Glory Info About Indirect Income Statement

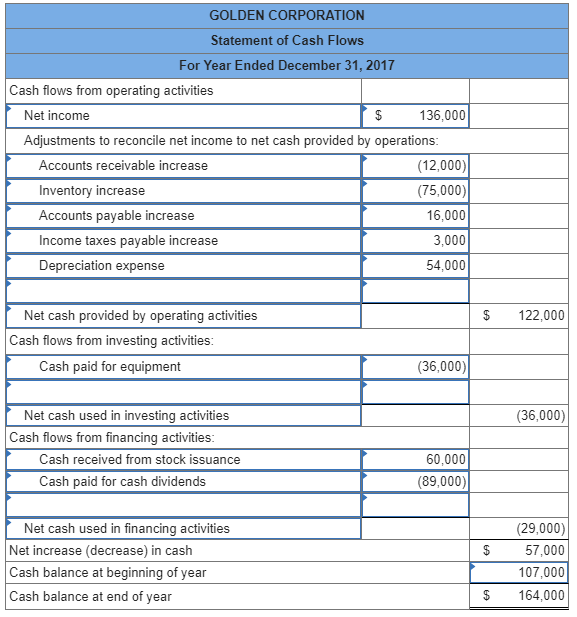

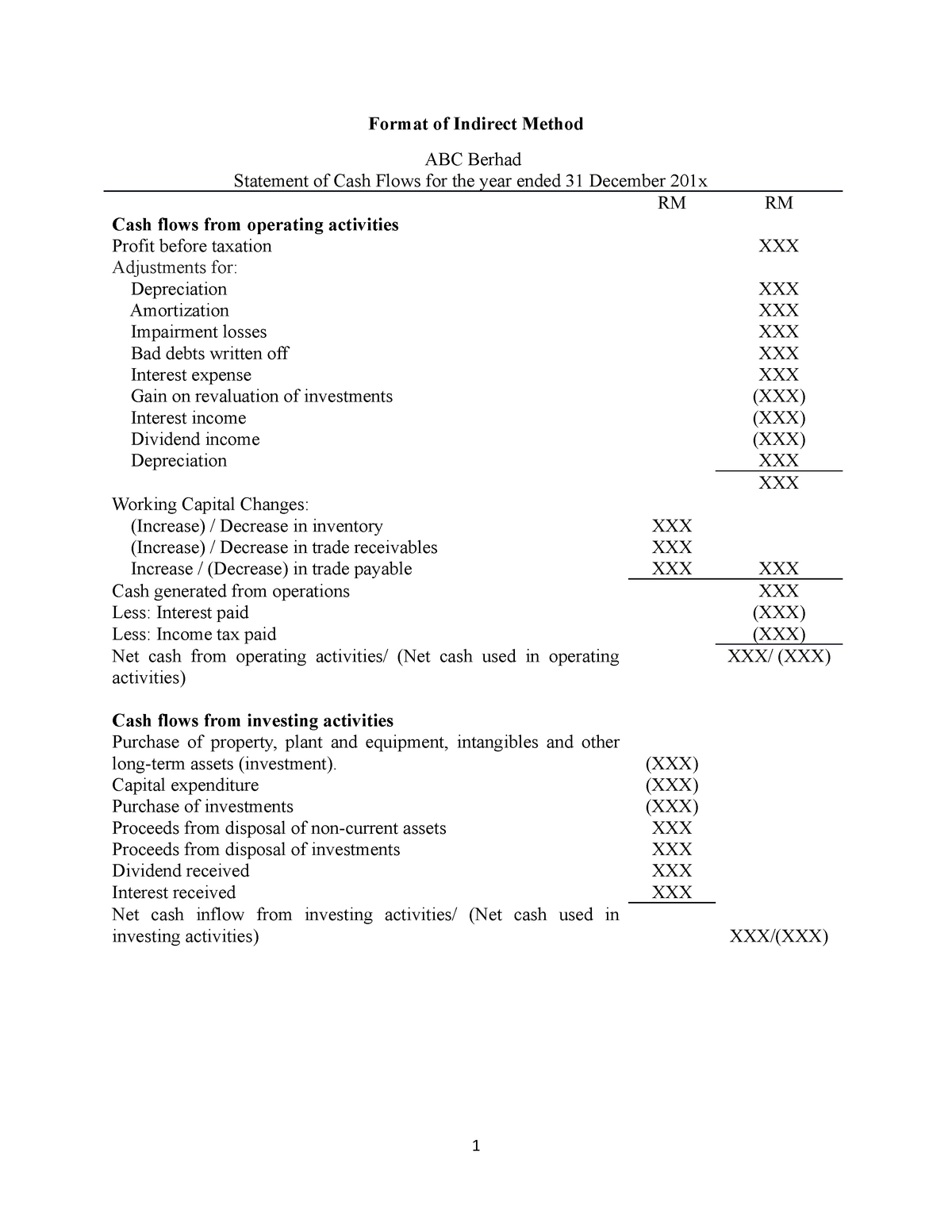

The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of.

Indirect income statement. The indirect cash flow method Add back noncash expenses, such as depreciation, amortization, and depletion. The statement of cash flows is prepared using the four steps described in the previous segment.

