Unbelievable Info About Cash Flow Statement Period Of Time

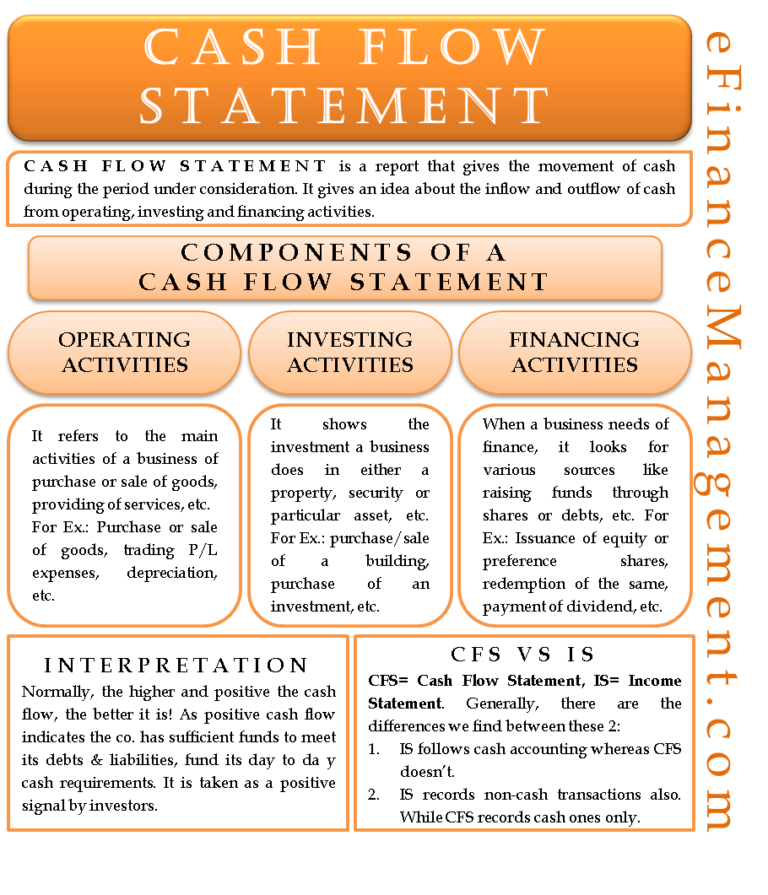

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

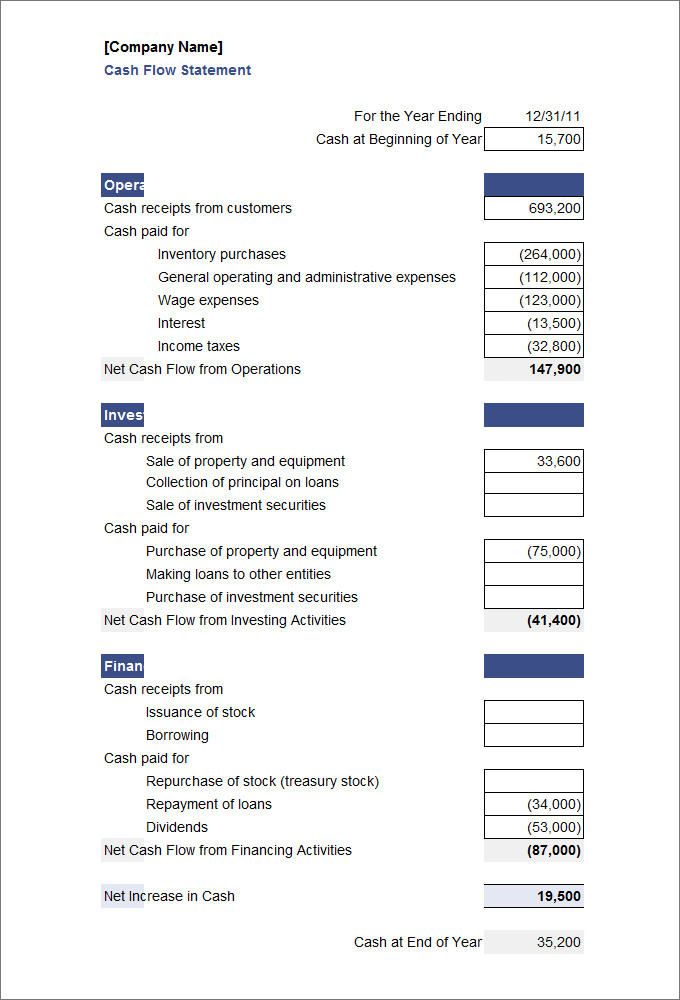

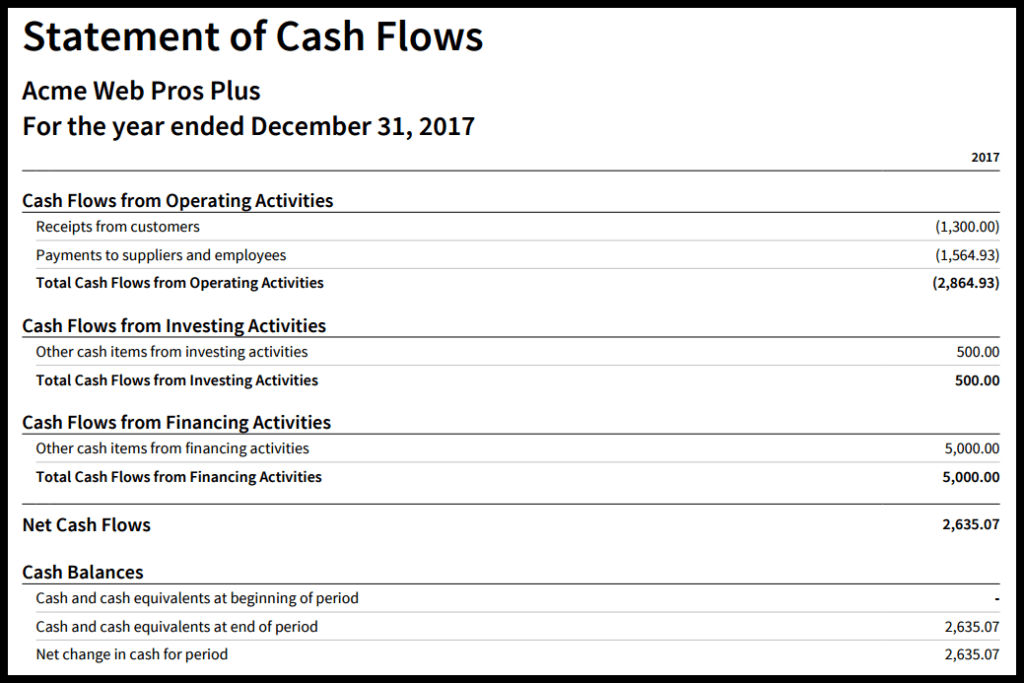

Cash flow statement period of time. It also includes all cash outflows that pay for business activities and investments during a given period. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time.

Remember that all money is assumed to be deposited in your investment at the beginning of each year. Cash receipts and cash payments are summarized and categorized as operating, investing, or financing activities. A cash flow statement is a crucial financial document that details all your sources of cash over a given period of time.

A cash flow statement lets you see at a glance how cash moves through a business. What time period your cash flow statement covers is entirely up to you. Therefore, cash flow statement is a report that shows the company’s movement of cash over a period of time.

It tells you how cash moves in and out of a company's accounts via three main channels: Your cash flow statement is one of your business’s most important financial statements. What goes into the preparation of a cash flow statement?

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. These cash can be physical cash that we can touch, like dollar bills and coins. A cash flow statement documents in detail all company income and debt over a specific period of time.

A cash flow statement shows the exact amount of a company's cash inflows and outflows over a period of time. A cash flow statement, also known as a statement of cash flows, is a financial statement that tells you how cash and cash equivalents entered into your business and how you spent them over a period of time. As noted in previous chapters, when solving a problem involving the time value of money, a timeline and/or table is helpful.

It also breaks down where you've spent that money so you can see if your business is making more money than it spends. The cfs measures how well a. Cash flow statements are financial accounting statements that provide a detailed picture of the movement of money through a company — both what comes in and what goes out — during a certain.

Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. If it does, then the company is considered to have a “positive” cash flow. The cash flows described above are shown in table 9.1.

A cash flow statement is essentially a snapshot of a business’s cash flow during a set time frame. The amounts on the scf provide the reasons for the change in a company's cash and cash equivalents during the period covered. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

Simply put, it reports the cash inflows and cash outflows within your business during a time period, whether that’s over a week, a quarter, or a financial year. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The cumulative cash flows do not yet consider interest.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)