Ace Tips About Adjusting Entry For Inventory Shrinkage

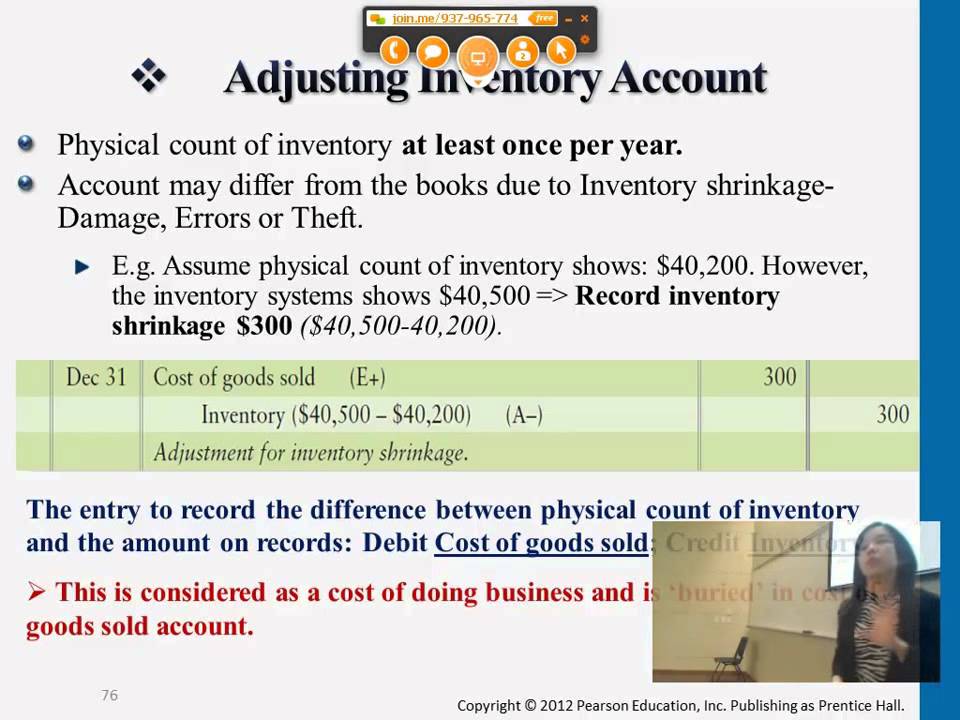

A physical inventory is typically taken once a year and means the.

