Smart Tips About Statement Of Cost Services

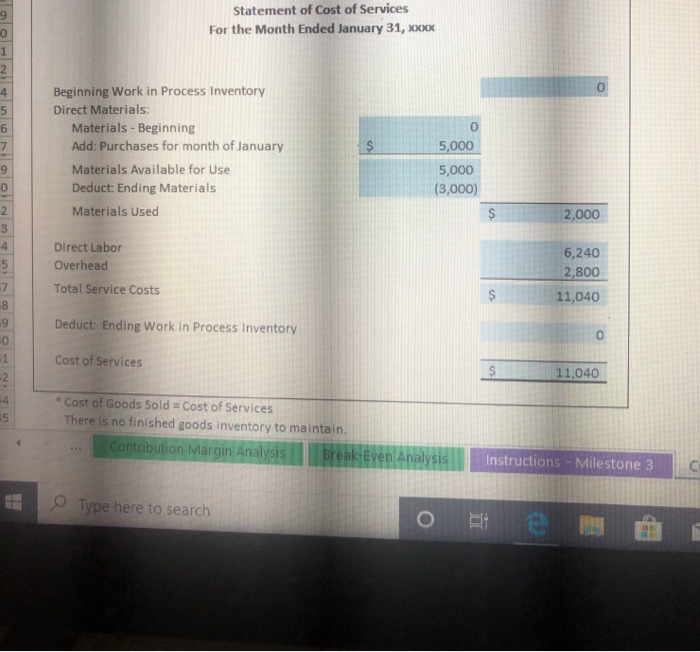

Your cost per hour would look something like this:

