Sensational Info About 1099 Profit And Loss Statement Manufacturing Balance Sheet Format

Plus, find tips for using these p&l templates.

1099 profit and loss statement manufacturing balance sheet format. In order to prepare the profit and loss account and the balance sheet, a business owner needs to set out the closing balances from the trial balance in the formats shown above in figs 7.1 and 7.2. A p&l statement provides information about whether a company can. Factory profit must be added with cost of production in the manufacturing account and recorded as an income in the income statement.

This ultimately increased profit by $9,000,000 because reported expenses were too low. Both the profit and loss account and the balance sheet are drawn from the trial balance. Plus, we’ll guide you through writing a p&l statement.

The template should automatically open in excel. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Customized profit and loss report.

Download, open, and save the excel template download and open the free small business profit and loss statement template for excel. Manufacturing financial statements manufacturing companies have several different accounts compared to service and merchandising companies. = mark up × cost of production.

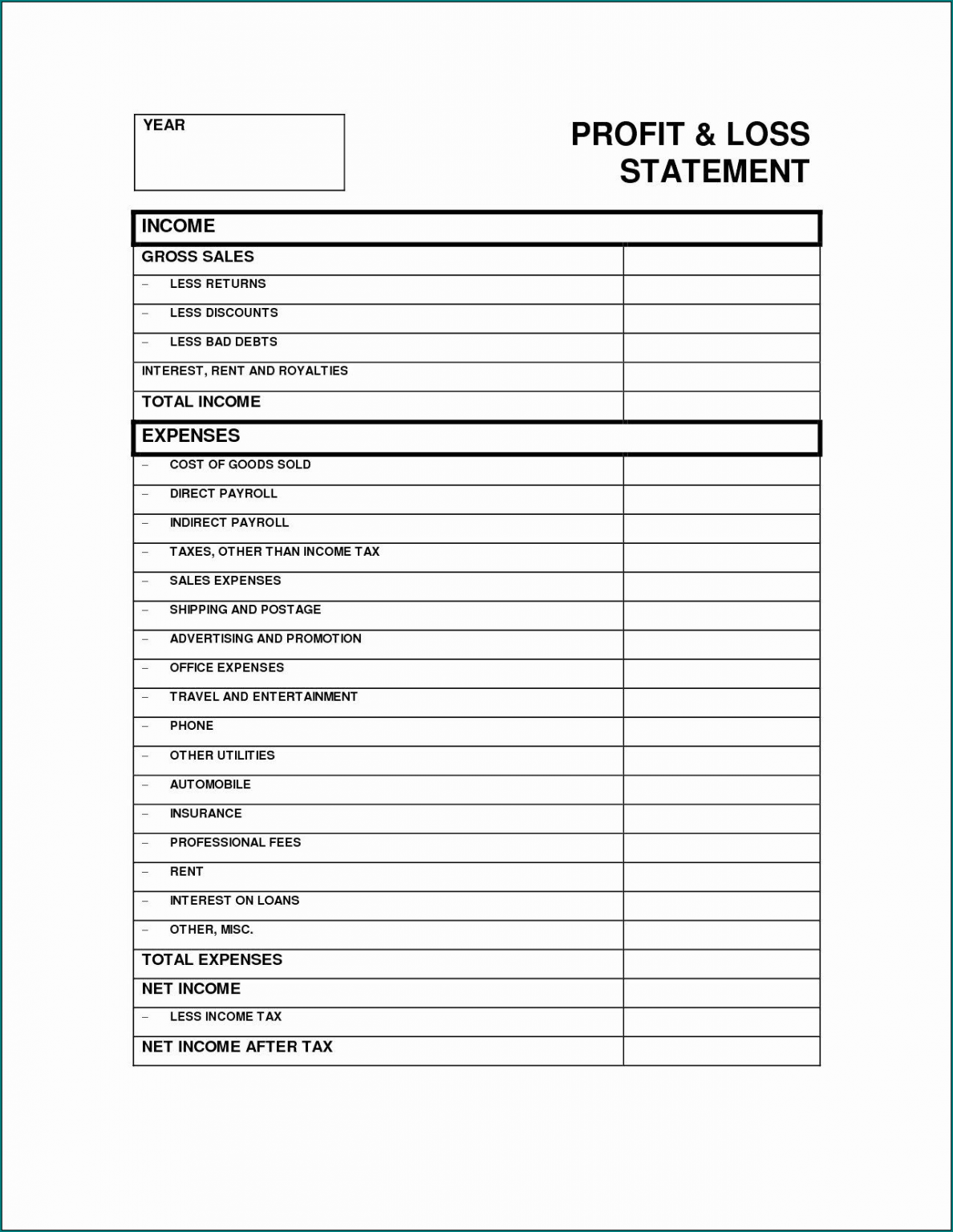

It shows your revenue, minus expenses and losses. #1 monthly profit and loss template A profit and loss statement, also known as a p & l, is a business document used to summarize the financial health of a business during a certain period of time.

