Breathtaking Info About Income Tax Paid Cash Flow Statement

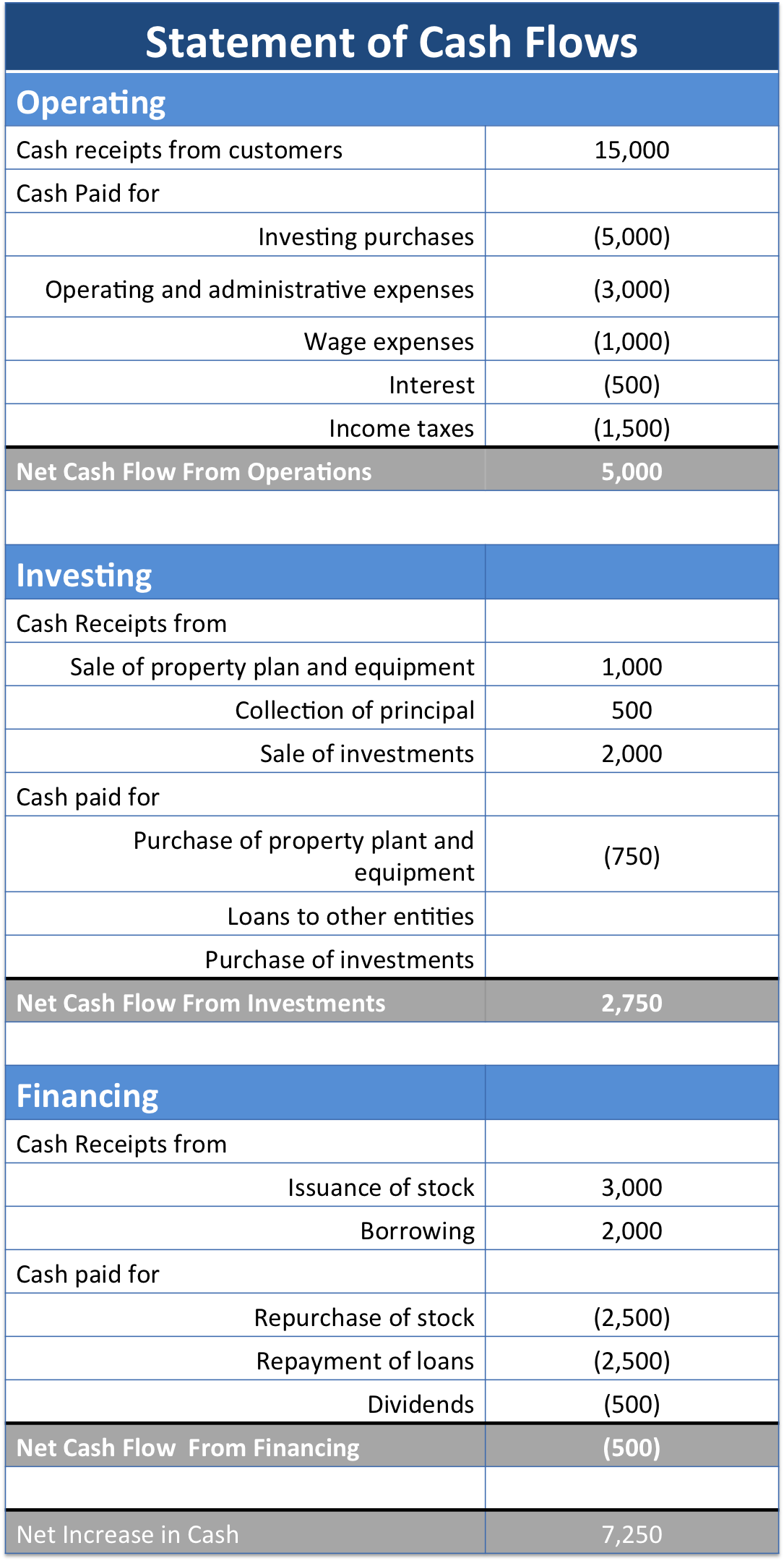

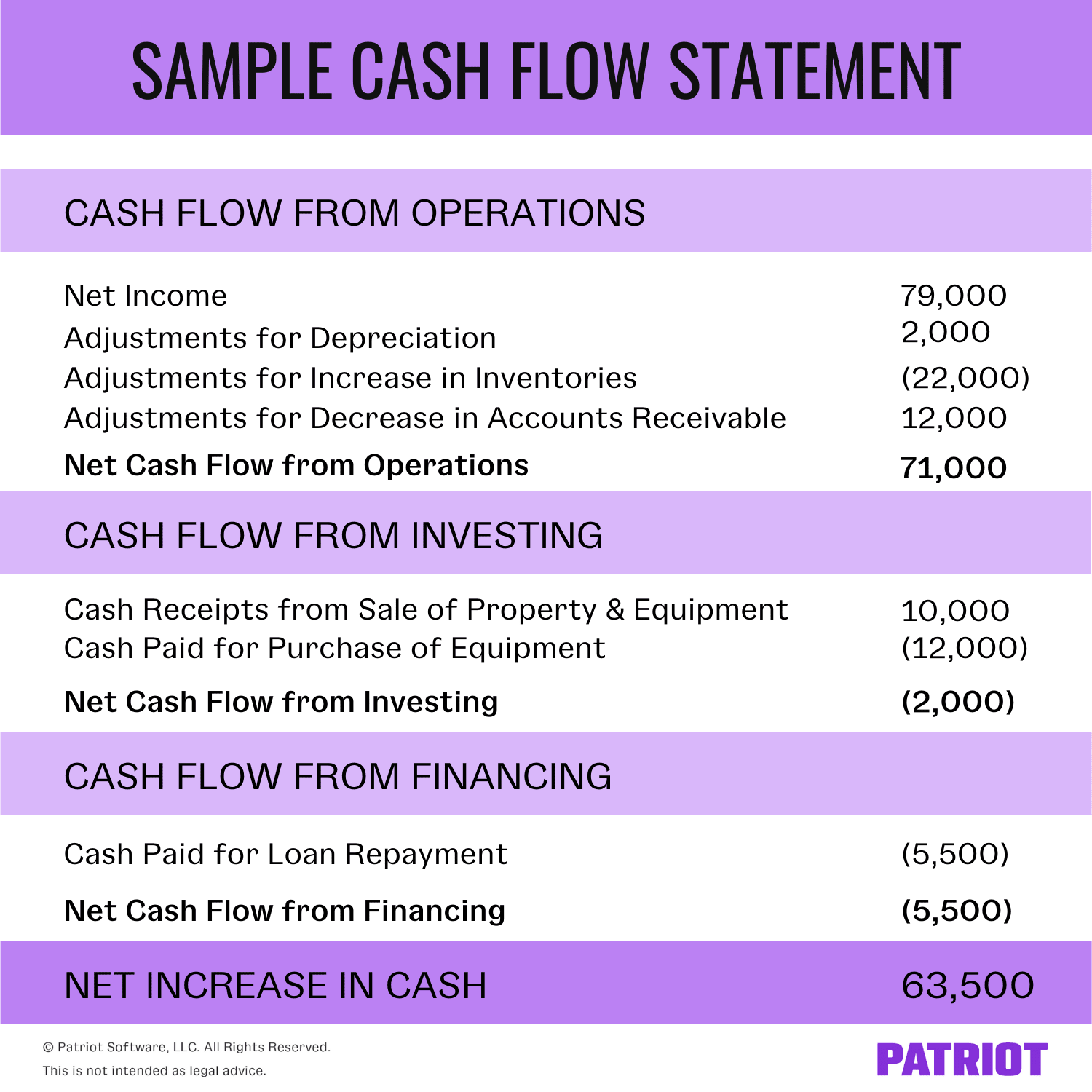

