Wonderful Info About Prepaid Expenses In Cash Flow Statement

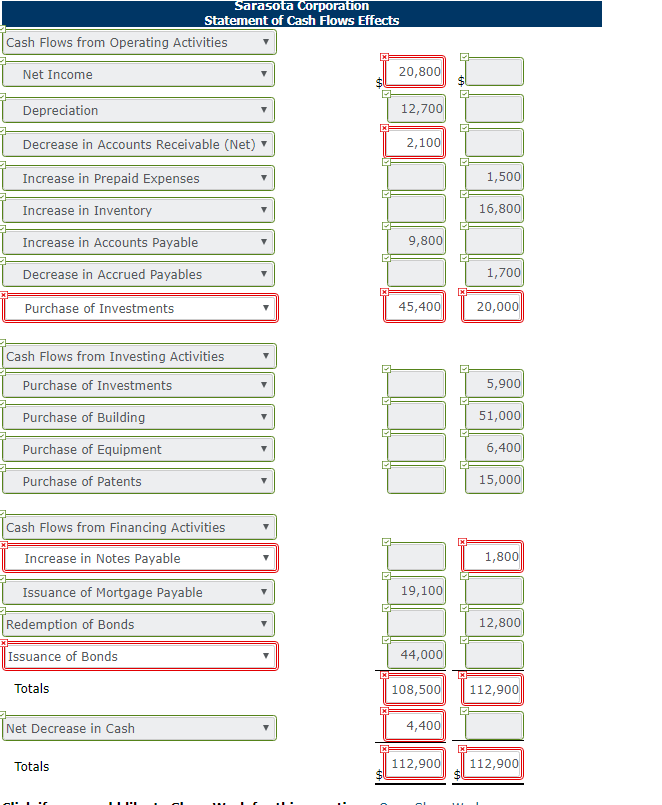

Additionally, we have $52,600 net income on the income statement and a $4,800.

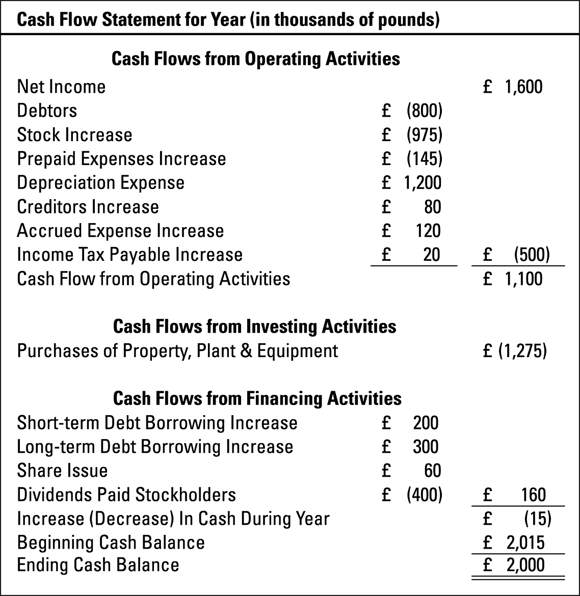

Prepaid expenses in cash flow statement. Begin with net income from the income. Introduction prepaid expenses is a financial maneuver that allows businesses to navigate their financial obligations with finesse. Prepaid expenses refer to expenses that a business pays in advance before they are actually incurred.

