Smart Tips About Qualified And Unqualified Opinion

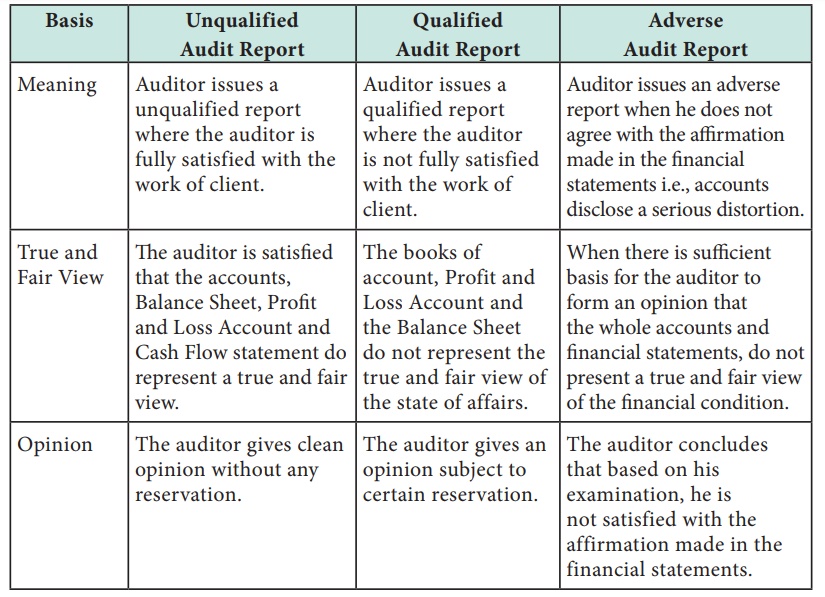

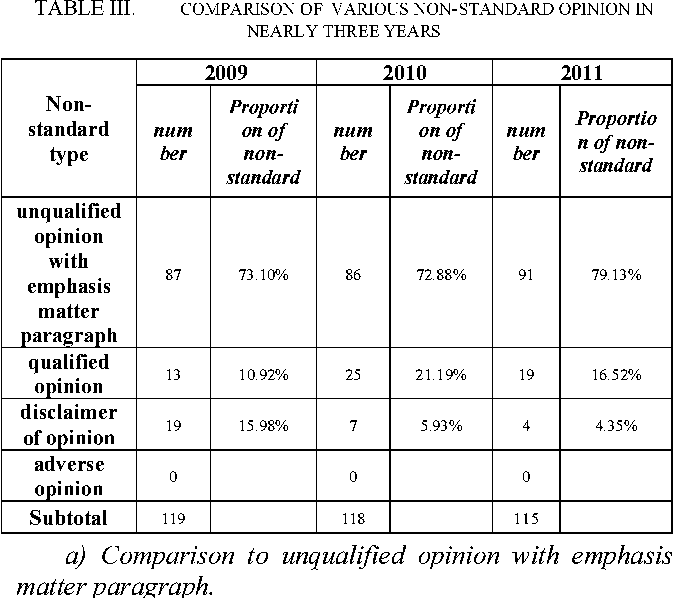

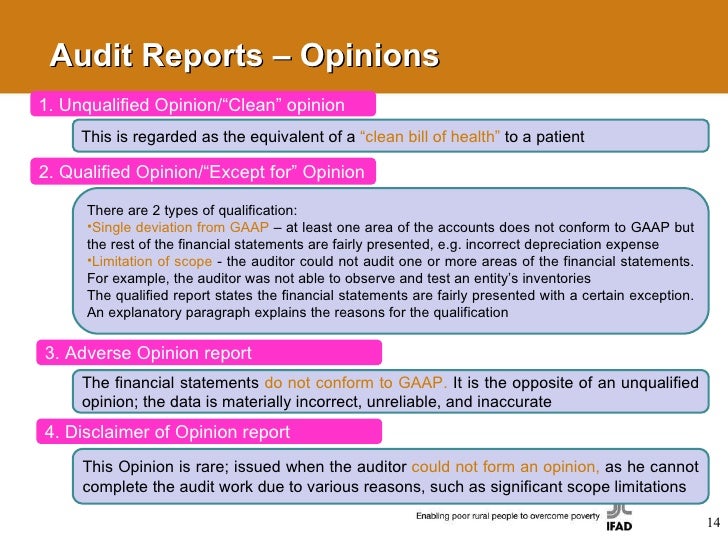

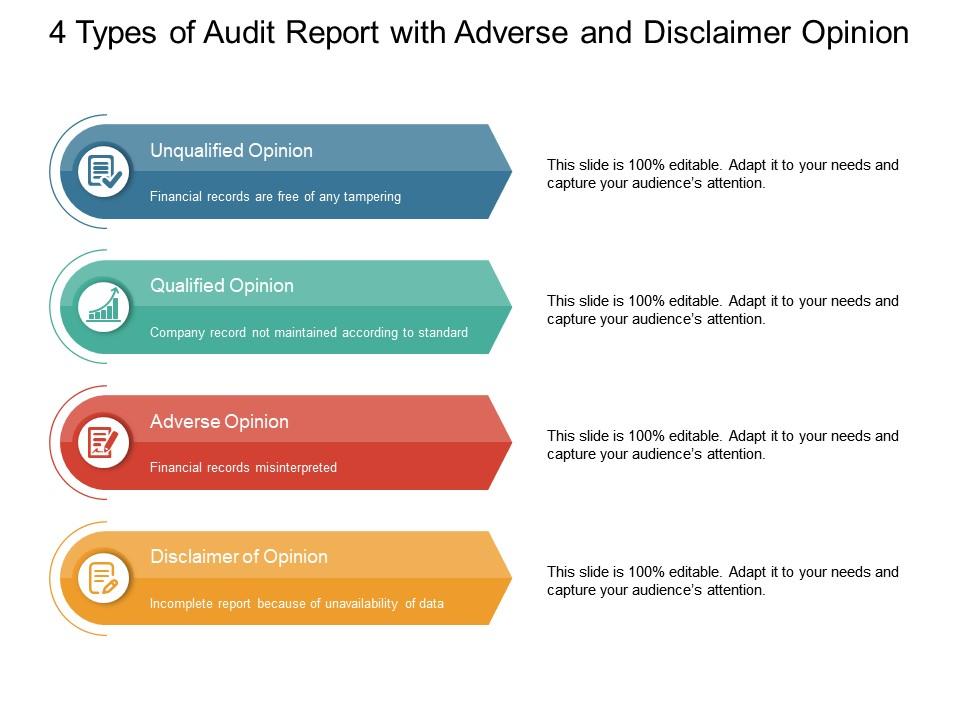

Those three modified opinions are qualified, adverse, and disclaimer opinions.

Qualified and unqualified opinion. An unqualified opinion is issued if the financial. An unqualified report is a report in which the auditor concludes that the company’s financial position represents a true and fair view of the financial position, and the profit or loss for. An adverse opinion is appropriate where a misstatement cannot be confined to specific elements, accounts or items of the financial report, ie.

