Outrageous Info About Insurance Company Balance Sheet

Balance sheets for insurance companies the bank's part in.

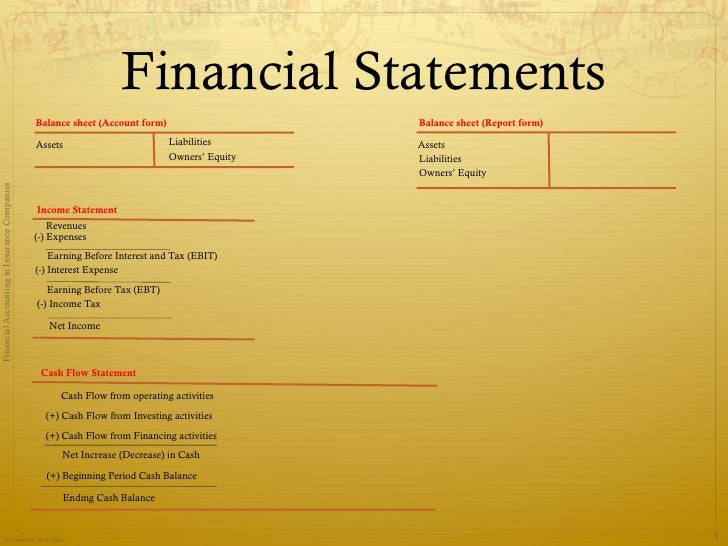

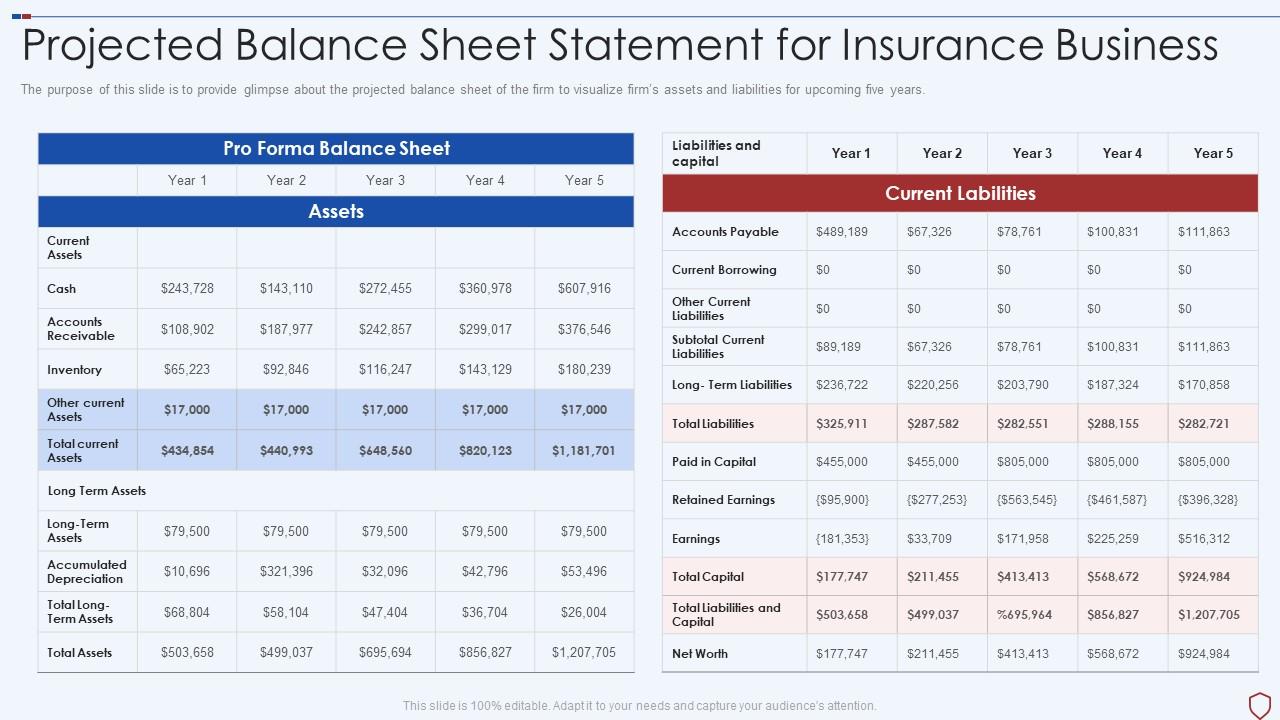

Insurance company balance sheet. You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios. Balance sheet and income, direct insurance (life insurance companies) : Total assets (log levels) significant increase of ic sector and, thus, financial intermediation capacity after.

Insurance corporations data balance sheet data. In april 2023 truist had confirmed the sale of a 20% stake, $1.95 billion, in truist insurance holdings to stone capital. In optimizing the relationship between risk, return and capital through their balance sheet, insurers are facing three interlocking challenges.

