Best Of The Best Info About The Income And Expense Statement Includes

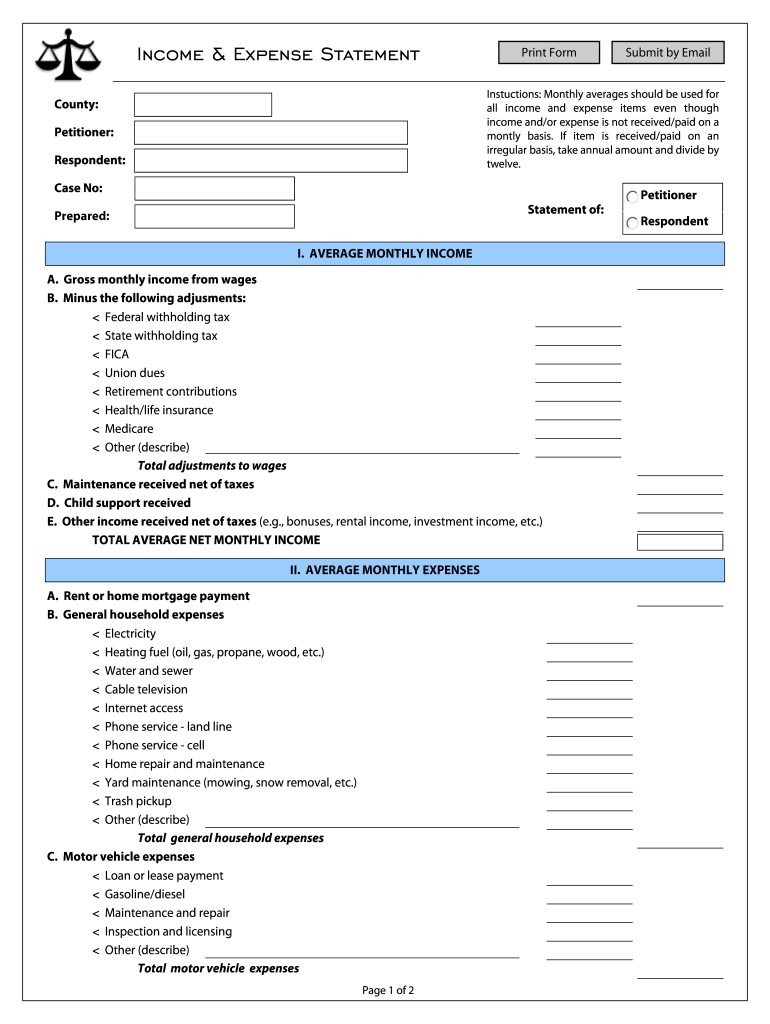

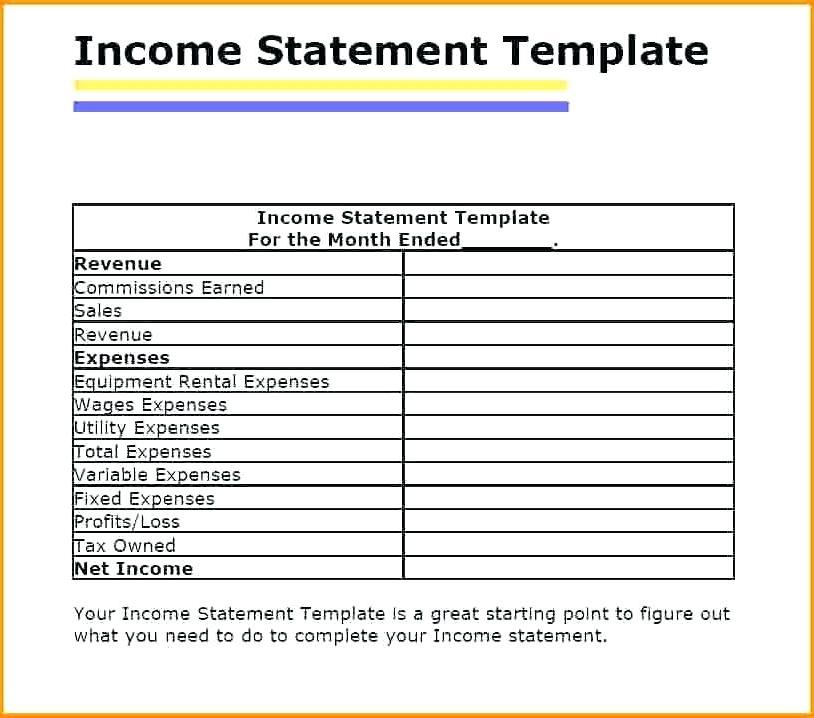

The income statement can either be prepared in report format or account format.