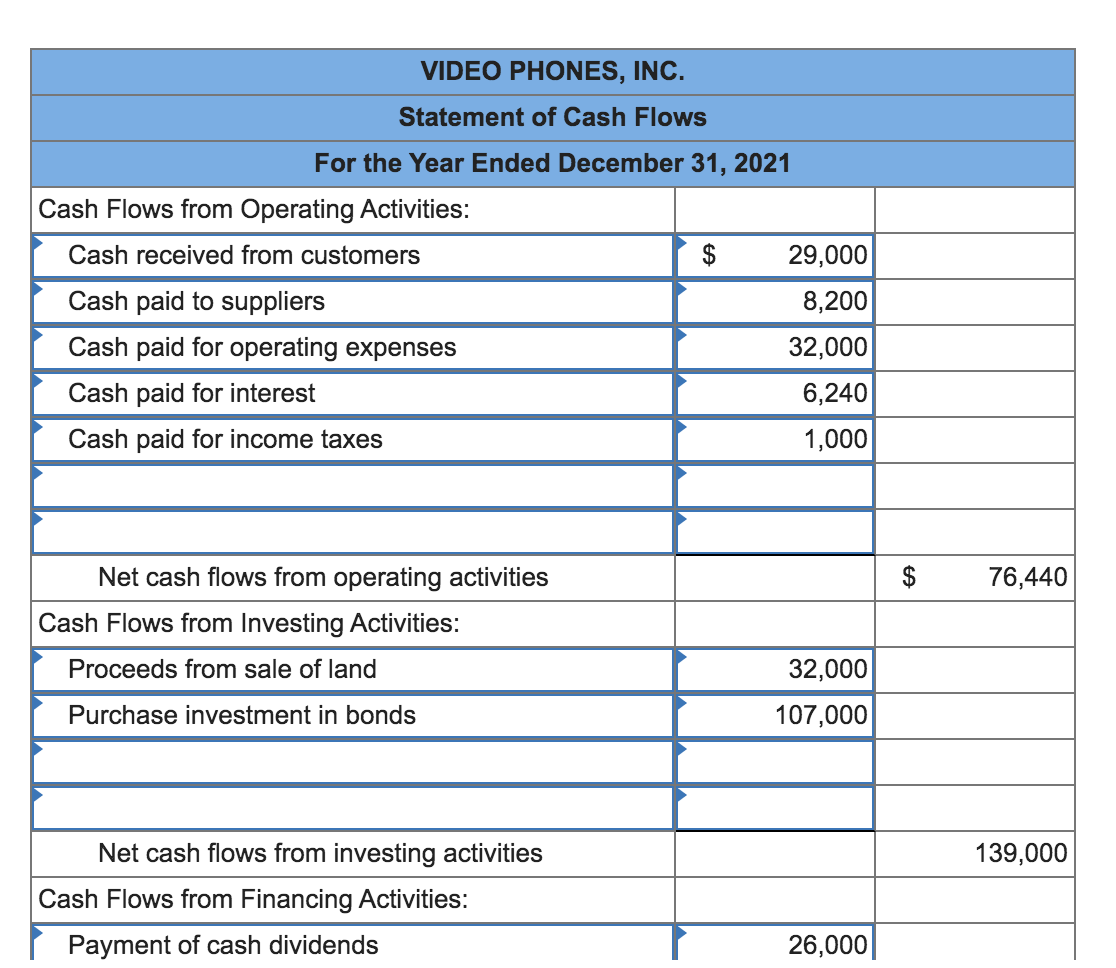

In this guide, we'll cover what. Accuracy of reporting: Effect of prepaid expenses on financial statements.

Yes, prepaid expenses are considered as cash outflows because they involve the payment of cash in advance. Prepaid expenses = prepaid expenses % of opex × operating expenses however, if the connection between upfront payments and operating expenses (sg&a). Prepaid expenses are listed as an asset in.

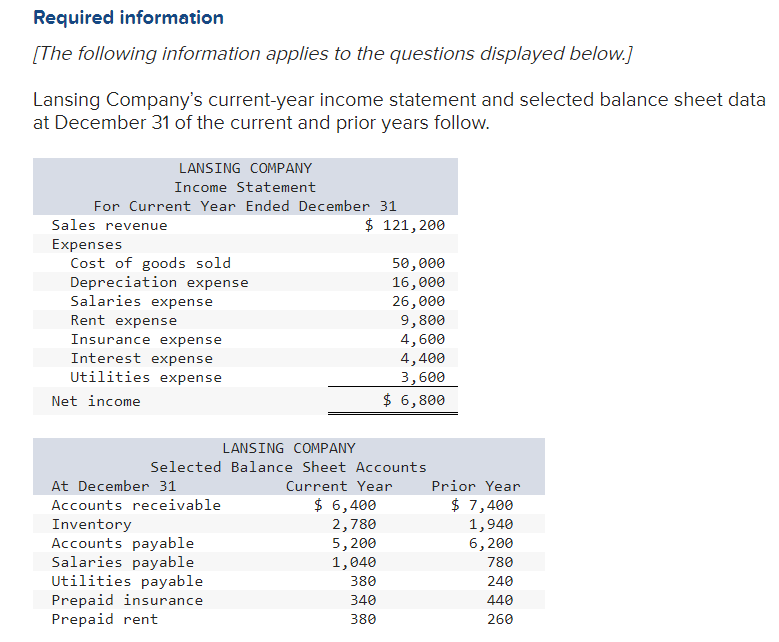

Prepaid expenses are payments made in advance for a product or service to be used at a later date. How do prepaid expenses impact financial statements? Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

Cash basis presentation on the. Their primary purpose is to allocate. For example, refer to the.