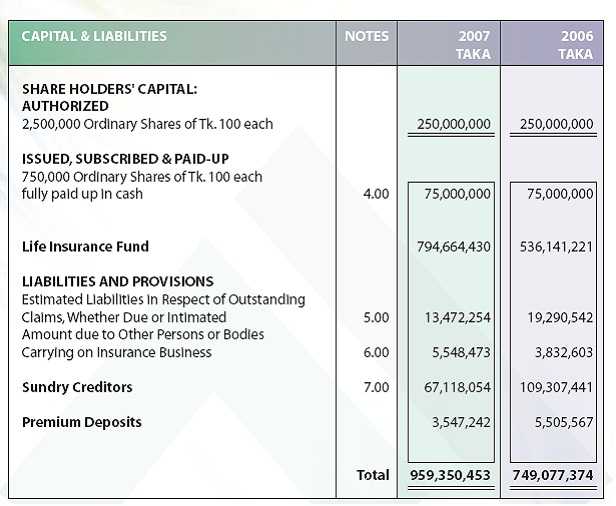

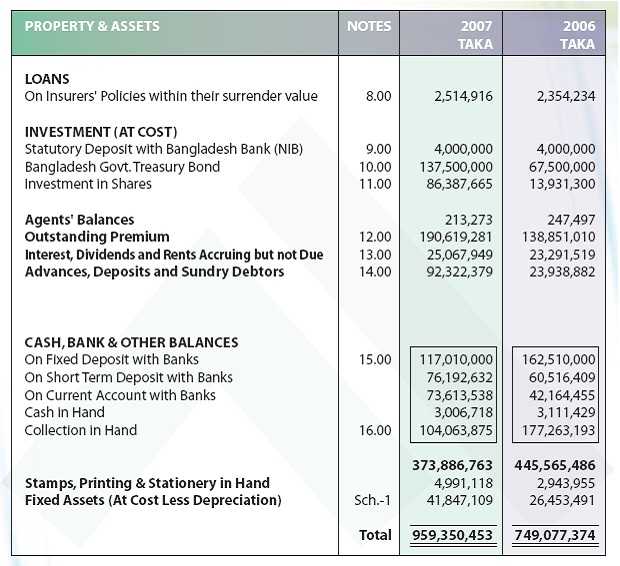

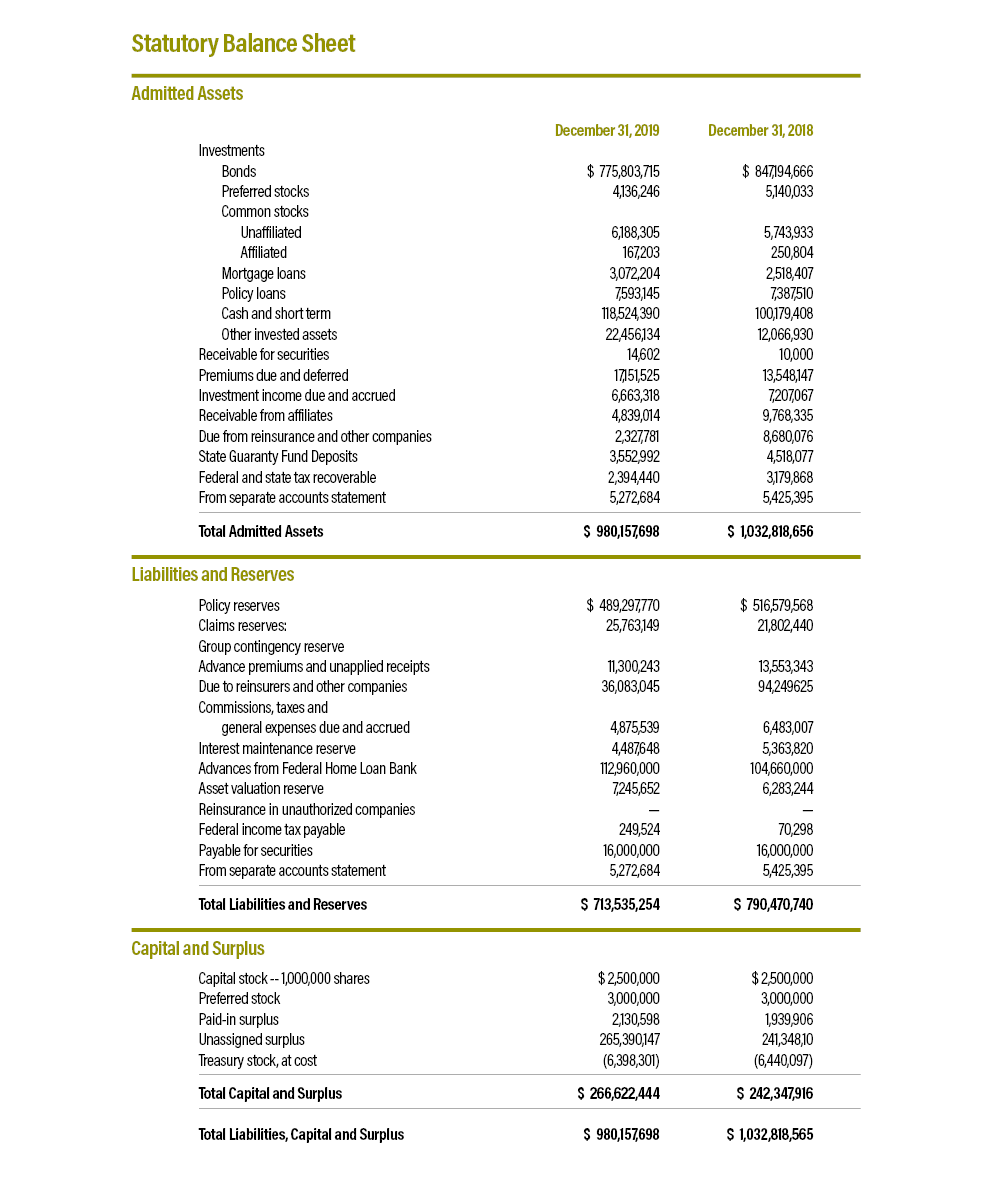

Statistics on the balance sheet for euro area insurance corporations are available as of q3 2016 through the ecb data portal. Loss reserves are generally the largest liability on an insurer’s balance sheet. Insurance revenue and expenses 56 2.4.1.

Simplifying an insurer's balance sheet the toughest part of understanding insurance companies and their finances is wrapping your head around. See the financial statements of allianz, a leading insurance company, for the year ended december 31, 2022. Main balance sheet aggregates response to mp shocks.

The shift in economic conditions over. When a claim is filed, a reserve is established for payment of that claim. Total liabilities (balance sheet), level (bogz1fl544190073q) observation:

2020 | oecd insurance statistics 2021 | oecd ilibrary home statistics oecd insurance statistics. (a) the fulfilment cash flows—the current estimates of. Composition of the balance sheet 55 2.4.

