Awe-Inspiring Examples Of Info About Balance Sheet Reconciliation Checklist

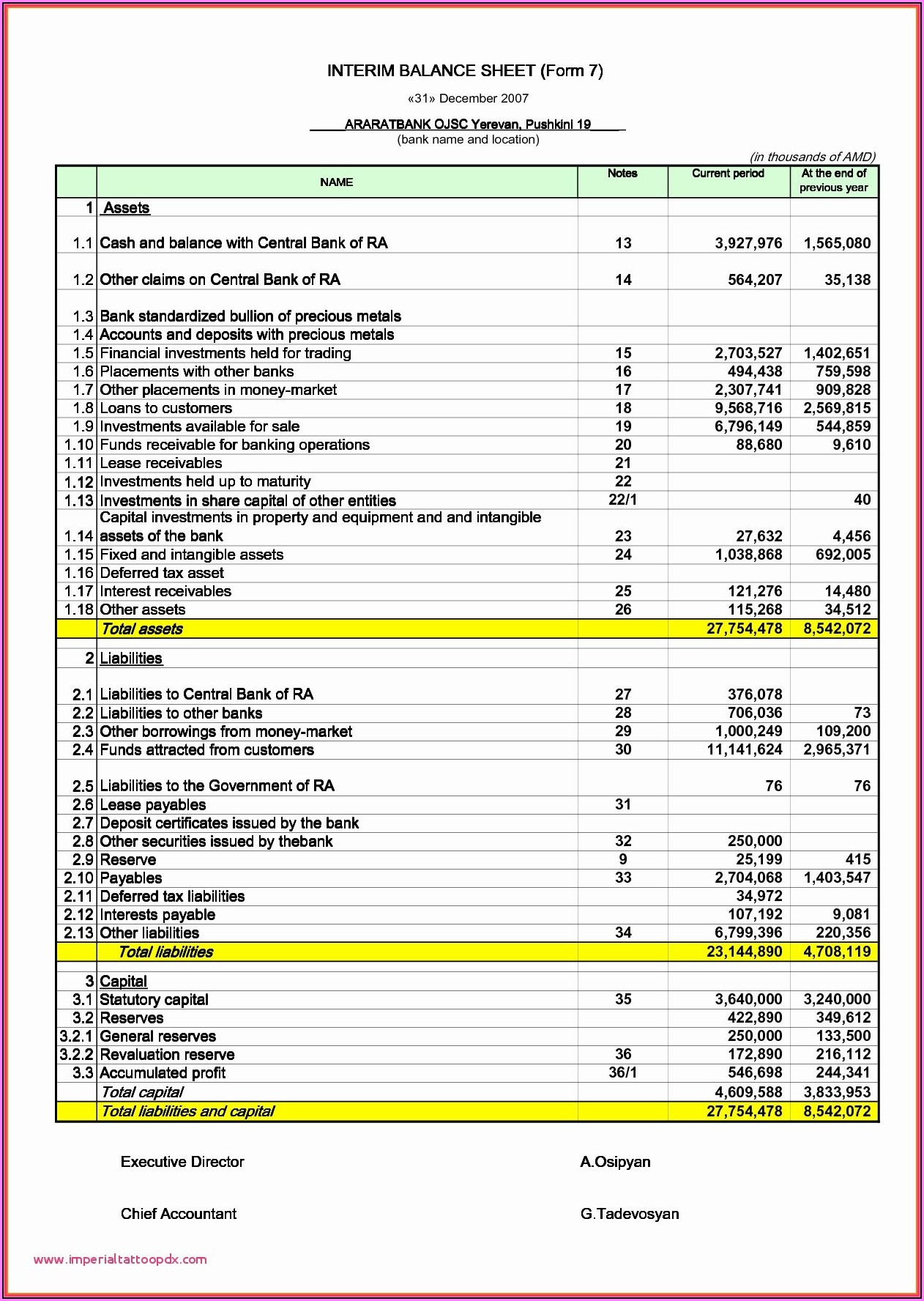

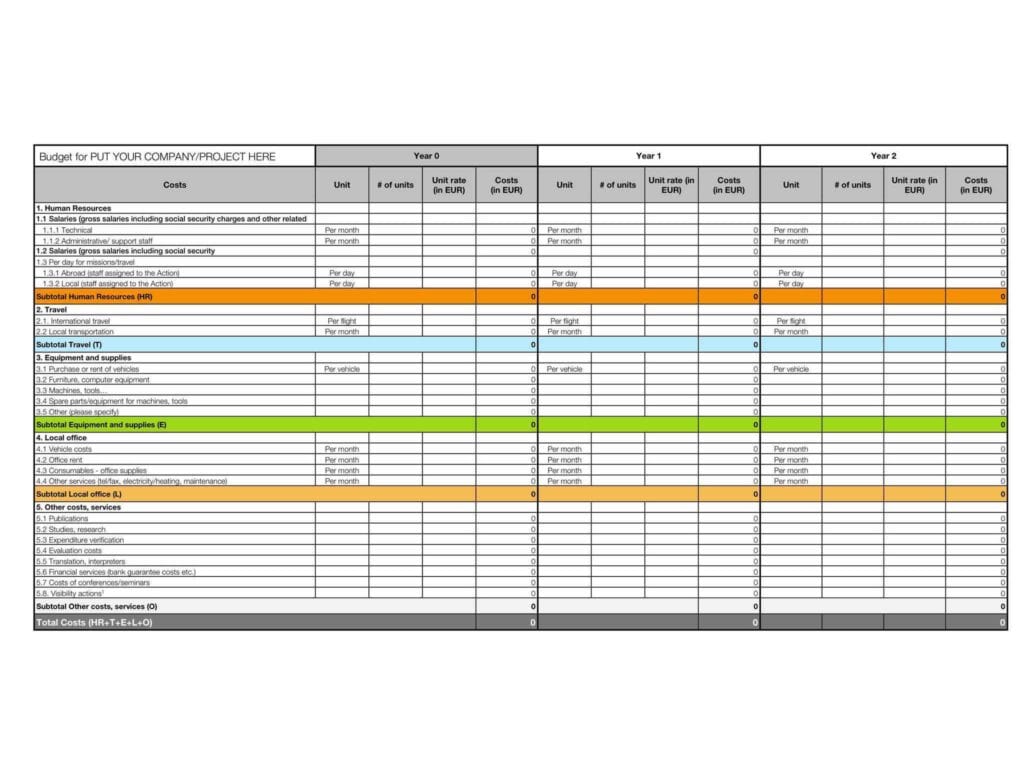

All of the tasks that go into the financial close—completing checklists, balance sheet reconciliations, submitting journal entries, ticking and tying unmatched transactions, doing flux analysis against prior periods—make the traditional, manual methods of accounting unsustainable.

