Brilliant Strategies Of Info About Cash Flow Projection Model

The cash flow forecast is different from the cash flow projection in one key way:

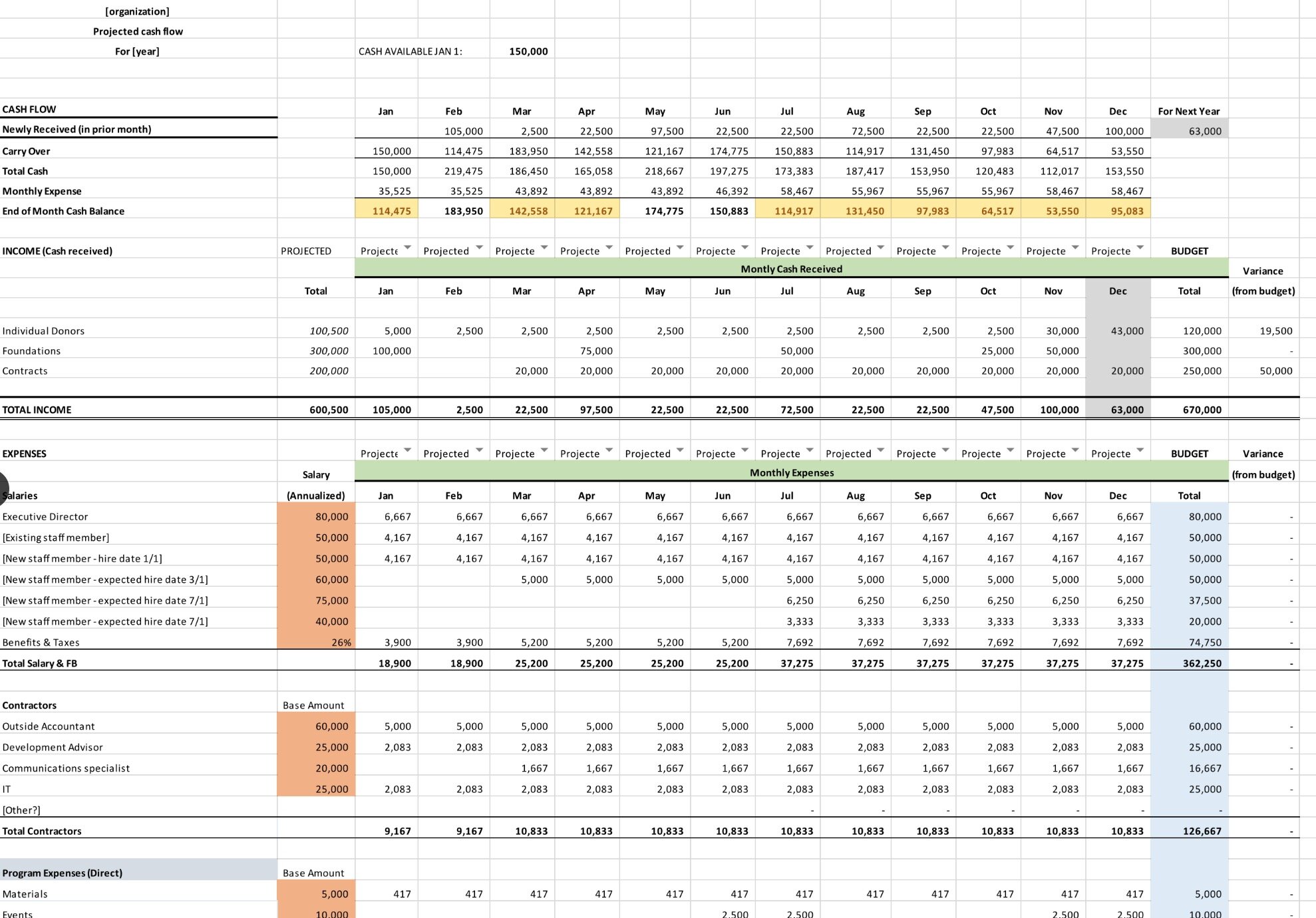

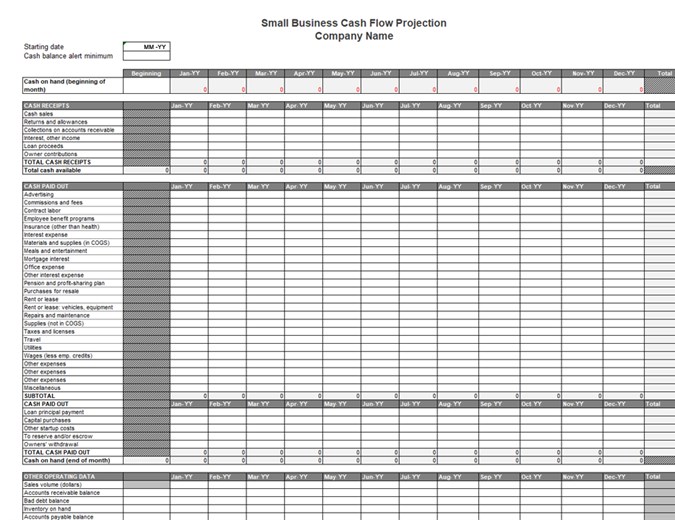

Cash flow projection model. As discussed earlier, adjustments have to be made to the pat/ ebit to get to. A forecast is a prediction of the most likely future cash flow income, whereas a. Your cash flow projection model should also include a cash balance forecast, which shows your projected cash balance at the end of each month or quarter.

