One Of The Best Tips About Income Statement Of Nonprofit Organizations

To help simplify financial reporting, genest tarnow offers the following top three financial reporting items that nonprofits should review each month.

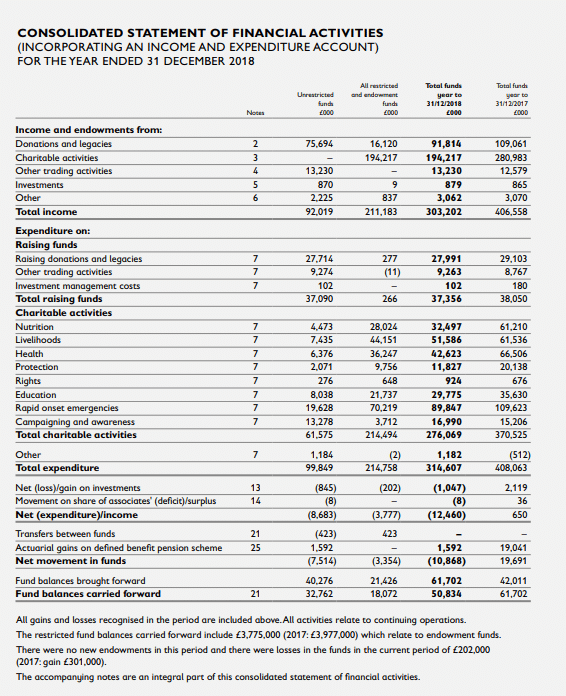

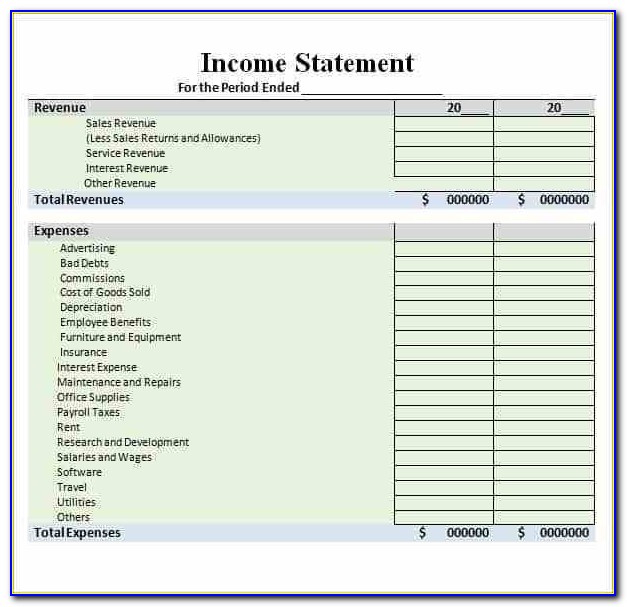

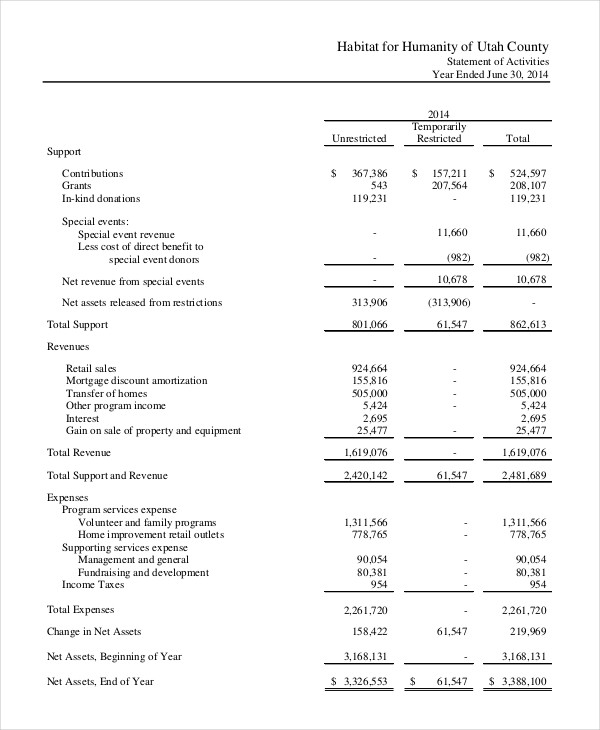

Income statement of nonprofit organizations. Statement of activities and changes to net assets 3. Typically, expenses are broken into two distinct sections—overhead expenses and program expenses. This results in inconsistency as demonstrated by the examples on this page.