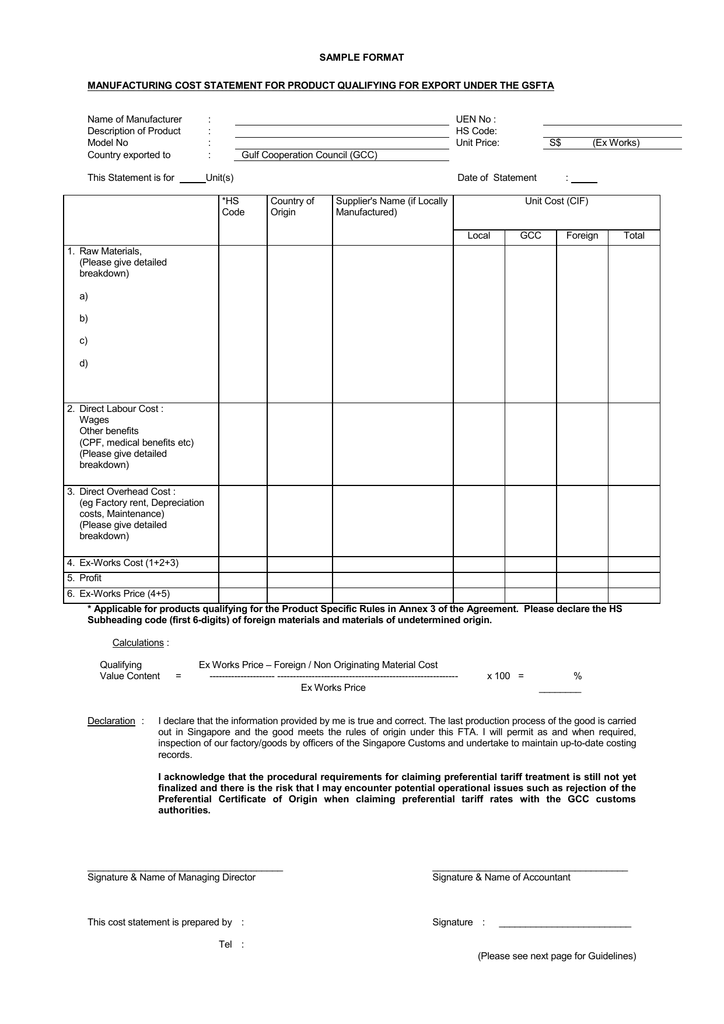

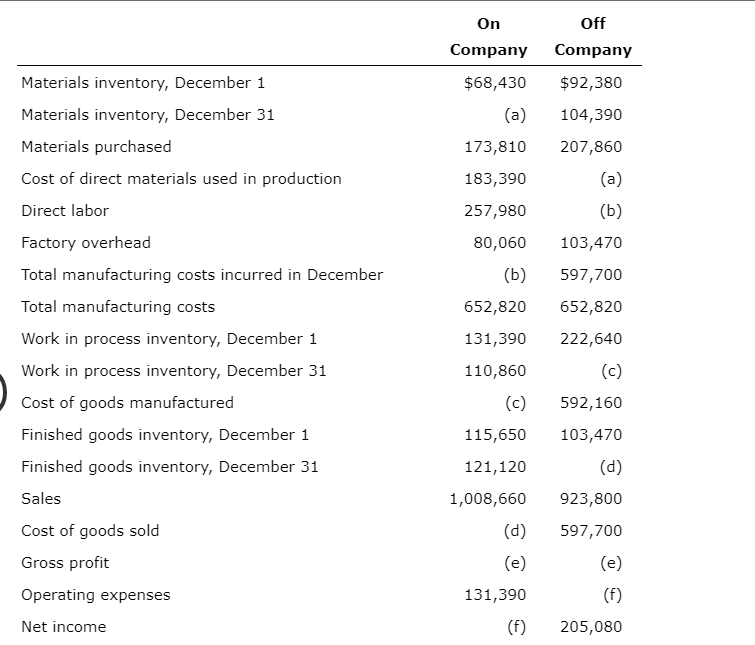

Statement of cost of services. Examples of cost of goods sold include the cost of the materials, prices of the goods purchased for reselling further, the distribution cost, etc. Coss does not include indirect costs such as overhead and sales and marketing. Ottawa, february 12, 2024.

Example john manufacturing company, a manufacturer of soda bottles, had the following inventory balances at the beginning and end of 2018: These costs can include labor, material, and shipping. You can find these in settings > battery > battery health (with ios 16.1 or later, find these in settings > battery > battery health & charging).

