Nice Tips About All Financial Ratios Trial Balance Sheet Example

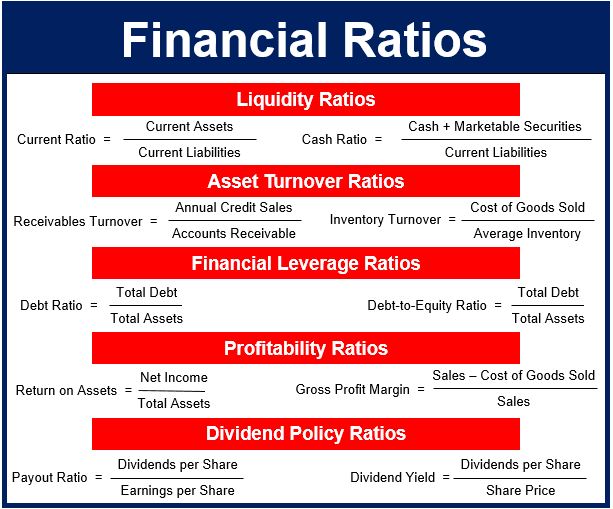

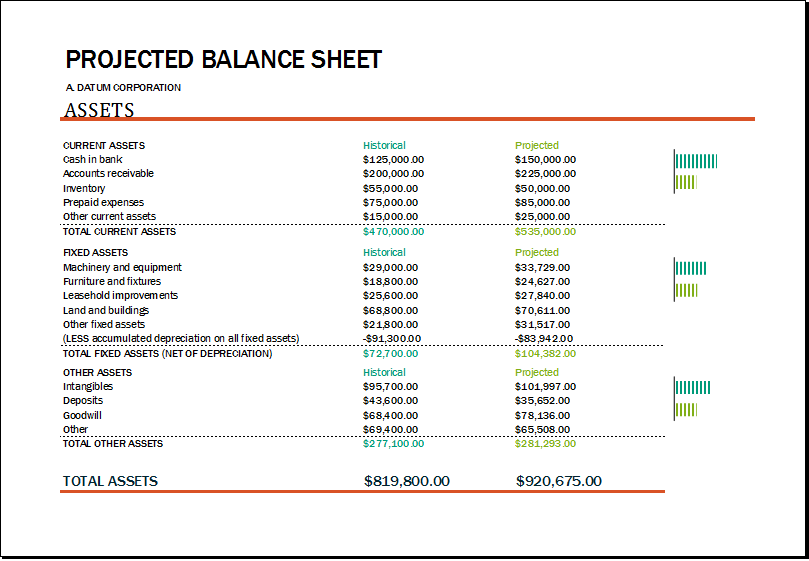

Total liabilities / total assets = debt to asset ratio.

All financial ratios trial balance sheet example. Some key balance sheet ratios include (but aren’t limited to): For example, if you determine that the final debit balance is $24,000 then the final credit balance in the trial balance must also be $24,000. Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc.