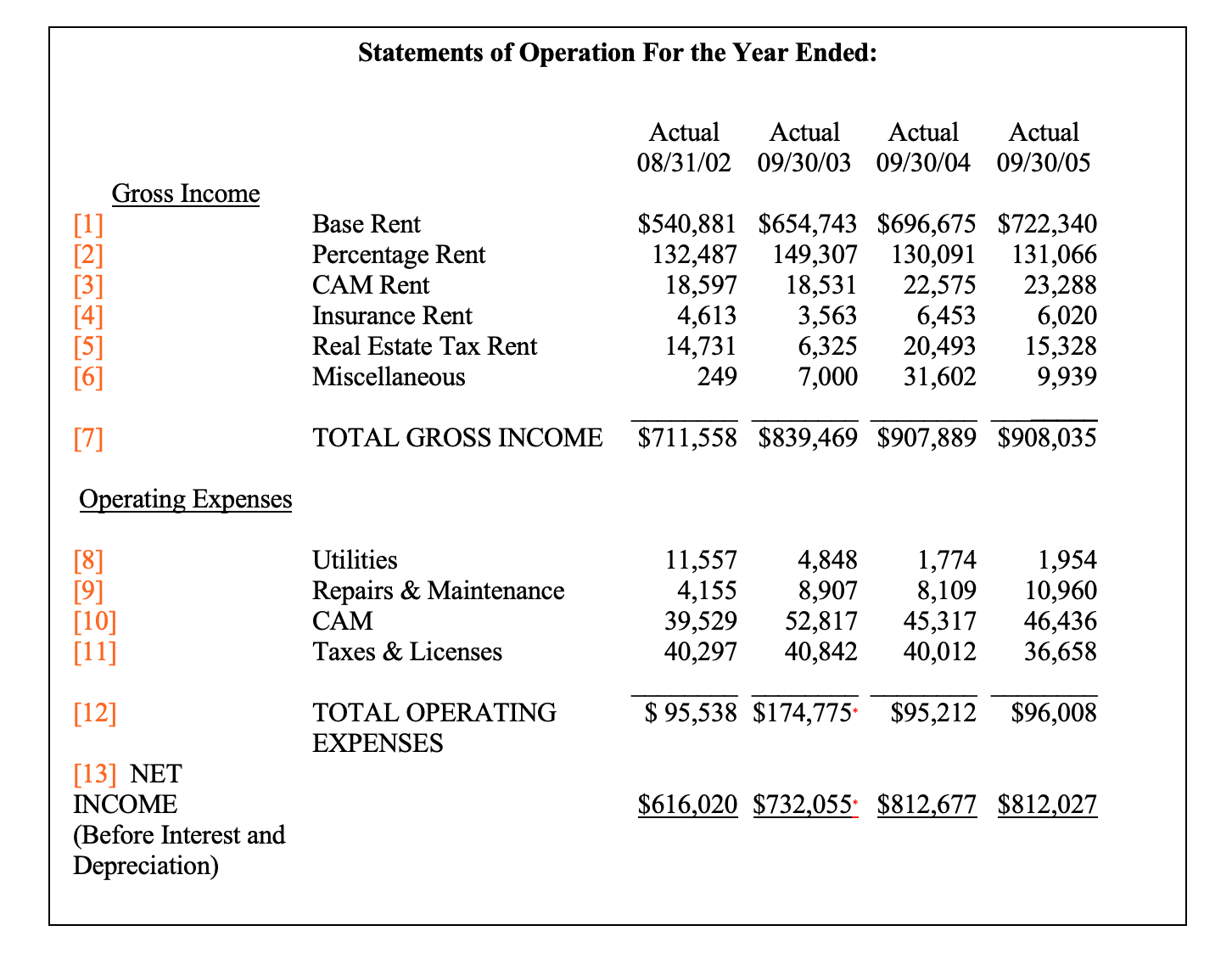

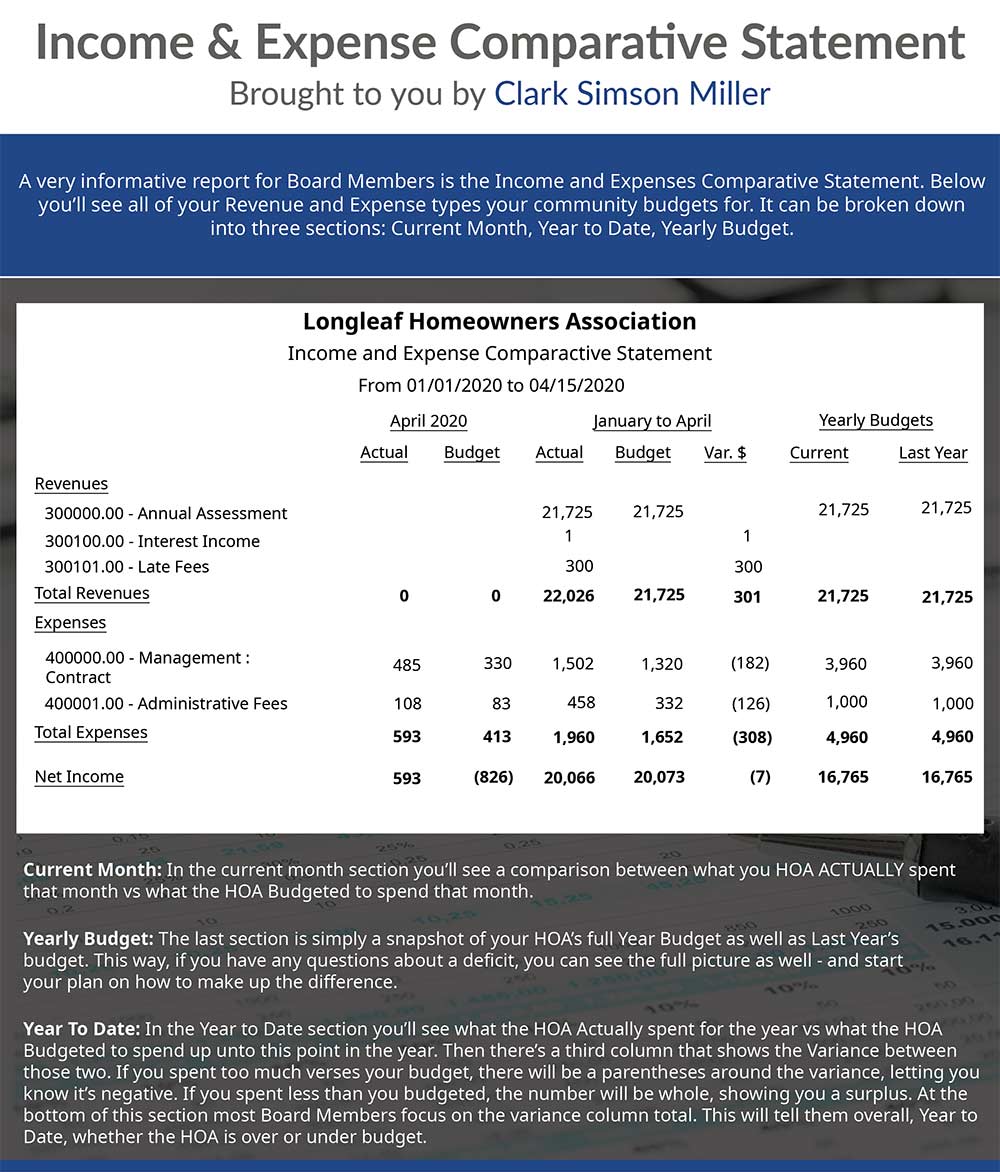

The income and expense statement includes. The income and expense statement (or the ‘financials’) is a summary of the annual net income of a property, broken down into individual sources of income as well as expenses. Below is an example for a. Key points an income statement is another name for a profit and loss statement (p&l).

