Simple Tips About Smsf Financial Statements

The swinstead approach julia has a reliable track record working with a diverse range of clients including fifo workers, tradespeople, home based businesses, freelance businesses, personal service businesses, family trusts, companies, partnerships, not for.

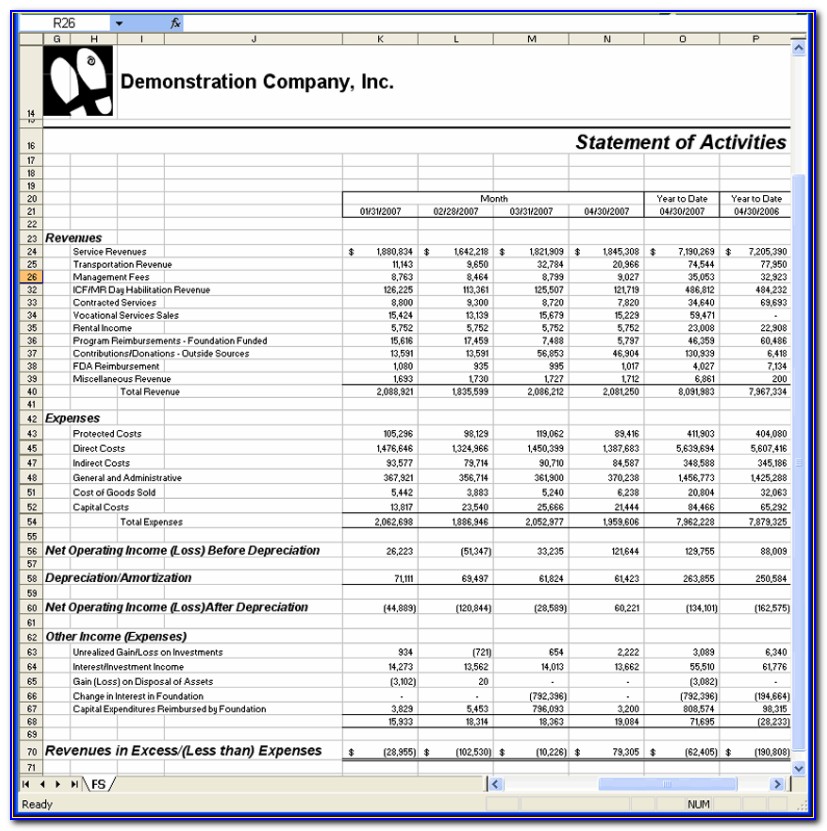

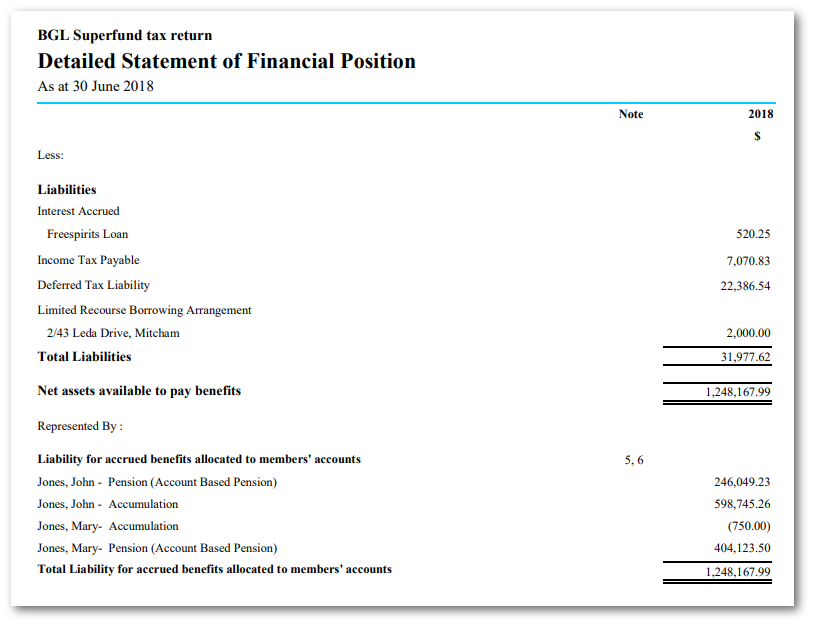

