Unique Tips About Investing Cash Flow

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

Investing cash flow. Financing activities detail cash flow from both debt and equity financing. Fiverr is also deeply undervalued. The stock price is down more than 91% from the all.

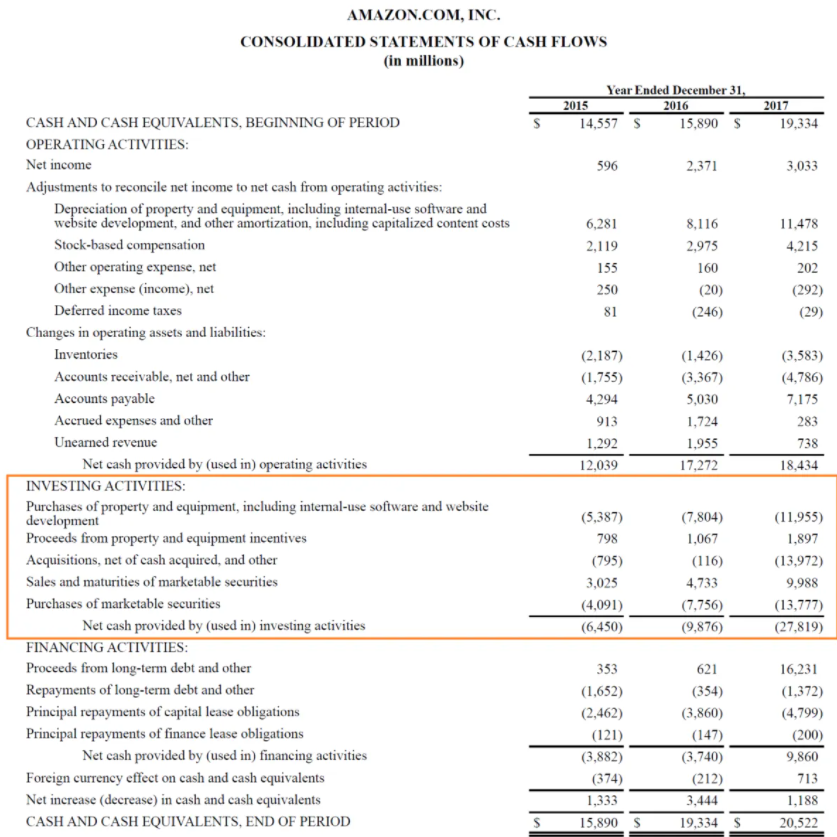

Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period. Cash flow from investing activities formula: Operating activities, investing activities and financing activities.

Cash flow from investing is listed on a company's cash flow statement. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two. Rockwool expects stable revenue in the current financial year with an.

The company continues to invest in expansion, with a net free cash flow of 12.7 eur per share after including growth capex. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories. Cash flow from investing section (cfi) the cash flow statement (cfs) contains three sections:

A cash flow statement gives investors insight into how a company manages its cash and where the money goes. An investor can learn more about a company's cash flows from their. Most use the indirect method.

There were inflows of $16.1 billion to stocks, and $11.6 billion to bonds, compared to outflows of $18.4 billion from cash, the most in eight weeks, bofa said in its weekly roundup of fund flows. Cash has been back in favour over the past two years after interest rates were cranked up by central banks seeking to rein in runaway inflation. The three sections of the cash flow statement are:

By marc guberti | reviewed by john divine | oct. The cash flows from investing activities line item is one of the more important items on the statement of cash flows, for it can be a substantial source or use of cash that significantly offsets any positive or negative amounts of cash flow generated from operations. Companies can choose two different ways of presenting the cash flow statement:

The cfs measures how well a. Usually, when companies expand they invest in property, plant, and equipment (ppe), and investors or shareholders of the company can easily find all these transactions in the. F ree cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a.

12, 2023, at 3:38 p.m. Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Real estate is a great.

Investing cash flow can offer a wide range of benefits for individuals and businesses looking to grow their wealth and achieve their financial goals. Investopedia / nono flores understanding cash flow businesses take in money from sales. With these etfs, cash flow is king.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)