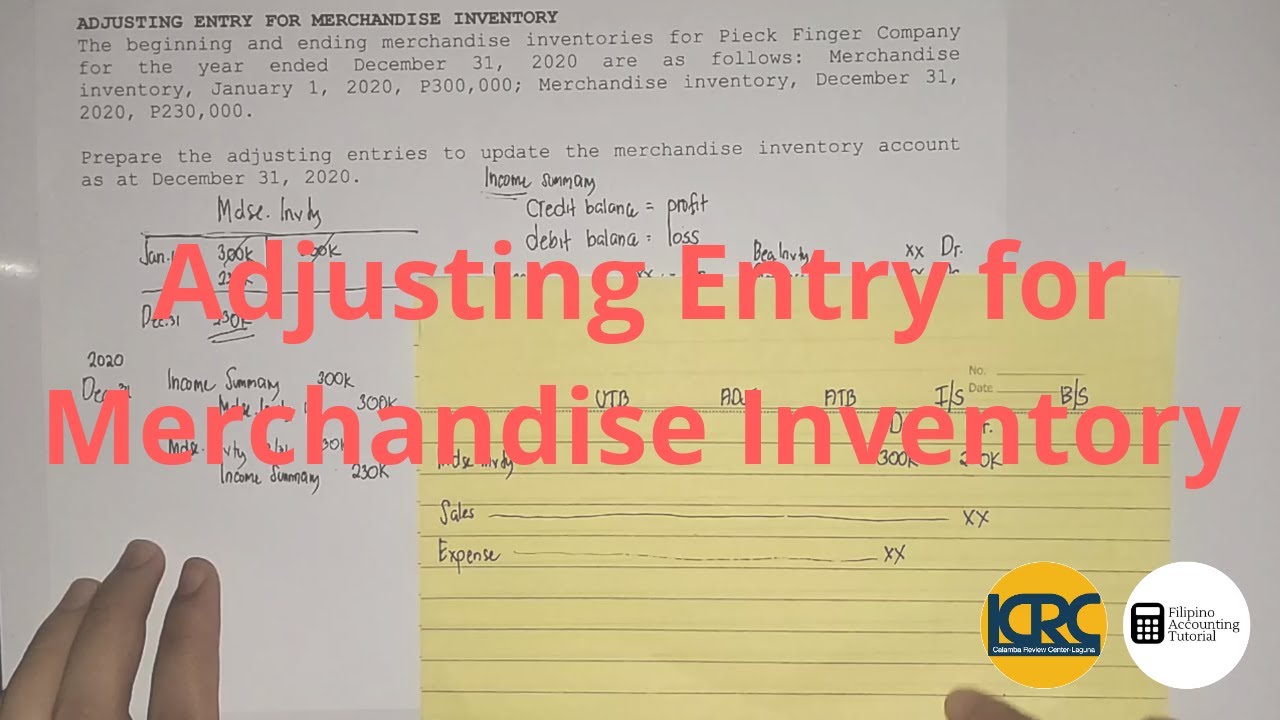

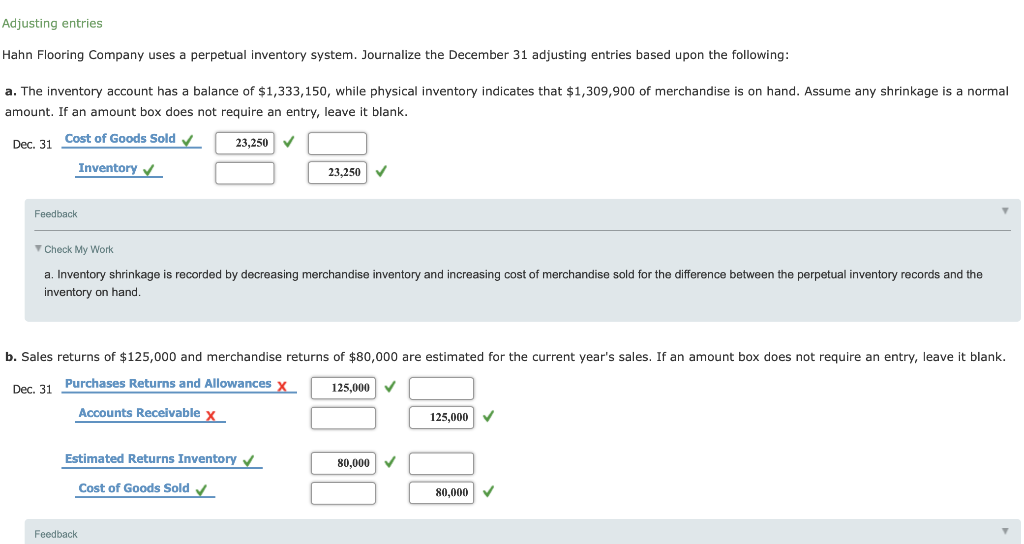

Adjusting entry for inventory shrinkage. Inventory shrinkage occurs when the actual quantities in your inventory are smaller than what is recorded in your books or inventory management system. Rarely will the inventory grow, although this could happen if an accounting. When adjusting the quantity on hand of an inventory item, quickbooks online automatically records the adjustments to your asset and cost of goods sold.