The table below summarizes these two accounts: Manufacturing account (statement of production) trading and profit and loss account (income statement) balance sheet (position statement) preparing a manufacturing account shows the cost of materials consumed, productive wages, direct and indirect expenses of production, and the cost of finished goods produced. By failing to record the inventory loss, rite aid overstated inventory (an asset) on the balance sheet by $9,000,000 and understated cost of goods sold (an expense) by $9,000,000 on the income statement.

Show the company9s manufacturing account and the trading, profit and loss account for the year ended. Profit and loss (p&l) statement template. The slight change in the format of the profit and loss account and balance sheet will be as follows.

A balance sheet provides both investors and creditors with a snapshot as to how effectively a companys management uses its resources. By failing to record the inventory loss, rite aid overstated inventory (an asset) on the balance sheet by $9,000,000 and understated cost of goods sold (an expense) by $9,000,000 on the income statement. You can copy and paste initial balance sheet report as values and start to customize it.

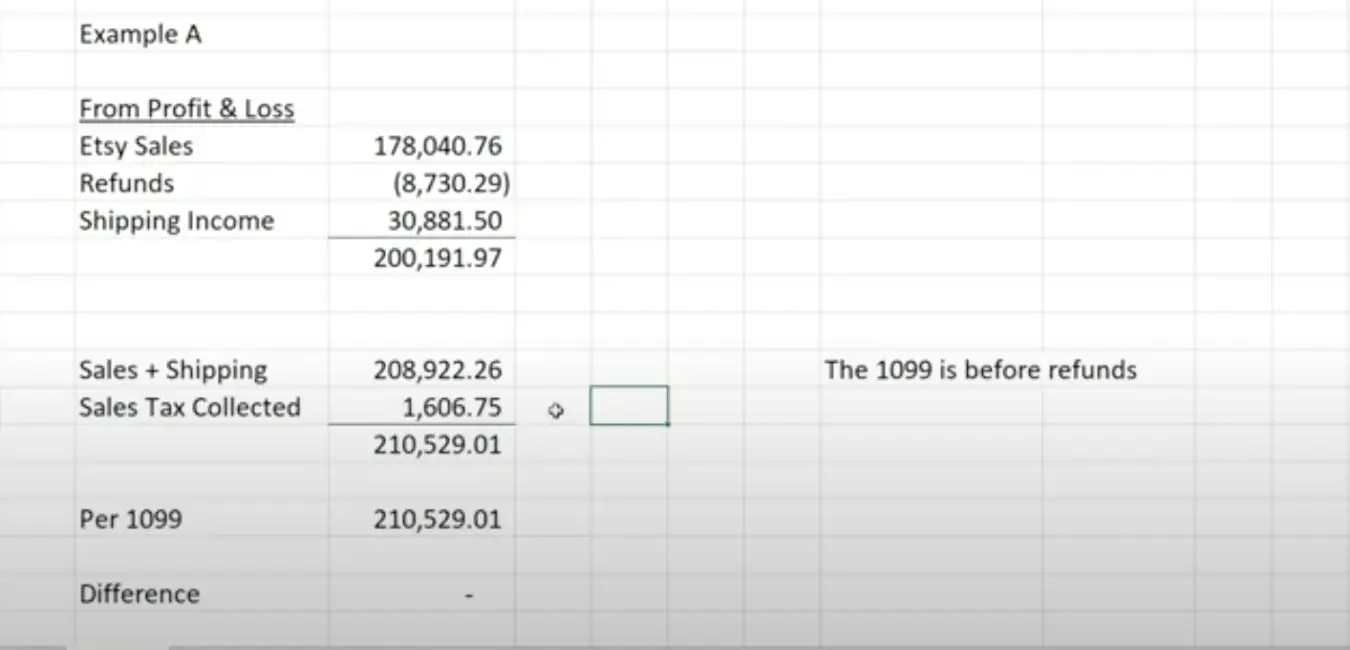

Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received. Below is a screenshot of the p&l statement template: The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services.

Then, it subtracts the costs of making those goods or providing those services, like. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Income accounts vs expenditure accounts there are two main categories of accounts for accountants to use when preparing a profit and loss statement.

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)