Out Of This World Info About Cash Flow Statement Reporting

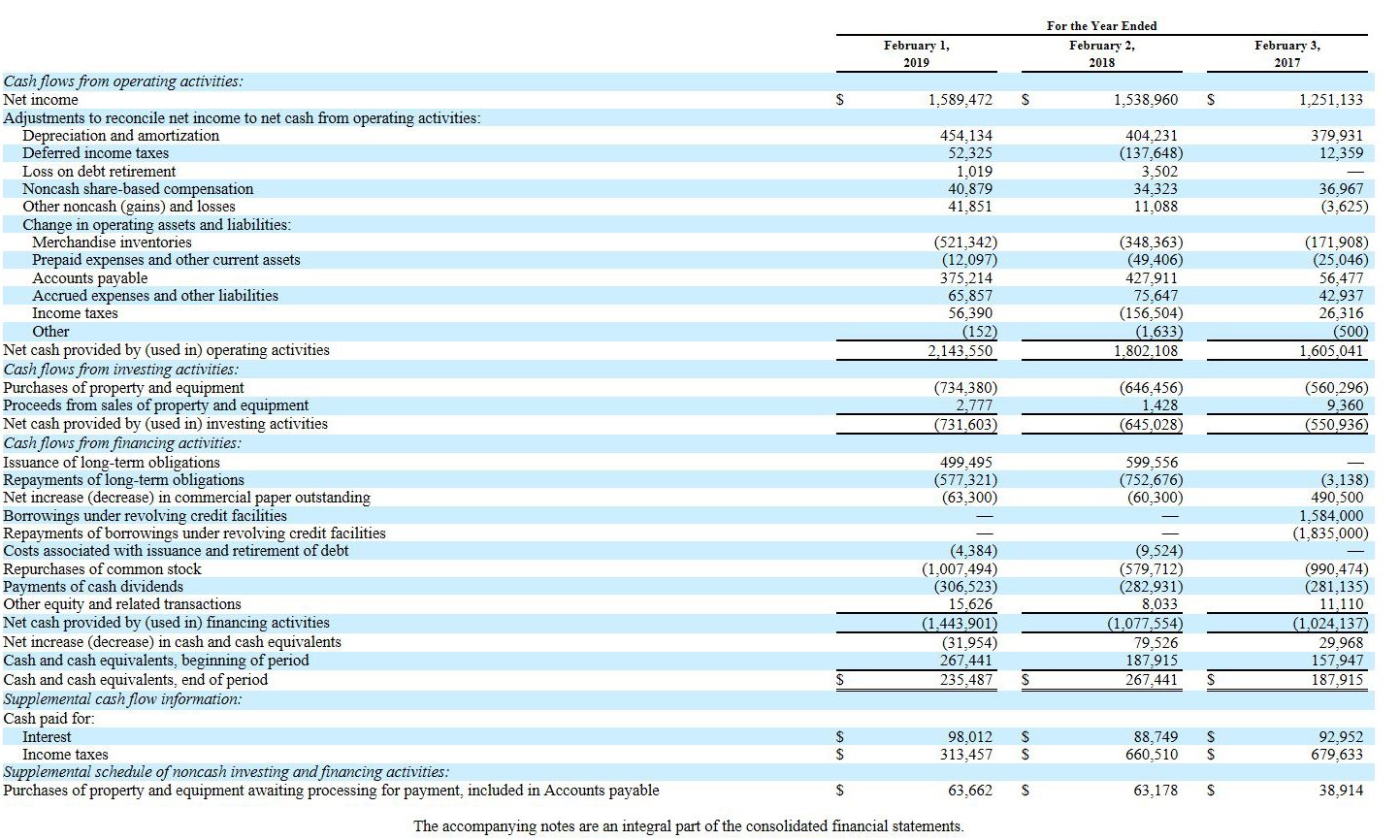

Reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency cash flows interest and dividends taxes on income 17 18 21 22 25