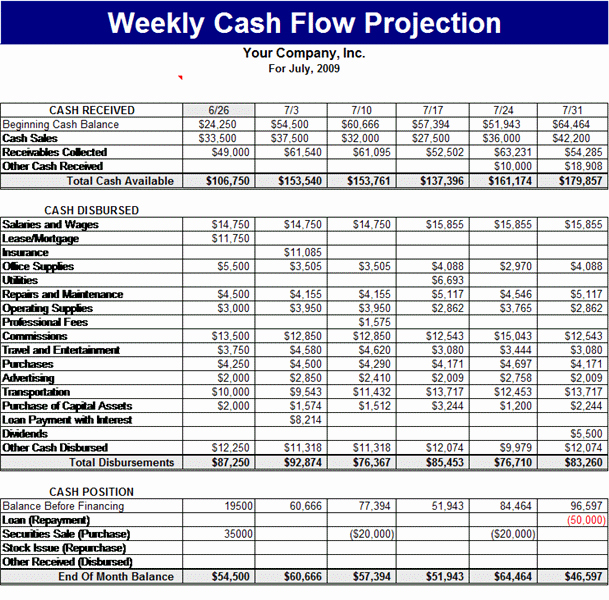

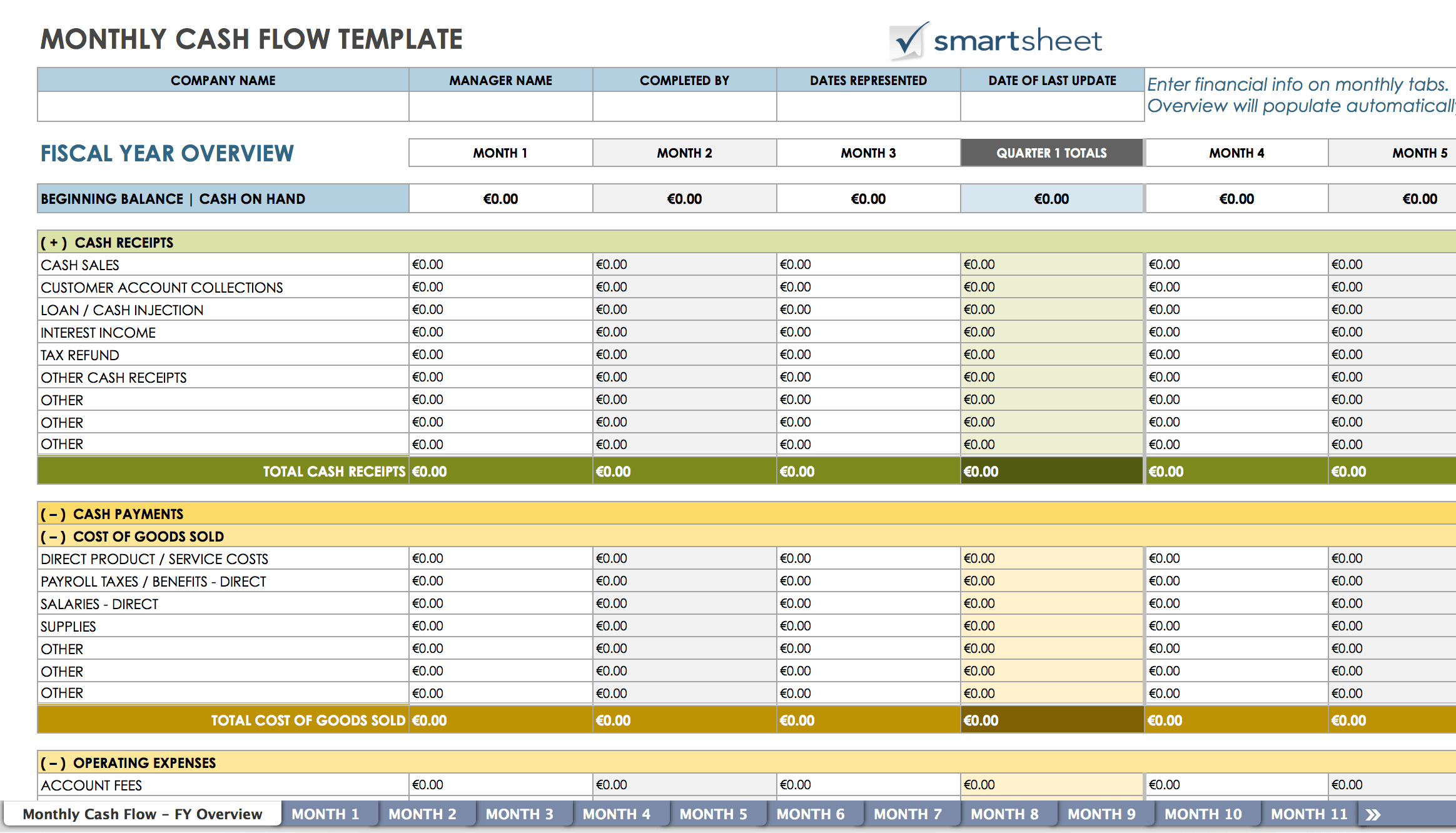

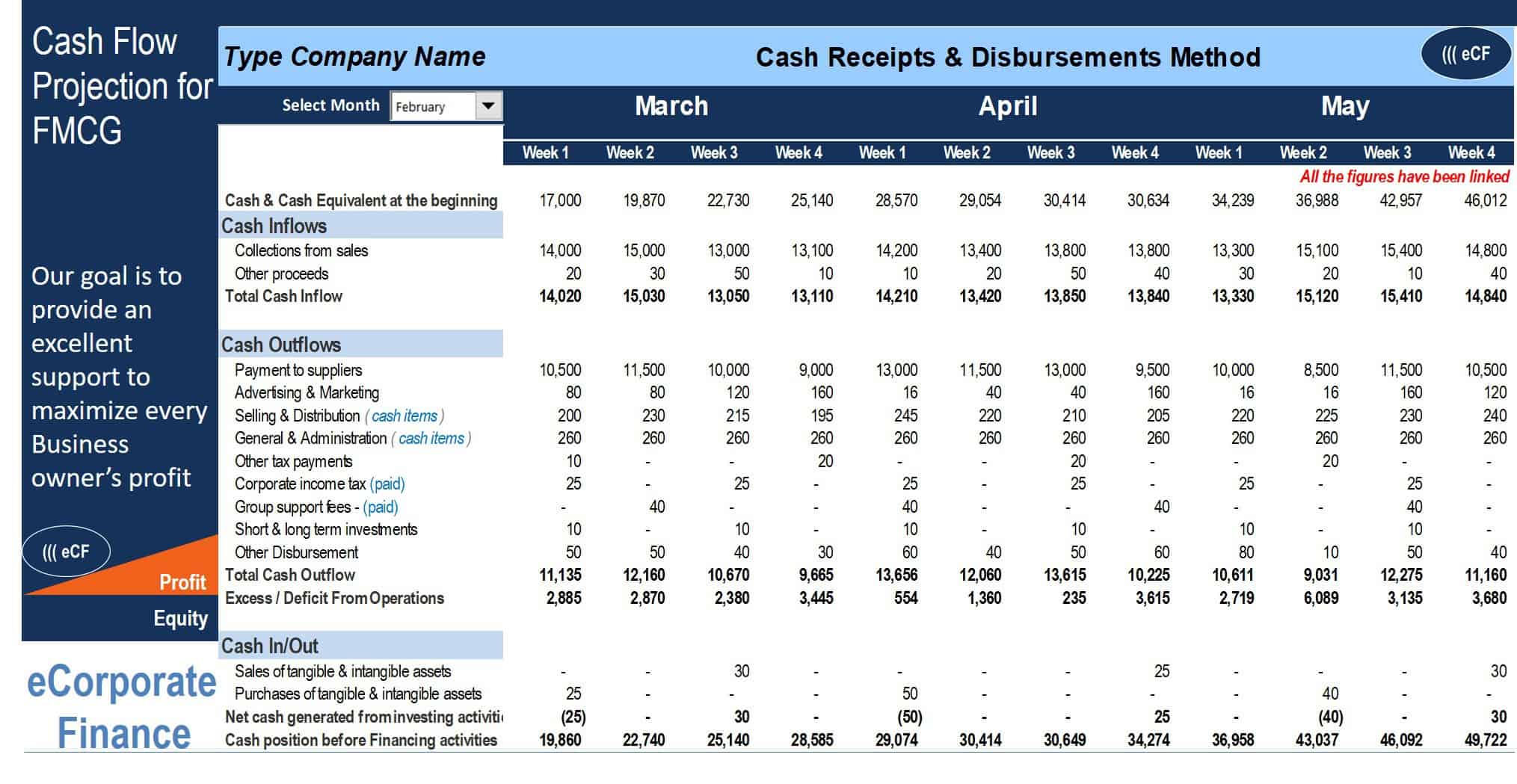

Purpose of model. The first step in our cash flow forecast is to forecast cash flows from operating activities, which can be derived from the balance sheet and the income statement. Use a spreadsheet or dedicated financial software to create the model.

This step is nice and easy. By henry sheykin the key to running a profitable business on a small or large scale comes with an understanding of cash flow financial modeling — the knowledge of. Here we are only demonstrating the idea, and in practice we should be using pandas (or numpy) to model a cashflow projection.