A quick glance over an insurer’s balance. The compilation of sector balance sheets national and sector balance sheets provide figures of outstanding. Understand the key components of an insurance company’s income statement and balance sheet calculate and apply some basic ratios to quantify an insurance.

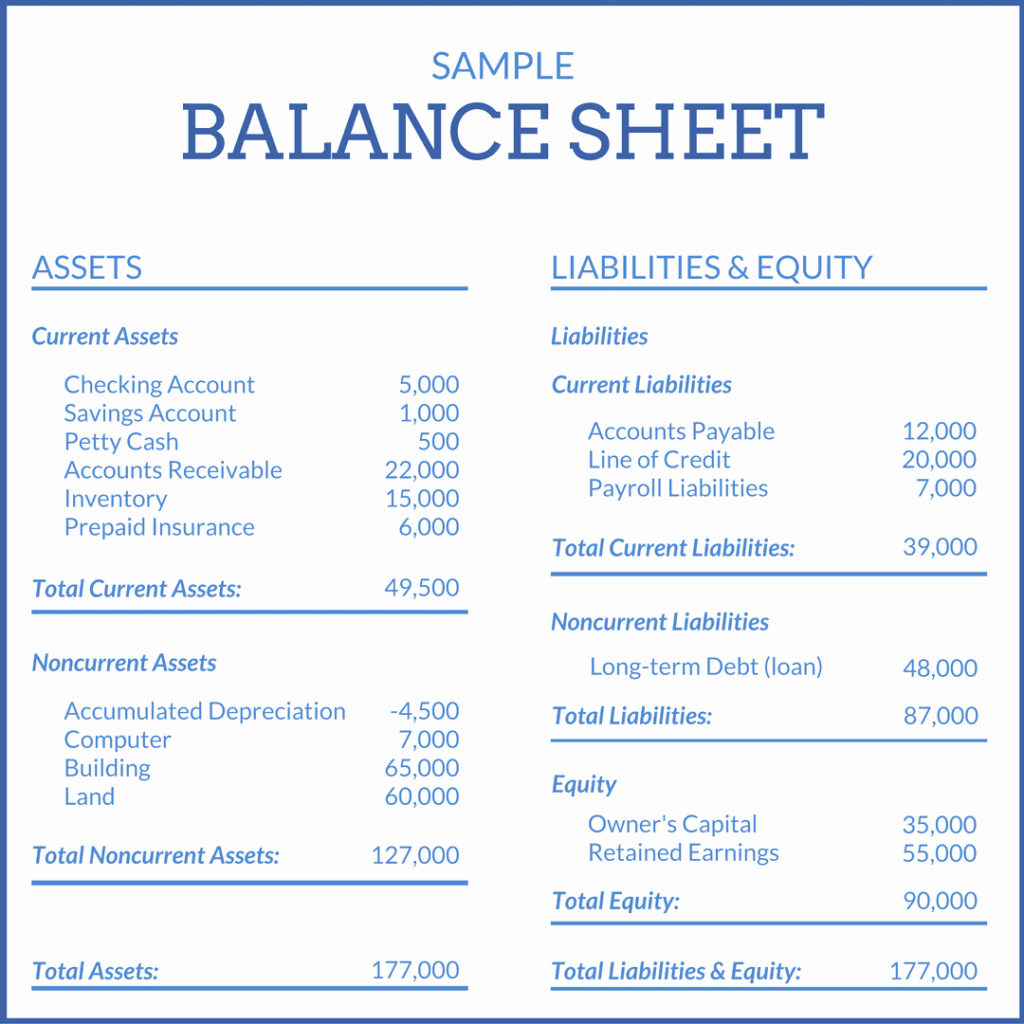

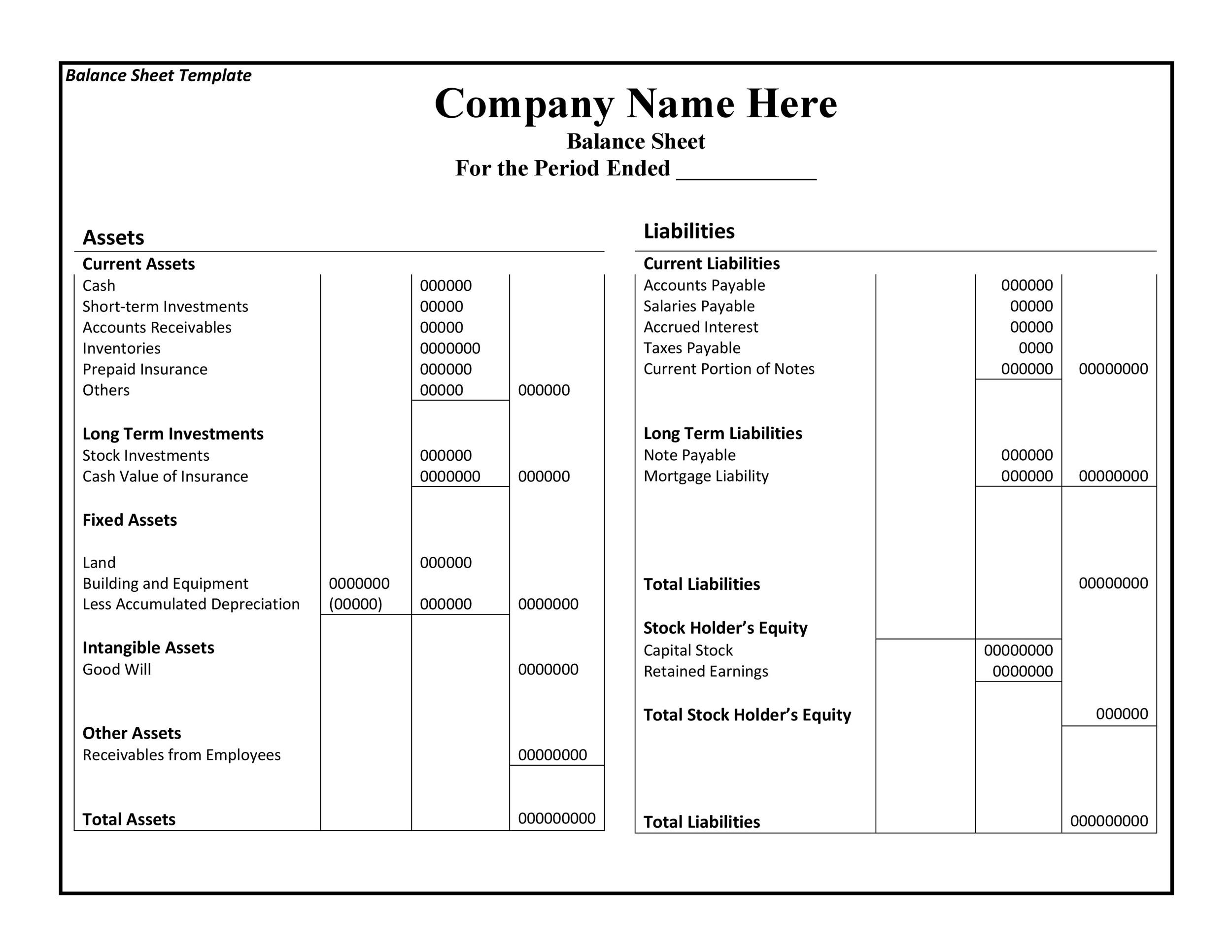

Balance sheet a term which refers to a list of assets, investments and liabilities held by an insurance company. Fwd group holdings limited, an asian insurance company, is considering selling shares among other options after delaying a planned initial public offering (ipo),. Ifrs 17 requires a company that issues insurance contracts to report them on the balance sheet as the total of:

Nevertheless, the general balance sheet structure is similar, because banks have sought to diversify themselves at both the asset and liability sides of the balance. The transaction represented an aggregate. Insurance revenue and insurance service result 56 2.4.2.

The balance sheet shows the assets, liabilities,. The following line items are relevant in the context of.