Spectacular Tips About Company Financial Ratios

Earnings per share (eps) earnings per share or eps measures earnings and profitability.

Company financial ratios. These ratios are used by financial analysts, equity research analysts, investors, and. Financial analysts use financial ratios to compare the strengths and weaknesses in various companies. Different financial ratios indicate the company’s results, financial risks, and working efficiency,.

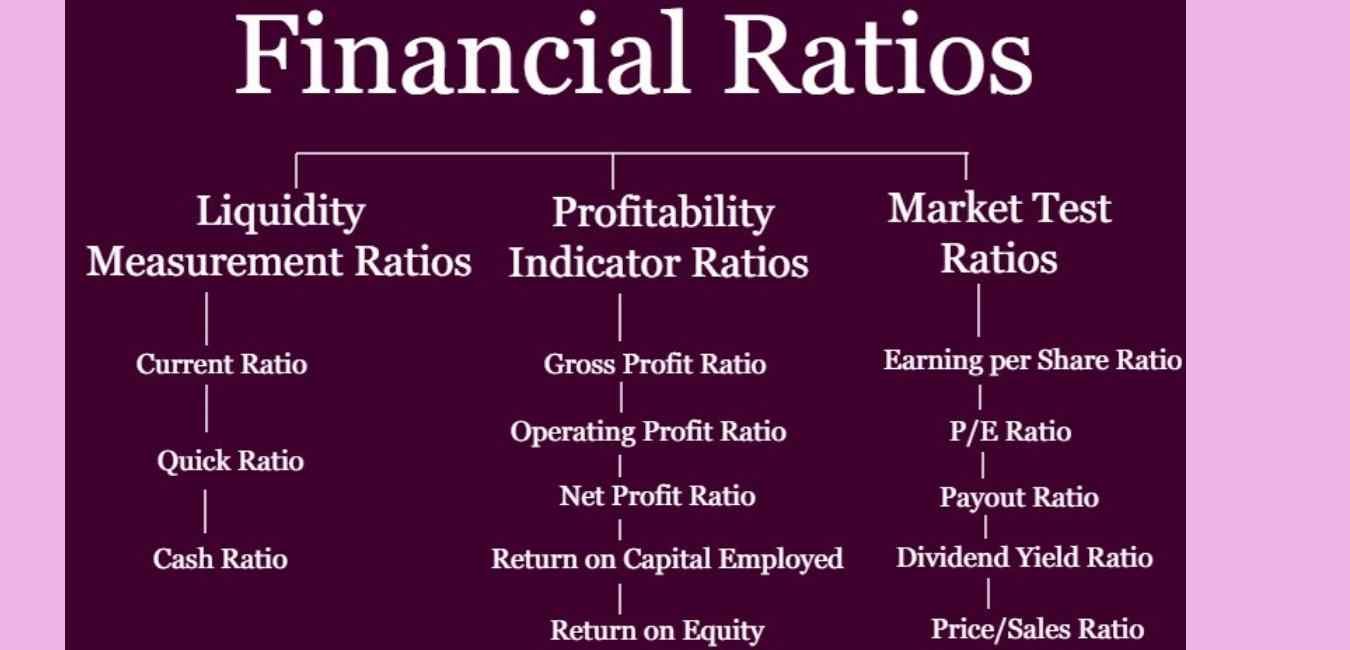

If shares in a company are traded in a financial market, the market. In other words, leverage financial ratios are used to evaluate a company’s debt levels. Common types include:

Examples include such often referred to. Guide to financial ratios investing Liquidity ratios, operational risk ratios,.

