Fantastic Info About Unearned Rent Balance Sheet

.webp)

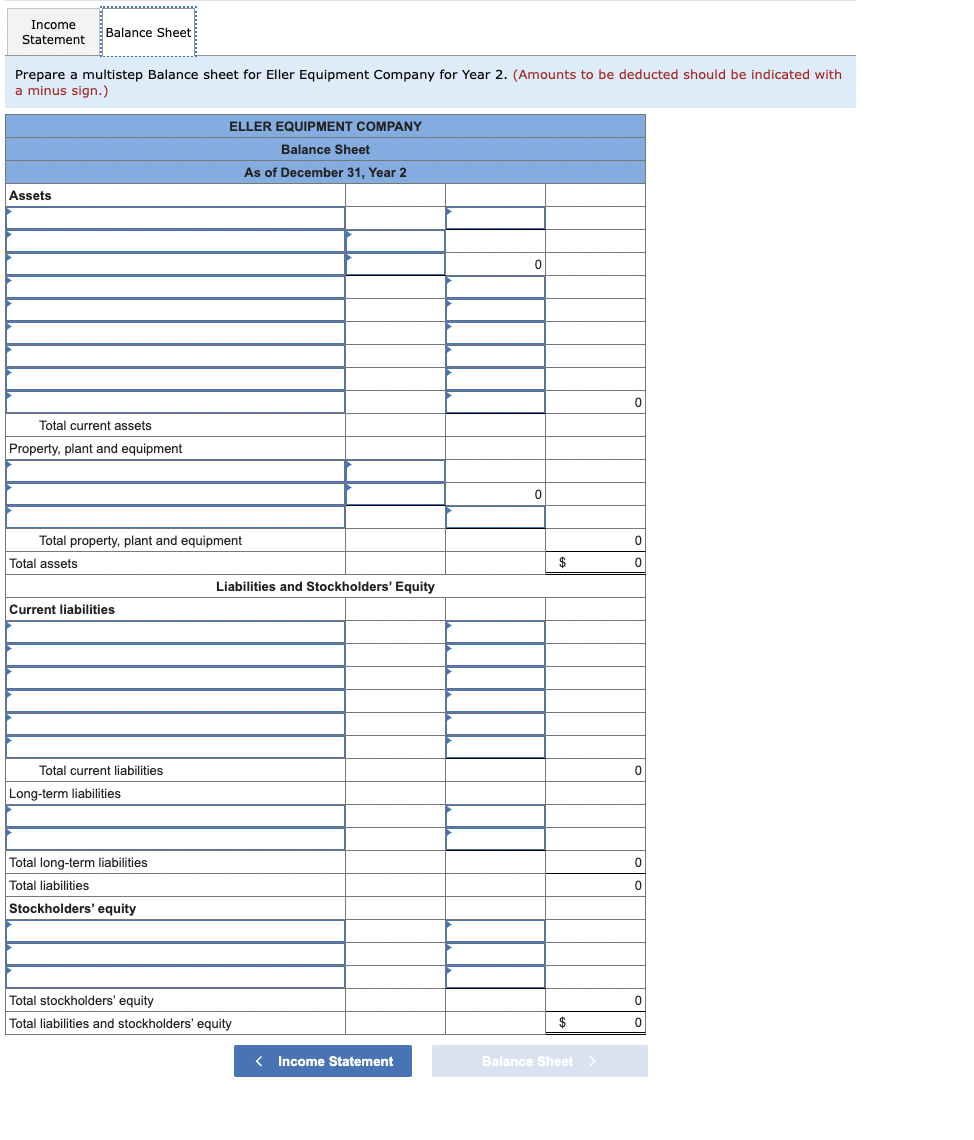

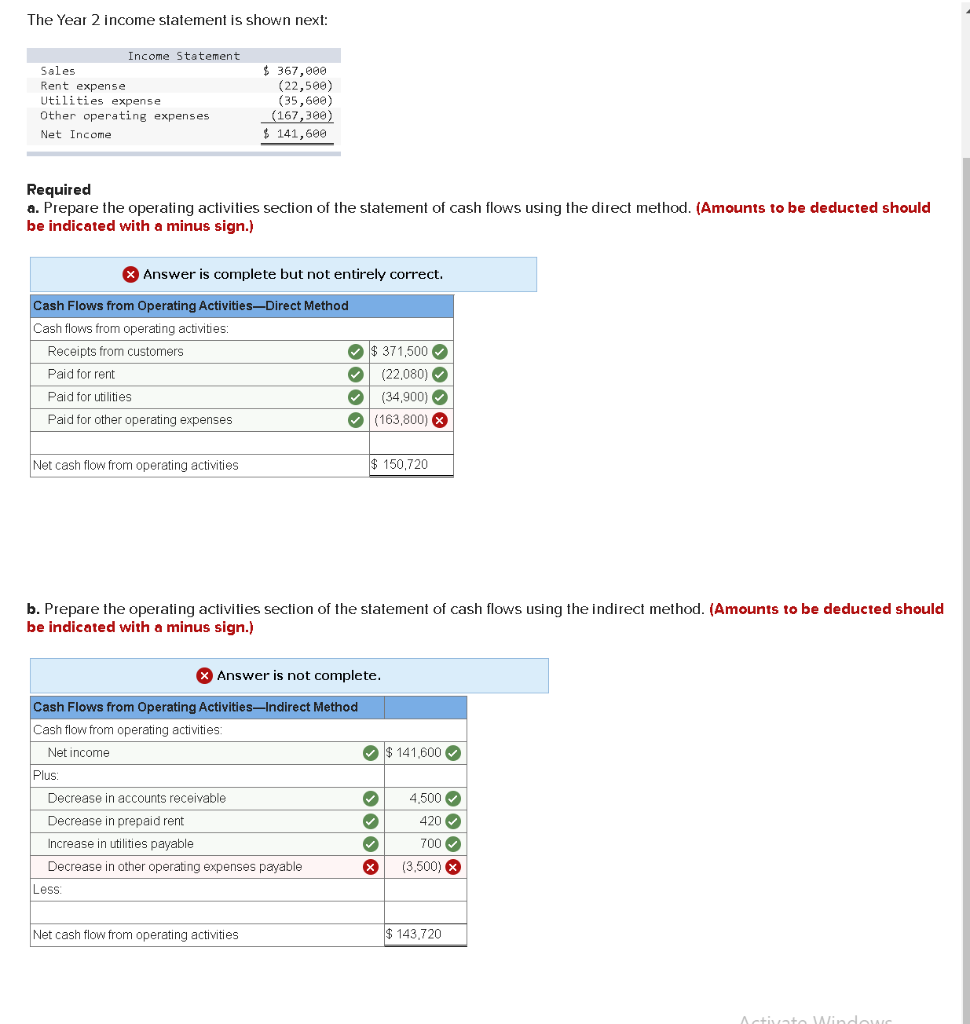

Accounting accounting questions and answers the financial statement on which unearned rent revenue would appear is:

Unearned rent balance sheet. Rental income is cash or the fair market value of property or services received for the use of real estate, according to irs topic no. To account for this unearned rent, the landlord records a debit to the cash account and an offsetting credit to the unearned rent account (which is a liability account). Rent receivable is one of the highly liquid current assets against.

The balance sheet, also known as the “statement of financial position,” presents a snapshot of a business's. Rent is commonly paid in advance, being due on the. How does unearned revenue appear on the balance sheet?

As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the balance in the revenue account (with a. Funds in an unearned revenue account are classified. Unearned revenue is recorded on the liabilities side of the balance sheet since the company collected cash payments upfront and thus has unfulfilled obligations.

December 01, 2023 overview of prepaid rent accounting prepaid rent is rent paid prior to the rental period to which it relates. Accounting equation for rent received in advance rent received in. In this journal entry, both assets and liabilities on the balance sheet increase by the same amount.

Unearned revenue is amount of money that is received by the business for goods and services that is yet to be delivered or rendered. In the month of cash receipt, the transaction does not appear on the landlord's income. When the last month of the lease is over, for example, the unearned rent credit balance is.

Here’s an example of a. That being said, unearned rent does not remain a liability forever. Income method under the income method, the accountant records the entire collection under an income account.

In accounting, unearned revenue has its own account, which can be found on the business’s balance sheet. Examples of rental income include: When you receive rent payments in advance from a tenant, you must record the unearned rent as a liability on your balance sheet until it is earned.

Unearned revenue is reported on a business’s balance sheet, an important financial statement usually generated with accounting software. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable,.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)