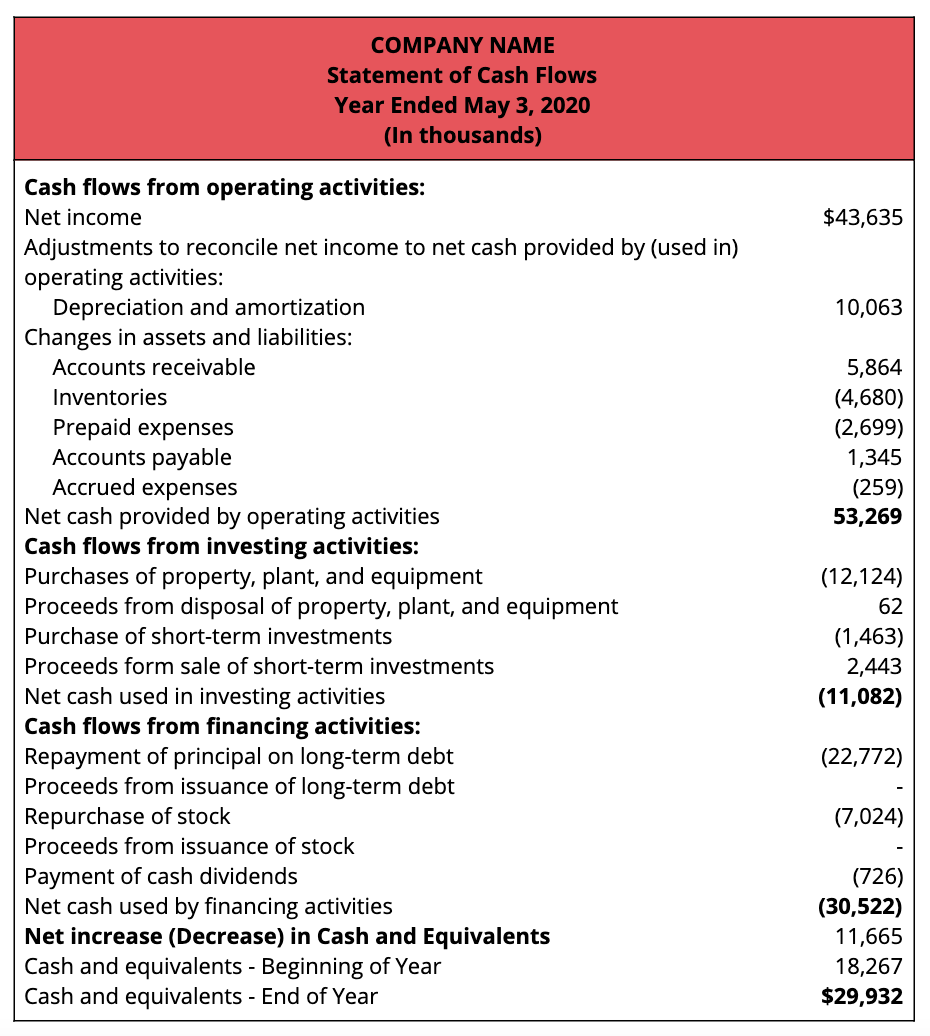

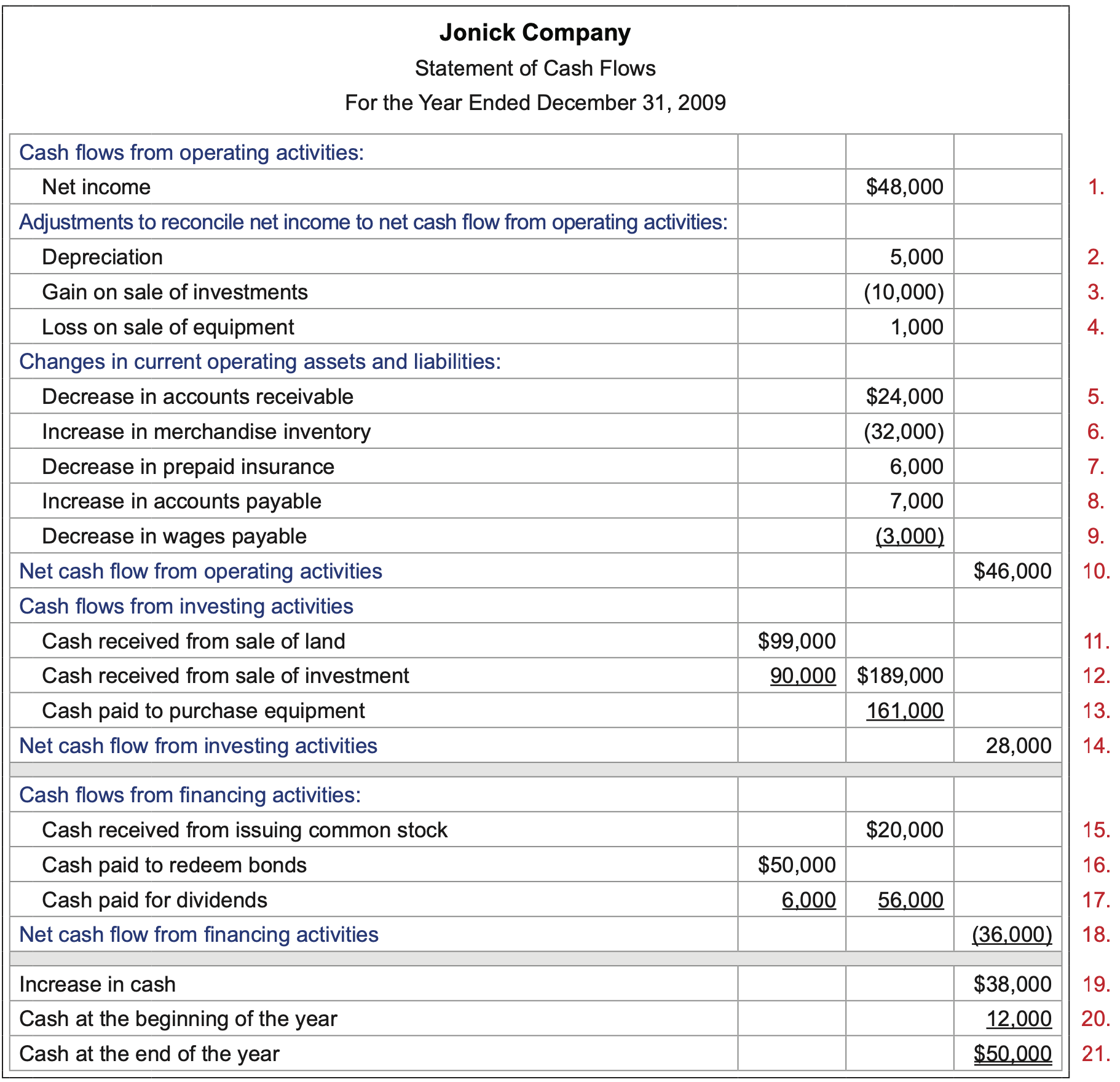

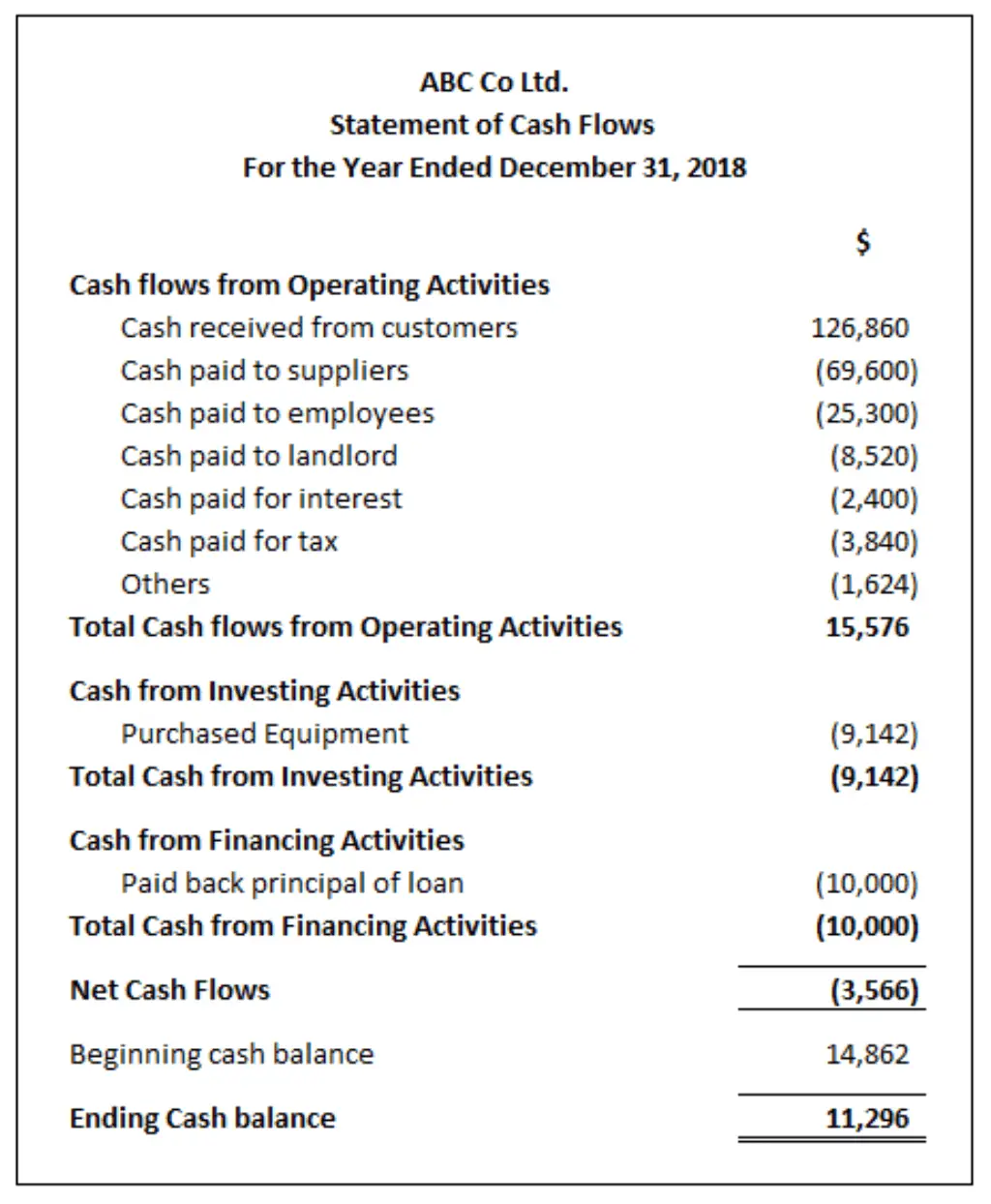

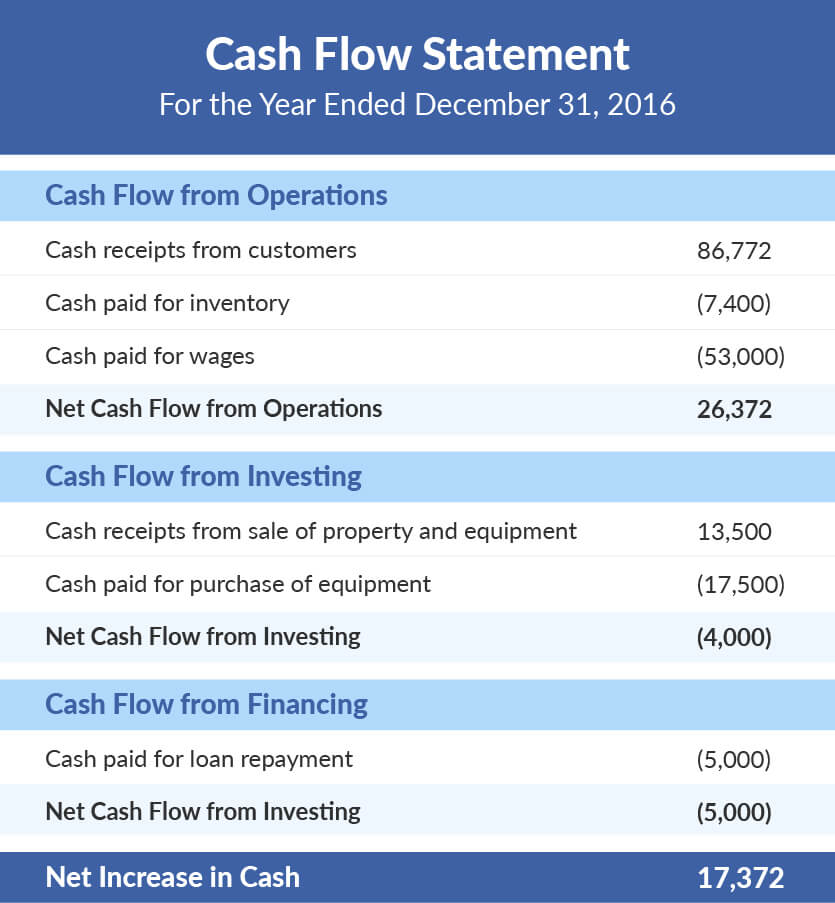

Namely, cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Income tax paid cash flow statement. The time interval (period of time) covered in the scf is shown in its heading. The cash flow statement and the income statement are integral parts of a corporate balance sheet. Because fathom does not receive individual transactions from the source accounting system, we calculate the cash tax paid to know how much actual.