Why do nonprofits need financial statements? One of the statements is entirely unique to nonprofits. Nonprofits must file four statements every year to comply with irs rules.

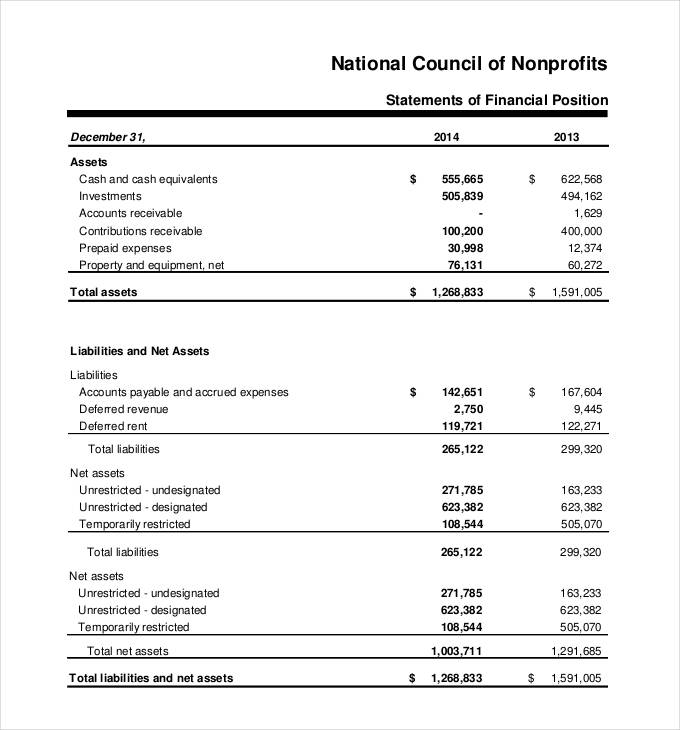

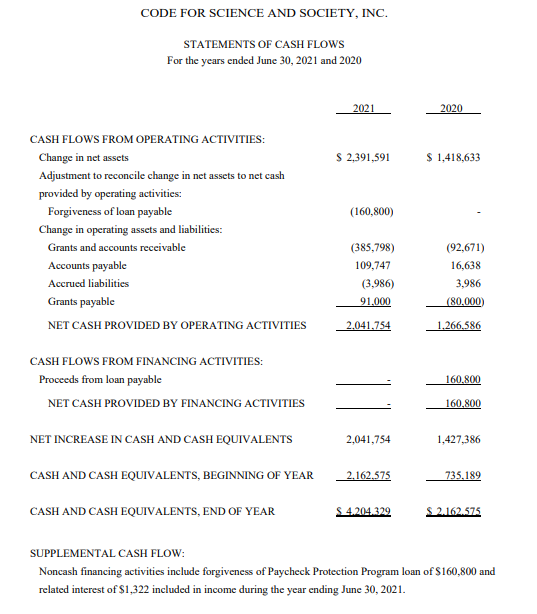

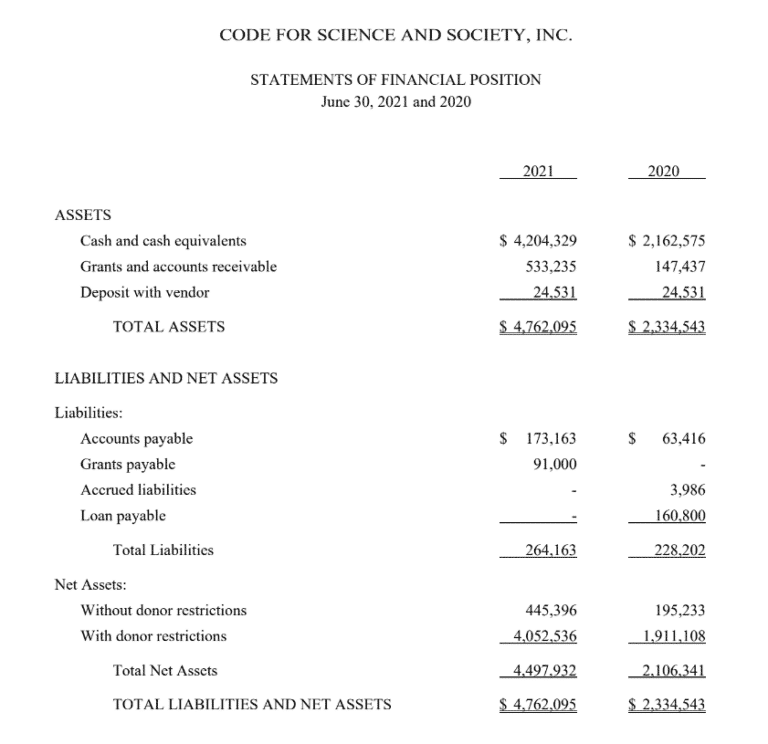

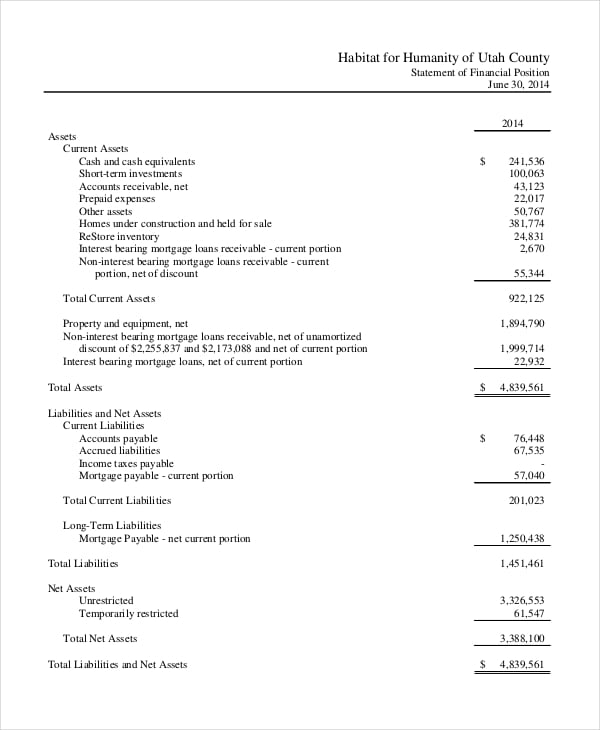

The statement of activities, the statement of financial position, and the statement of cash flows. Typically, this includes gifts, grants, membership fees, and/or income from fundraising events or investments. Overhead includes management, general, and fundraising expenses (for example, rent and utilities).