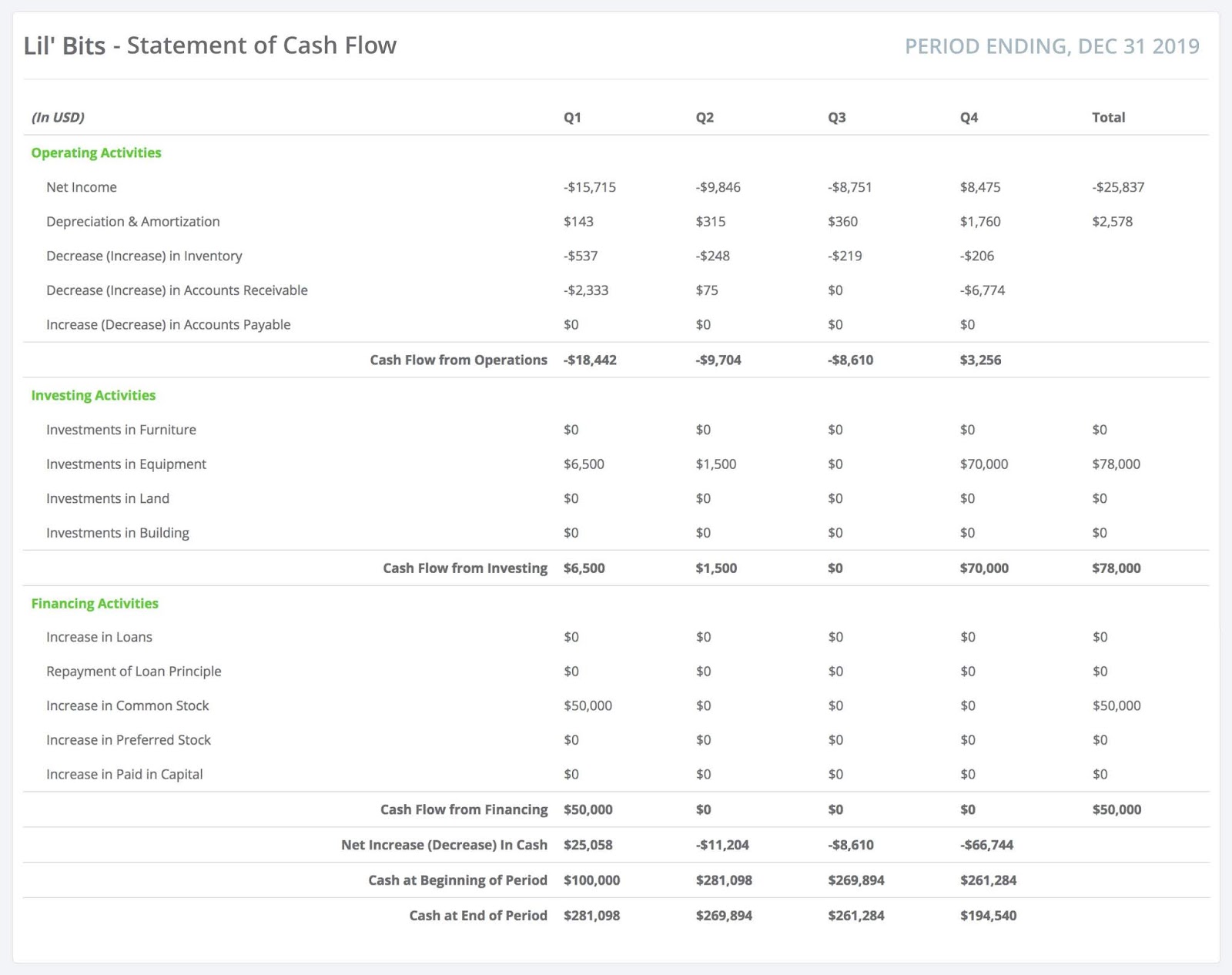

Cash flow statement reporting. It also shows you the net increase or decrease in cash, and explains the causes for the changes in the cash balance. It is an essential document for evaluating the sources and uses of cash for an organization. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period.