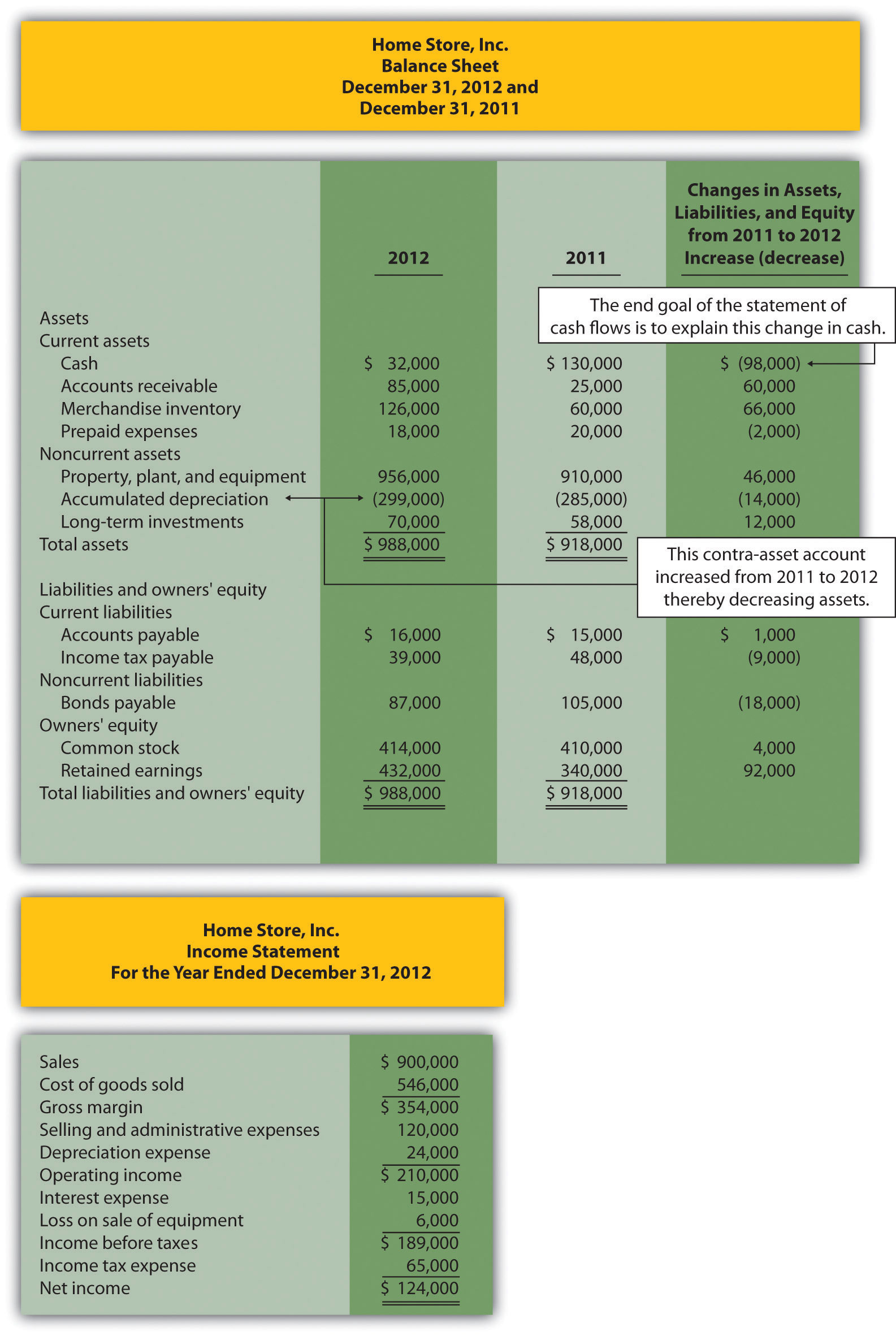

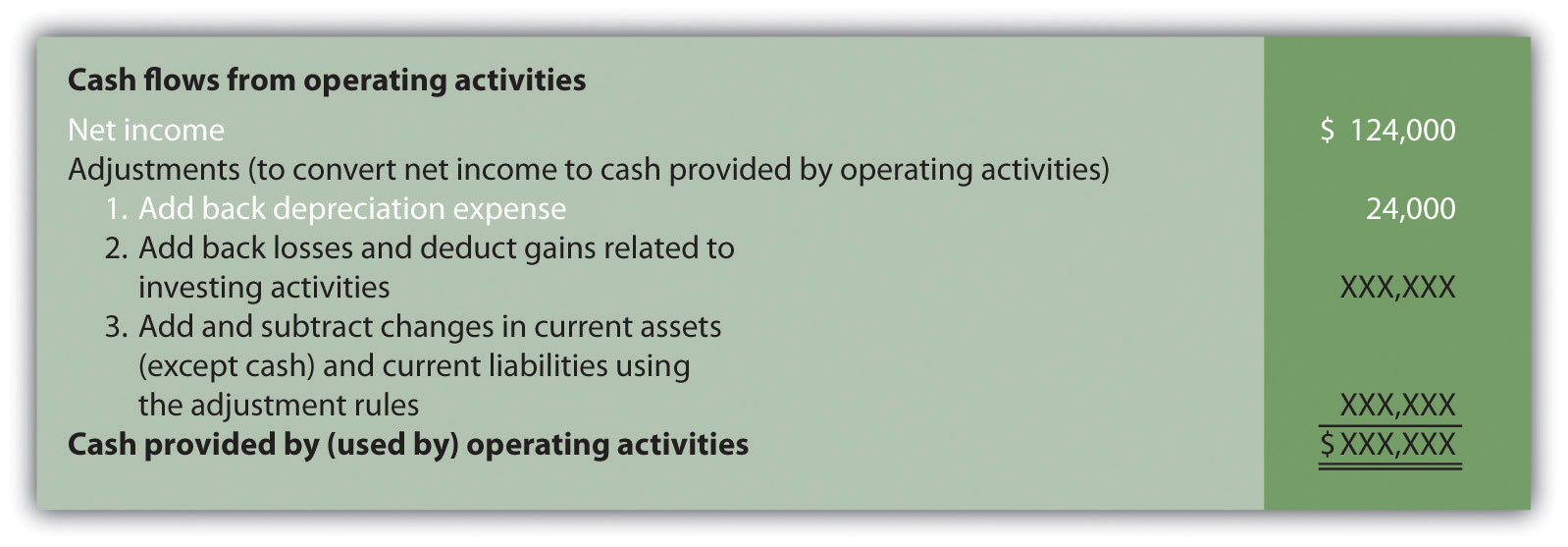

The operating cash flows section of the statement of cash flows under the indirect method would appear something like this: In step 1, the indirect method starts with net income in the operating activities section and makes three types of adjustments to convert net income to a cash basis. You can gather this information from the company’s balance sheet and income statement.

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. Company a had net income for the year of $20,000 after deducting depreciation of $10,000, yielding $30,000 of positive cash flows. Let's look at each in turn.