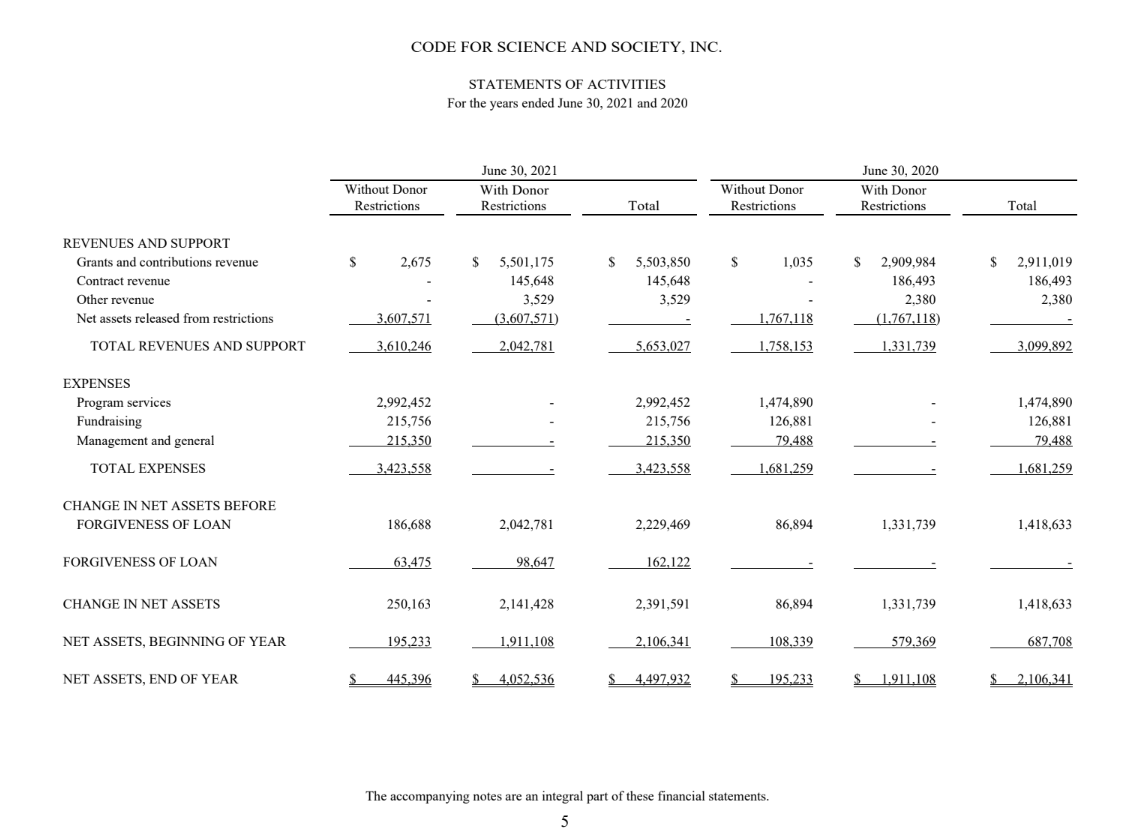

The financial statements issued by a nonprofit are noted below. In most cases, it’s better to let your accounting software or a bookkeeper take care of this step for you. The nonprofit statement of activities (or income statement) is a financial report that shows your organization’s revenue and expenses over time, ultimately allowing your organization to analyze your net assets.

It helps you understand your financial performance and whether your organization is operating out of a surplus or deficit. What is a nonprofit statement of activities? The income statement can be prepared on a monthly, quarterly, or yearly basis.

The four required financial statements are: The statement of activities is the income statement of a nonprofit organization. Key takeaways nonprofit financial statements are important tools for assessing the financial health and accountability of nonprofit organizations.

Reports an organization’s revenue and expenses over a specific period. Nonprofits use three main kinds of financial statements: It’s one of the core financial statements that all nonprofits need.

An income statement is a record of the revenue and expenses of a nonprofit organization over a period of time. You may also hear it referred to as a profit and loss statement or income and expense report. For example, if a donor contributes $500, the effect on the nonprofit's accounting equation and its.

What is the importance of an income statement? In this guide we explore the do's, don'ts and requirements of financial statements for your nonprofit organization. How to create financial statements for your nonprofit;

Statement of cash flow interpreting nonprofit financial statements analyzing key indicators Statement of functional expenses 5. Known as the statement of activities for nonprofits, it shows the following formula:

![Free Printable Nonprofit Financial Statement Templates [Excel]](https://www.typecalendar.com/wp-content/uploads/2023/08/Nonprofit-Financial-Statement-Word-Format.jpg?gid=902)