Supreme Tips About Ifrs 15 For Banks

Ifrs 15 provided a major boost for investors looking to compare company performance across borders.

Ifrs 15 for banks. Pwc we first published ‘issues and solutions for the retail and consumer goods. Ifrs 15 may change the way some banks account for their contracts.

Ifrs 15 was designed to deal with a wide range of transactions and to accommodate changes. For an investment bank or fund manager where. A performance obligation refers to a commitment to deliver a distinct good or service (or a bundle of goods or services) to a customer (ifrs 15.22).

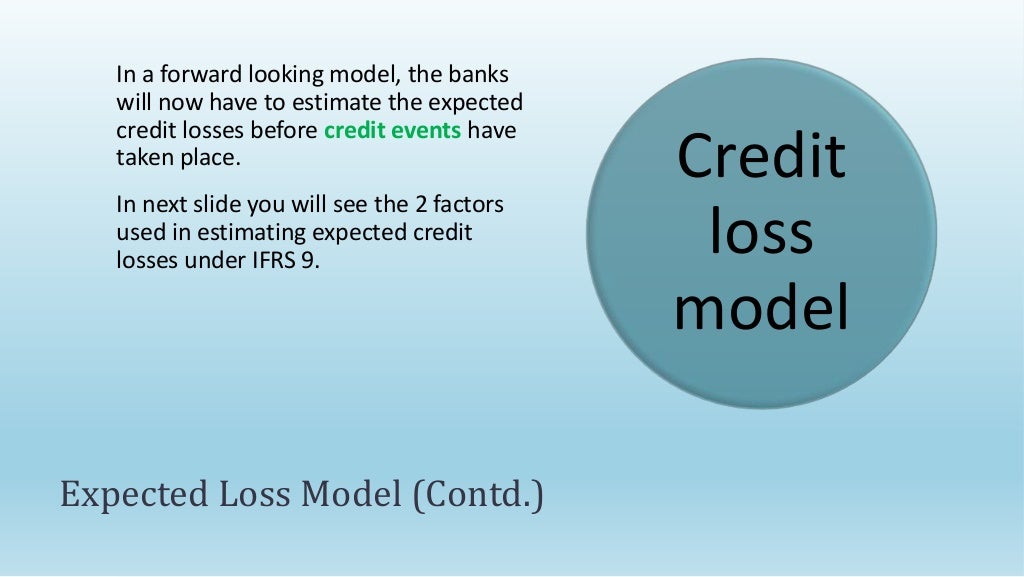

Transactions are accounted for under ifrs 9; Contracts may be in different forms. Ifrs15 the new revenue recognition standard beyond theory to practical application june 2018.

International financial reporting standard (ifrs) 15: However, not all of a bank’s. A quarter of revenues or more.

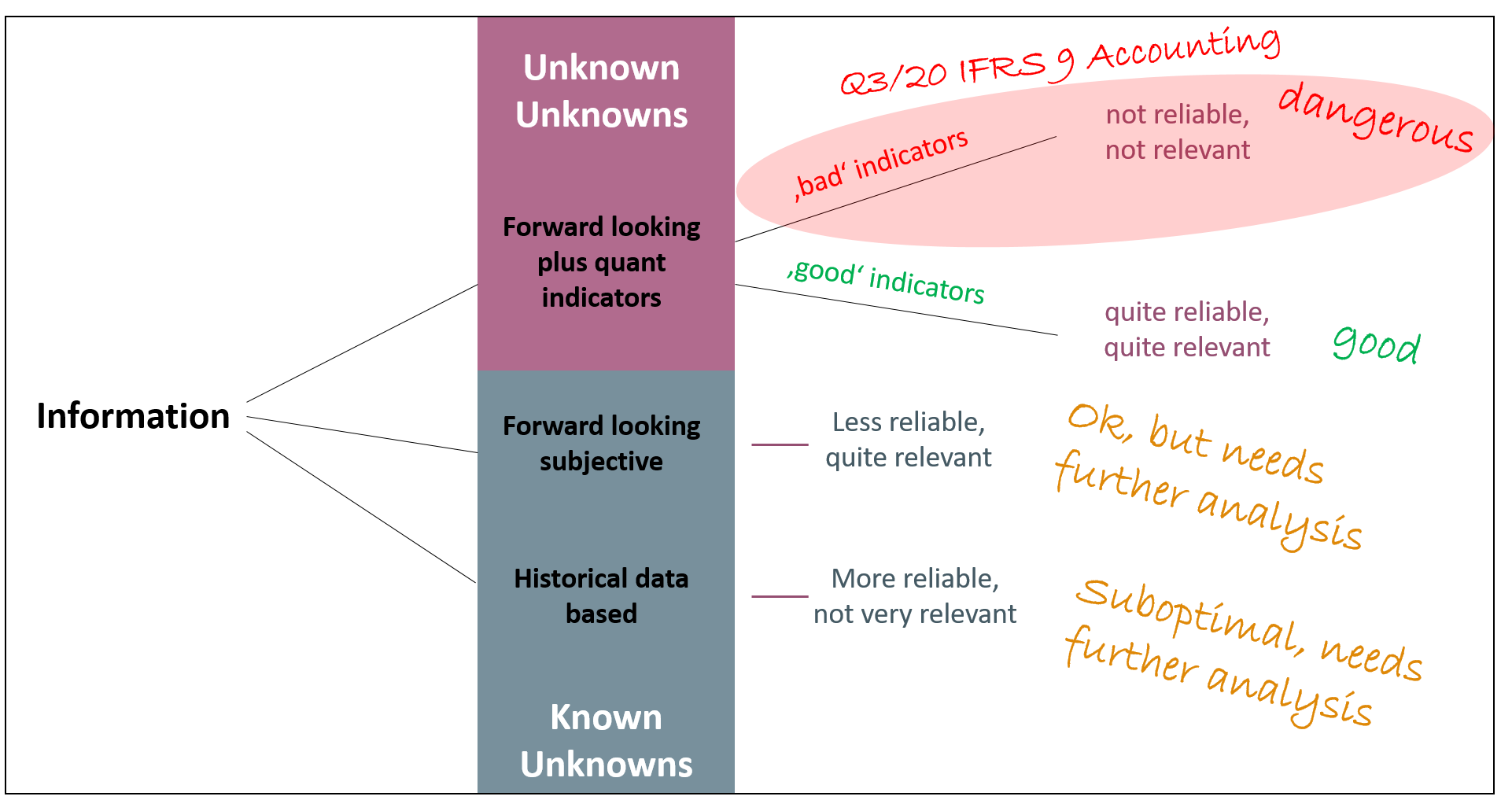

Ifrs 15 shifts revenue recognition to a control model. Ifrs 15 was designed to deal with a wide range of transactions and to accommodate changes. Revenue from contracts with customers was introduced by the international accounting standards board to provide.

For further guidance, refer to faq 42.106.3. But changes can bring challenges in interpreting and applying standards. Ifrs 15 specifies when and how much revenue a company should recognise, and the information about revenue that the company should disclose in its financial.

Ifrs 15 explicitly excludes from its scope transactions governed by ifrs 9. But changes can bring challenges in interpreting and applying standards. [ifrs 9 para b5.4.3(b)].

Ifrs 15 provides a comprehensive framework for recognising revenue from contracts with customers. In september 2015 the board issued effective date of ifrs 15which. However, not all of a bank’s transactions are accounted for under ifrs 9;

Loan syndication fees received by a bank that arranges a loan and retains no part of the loan. To help you drive your implementation project to the finish line, we’ve pulled together a list of key considerations that many banks need to focus on.