Inspirating Info About Cash Flow Statement From Financing Activities

Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company.

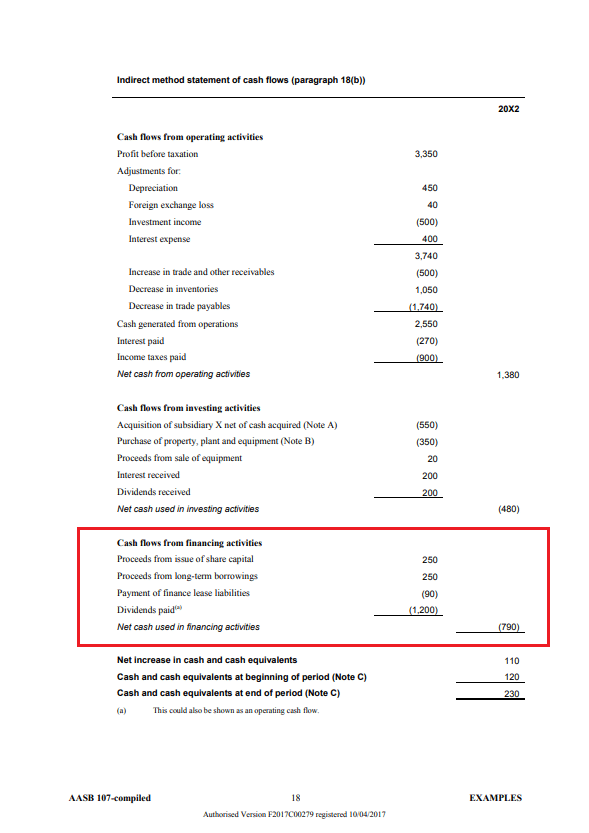

Cash flow statement from financing activities. Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a. Information about the cash flows of an entity is useful in providing users [refer: The separate disclosure of cash flows arising from financing activities is important because it is useful in predicting claims on future cash flows by providers of.

The cash flow statement (cfs), which tracks the net change in cash during a specific period, is split. Cash flow from financing activities provides investors with insight into a. On a statement of cash flows, this transaction is listed within the financing activities as a $400,000 cash inflow.

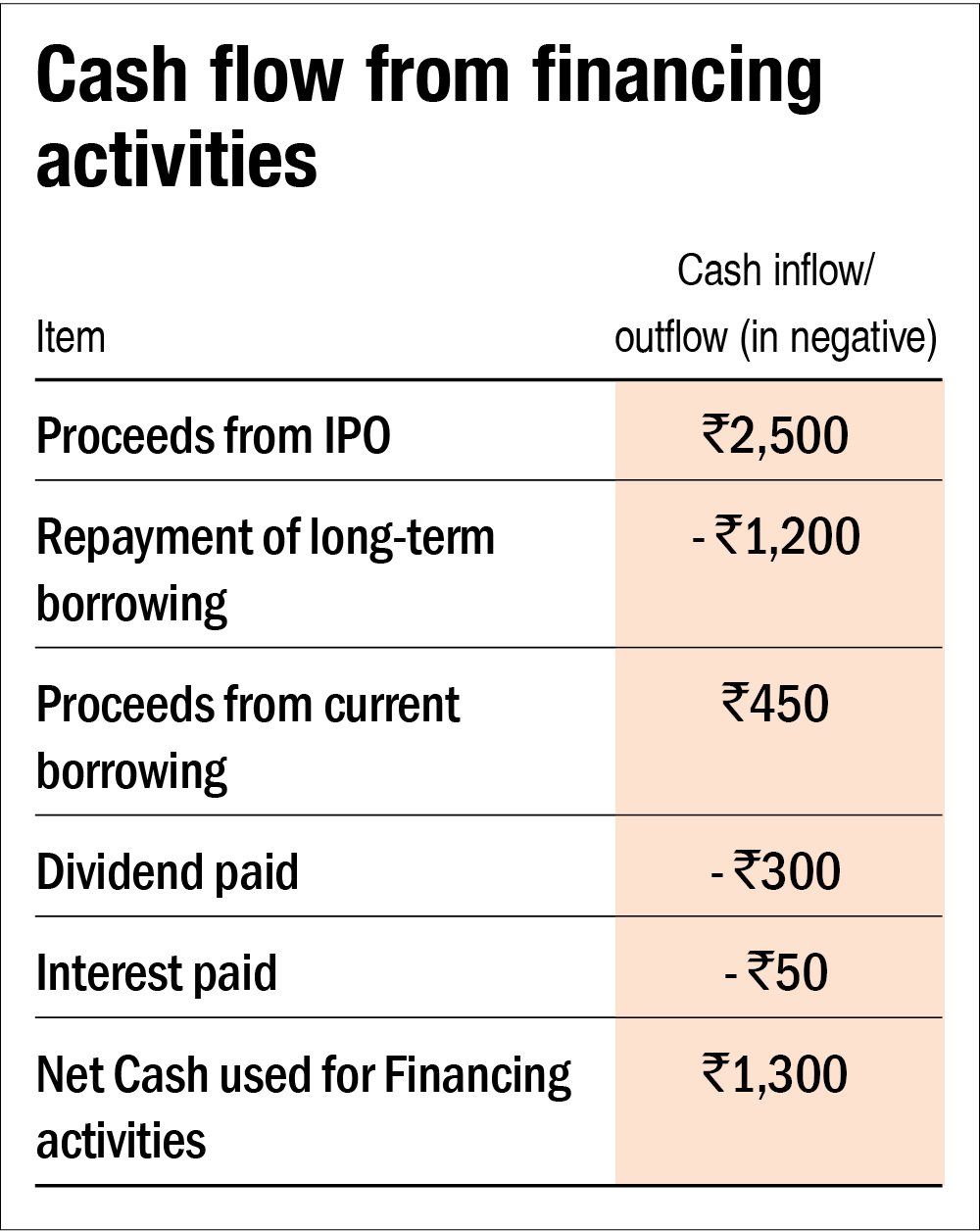

Cash flow from financing (cfi): Cash flow from financing activities is represented in the cash flow. Cash flow from financing activities is the net amount of funding a company generates in a given time period.

Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Your cash flow comes from three activities: Cash flow from financing activities (cff):

The formula for cash flow from financing activities includes adding all items contributing to an inflow of cash, such as issuing stock, borrowing, and subtracting all. The third section of the cash flow statement examines cash inflows and outflows related to financing. Get access to 40+ years of historical.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. This section essentially captures the flow of cash between the business and its investors, owners, and creditors. Incurring the above $400,000 debt raises.

Cash flow from financing activities describes the incoming and outgoing capital that a business raises and. In a nutshell, we can say that cash flow from financing activities reports the issuance and repurchase of the company’s bonds and stock and the payment of dividends. Finance activities include the issuance and repayment of equity,.

Calculate cash flow from financing activity. The cash flows from financing activities line item is one of the more important items on the statement of cash flows, for it can represent a substantial. Understand the cash flow statement for rollins, inc.

Operating investing financing this article discusses the “ins” and “outs” of the types of cash flow and how they might. Cash flow from financing activities (cff) is the net cash flow used to raise capital for your business. It covers all cash and equivalent transactions involving.

What is cash flow from financing activities? A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Financing activities include transactions involving debt, equity, and dividends.

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)