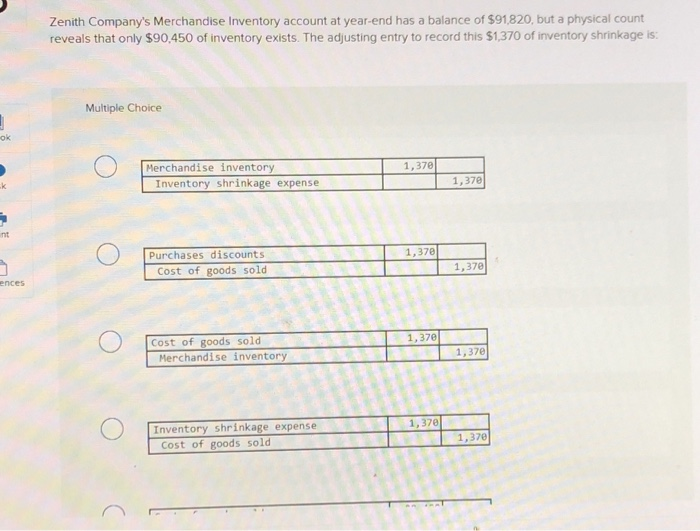

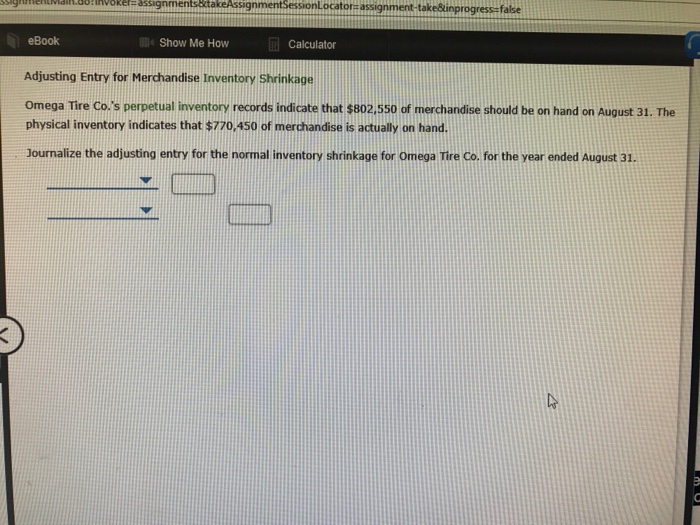

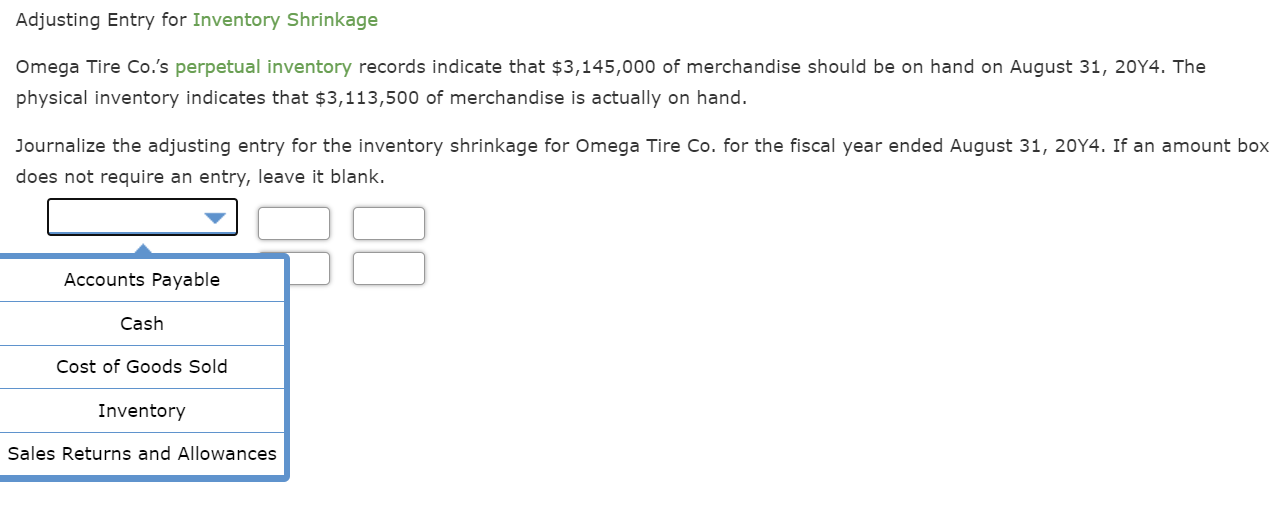

Journalize adjusting entry for inventory shrinkage: It might be associated with theft or damage. Generally, shrinkage is recorded as part of cost of goods sold.