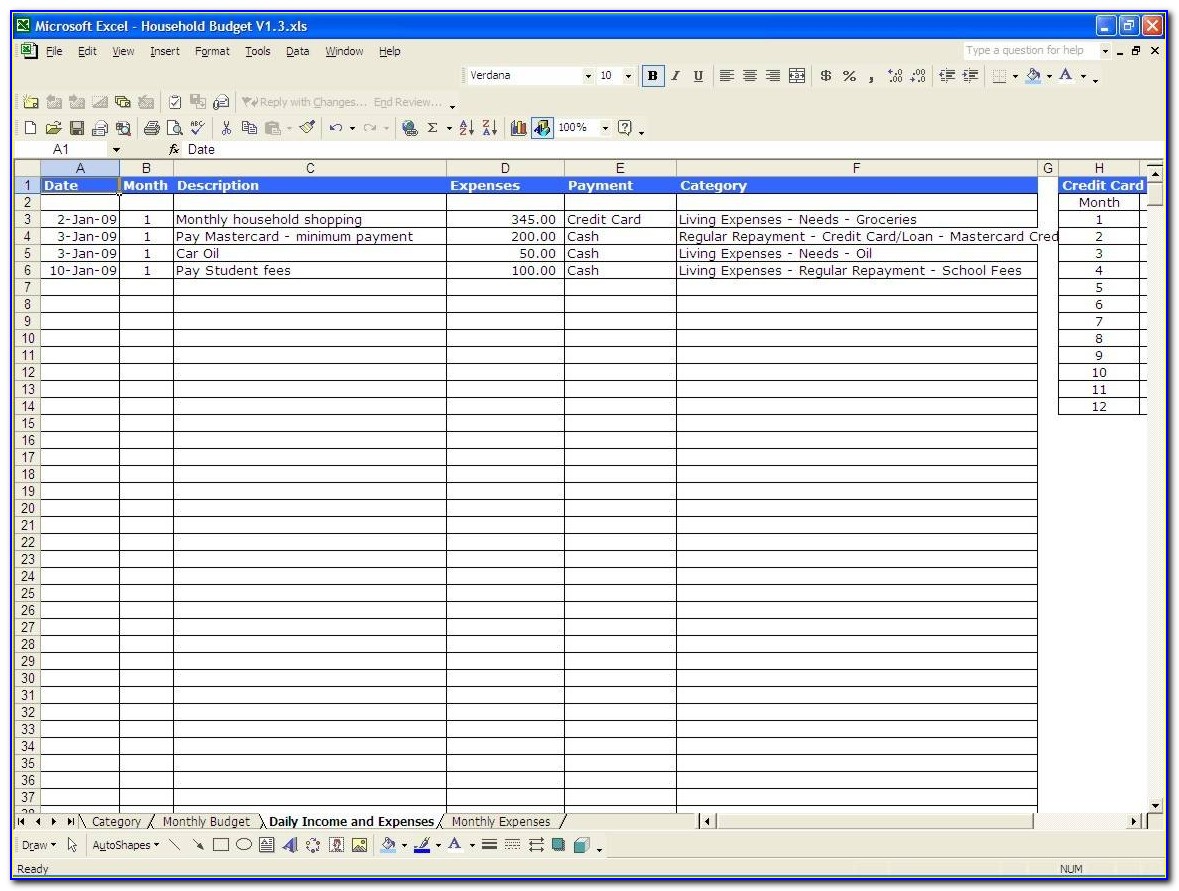

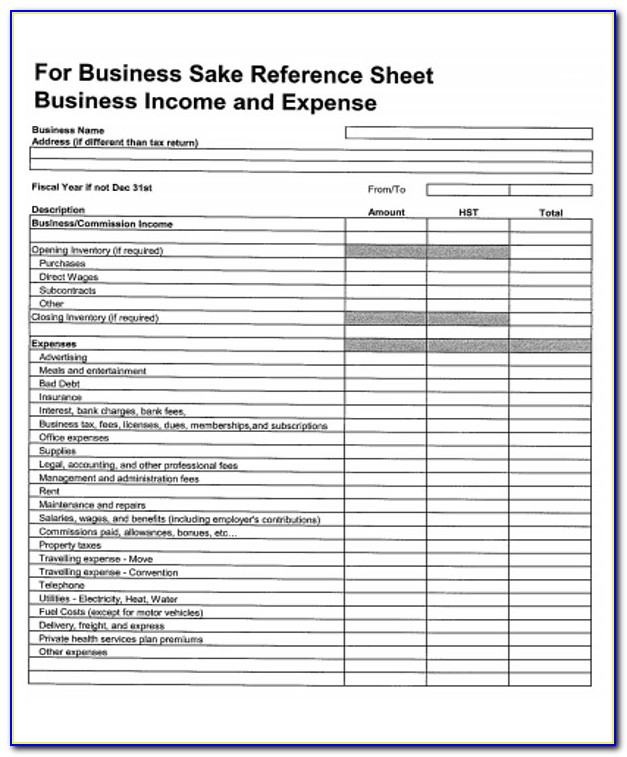

To summarize, the key steps for making an income and expense statement in excel include organizing your data, creating a new worksheet, inputting your income and expenses, and using formulas to calculate totals and analyze. For example, freelancers, travel, website costs and marketing. Income includes both revenue and gains, which is recognised in the statement of profit or loss and other comprehensive income when an increase in future economic benefits related to an increase in an asset or a decrease of a liability has arisen that can be measured reliably.

