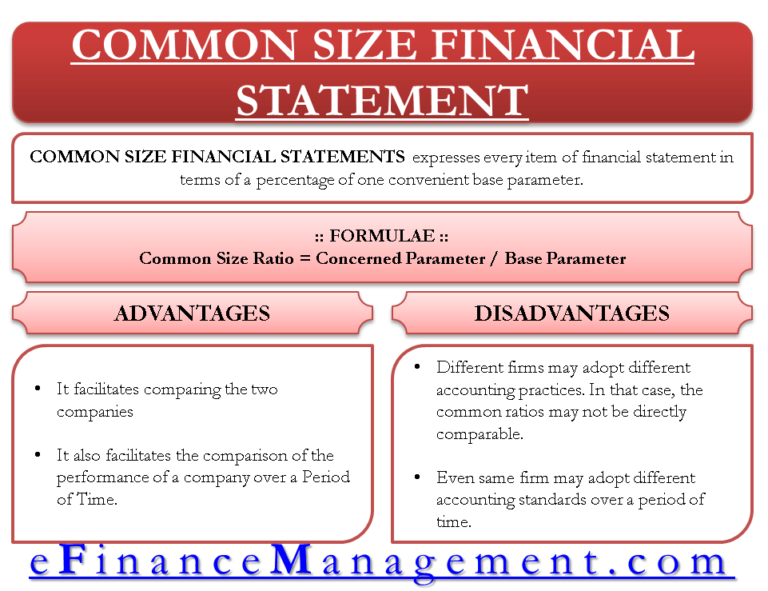

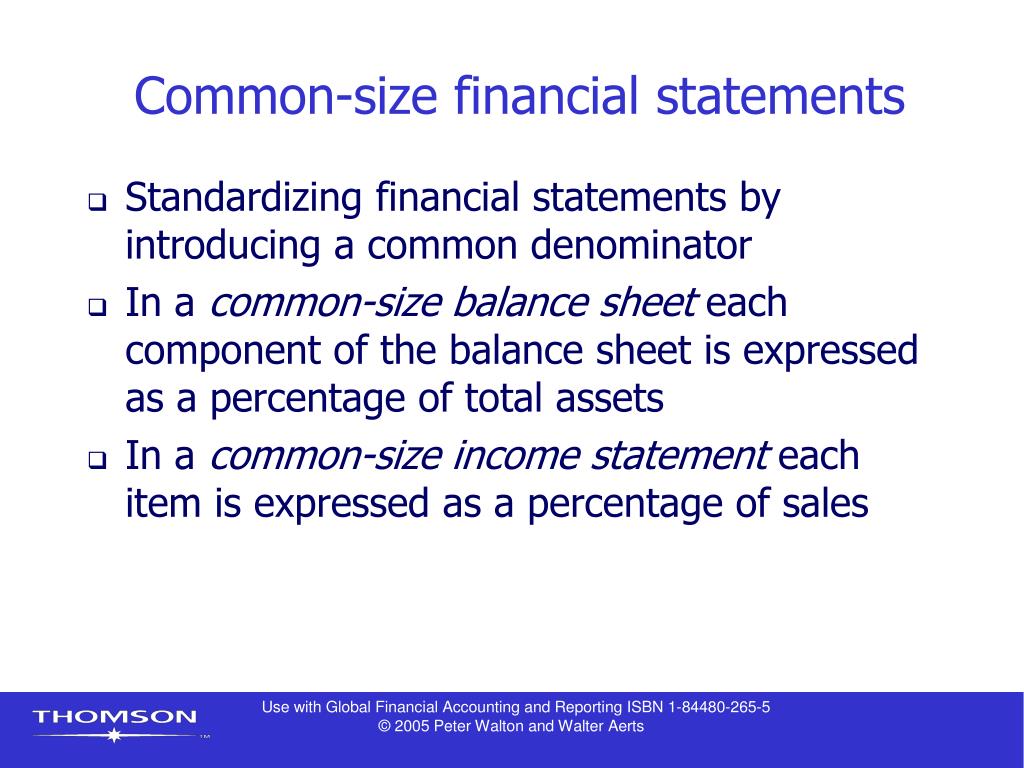

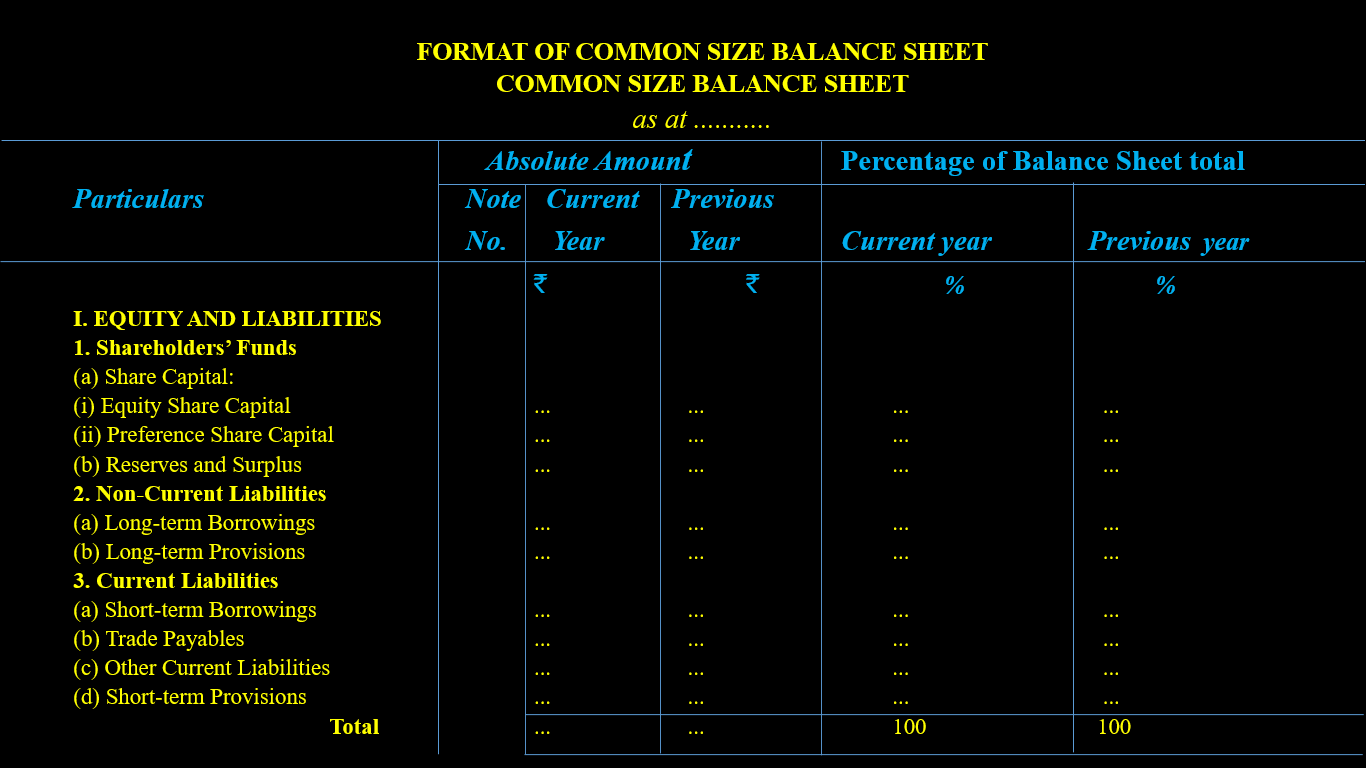

Objectives of common size statement. It is also prepared to see the trends of different items of assets, equity and liabilities of a balance sheet. The common size financial statements are an analytical approach used to understand how a company allocates its resources across various balance sheet and income statement accounts. Expressing each item on the income statement as a percentage rather than in absolute dollars makes it much easier to make comparisons, particularly to other divisions or competitors of varying sizes.

These are statements in which items are converted into percentages taking some common base. All patients used dopaminergic medications; Common size balance sheet:

A common size financial statement displays items as a percentage of a common base figure, total sales revenue, for example. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities and equity accounts. These statements are also called "100"

This makes it easier to compare figures from one period to the next, compare departments within an organization, and compare the firm to other companies of any size as well as industry averages. Judge fines donald trump more than $350 million, bars him from running businesses in n.y. It is also prepared to study the trend in different items of incomes and expenses.

A common size financial statement lists any entries as a percentage of a base figure. It is also prepared to see the trends of different items of assets, equity and liabilities of a balance sheet. A common size income statement occurs when every line item on the income statement is shown as a percentage of sales.

Common size analysis evaluates financial statements by expressing each line item as a percentage of a base amount for that period. Common size analysis is applied to the balance sheet, income statement, and cash flow statement to assess components' relative significance within these statements. The formula for common size analysis is the amount of the line item divided by the amount of the base item.

This method analyses financial statements by taking into consideration each of the line items as a percentage of the base amount for that particular accounting period. Common size analysis is a technique that is used to analyze and interpret the financial statements. Usd) and the percentage of each line item compared to total revenues for a specific period.

A common size income statement is an income statement in which each line item is expressed as a percentage of the value of sales, to make analysis easier. It is another technique of financial analysis. The practice of common sizing financial statements allows you to compare two companies that are of different sizes.

At t0, 51% of patients had changed therapy, with response fluctuations being the most common reason (74%); This technique allows managers to identify strategies and investors to evaluate profitability and make informed investment decisions. (1) to evaluate information from one period to the next within a company and (2) to evaluate a company relative to its competitors.

Common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year over year, and compared to. What is a common size income statement? It is also known as vertical analysis.

.jpg?w=620&is-pending-load=1#038;ssl=1)