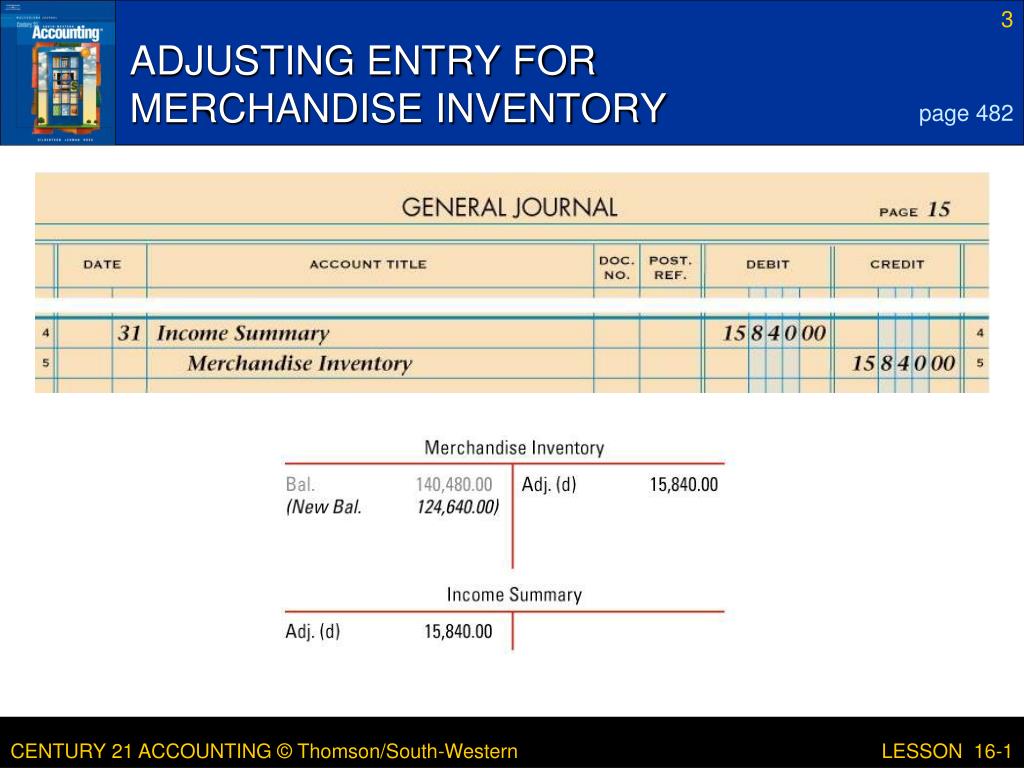

In this discussion, the focus will be on the. A business may determine the value of the shrinkage by physically counting the stock and determining its value, and then. First, the amount of loss is entered as a credit to an inventory asset account.

