Awesome Info About Cash Flow Statement Guide

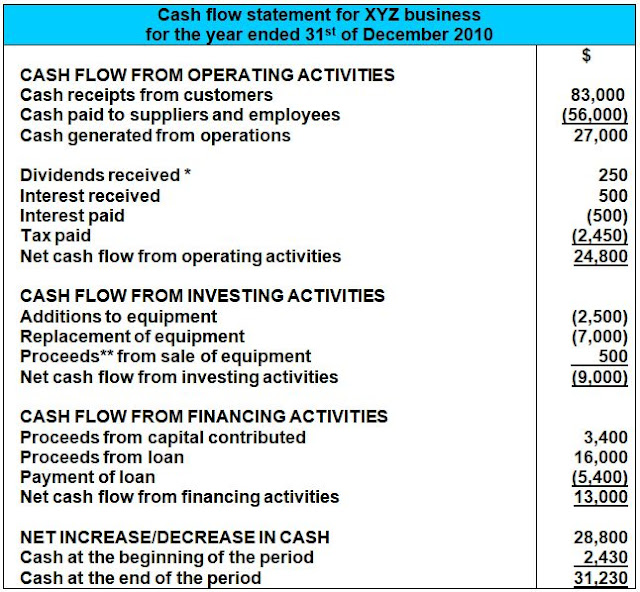

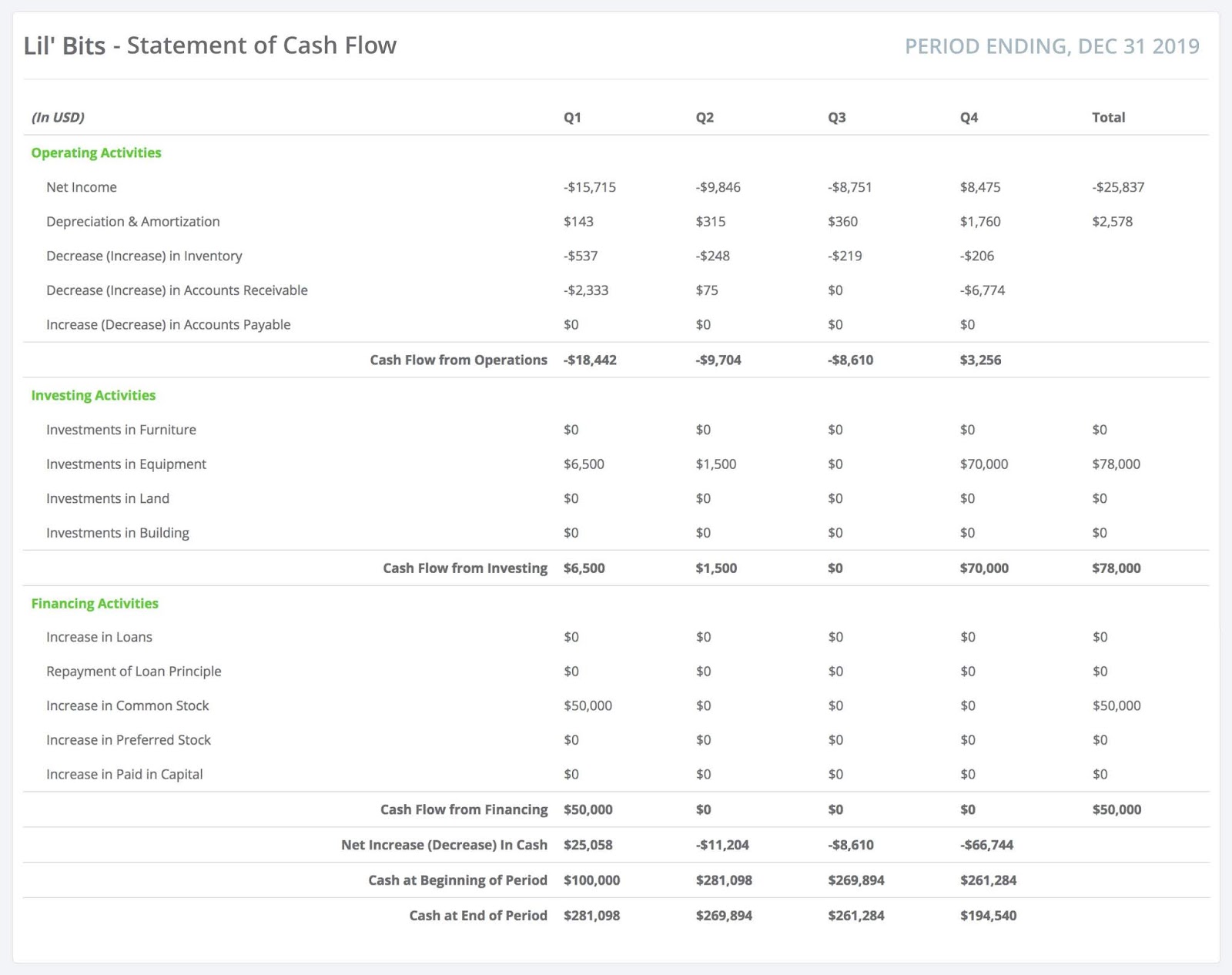

A cash flow statement is a document, typically generated monthly, quarterly, and/or annually, showing how much cash a business has on hand at a given moment in.

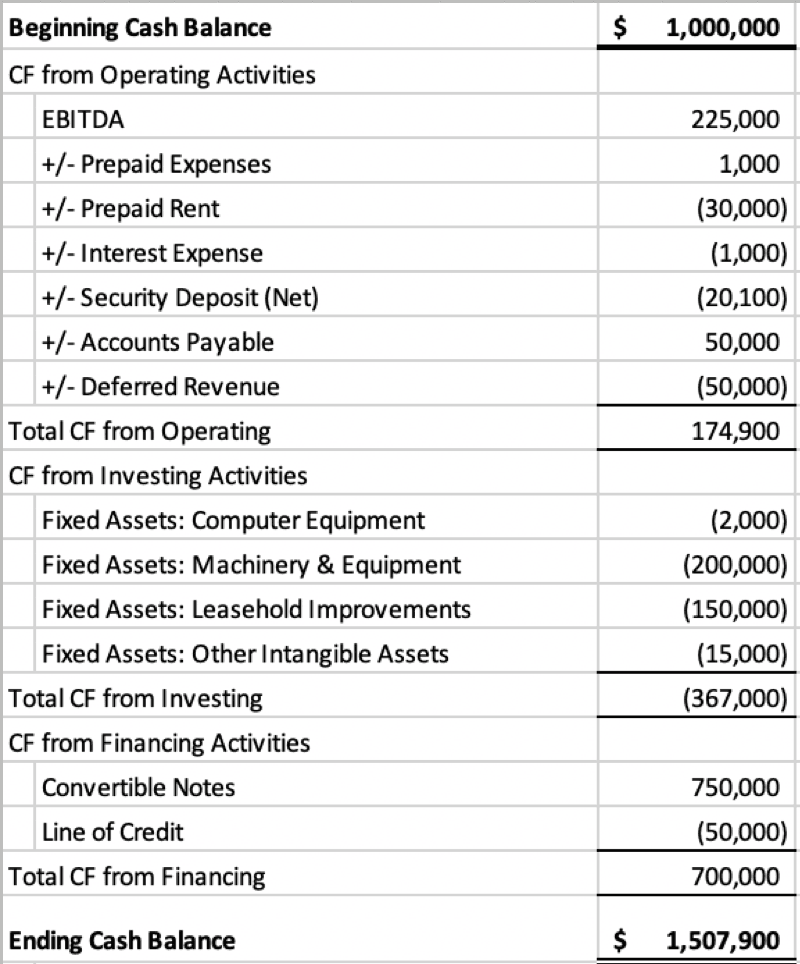

Cash flow statement guide. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. Us financial statement presentation guide 6.1 this chapter discusses the concepts that guide classification within the statement of cash flows. It breaks down the inflows and outflows of cash, giving you a clear picture of how money is.

This should include cash in your bank accounts, cash. A cash flow statement is one of the three basic financial reports—the other two being the balance sheet and income statement (or profit and loss statement). Refer to appendix e of.

Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. Our frd publication on statement of cash flows has been updated to further enhance and clarify our interpretive guidance in several areas. Determine operating cash flow step 2:

A cash flow statement provides valuable insights into the financial health of a business. In this guide, you will get an effective and reliable method of reading and analyzing a company's financial statements, this includes: Janelle mccreary, wealth advisor at rmb.

This is the ultimate cash flow guide to understanding the differences between ebitda, cash flow from. The cash flow statement indirect method format involves adjusting the net income with changes in the balance sheet accounts. The goal is to arrive at the amount.

We will use these names interchangeably throughout. A cash flow statement (cfs) is one of the three primary financial statements (along with an income statement, also known as a profit and loss statement, and a balance sheet). Examine financing cash flow step 4:

The first step in creating your cash flow statement is to determine your beginning cash balance. Assess investing cash flow step 3:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)