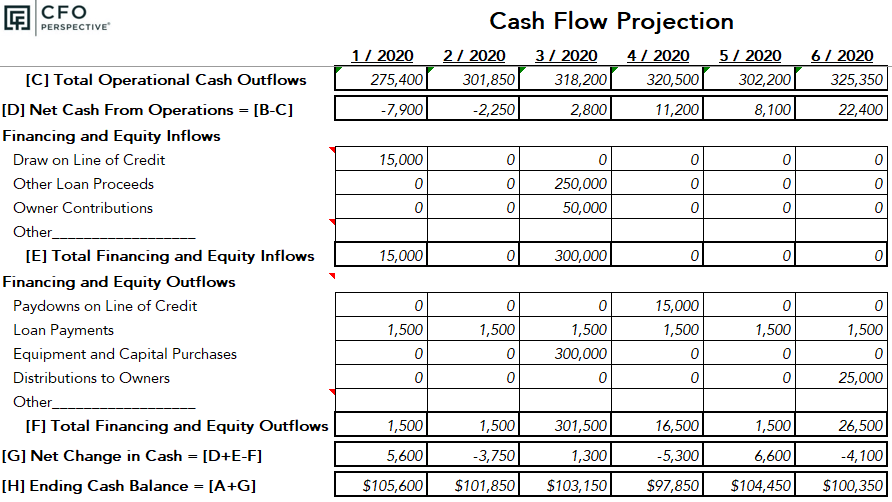

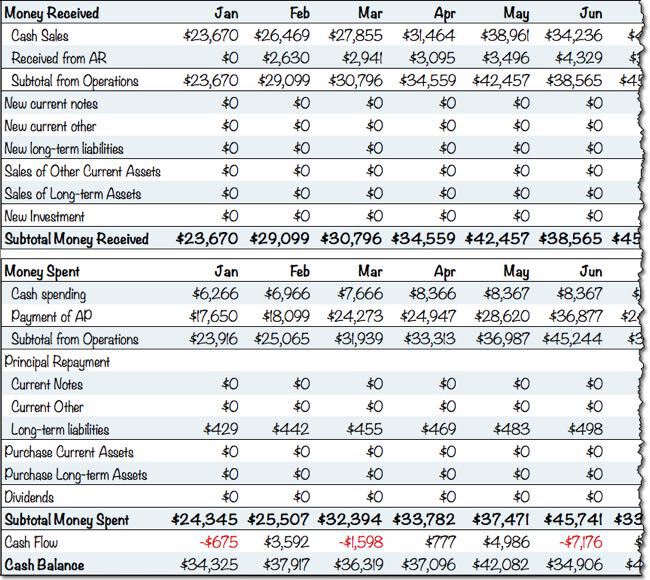

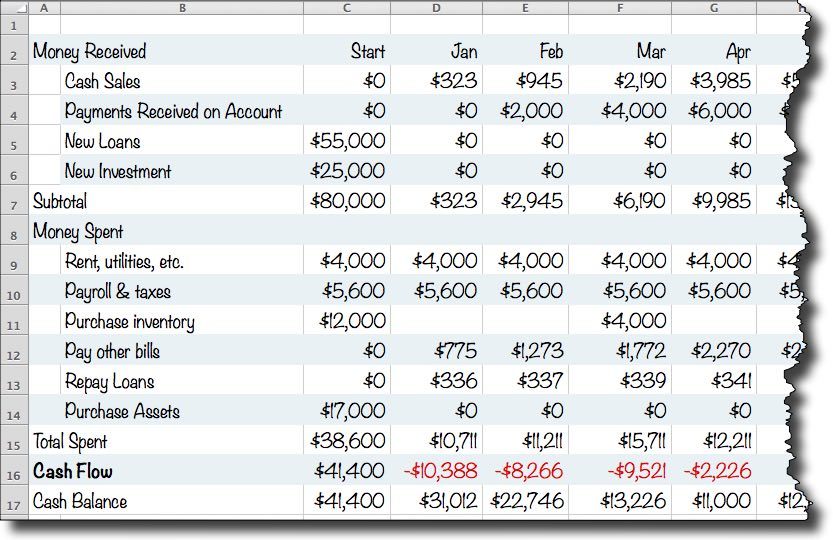

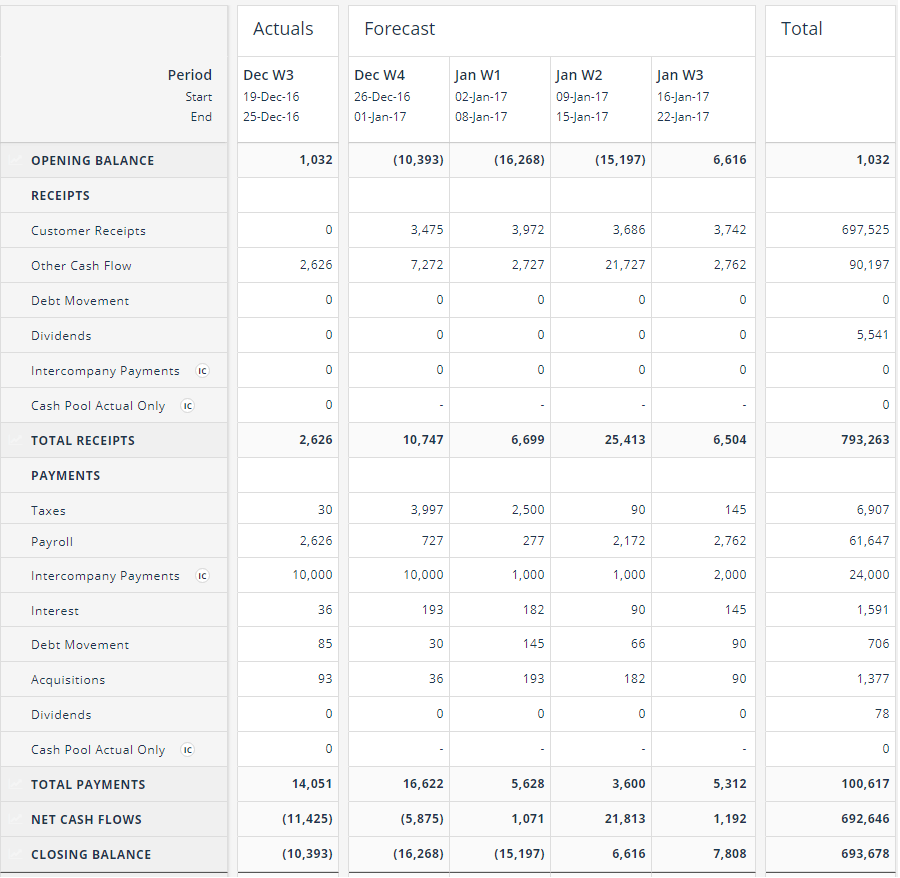

Leverage cash flow projection reports. This is the type of math you will be doing when building financial models. A cash forecasting model is the reporting structure and logic that produces a cash flow forecast.

Capture cash flow data from banking and accounting platforms and classify transactions. A cash flow forecast (also known as a cash flow projection) is like a budget, but rather than estimating revenues and expenses, it estimates cash coming in and going out. Head into your banking app or.