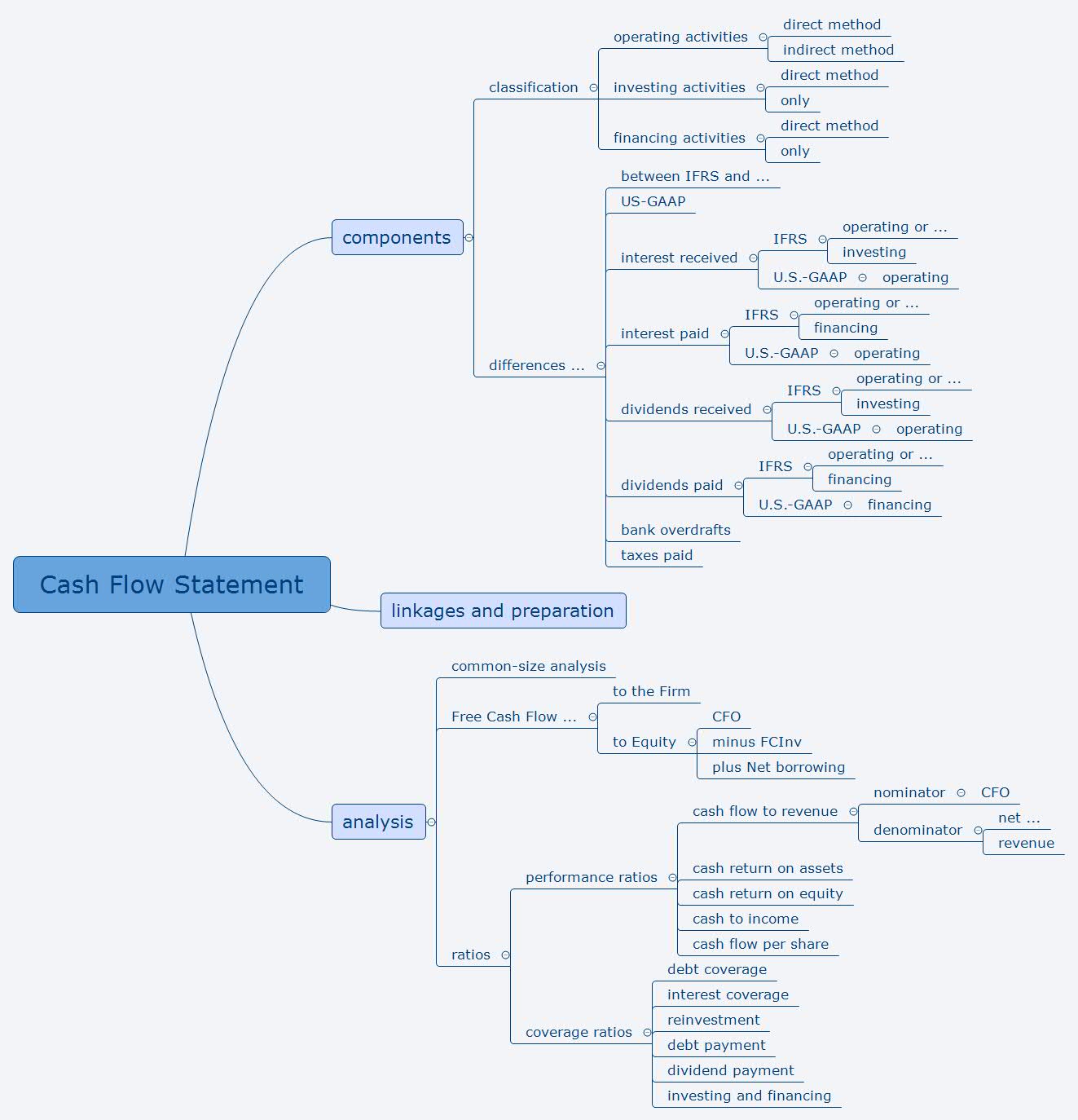

Income from operations of $652 million; A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally.

The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. The income statement, balance sheet, and statement of cash flows are required financial statements. With regards to the recent short seller report and further to the statement made by the board in the press release on 15 february 2024, we reiterate our position.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). It helps to figure out the funds available to the company.

The cash flow statement is required for a complete set of financial statements. Full year revenue up 26% and free cash flow margin achieves 13%.

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. It is often prepared using the indirect method of accounting to calculate net cash flows. What is a statement of cash flows?

In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

Simply put, it reports the cash inflows and cash outflows within your business during a time period, whether that’s over a week, a quarter, or a financial year. The cash flow statement recognises three major.

A cash flow statement is one of the three basic financial reports —the other two being the balance sheet and income statement (or profit and loss statement). We will use these names interchangeably throughout our explanation, practice quiz, and other materials. What is a cash flow statement?