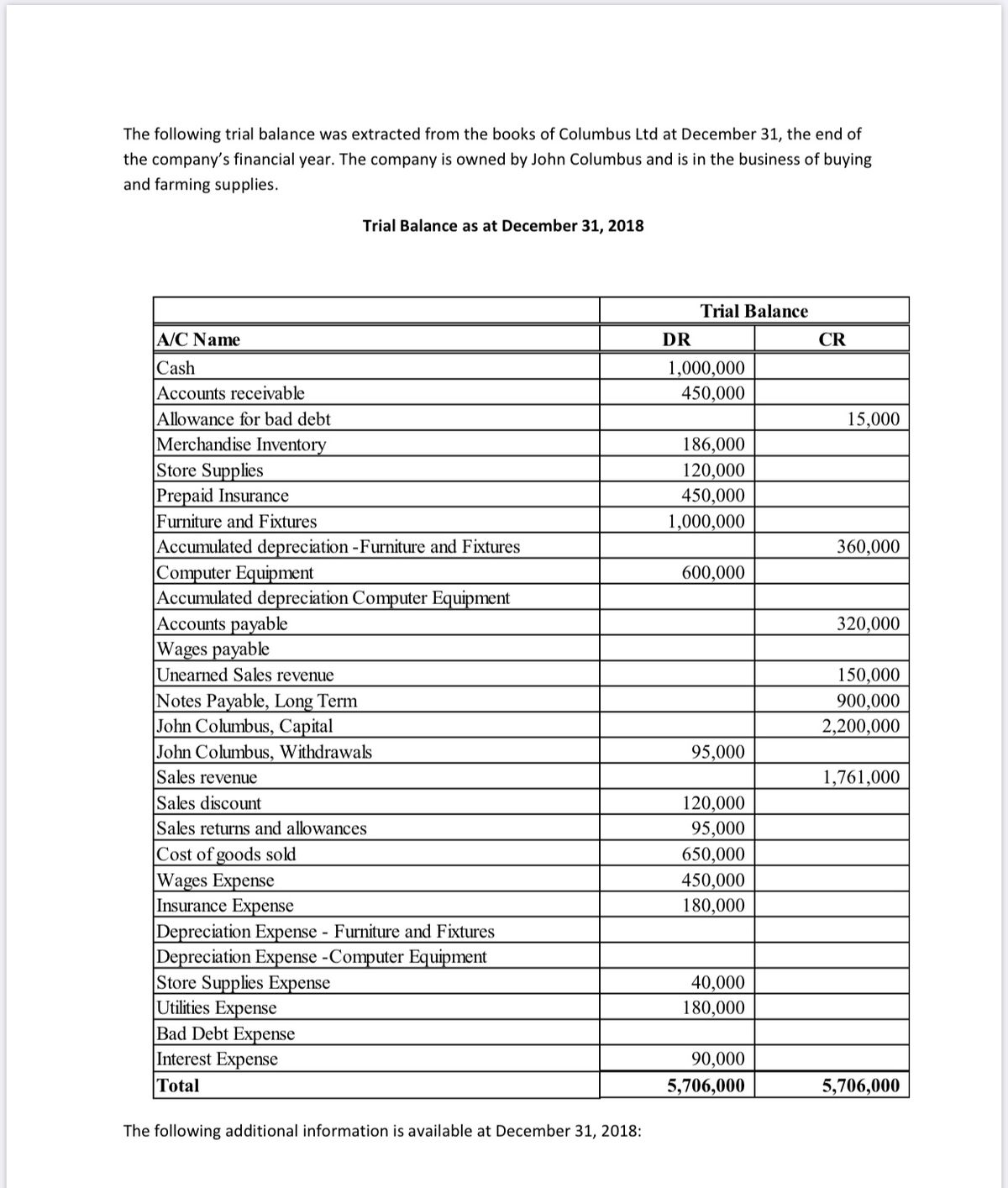

Financial ratios in concept; Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative to revenue, balance sheet assets, operating costs, and shareholders’ equity during a. It is prepared again after the adjusting entries are posted to ensure that the total debits and credits are still balanced.

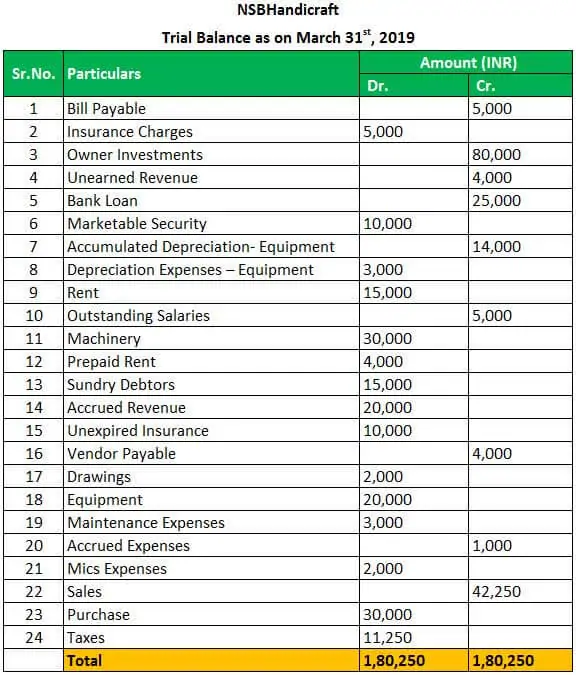

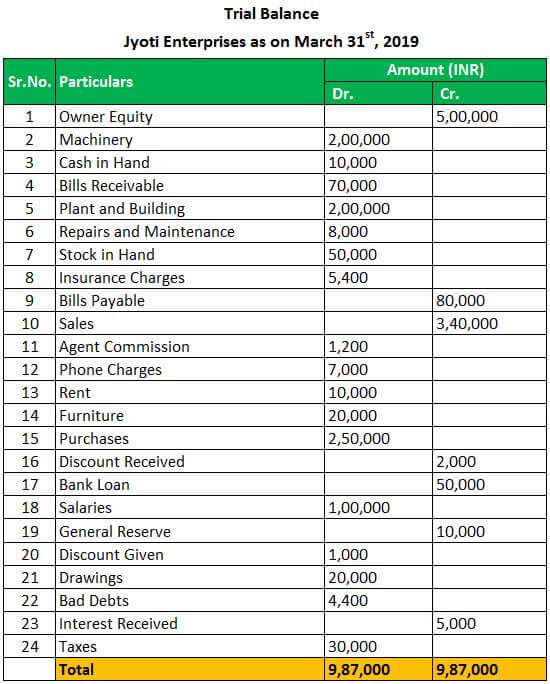

Financial ratios are grouped into the following categories: From the available balances as on date 31.03.2019, which as follows: The main thing to focus on is that the total balance of the credit and debit sides of the trial balance would always match if all the postings were made correctly.