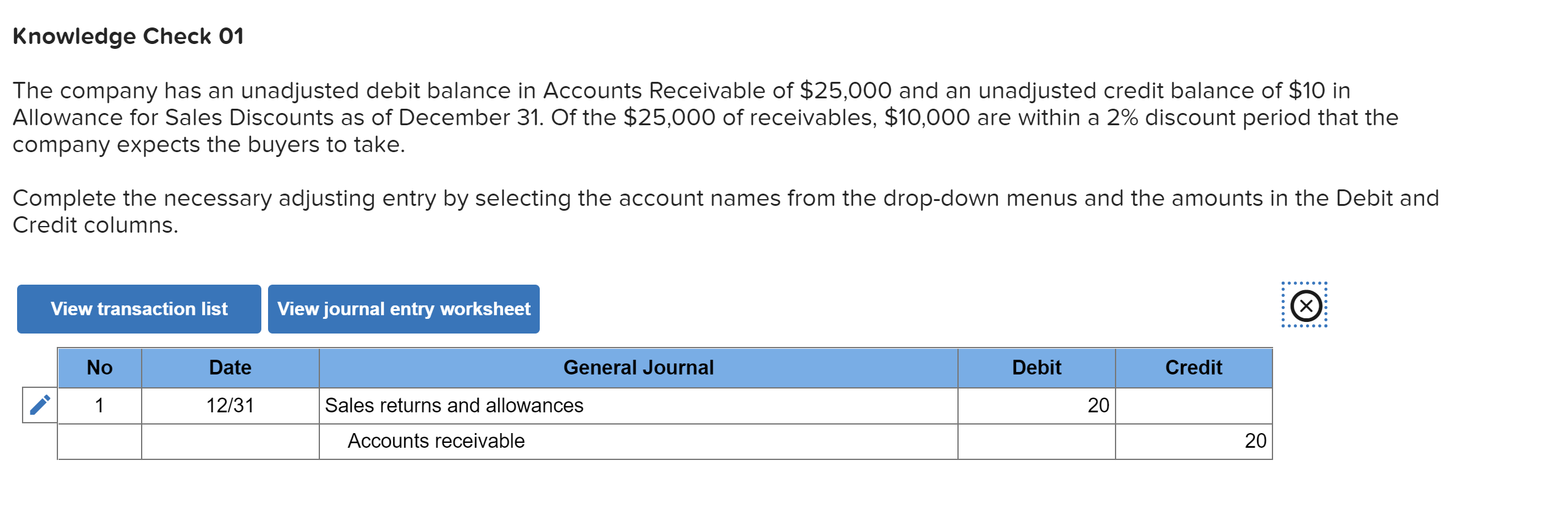

If the amounts are abnormally large, however, a. Adjustments for inventory losses are made via two accounting entries. Learn how to record inventory shrinkage, the difference between actual inventory and the recorded amount, in the journal entry.

