Here’s A Quick Way To Solve A Info About Clearing Accounts On Balance Sheet

The second point to ponder is that a clearing.

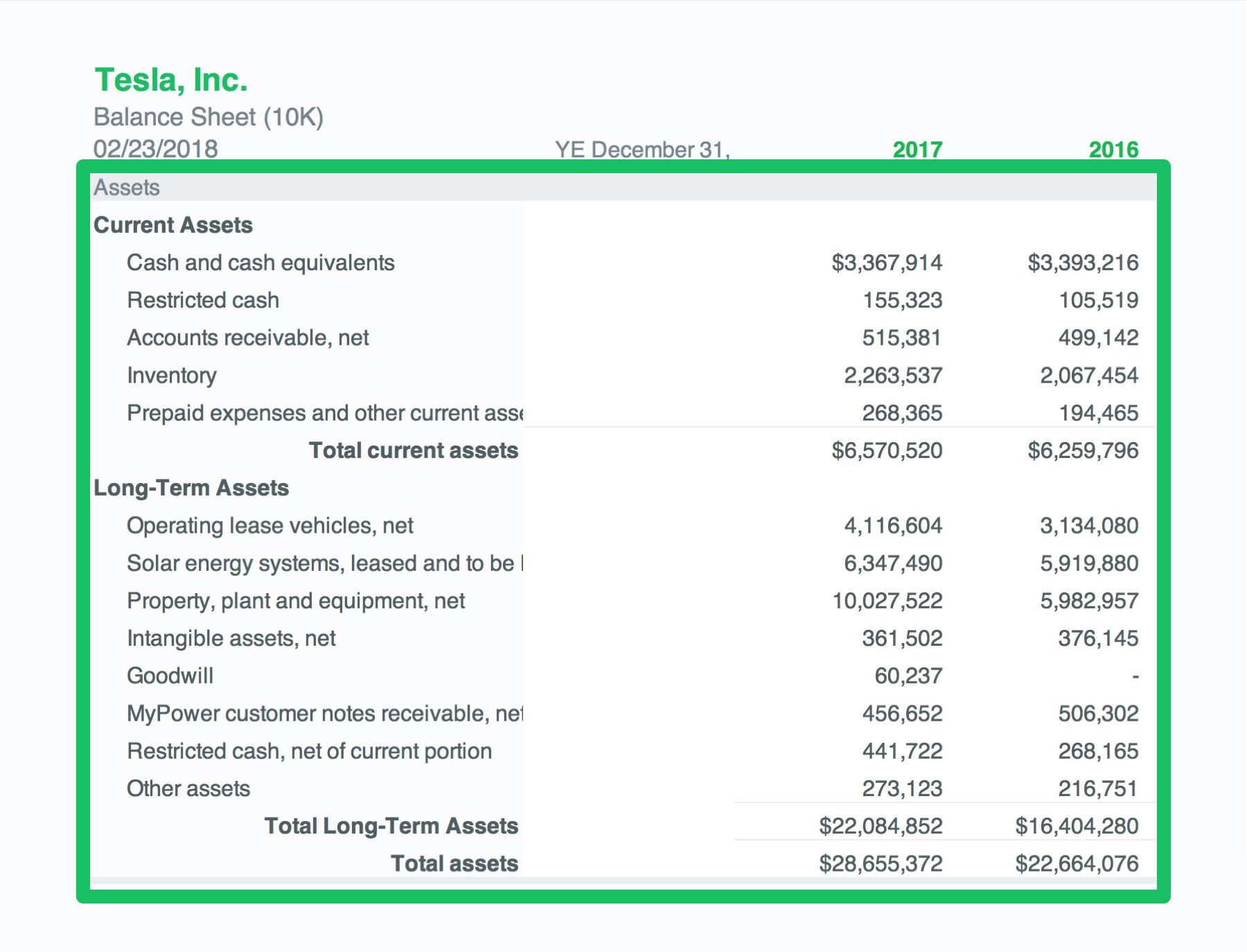

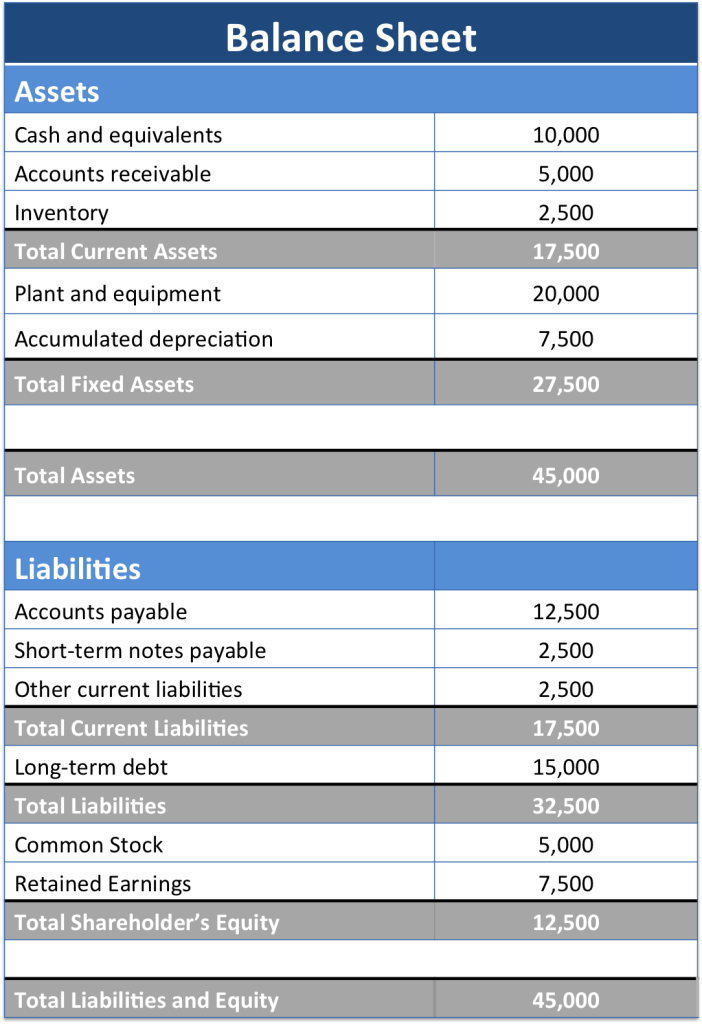

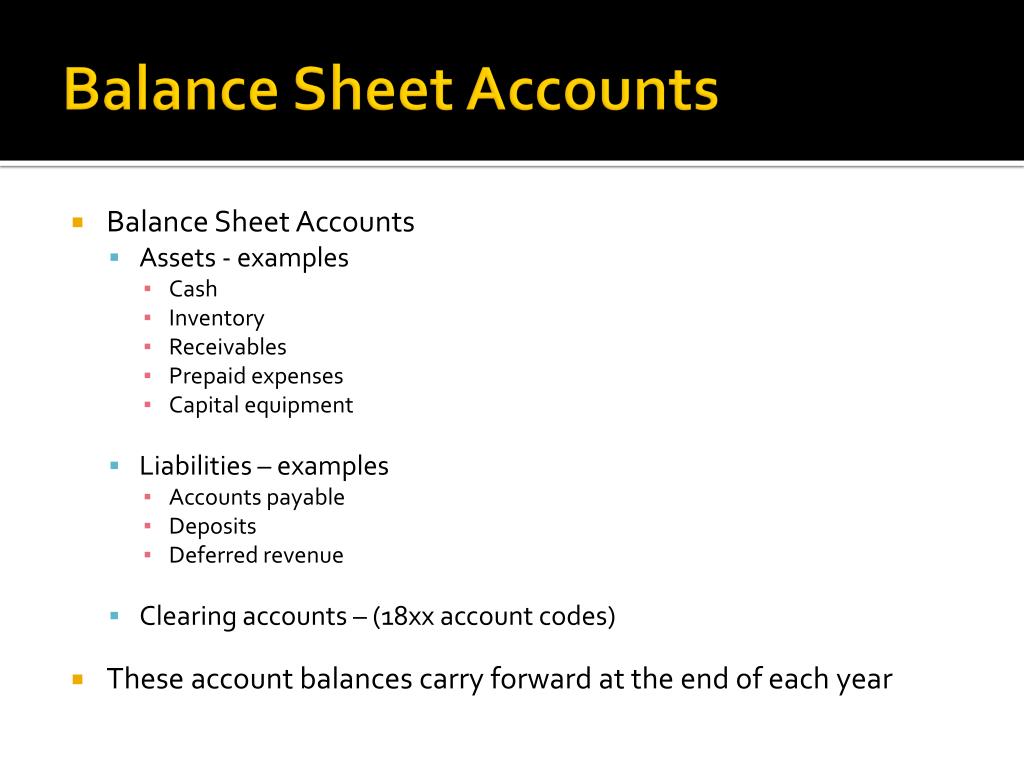

Clearing accounts on balance sheet. For example, you may