Smart Info About Profit And Loss Review

.png?width=1300&height=818&name=Profit Loss Macbook (1).png)

Profit (p) the amount gained by selling a product for more than its cost price.

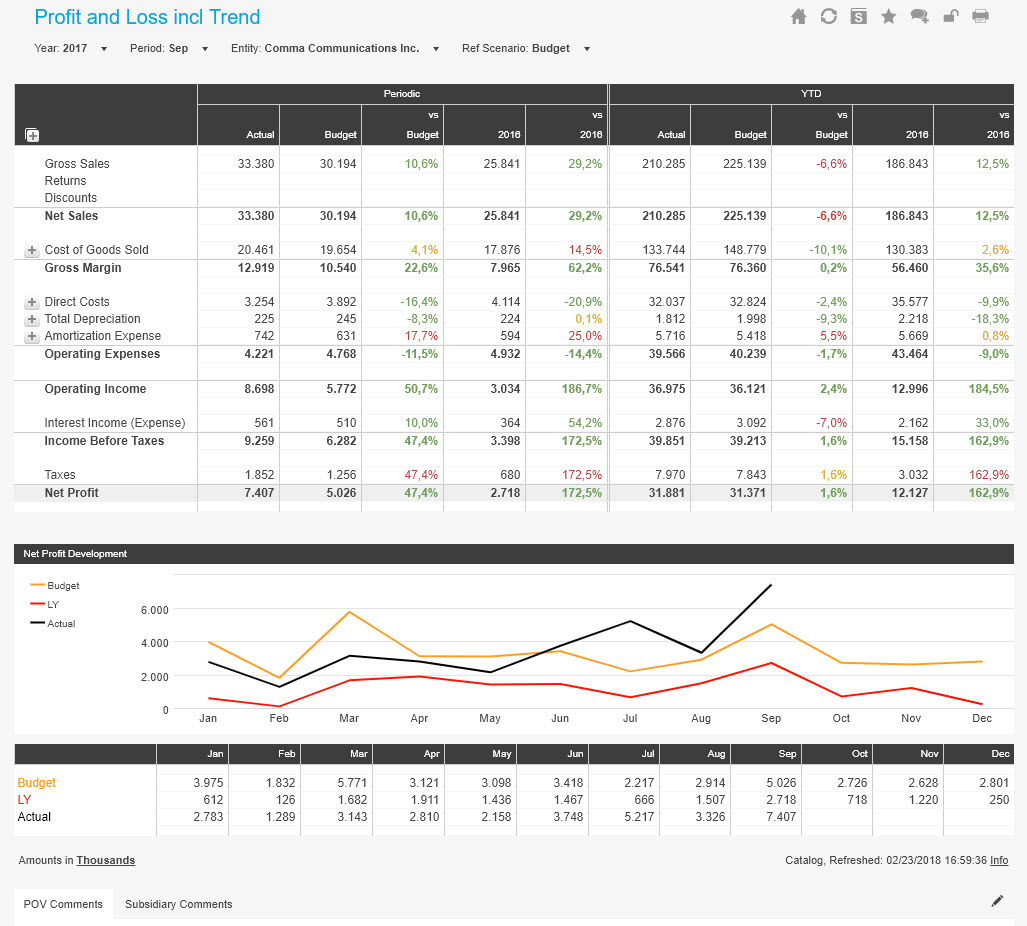

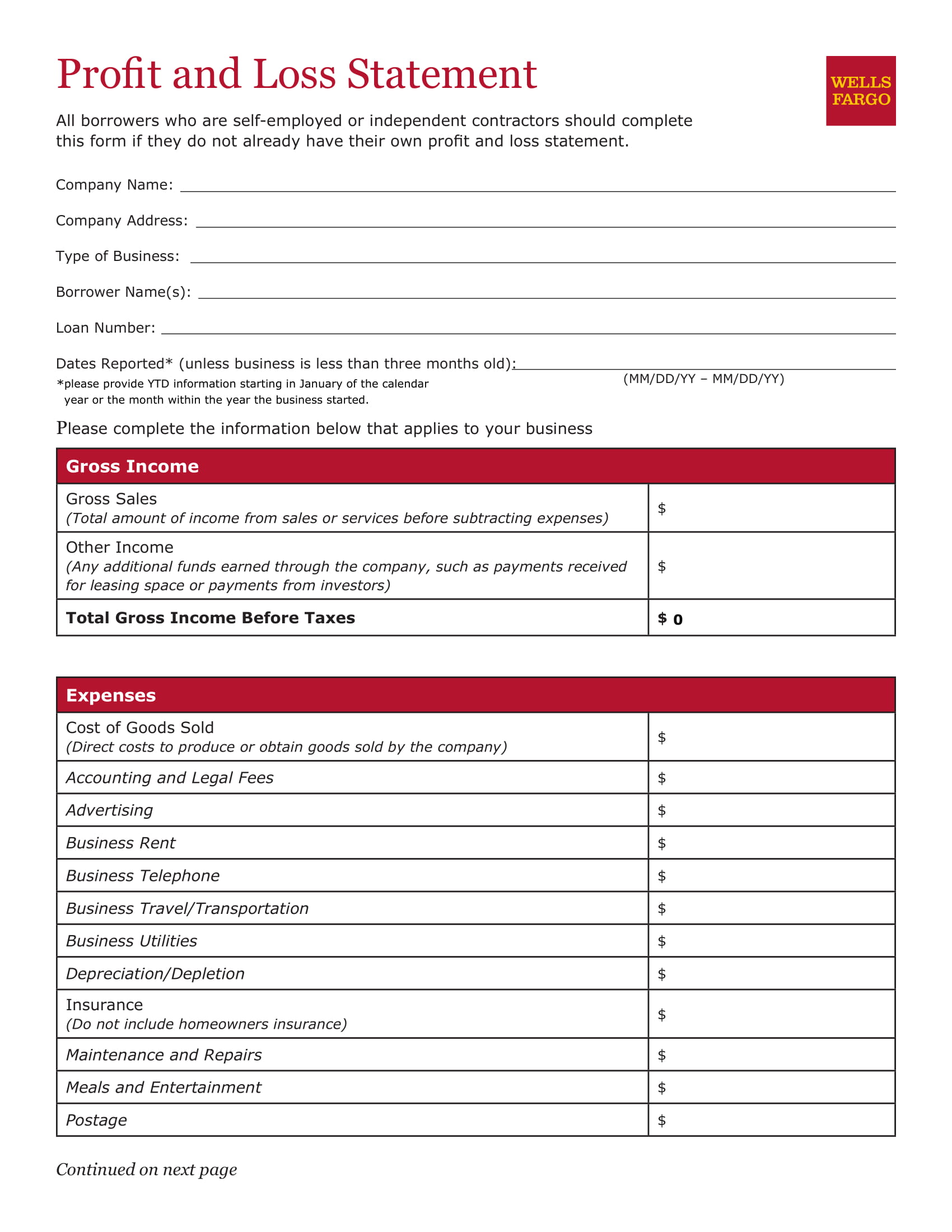