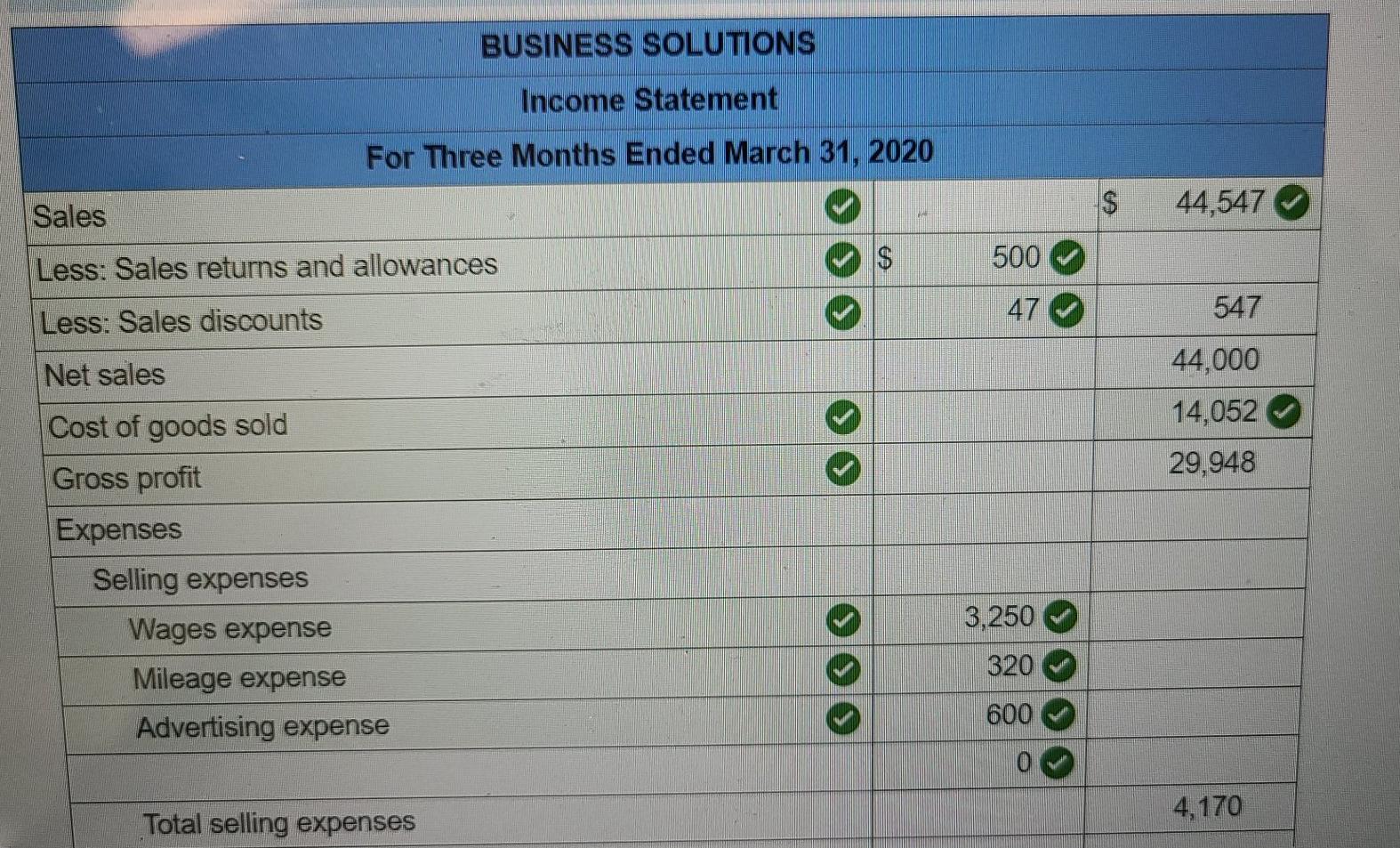

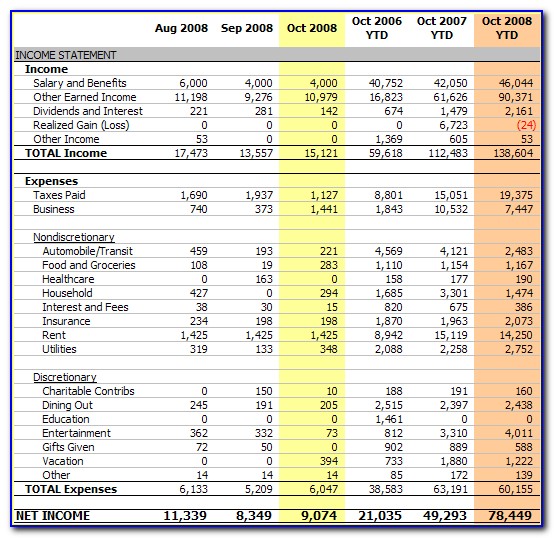

An income statement is a financial statement in which a company reports its income and expenses over a specific period of time, usually a quarter or fiscal year. This is the final line on the income statement and represents the total profit (or loss) earned by the company during the period. The income statement focuses on four key items:

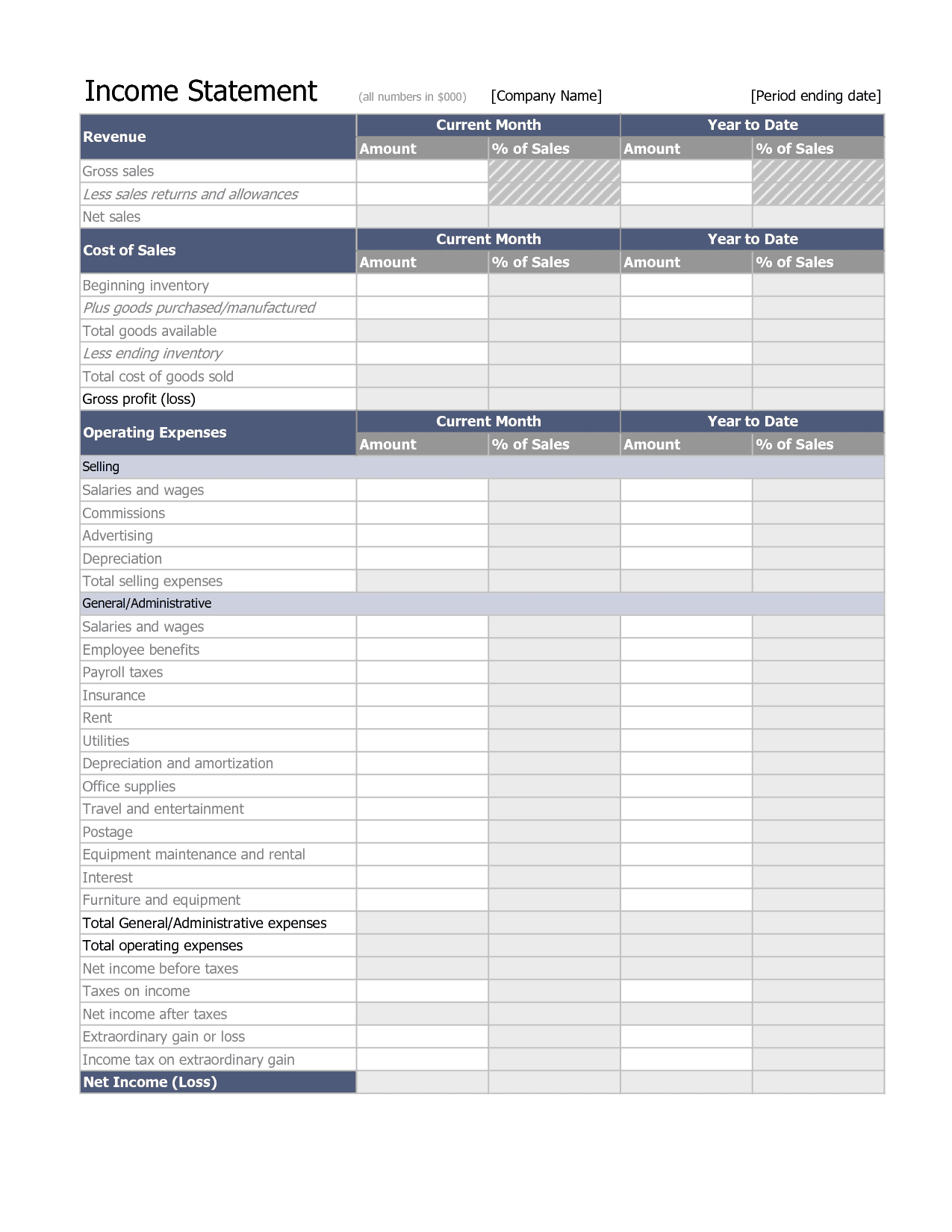

An income statement is a core financial statement that shows you the company’s revenues, costs and expenses, net income or loss, and other comprehensive income (loss) for a period of time used in accounting. This includes any additional income or expenses that are not directly related to the company’s core business activities, such as interest income or expenses. The income statement, along with balance sheet and cash flow statement, helps you understand the financial health of your business.

It is categorised into different line items such as revenue by type, or costs. These may include gains or losses from the sale of assets , foreign exchange gains or losses, or any unusual items outside the normal course of business operations. Net income is the profit that remains after all expenses and costs, such as taxes.

It can be used to analyze. An income statement, which shows your revenue after expenses and losses, tells a story about the performance of your business over a certain time period, such as monthly, quarterly or annually. The income statement includes the company’s revenues and expenses, while the balance sheet shows assets, liabilities, and equity.

The income statement is a useful way to see how a company makes money and how it spends it. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain,. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

What is an income statement? The income statement is used to report expenses and revenue during a specific period of time. An income statement is a financial statement that shows you how profitable your business was over a given reporting period.