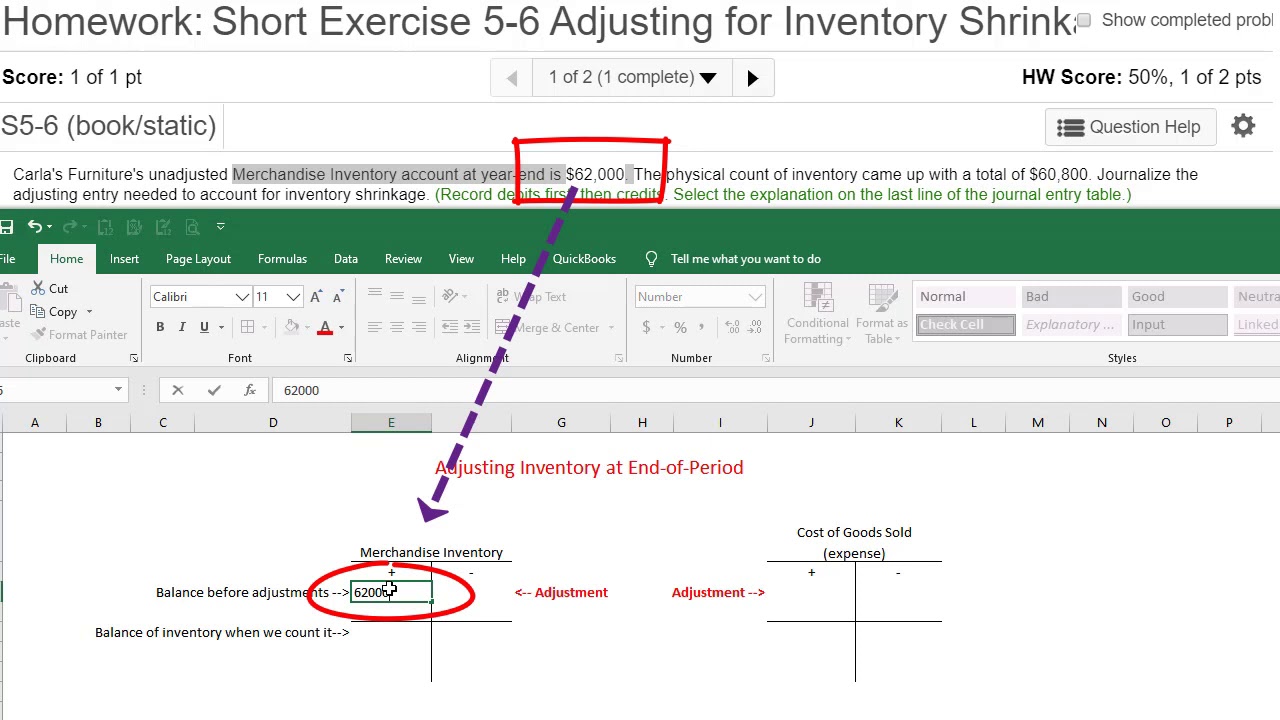

Have, determine how much inventory you actually have to find the inventory shrinkage rate, divide your inventory losses by the amount of inventory you should have. How to calculate inventory shrinkage? See the formula, account names, and an example of a journal entry for inventory shrinkage with a debit and credit entry.

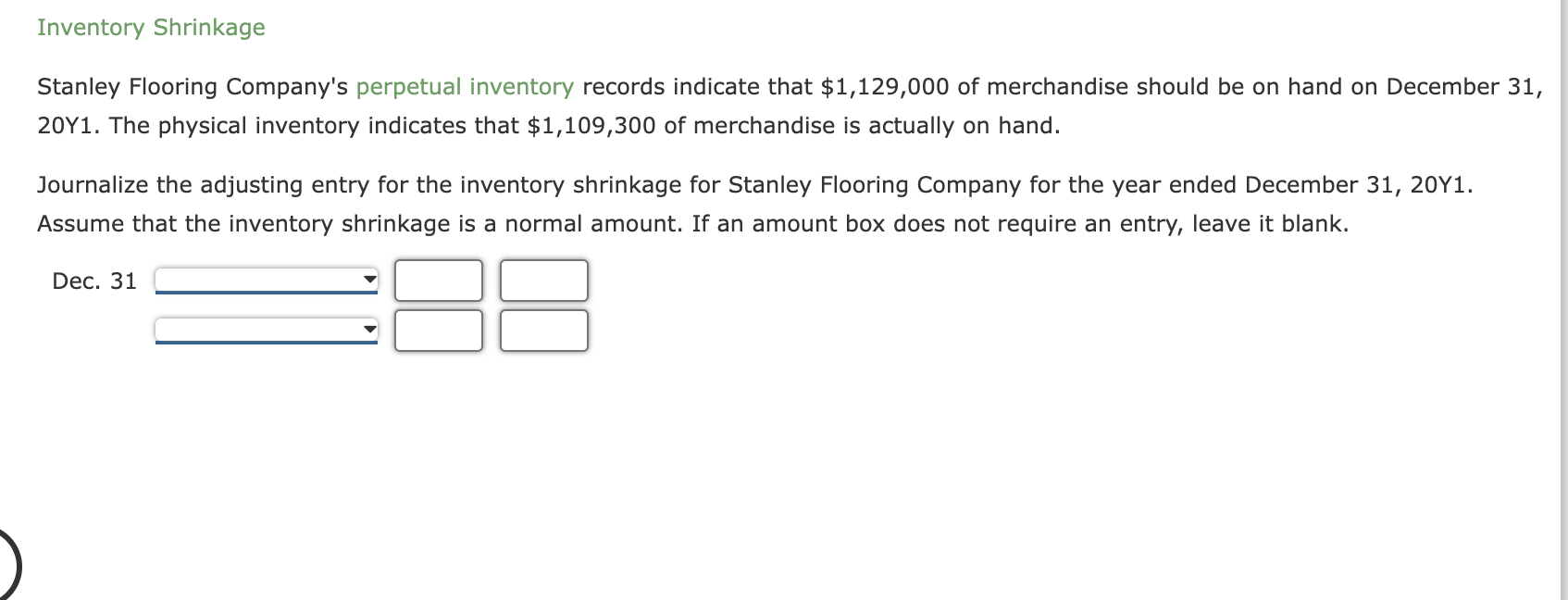

Inventory shrinkage is the excess amount of inventory listed in the accounting records, but which no longer exists in the actual inventory. The only way an adjustment expense account would show negative on the p&l is if you are increasing the qty on hand in an adjustment. Inventory that is less than the expected amount.