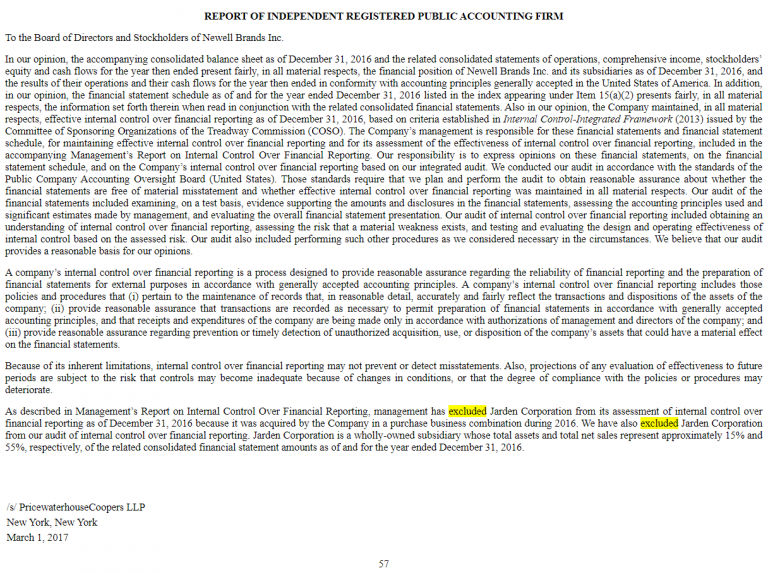

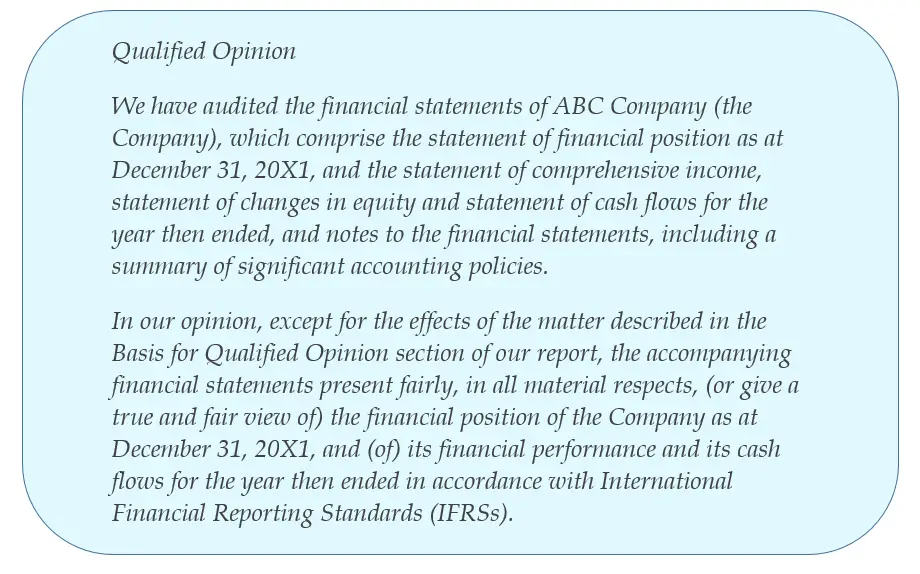

Any possible remaining discrepancies with the audit. When the auditor modifies the audit opinion, the auditor shall use the heading “qualified opinion,” “adverse opinion,” or “disclaimer of opinion,” as appropriate, for the. Unqualified, qualified, disclaimer, and adverse.