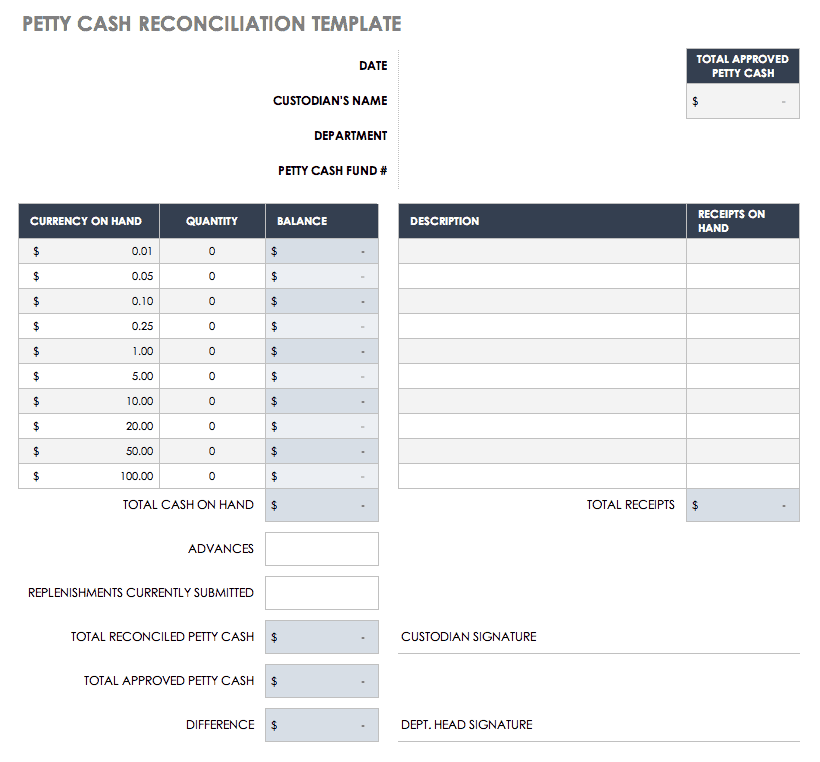

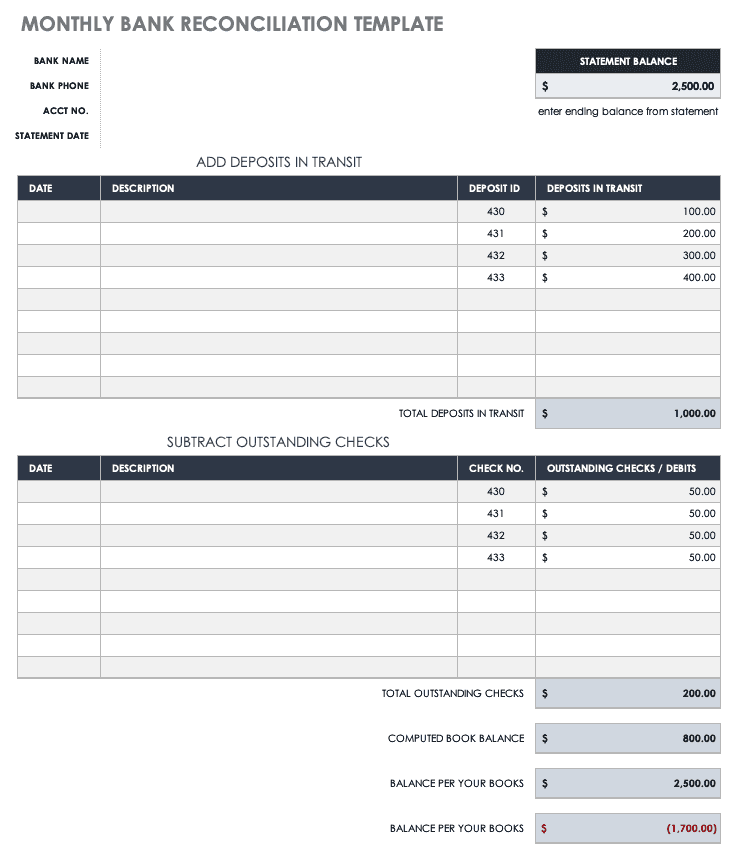

Balance sheet reconciliation checklist. How to overcome challenges of balance sheet reconciliation? Step 1 set up the reconciliation spreadsheet step 2 gather documentation to support the balance sheet account balance step 3 reconcile supporting documentation with the balance sheet account balance step 4 resolve current and prior period reconciling items step 5 resolve current and prior period reconciling items. The amount has to be tallied with the closing cash balance in the bank.

How accounting technology helps balance sheet reconciliations? Gather necessary information know the balance sheet's basic accounting equation building the statement: What are the challenges of financial close?

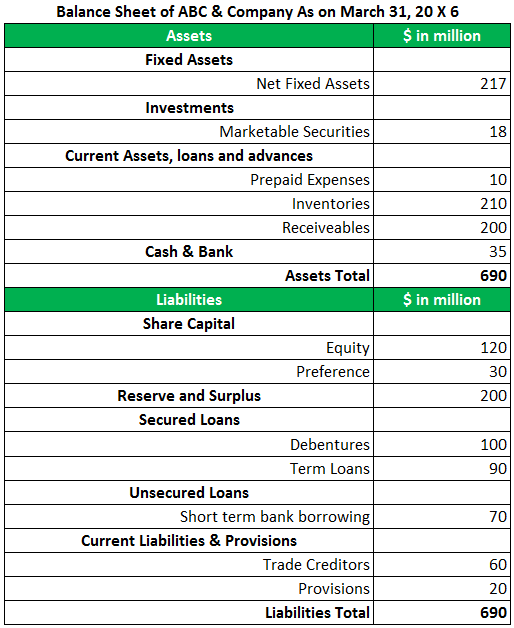

It ensures that all accounts are correctly identified and classified, transactions match supporting documents, accruals are accurate, and intercompany transactions are reconciled. This is done by businesses to ensure that the company closing balances are classified and recorded properly in a. Download 41.84 kb 15004 downloads.

Balance sheet reconciliation is the process of checking that closing balances on external statements match that of the general ledger entries and accounts. Challenges associated with balance sheet reconciliation A balance sheet reconciliation checklist is a concise tool used to verify the accuracy of a company’s balance sheet.

Balance sheet reconciliation is of utmost importance because it ensures the accuracy of financial statements. What are the types of balance sheet reconciliations? You’ll also need to gather:

Read more for a respectiv. What is included in a balance sheet reconciliation checklist? Balance sheet reconciliations are performed monthly to ensure transactions are timely and accurately reported.