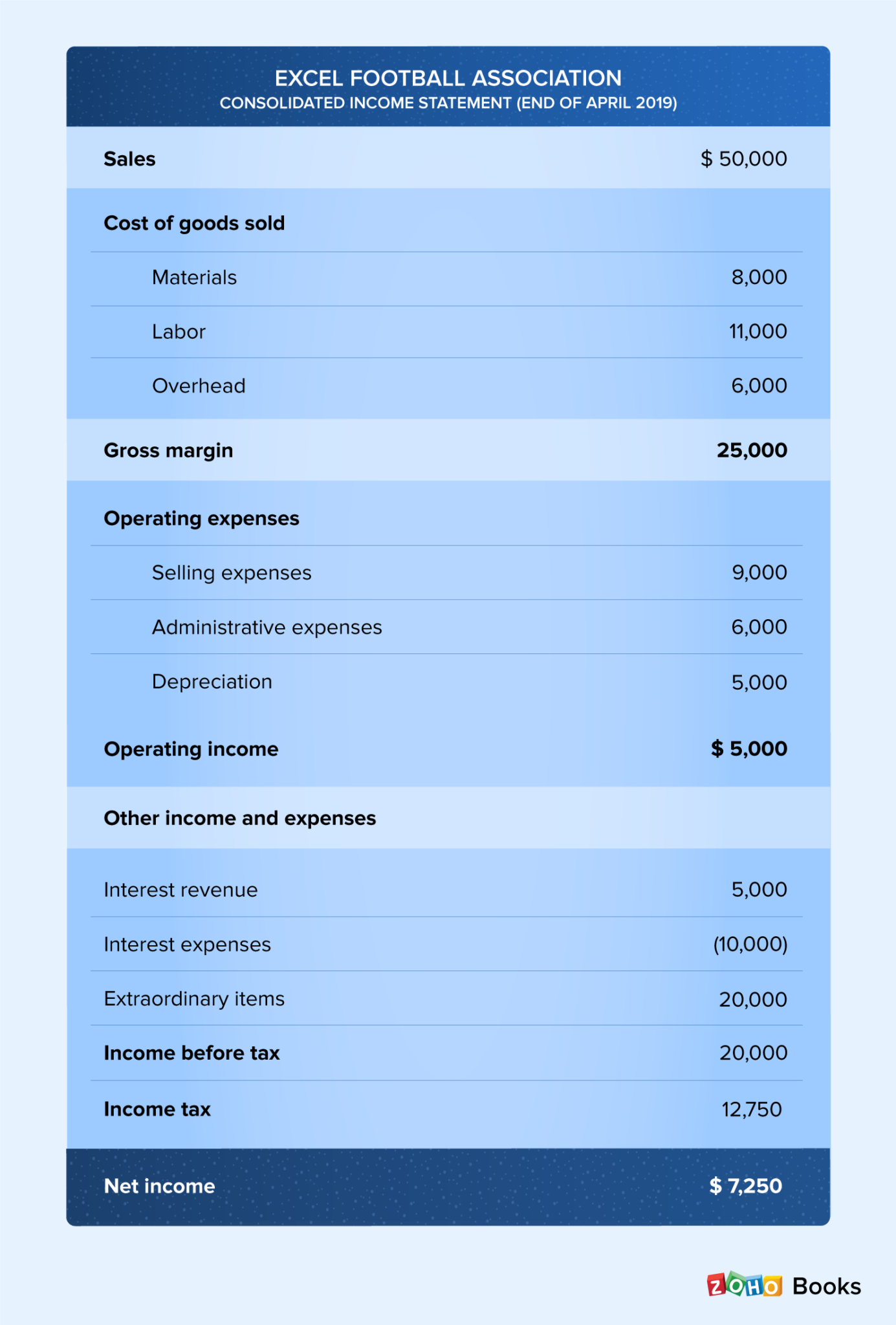

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. But there is a floor. Published september 08, 2020.

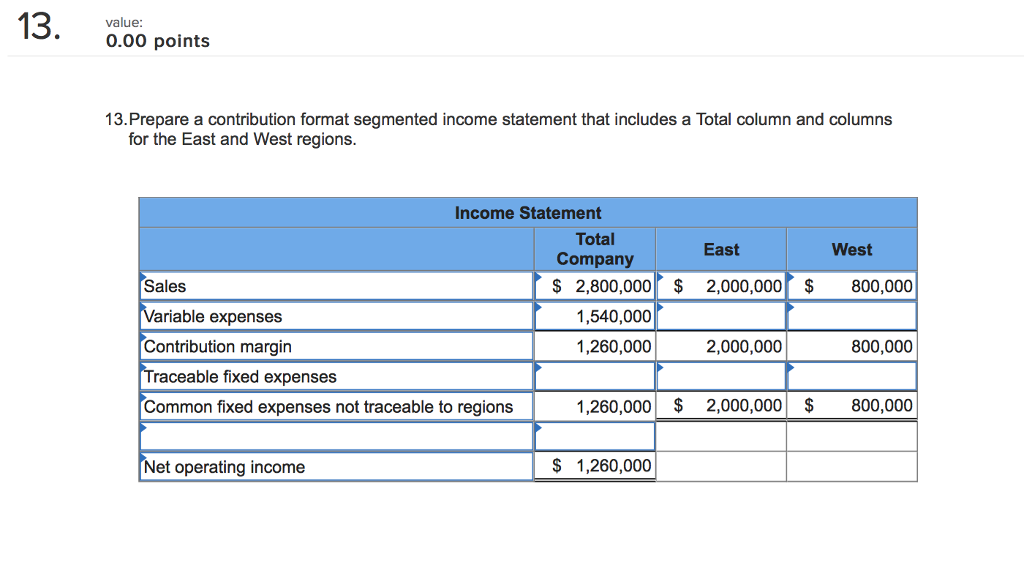

How to read & understand an income statement. Other income and expenses: Example of an income and.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)