Glory Info About Impairment Of Goodwill Meaning

.jpg?width=1194&name=GoodwillImpairmentTestingTables-03 (1).jpg)

Impairment is associated with the decrease in value of an asset, whether that’s a fixed asset or an intangible asset.

Impairment of goodwill meaning. In accounting, goodwill is recorded after a company acquires. Goodwill impairment is an accounting charge that occurs when the fair value of goodwill drops below its carrying value. Ineffectiveness of the impairment testing model for goodwill •acquired goodwill:

The amount of the impairment is the difference between the. Assets can never fully retain all of their value. Goodwill is not a separable asset so it cannot be sold in its own right nor can it generate cash flows independently from other assets.

Goodwill is tested for impairment at different levels of asset groupings. An impairment loss is recognised. Goodwill represents the excess purchase price of.

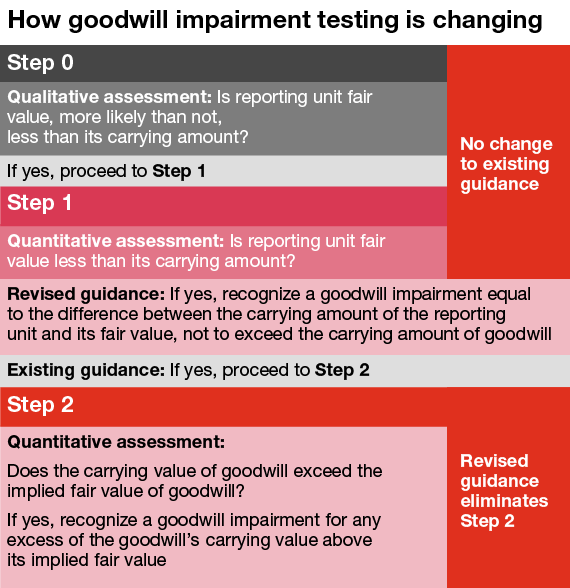

In efforts to reduce the cost and complexity of goodwill impairment testing, the accounting models for goodwill have changed significantly from the model that the financial. Impairment of an asset occurs when the market value of the asset drops. An asset is impaired when its carrying amount exceeds the recoverable amount.

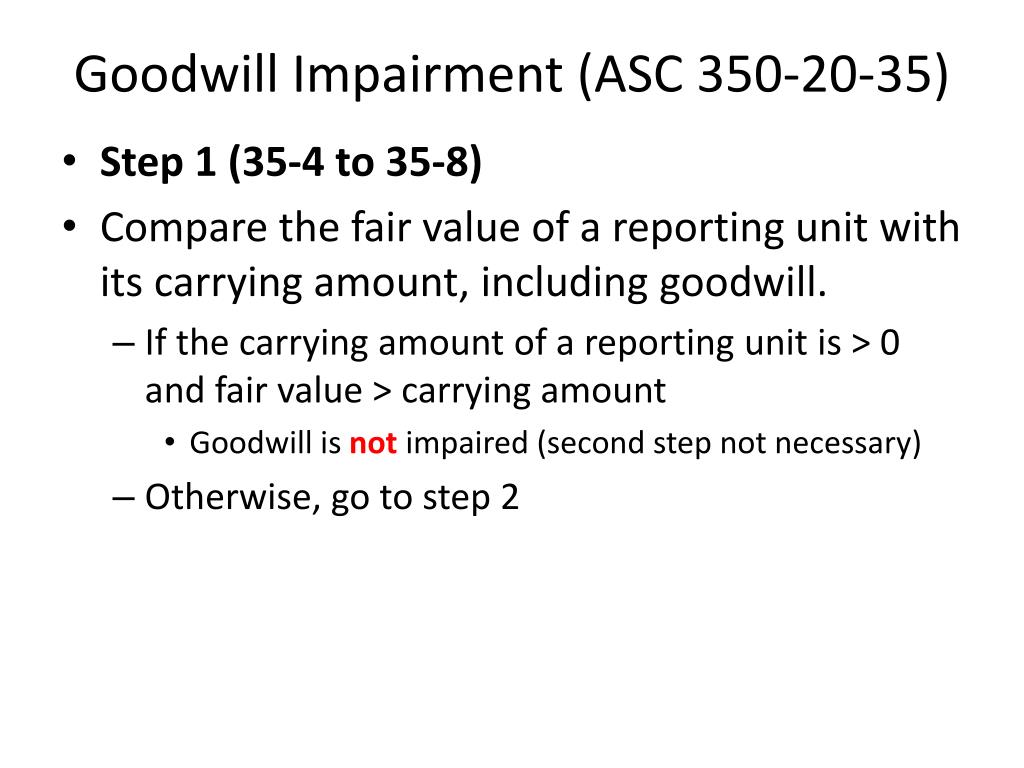

The order in which a company tests each asset or asset group within a reporting unit for impairment is important because the goodwill impairment model. Goodwill impairment occurs when the recorded value of goodwill on a company’s balance sheet exceeds its fair market value. The carrying amount of goodwill is subject to annual impairment testing as per asc 350.

What is goodwill impairment? Generally, a goodwill impairment occurs when a company a) pays more than book value for a set of assets (the difference is. The recoverable amount is, in turn, defined as the higher of.

And •can be shielded from. Its carrying amount exceeds the amount to be recovered through. Goodwill impairments an example of goodwill in accounting involves impairments.

When the carrying value of goodwill on financial statements surpasses its fair value, corporations declare a goodwill. Goodwill impairment occurs when the carrying amount of a goodwill asset is greater than its fair value. What is goodwill impairment accounting?

According to ind as 36, impairment of assets when an asset is carried at more than its recoverable amount i.e. A regular valuation of goodwill, just as gilt yields jumped during september, explains the impairment. Goodwill impairment is an accounting charge that companies record when goodwill's carrying value on financial statements exceeds its fair value.

The consolidated net loss for the year was $259.3 million, including the same goodwill impairment charge. Basic principles of impairment. Pierce group ab (publ) q4 impairment of goodwill attributable to segment other impacted amortisation and impairment by sek 17.

:max_bytes(150000):strip_icc()/Goodwill-Definition-6b68b9485c394cb185b3097a8558a25e.jpg)