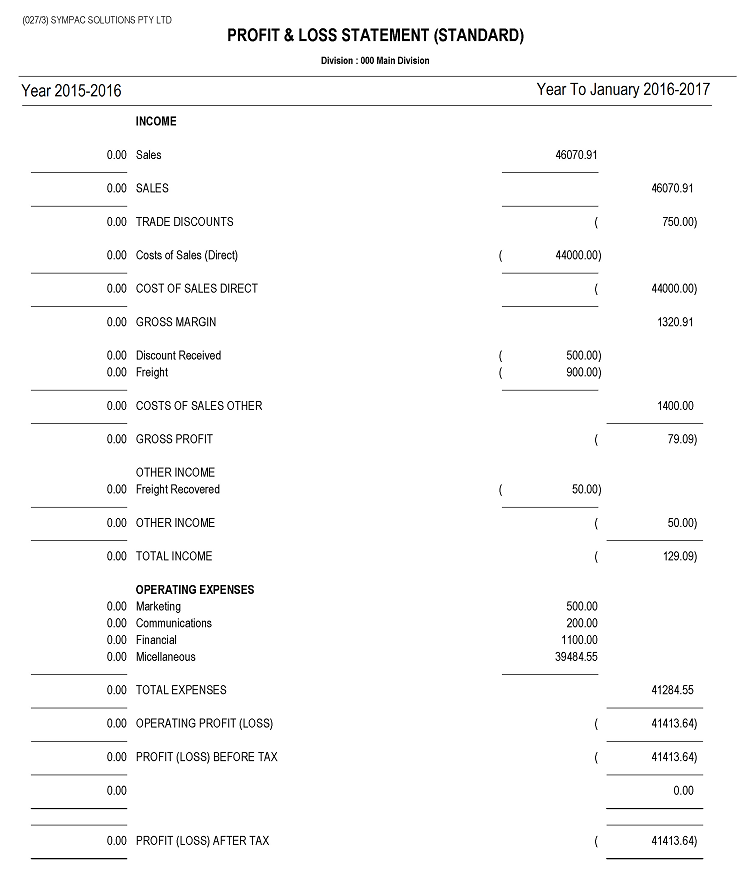

Profit and loss review. A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report. It shows your revenue, minus expenses and losses. The profit and loss report is an important financial statement used by business owners and accountants.