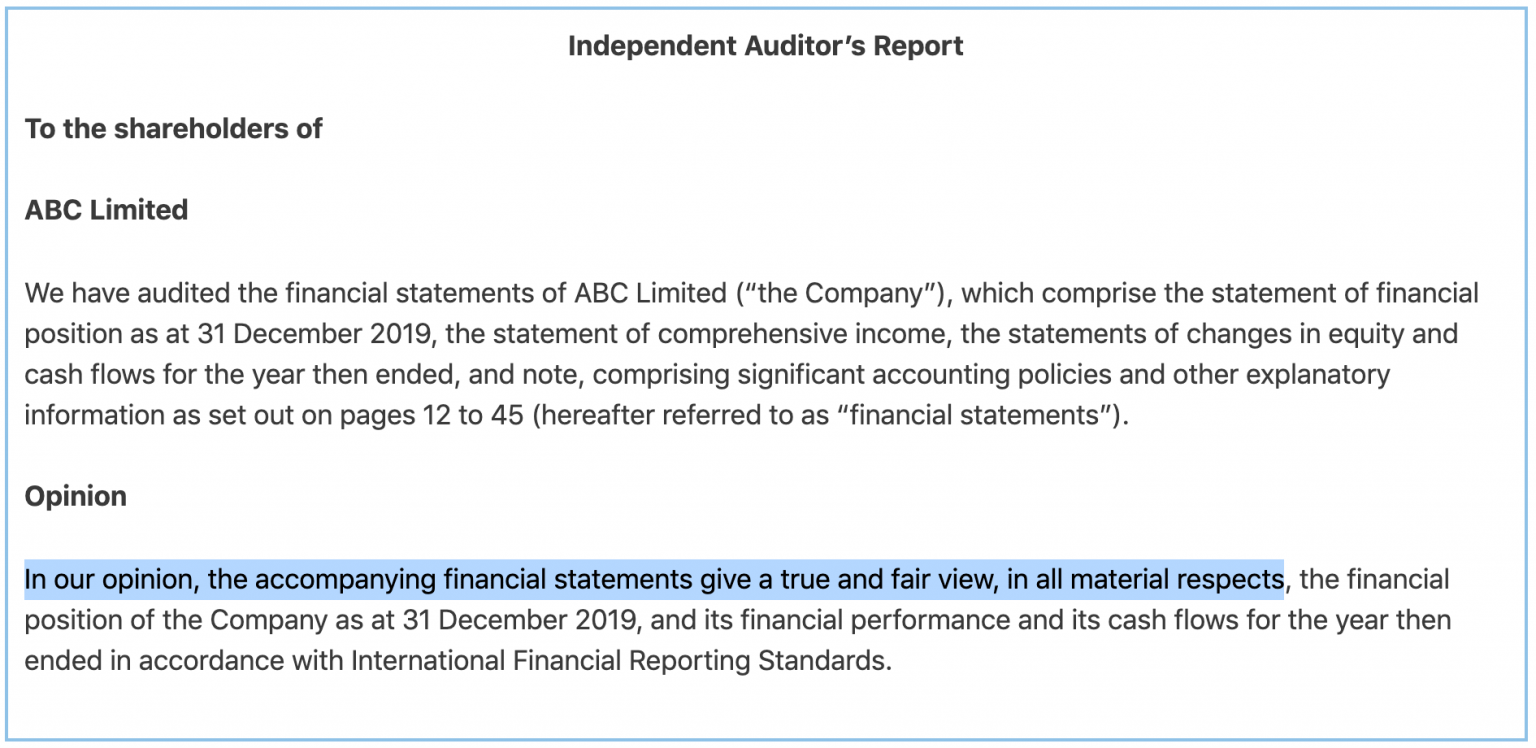

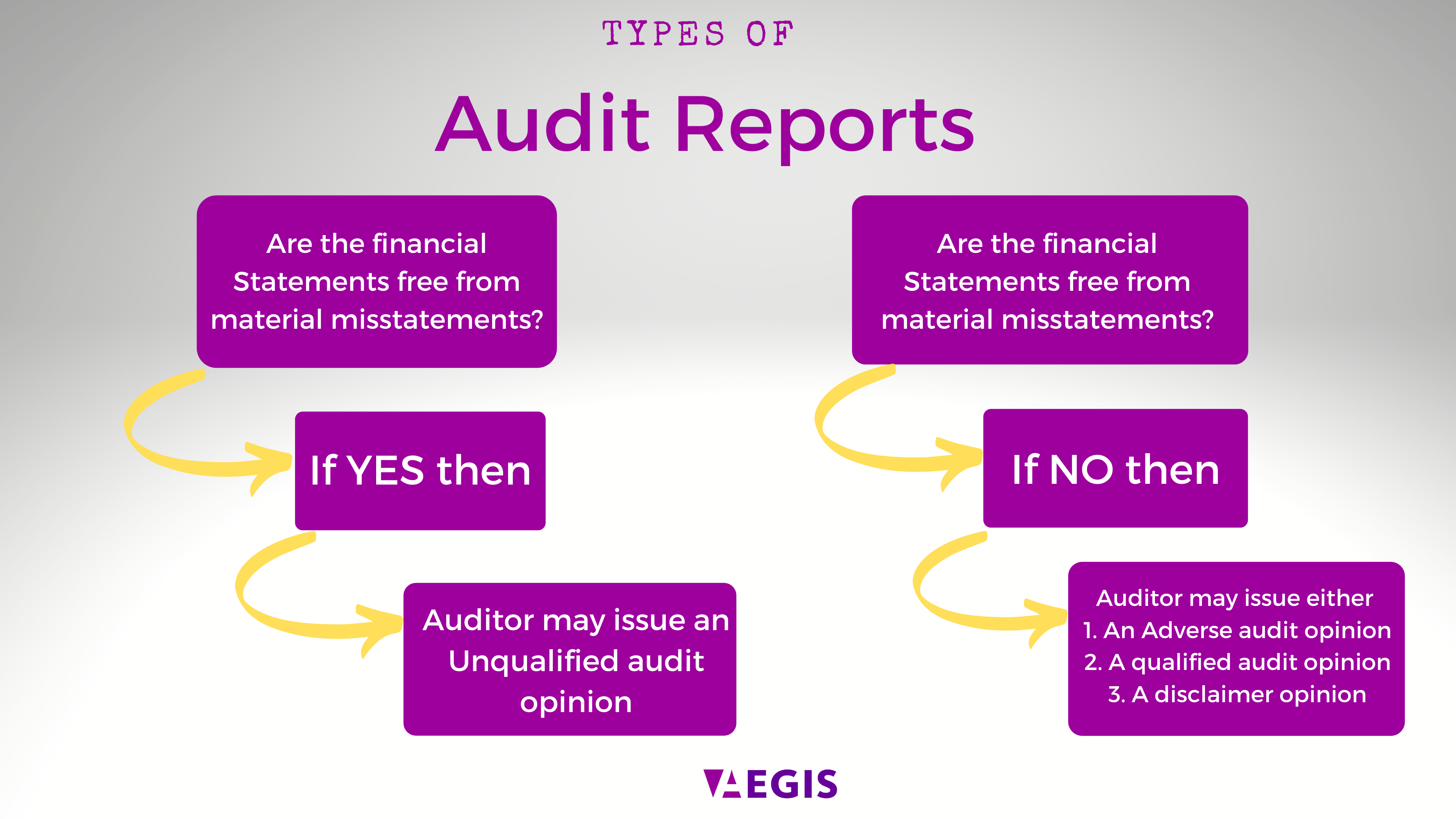

When an auditor is able to satisfactorily conclude that the financial statements are free from material misstatement they express an unmodified opinion. Unmodified(unqualified), qualified, adverse, and disclaimer opinion. The distinct difference between a qualified and unqualified report that separates them from each other is simply the wording in the letter.

An unqualified report states that the auditor has. The secure act 2.0 adds an option to roll over excess 529 funds to a roth ira tax free. So, in total, there are four types of audit opinion right?

A qualified opinion is a reflection of the auditor’s inability to give an unqualified, or clean, audit opinion. Are pervasive to the financial. An unqualified opinion is given after thorough research considering all accompanying financial documents.

There are four different opinions that can be issued with a soc report; February 16, 2024 at 7:45 a.m. An unqualified report, or a clean report, states that your financial statements are in order, while a qualified report can mean there is a problem as the auditor notes.

A qualified audit report is required to substantiate its qualified opinion by stating the audit evidence it has gathered on which the qualified opinion is based. For unqualified opinion, the audit report is dealing isa 700 and it is for financial statements that have no material misstatements. Ashleigh merchant is a lawyer representing michael roman, a former campaign official for former president.

In contrast, an unqualified report is an auditor’s opinion that is not qualified in accordance with gaas. A qualified opinion is one of four types of statements an auditor can make after reviewing a company's financials. For audits in the u.s., the opinion may be unqualified and in accordance with generally accepted accounting principles (gaap), qualified or adverse.

That means the financial statements are free from. Let’s see the audit opinion flow chart below to gain a better understanding: It typically indicates that the auditor isn’t confident about any specific process or.