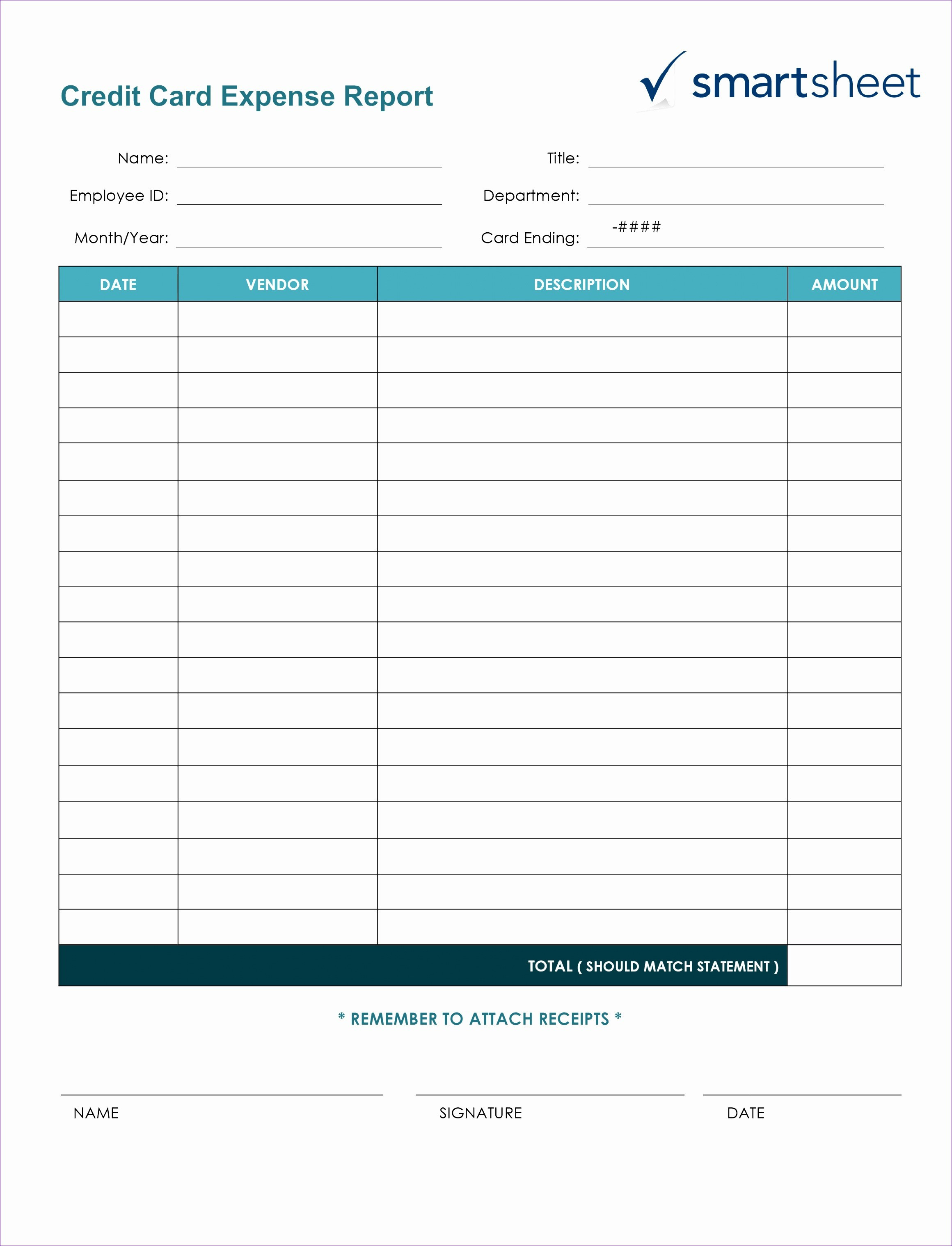

The profit and loss for the fiscal year and the balance sheet as of the last day of the year. Compare and reconcile accounts payable compare accounts payable figures on the balance sheet to those reported in the general ledger and investigate any discrepancies. If checklists are good enough for pilots, astronauts, and surgeons, they’re good enough for the office of the cfo.

Oct 16, 2023 michael whitmire total assets = total liabilities + total equity. Why use balance sheet reconciliations? Account reconciliation is the process of matching internal accounting records to ensure they line up.

The reconciliation process requires a review of the general ledger with external documentation and supporting information to verify that the general ledger’s balance is correct. Turning your reconciliation process into a checklist can help prevent potential errors and streamline the entire effort. You may be wondering what items you need in your balance sheet reconciliation checklist and here they are:

Balance sheet) at a given point in time. What are common pitfalls of balance sheet reconciliation? Several years ago we created a bank reconciliation template, which has been the most downloaded template since we’ve been tracking downloads.