A profit and loss statement (p&l), also known as an income statement or statement of earnings, is a crucial financial document that provides insights into a company’s financial performance. Updating your profit and loss statement helps you check in on the health of your business. Sales this may seem obvious, but you should review your sales first since increased sales is generally the best way to improve profitability.

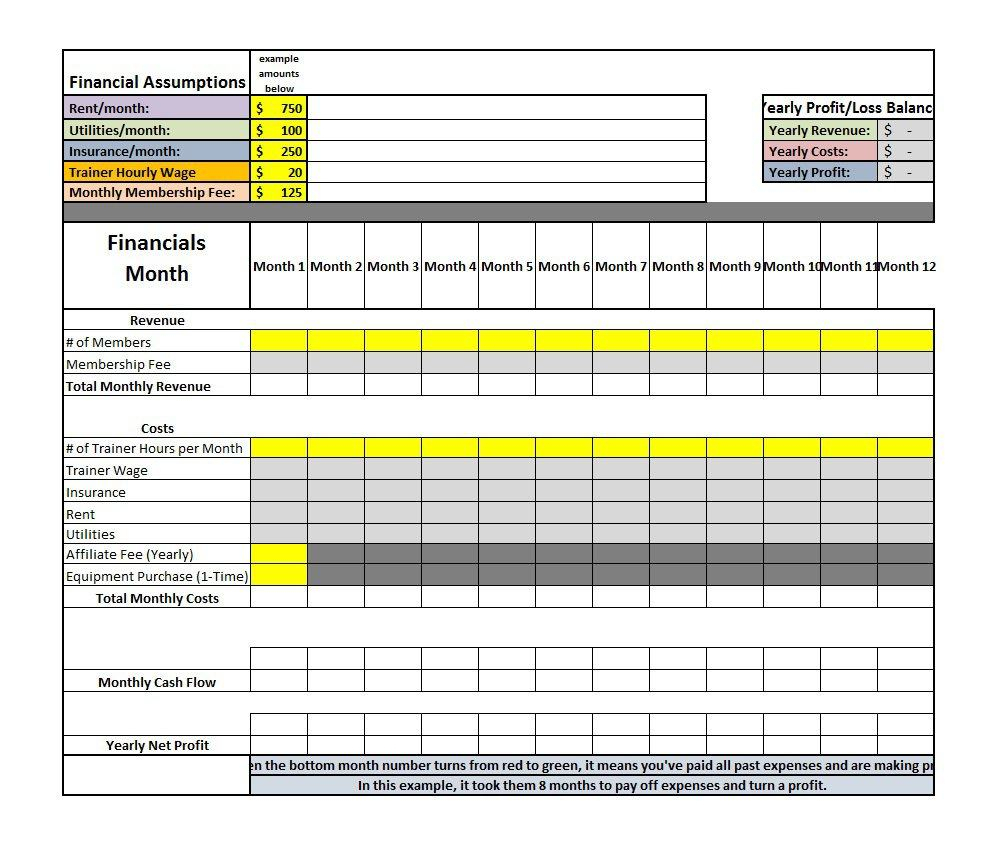

Practice questions faqs profit and loss basic concepts let us learn profit and loss concepts in maths. Your income statement, also known as the profit and loss statement (p&l), summarizes your business revenue and operating expenses over a period of time. Basic elements of the profit and loss report are:

Calculate net profit/loss: Key takeaways a p&l statement shows a company's revenues. The result is either your final profit (if.

Sembcorp industries has posted a group net profit after exceptional items (ei) and loss from discontinued operations was s$942m for the full year of 2023, 11% higher than the s$848m in fy2022. Profit and loss there’s a fundamental difference between your profit and loss and your balance sheet. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. To compare your profit margin to others in your industry, do a google search to find that data, or review a profit and loss statement (and do the calculation discussed above) for a public company in your industry since they publish their financial statements. Bhp, which supplies nickel to electric vehicle manufacturers toyota and tesla, acquired the nickel west business in its $9.2 billion takeover of wmc resources in 2005.

The p&l is carefully reviewed by market analysts, investors, and creditors to evaluate a company's revenues, expenses, and profitability. It's about how to evaluate. Here’s a peek at what you’ll find in this week’s video:

Creating and using p&l statements is easier than you may think. Commonly sales are presented net of different discounts, returns, etc. It is well explained in terms of cost price and selling price.

Once you have the necessary details and figures to calculate your net profit or loss, you then need to understand the components of each side of the equation. This will provide the net profit or loss for each period. This entry represents the value of goods or services a company has sold to its customers.

The profit and loss (p&l) statement is a basic tool that allows you to monitor the money your practice is generating against the money it has spent. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. It summarizes revenues, costs, and expenses, allowing stakeholders to evaluate profitability.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-for-Small-Business-TemplateLab.com_-scaled.jpg)