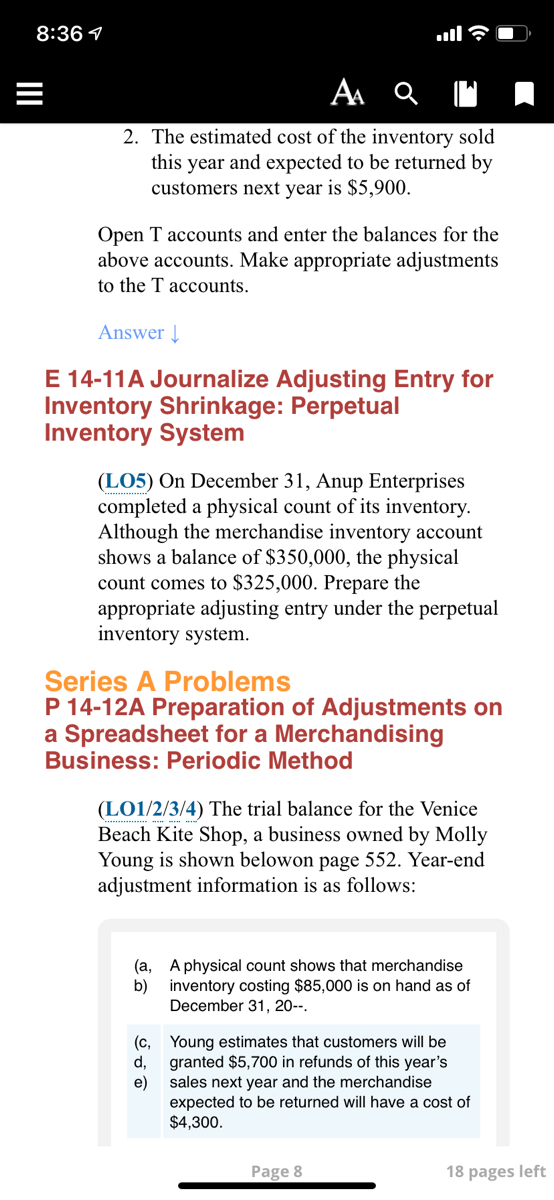

The primary purpose for adjusting entries periodically is to account for inventory shrinkage. The following adjusting entry would be made: Perpetual inventory system on december 31, anup enterprises completed a physical count of its inventory.

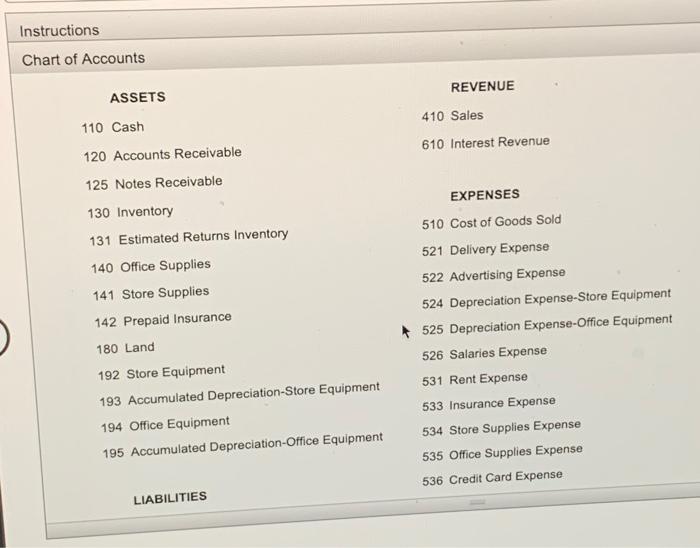

Adjusting entry for inventory is made at the end of an accounting period to ensure that a company’s recorded inventory tally with the actual inventory on the. In the remainder of this chapter, the adjusting and closing process for a merchandising business will be described.