James biden testified wednesday that his brother, president biden, “never had any involvement or any direct or indirect financial interest” in his business ventures, countering republican. In the direct method, these two amounts were simply omitted in arriving at the individual cash flows from operating activities. List the net income from the financial statements.

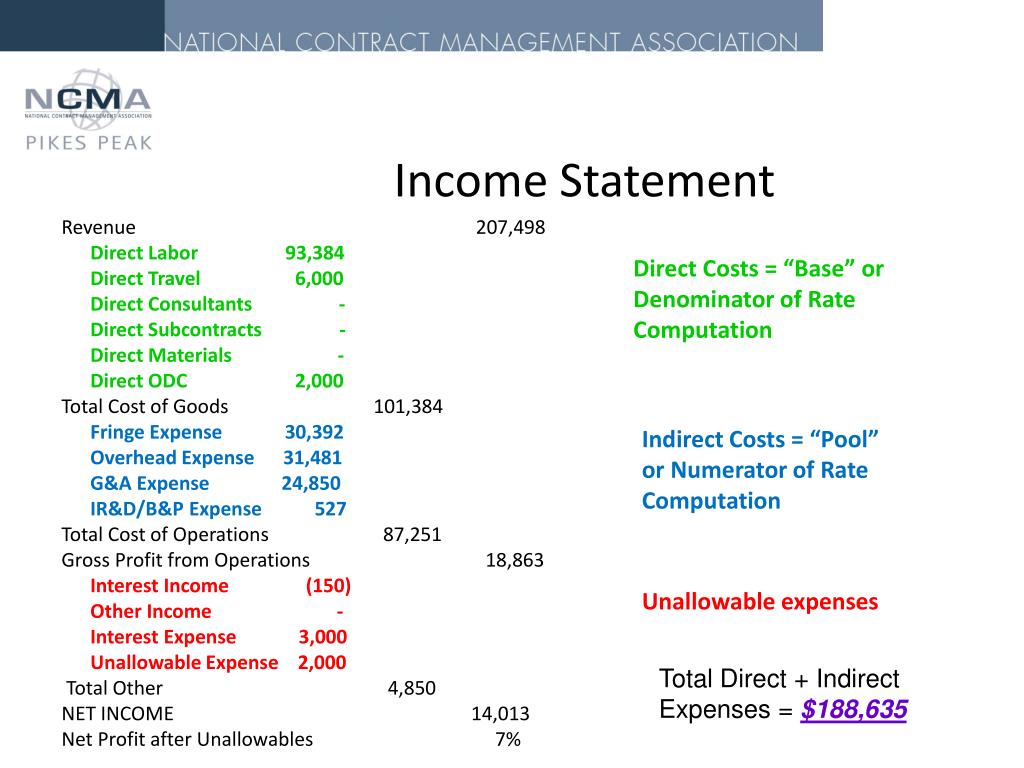

An income statement is a financial report detailing a company’s income and expenses over a reporting period. Direct expenses and allocated indirect expenses are reported as costs of goods sold to calculate gross profit. They help government and the public assess the costs, benefits and overall effectiveness of this expenditure.

Add back noncash expenses, such as depreciation, amortization, and depletion. Direct and indirect costs can be declared on the income statement as expenditures since a personal service company does not hold inventory. Begin with net income from the income statement.

How indirect costs appear on an income statement. Direct and indirect costs are reported under two separate line items on an income statement: Using the indirect method, operating net cash flow is calculated as follows:

Pull your company’s net income from its income statement, and list it on the first line of the cash flow statement. Alternatively, the direct method begins with the cash amounts received and paid out by your business. This annexure presents government’s latest estimates of the fiscal cost of tax expenditures, as well as the methodology used to produce these estimates.

The indirect method is based on accrual accounting and is generally the best technique since most businesses use accrual accounting in their. You can also use an independent “cost of sales a/c” to list the expenses on the profit and loss account. This video demonstrates how to prepare a statement of cash flows using the indirect method.

What is the income statement? Profit before interest and income taxes. The selling, general and administrative expenses to go to market are $10,000, $10,000 and $5,000, respectively.