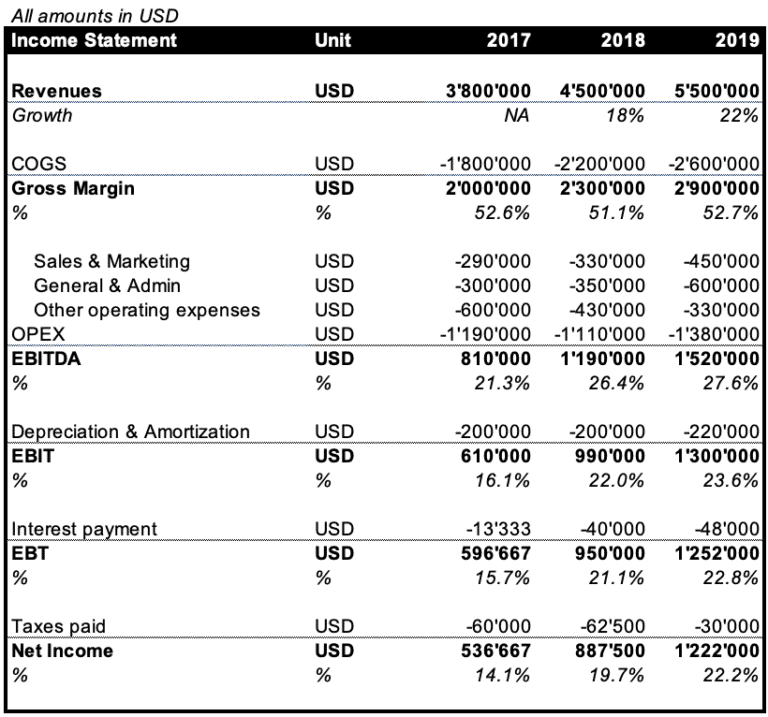

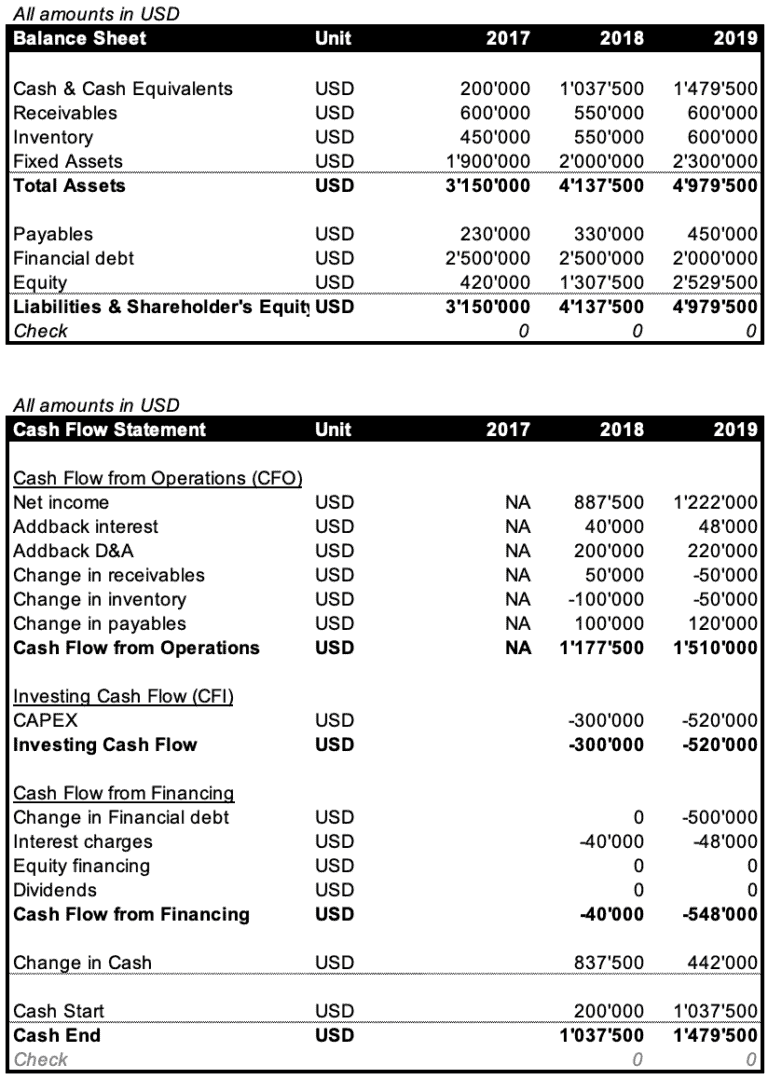

Ebitda, pat, roe, and roce offer a comprehensive view of profitability. Corporate finance ratios are quantitative measures that are used to assess businesses. Understanding an analysis of a company's.

Corporate finance ratios can be broken down into four categories that measure different types of financial metrics for a business: Purpose this research is aimed at analyzing in this paper is financial performance by using financial ratios at pt. A market snapshot appears at the top of the page.

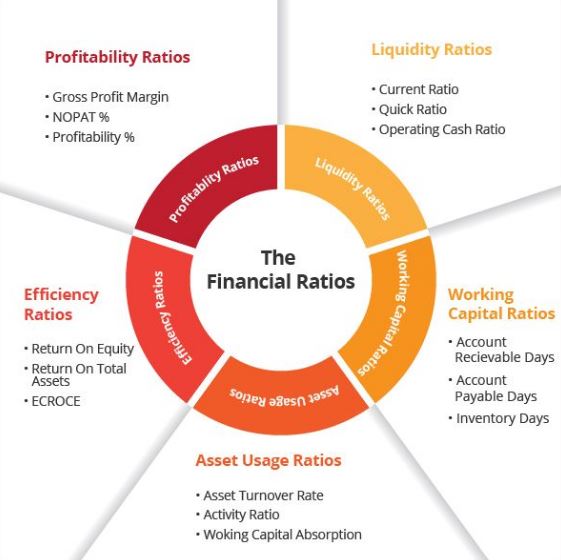

These ratios measure how profitable a company is. Financial ratios are the indicators of the financial performance of companies. Profitability ratios (e.g., net profit margin and return on shareholders' equity) liquidity ratios (e.g., working capital).

Common leverage ratios include the following: In addition to being a benchmark in assessing the performance of a company or business, financial ratios, also known as financial ratios, are often used. This includes ratios such as current ratio and quick ratio.

Financial ratios are relationships determined from a company's financial information and used for comparison purposes. Some examples are gross margin,. The debt ratiomeasures the relative amount of a company’s assets that are provided from debt:

Leverage ratiosmeasure the amount of capital that comes from debt. This metric can tell you how likely a company is to generate profits for. There are five basic types of financial ratios :

Energy and agriculture investors can find a quick view of the markets at bloomberg.com/markets.