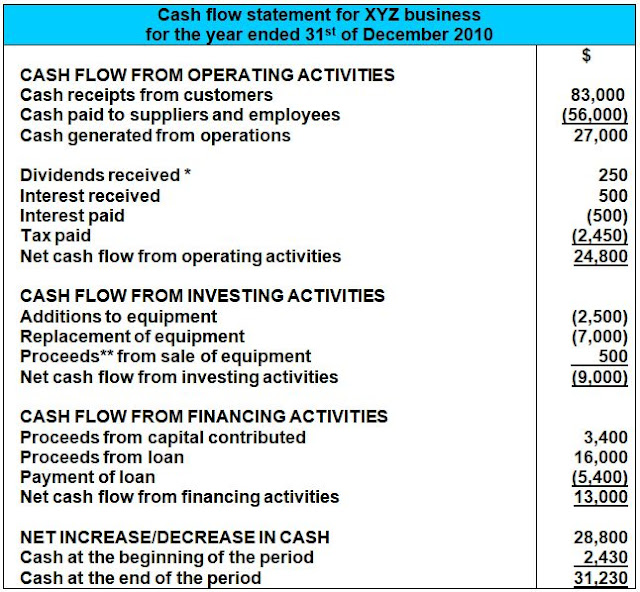

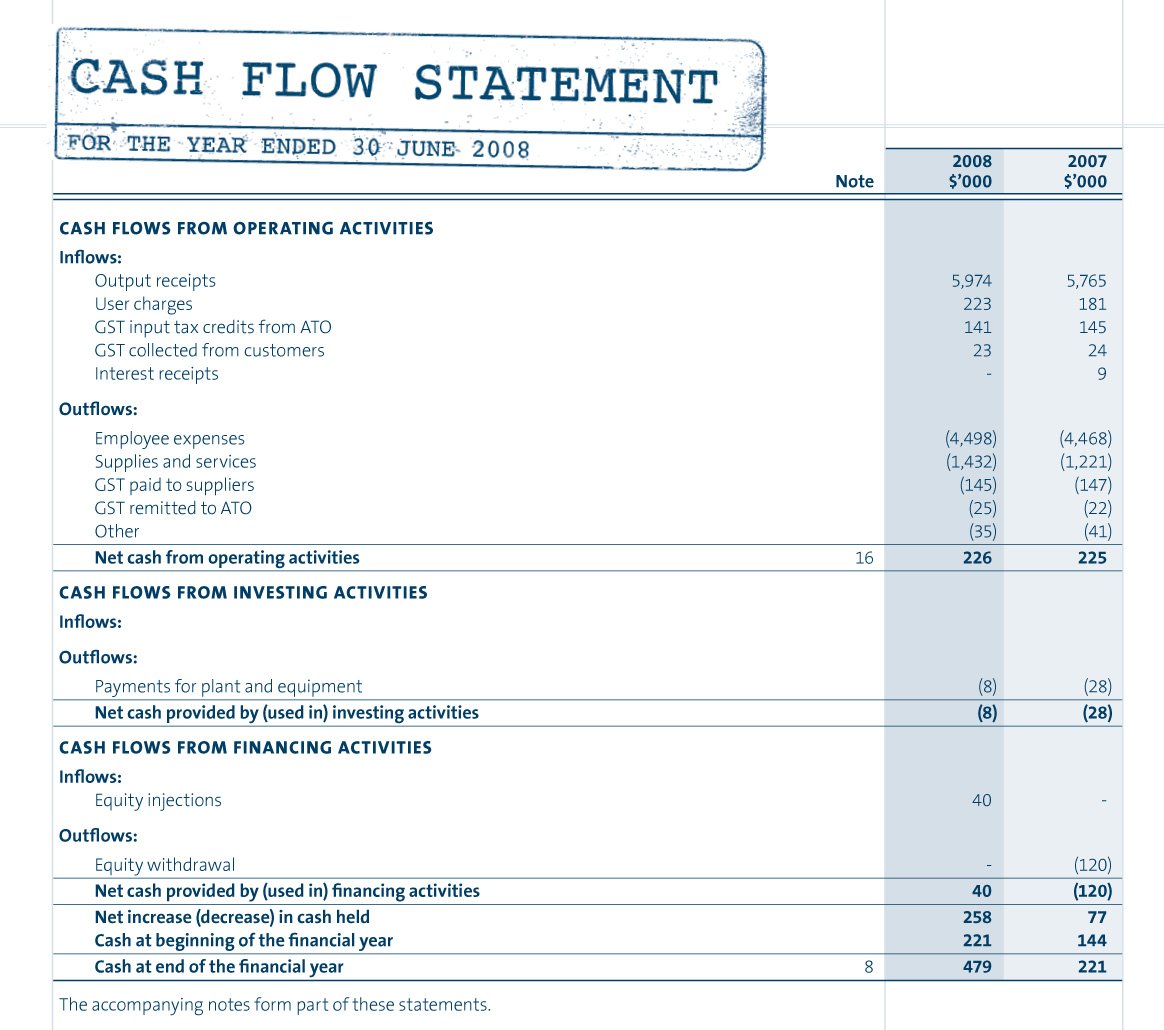

Sfas 95, statement of cash flows, classifies income tax payments as operating outflows in the cash flow statement, even though some income tax payments relate to gains and losses on investing and financing activities, such as gains and losses on plant asset disposals and early debt extinguishments. Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements,. The cash flow statement also includes information on tax expenses.

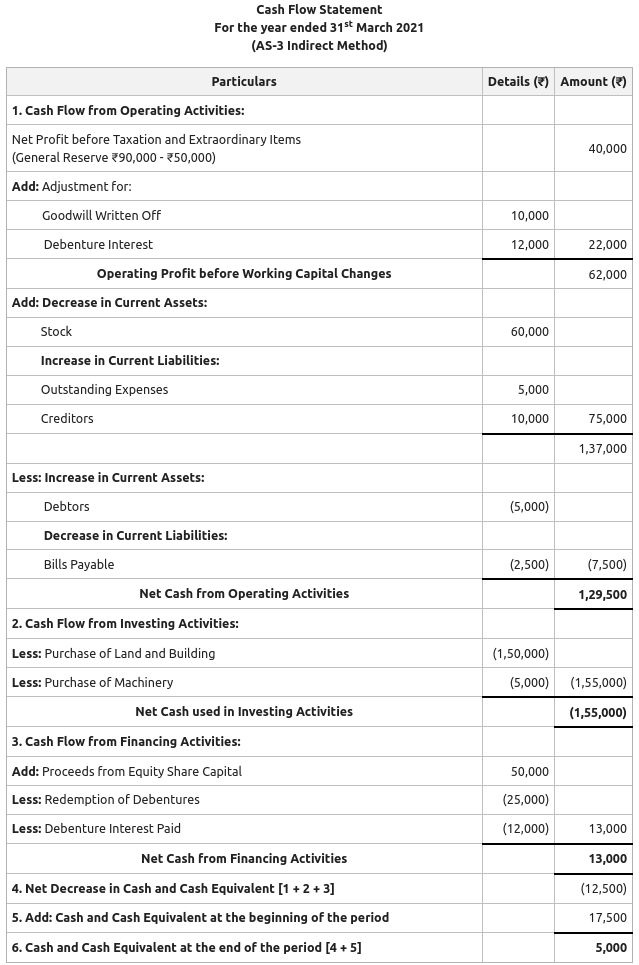

How to prepare cash flow statement? Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing activity cash out flow and dividends paid, which is a financing activity cash out flow. It is common to not only miss these disclosures but also.

Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities; Tip you report income tax payable on your current profits as a liability on the. The amount of interest and income taxes paid are often overlooked when using the indirect method of reporting the statement of cash flows.

The cash flow should be calculated by reference to: The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Calculation of interest/income taxes paid.