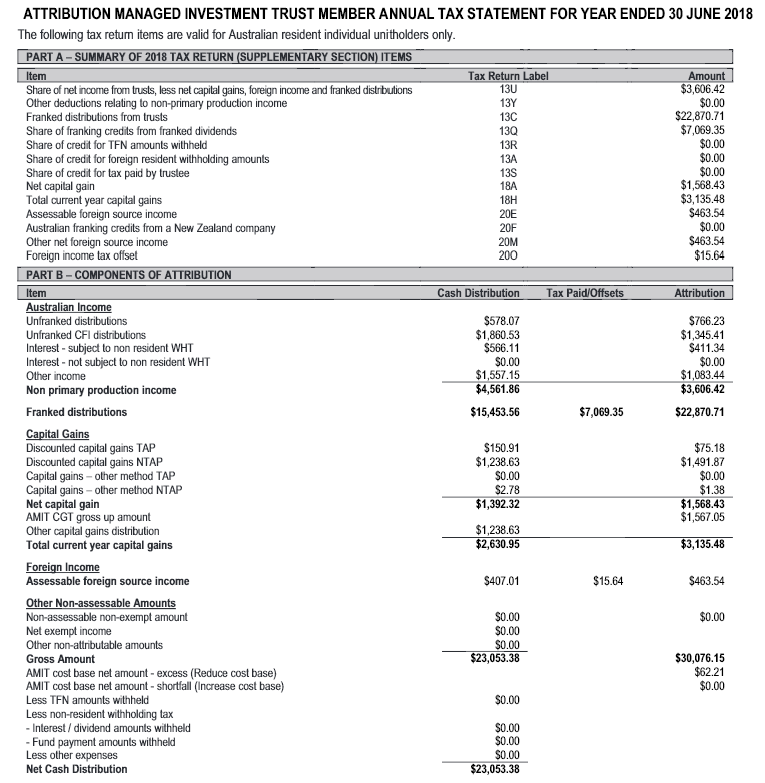

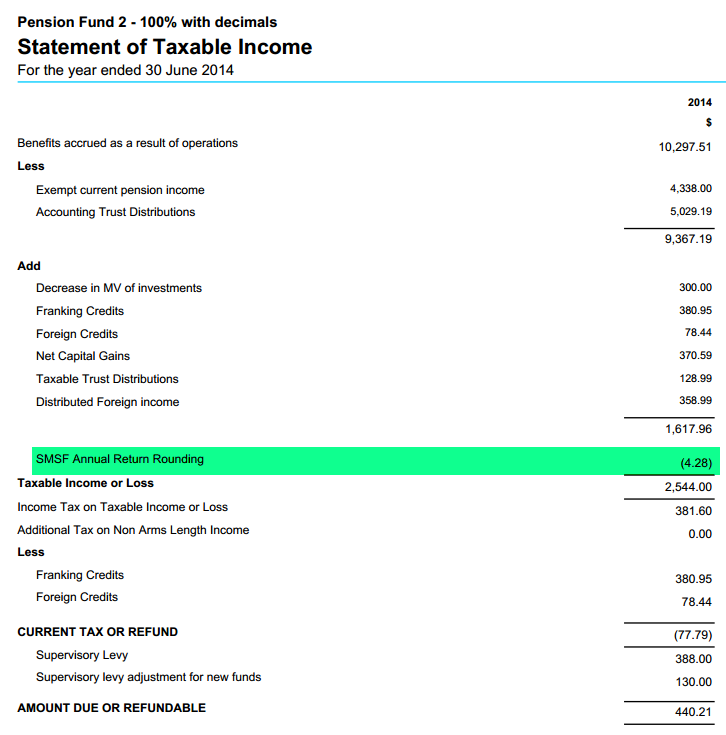

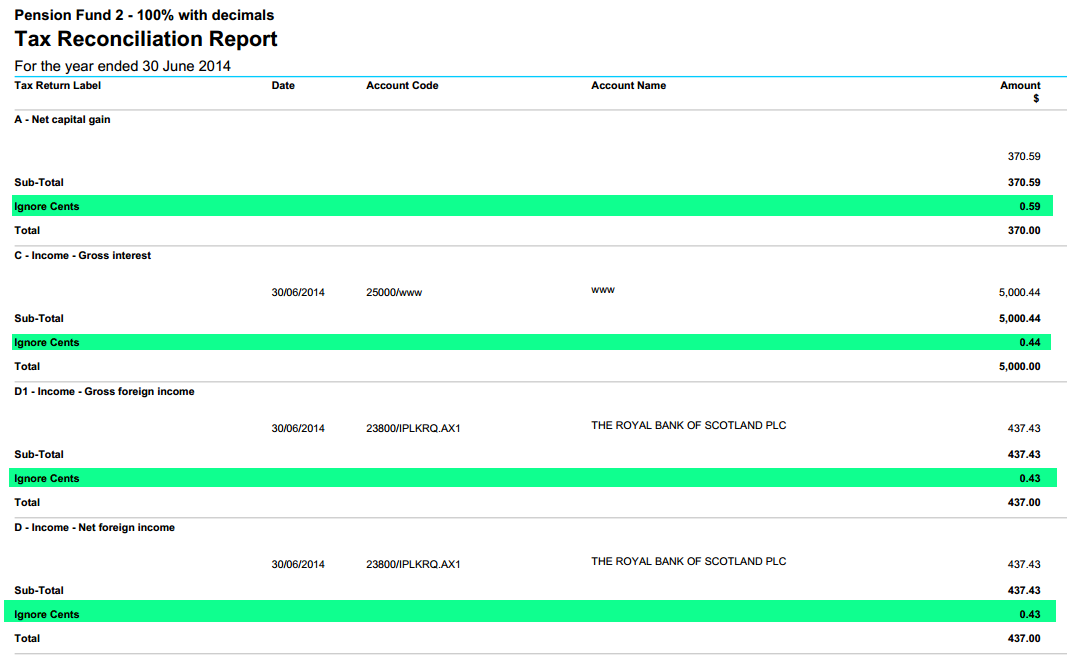

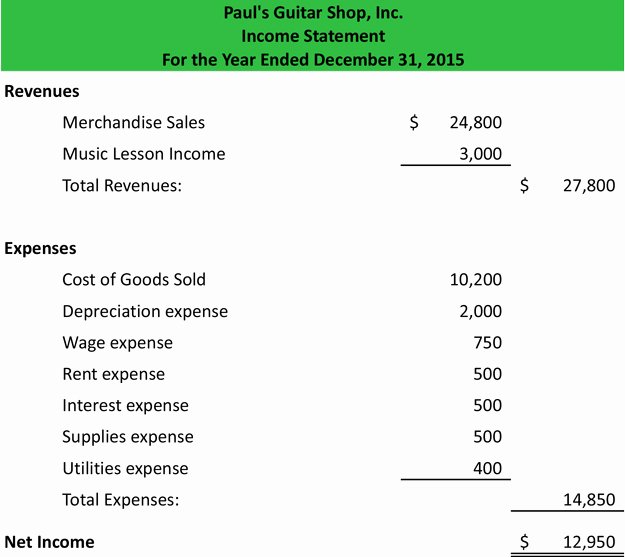

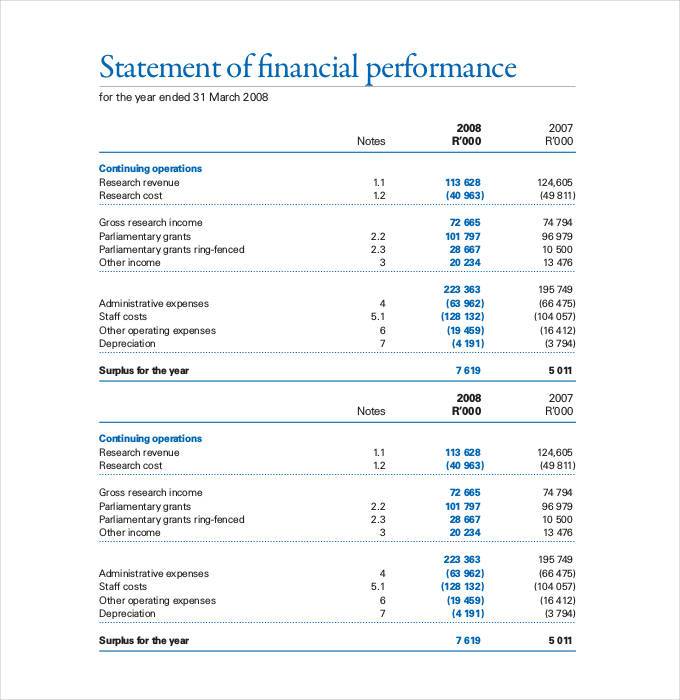

Smsf financial statements. Has anyone a solution for me please. The auditor collects the smsf’s financial statements, including the balance sheet, income statement, and member statements. These documents are thoroughly reviewed to assess their accuracy and compliance with accounting standards.

Sale or transfer of assets. The smsf auditor is required to review the financial statements and supporting records of the funds, and provide an opinion as to whether it considers the financial statements provide a true and fair position of the fund. Welcome to institute of financial professionals australia smsf toolkit.