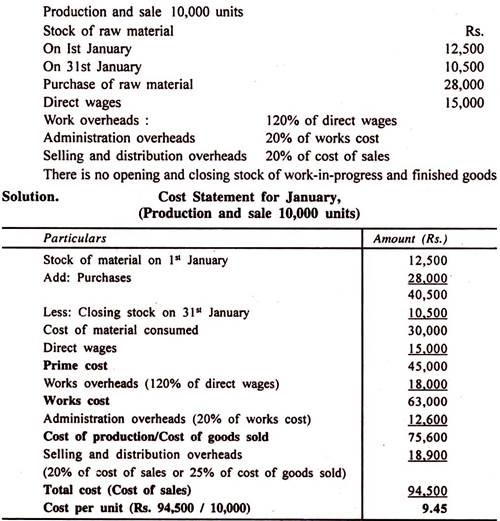

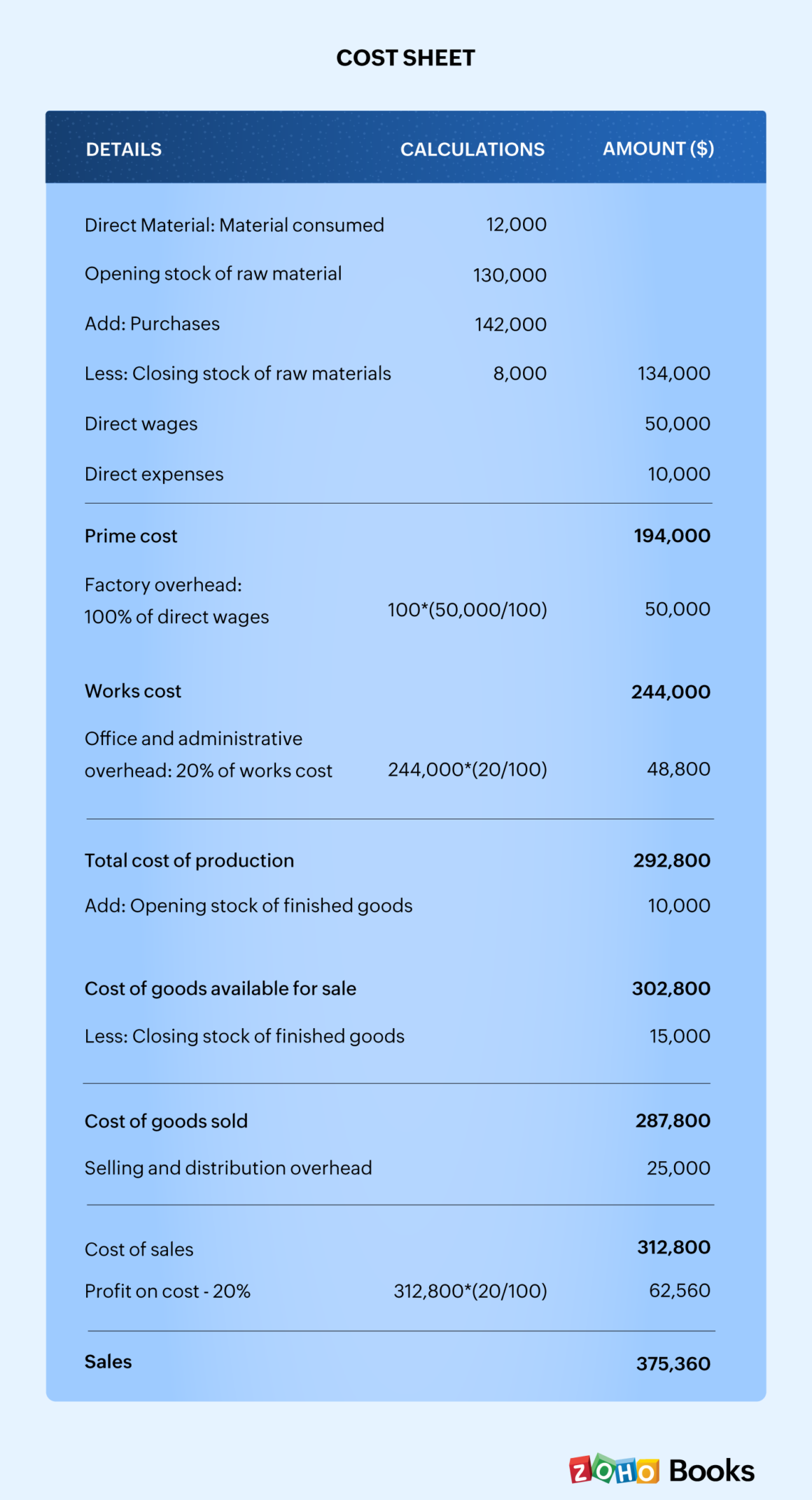

Cost of services sold (coss) is a metric used to measure the costs and expenses directly related to providing services. Written as a formula, it is: Cost of services includes:

The unit that most service businesses use is hours. $150 / 8 hours = $18.75 per hour. Let’s say you charge the client $300 per hour.

The business can charge the cost of goods sold in its financial statements. In this article, we explain what cost of goods sold for services is, describe the value of reviewing the costs of goods sold, list what to include in your calculation and provide a formula to use to find your organization's cost of goods sold for services. Canada border services agency / public services and procurement canada / public health agency of canada.