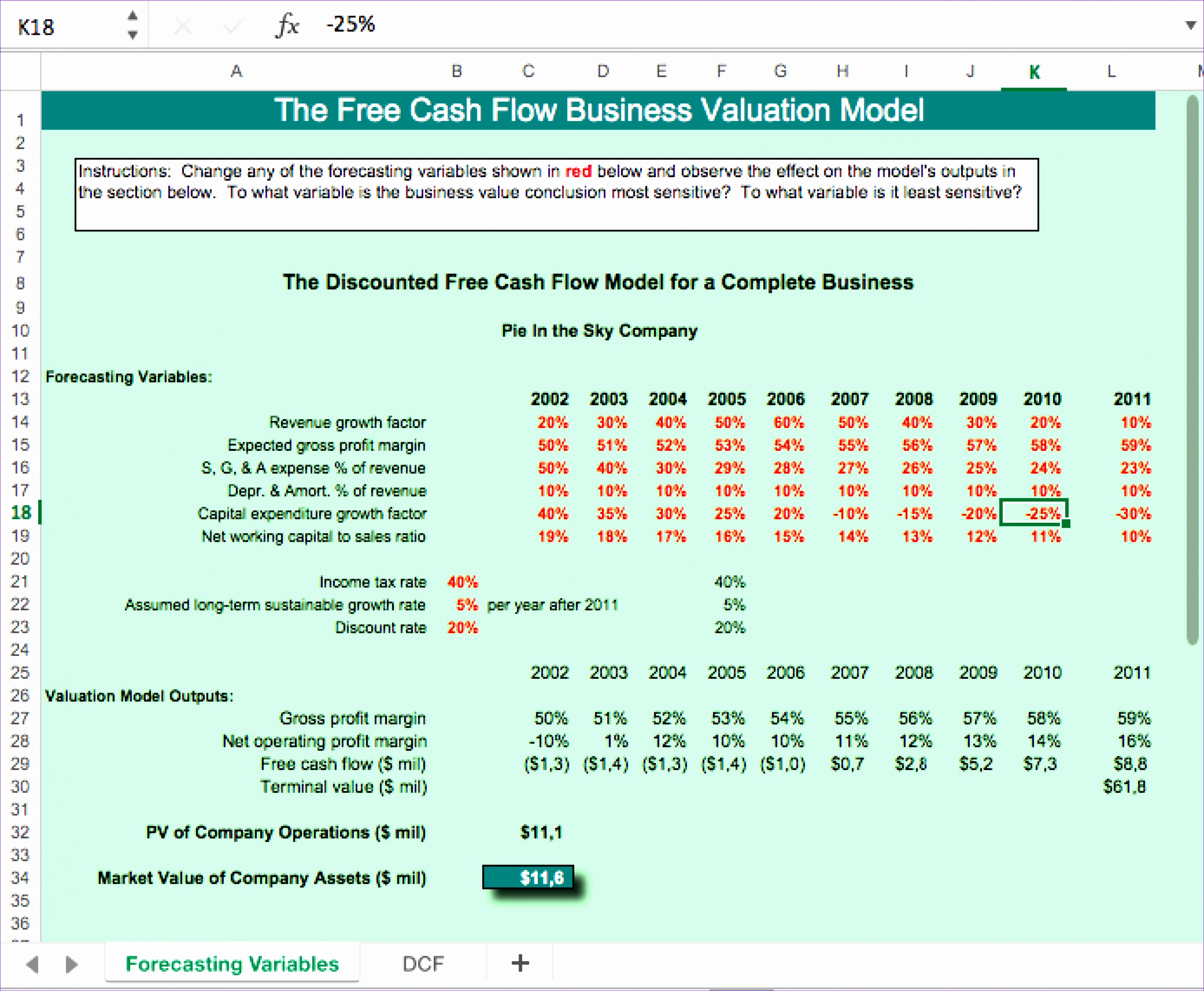

Key cash flow drivers should be modeled explicitly. Utilizing cash flow projection reports is crucial for effectively managing and forecasting future cash positions. In its simplest terms, building a cash projection model is the way a company forecasts or estimates its future position—cash balance positive, hopefully.

Project cash flow refers to how cash flows in and out of an organization in regard to a specific existing or potential project. The process typically includes 1. It offers a comprehensive overview of a company's.

Start with your opening cash balance. In our example, a retail store business should start with the number of stores it plans to operate each month, then. That means every business—regardless of its.

Project cash flow includes revenue and. A cash flow forecasting template allows you to determine your company’s net amount of cash to continue operating your business. Include separate sections for ocf, icf, fcf, and overall cash flow.

If you would like to p. the wall. What does the process entail? Create up to 72 months of financial projections based on….