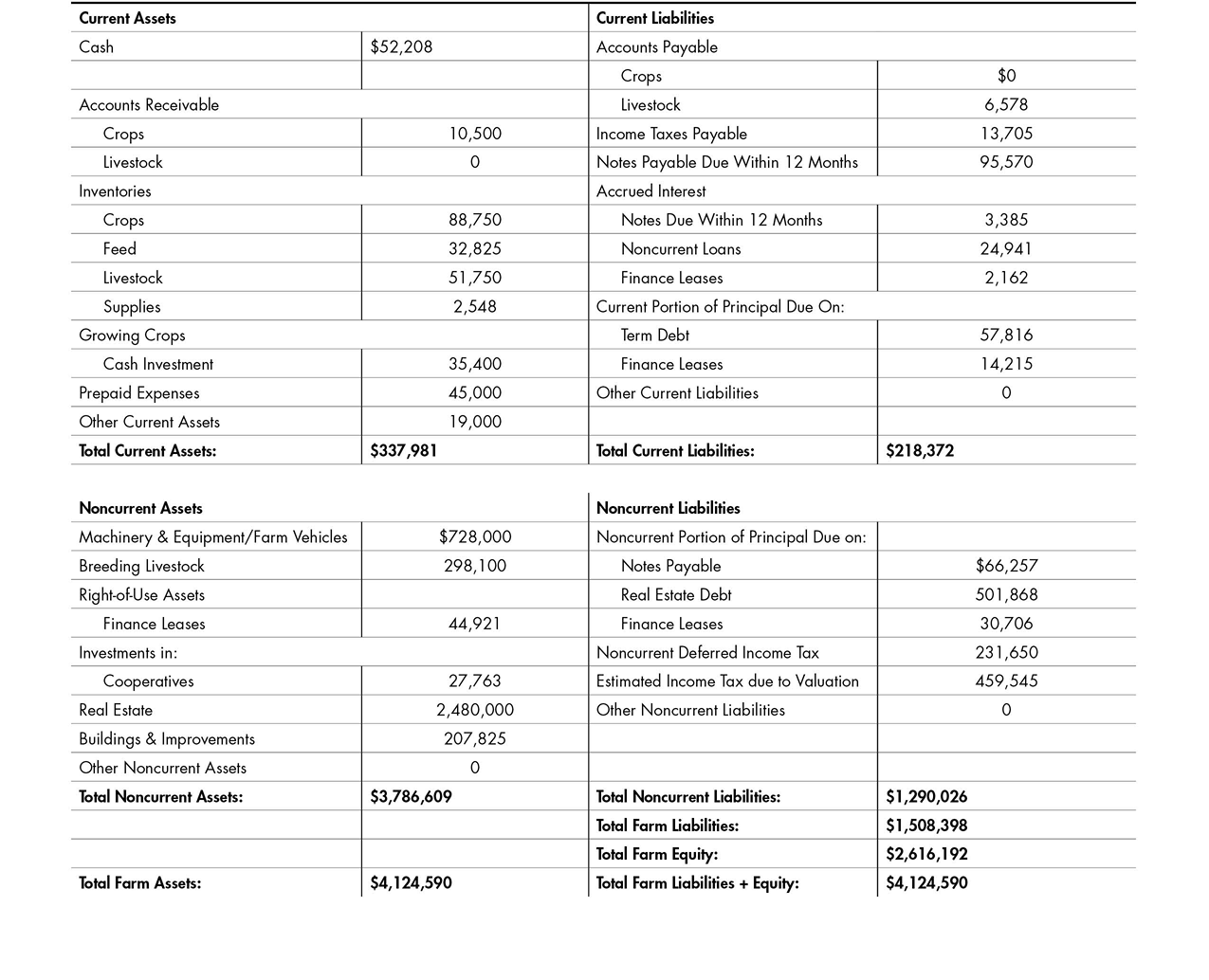

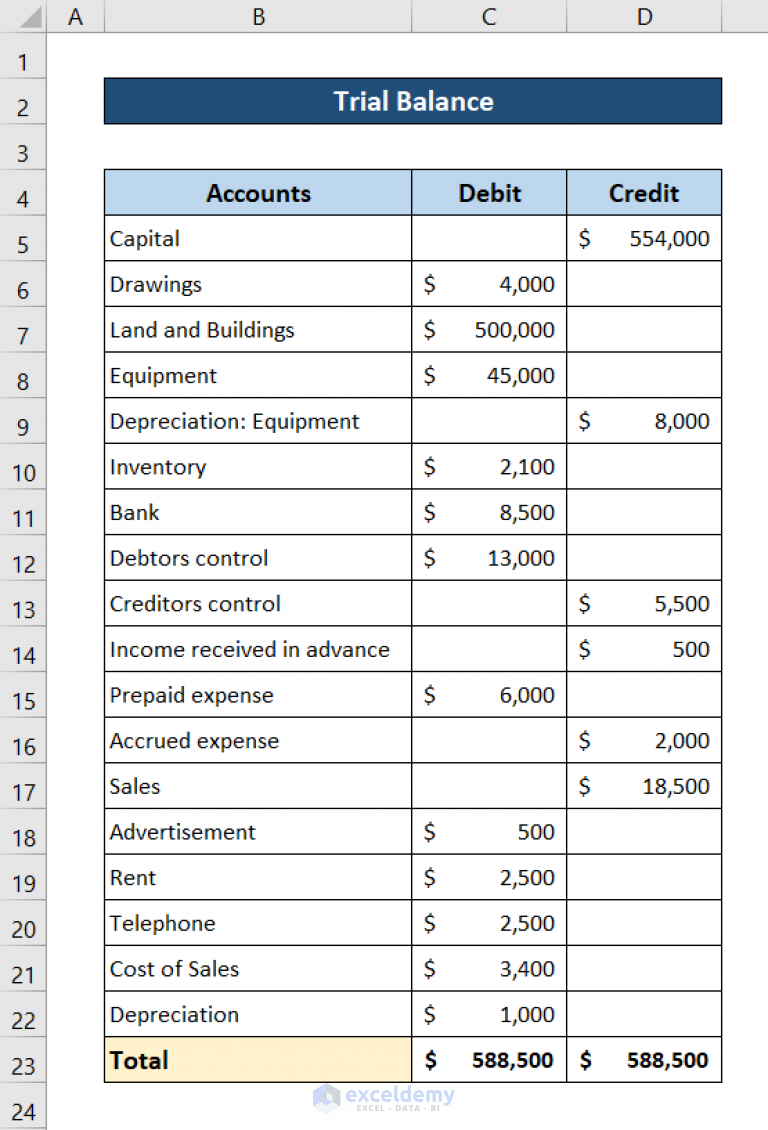

Balance sheet ratios are the ratios that analyze the company’s balance sheet which indicate how good the company’s condition in the market. From the following particulars found in the trading, profit and loss account of a company ltd., work out the operation ratio of the business concern: Use the amounts in example corporation's balance sheet (above) to calculate the following financial ratios:

Quick ratio as of december 31, 2022: Current ratio as of december 31, 2022: These ratios usually measure the strength of the company comparing to its peers in the same industry.

Analysis of financial ratios serves two. Trial balance is the report of accounting in which ending balances of the different general ledgers of the company are available; Financial ratios, such as efficiency ratios, liquidity ratios, solvency ratios, quick ratios, and profitability ratios, can be utilized by the managers, stakeholders, and business owners to fetch an insight into the financial status of the organization.

Part 1 introduction to financial ratios part 2 financial ratios using balance sheet amounts part 3 financial ratios using income statement amounts part 4 financial ratios using amounts from the balance sheet and income statement part 5 A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Balance sheet ratios formula and example definition.

They are financial ratio which includes debt to equity ratio, liquidity ratios which include cash ratio, current ratio, quick ratio and efficiency ratios which include account receivable turnover, payable account turnover, inventory turnover ratio. How to calculate your debt to asset ratio. To calculate your debt to asset ratio, look at your balance sheet and divide your total liabilities by your total assets.

Calculate the quick ratio from the balance sheet shown below. You have $10,000 in assets and $4,000 liabilities (debt). Financial ratios using amounts from the balance sheet and income statement in this section, we will discuss five financial ratios which use an amount from the balance sheet and an amount from the income statement.

Examples of trial balance format example #1. For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown wi. Basically, this ratio measures the liquidity of your company.