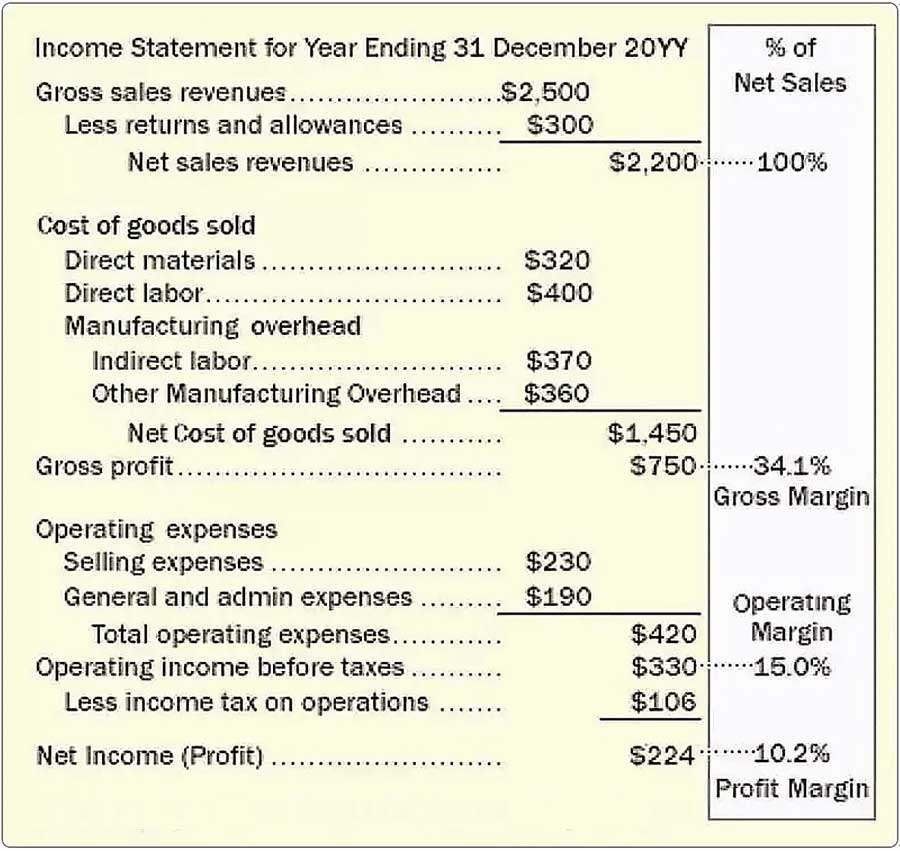

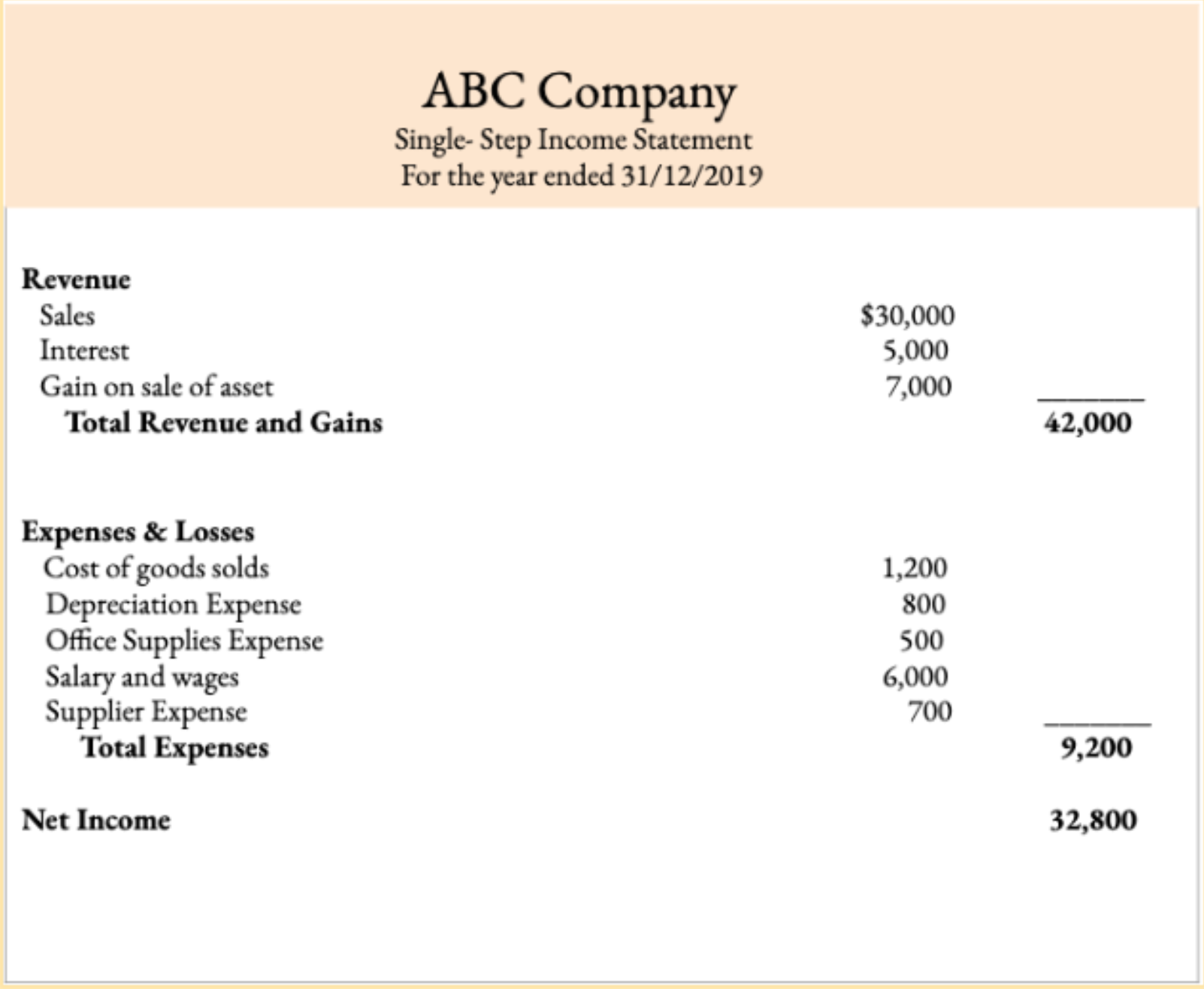

The medicare prescription payment plan complements these provisions by allowing individuals to spread their spending over the. For example, the income statements of apple and intuit report both cost of. Cost of goods sold in a service business.

Businesses calculate their cos to comply with the matching concept of accounting, which requires them to match their costs with their revenues. This means our fees must cover the cost of the services we deliver. These firms use the cost of service to present their direct expenses better.

Most production companies use the cost of goods sold in the income statement. Client will reimburse rgp for actual expenses incurred by consultants in connection with the performance of services which are consistent with client's expense policy, a copy of. It is commonly used in accounting to measure the cost of services sold in a given period of time.

On most income statements, cost of goods sold appears beneath sales revenue and before gross profits. For iphone 6 and later, ios 11.3 and later add new features to show battery health and recommend if you need to replace the battery. Calculate service businesses’ cost of goods with this formula:

Fees for the services provided hereunder are based on the billing rates set forth in the applicable statement of services. T he cost of direct labor or salaries of experts should be included while calculating. Then, subtract the value of the inventory yet to be sold.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)