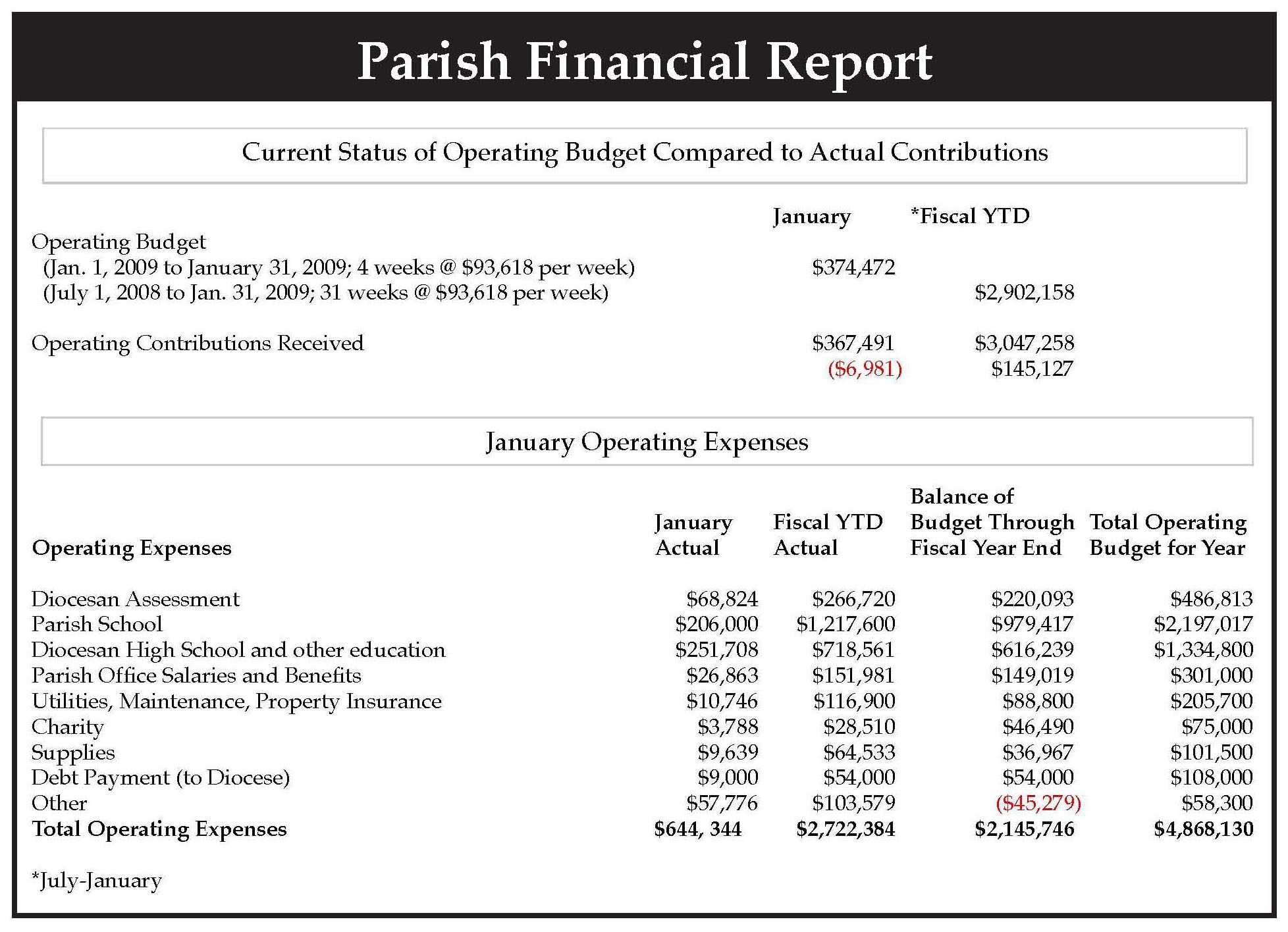

The draft financial statements should include all income and expenses to date. One of the many responsibilities trustees must perform. The steps for the auditing process are.

I usually attend my accountant’s premises to sign my smsf’s financial statements. This checklist is also available as a pdf download to keep with your documents smsf auditor checklist. Be empowered to manage your smsf with confidence, with a wide range of resources covering key smsf topics.

Managing an smsf is a major responsibility as trustees are responsible for complying with the superannuation and tax laws. Learn about the preparation of financial statements, including the balance sheet, income statement, and statement of changes in equity, to gain insights into the fund’s. Any smsf records that your auditor requests must be.

This includes an operating statement and a statement of financial position which. Signature requirements for financial statements question: Signature requirements for financial statements.

The draft financial statements will determine the value of each member’s benefit. Preparing your super fund’s financial statements, including an operating statement, balance sheet, member balances, and notes to these financial statements. Under the super laws, smsf trustees must sign their smsf’s financial statements before finalising their annual audit.

The financial audit focuses on the smsf’s financial statements to make sure they meet australian auditing standards whereas the compliance audit confirms that the fund adheres to superannuation legislation. In addition, they should factor in both actual and estimated future expenses. How can i meet the signature.

Consequently most smsfs prepared special purpose financial statements (spfs) which satisfied the requirements of the ato and also the requirements of the members given the members were generally the management of the smsf, by. The first step towards establishing the smsf is by applying for an australian business. The financial audit analyses all the fund’s financial statements, such as its balance sheet, income statement and member statement, based.

It is reflected correctly in the profit and loss, however in the notes to the accounts the entry is in brackets. Your smsf auditor is responsible for analysing your fund’s financial statements and assessing its compliance with super law. Financial statements for an smsf.