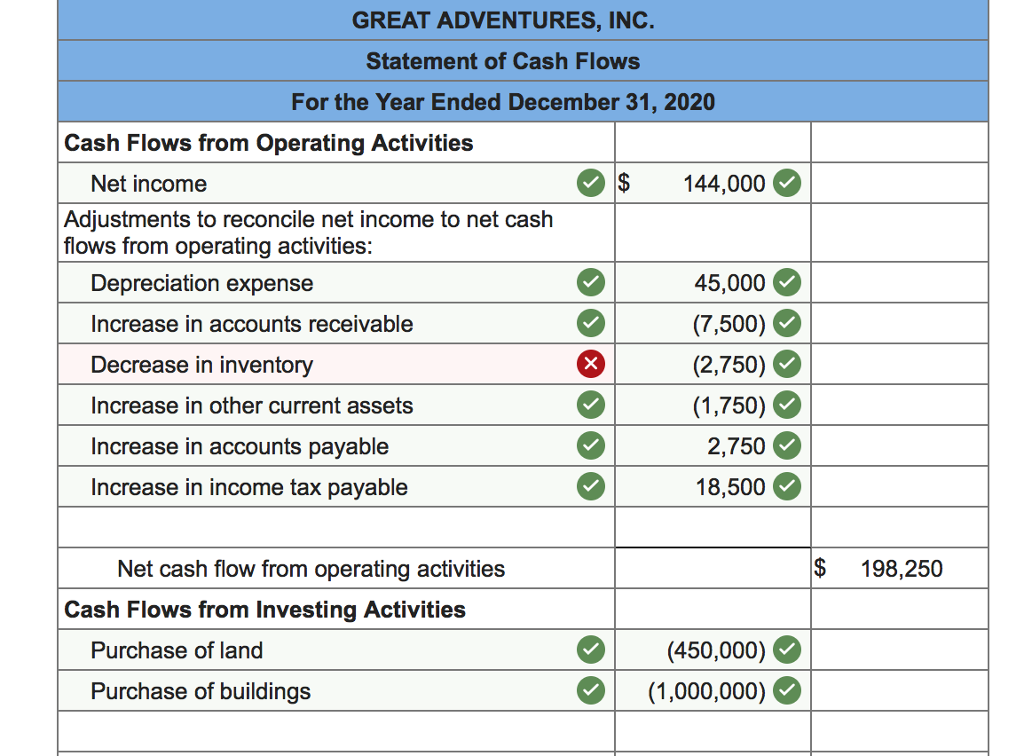

The reported tax account balance owed to authorities paid in arrears: Cash flow from operating activities is calculated by adding depreciation to the earnings before income and taxes and then subtracting the taxes. Interest and taxes:

While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. A t account working may be useful:

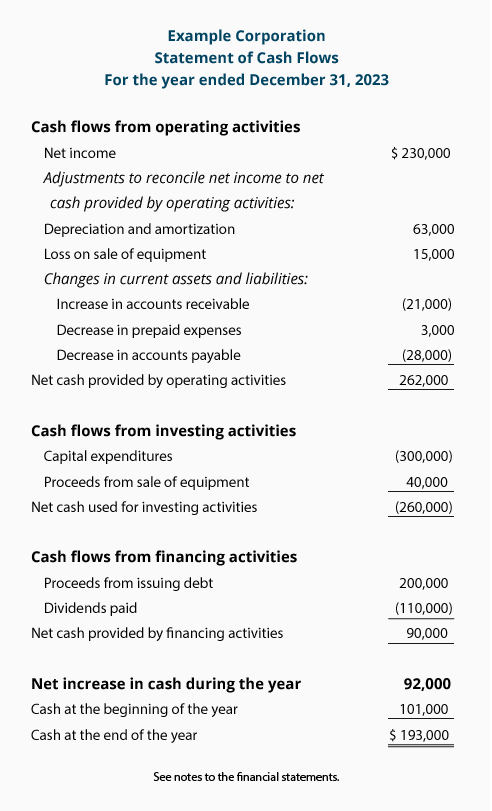

A company's ebit —also known as its earnings. The tax paid in the year can be calculated by taking the opening balance of tax payable in the statement of financial position, adding the tax charged in the income statement, and deducting the closing balance of tax payable. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities.

The cfs measures how well a. Cash tax paid is an estimate of the tax amount actually paid in a given period. Two examples include year ended december 31, 2022 and three months ended september 30, 2022.

Income tax payable goes on the balance sheet while you find tax paid in the cash flow statement. The amount paid will be deducted from the amount of cash generated from operations in operating activities. The tax paid in the current accounting period

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)