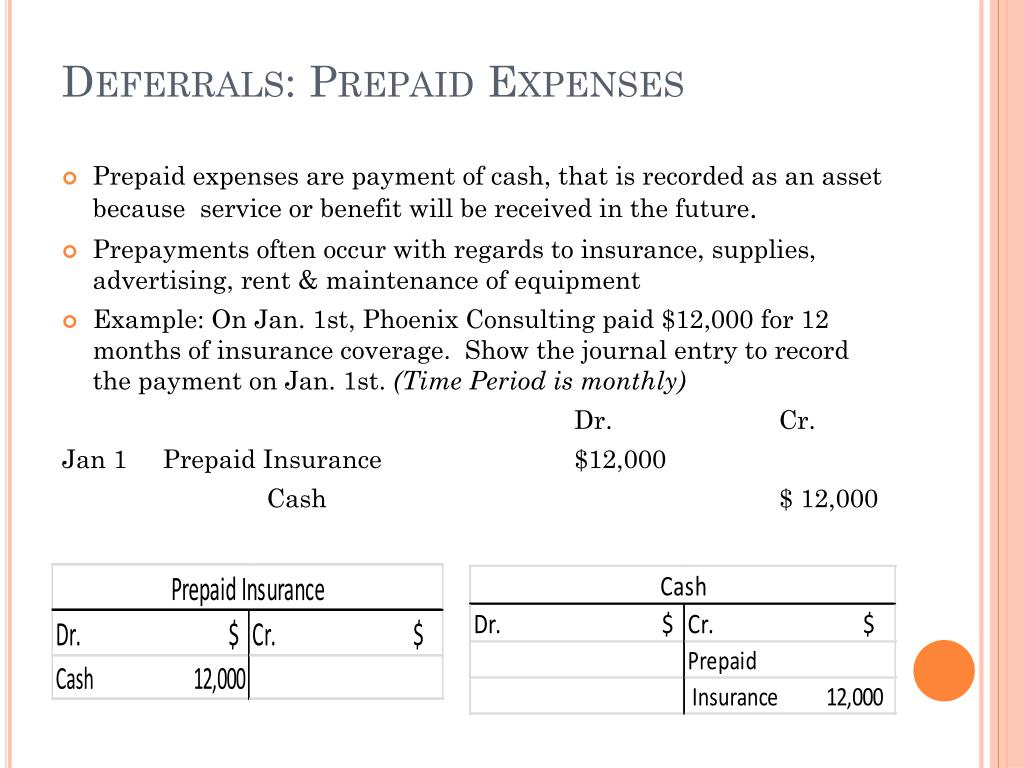

Prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future. The transaction will reduce the prepaid rent balance on the balance sheet and increase expenses on the income statement. Prepaid rents become a part of the cash flow statement when paid.

How to record change in prepaid expenses statement of cash flows accounting instruction, help, & how to 82.6k subscribers join subscribe subscribed 31 6k views 5 years. And as a result, we have a $5,300 increase in prepaid expenses and other changes as in the table below: Accurate portrayal of expenses over time enhances the reliability of financial statements.

Are prepaid expenses considered cash outflows? Prepaid expenses affect financial statements by reducing the reported expenses in the period of payment. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet.

The expense is recorded when the company. The gaap matching principle prevents expenses from being recorded. The initial journal entry for a prepaid expense does not affect a company’s financial statements.

In accounting, you might want to record a prepaid. Prepaid expenses are one way to help manage cash flow more effectively and ensure you're not overspending or leaving money on the table. Cash payments for prepaid assets = + ending prepaid rent, prepaid insurance etc.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)