have high amounts of payroll, a high volume of invoices, or both. Like anything, starting with the basics is best before upgrading or. A payroll clearing account is a general ledger account that is normally set up in the asset section of the balance sheet, says john w.

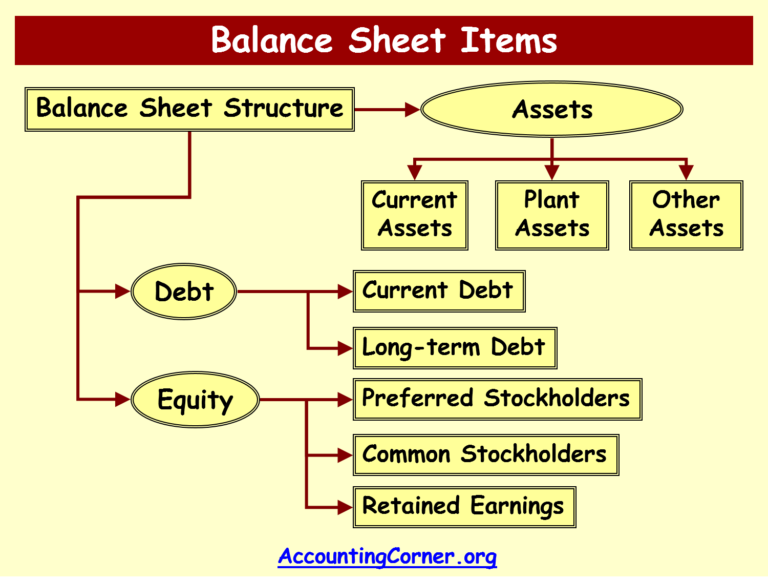

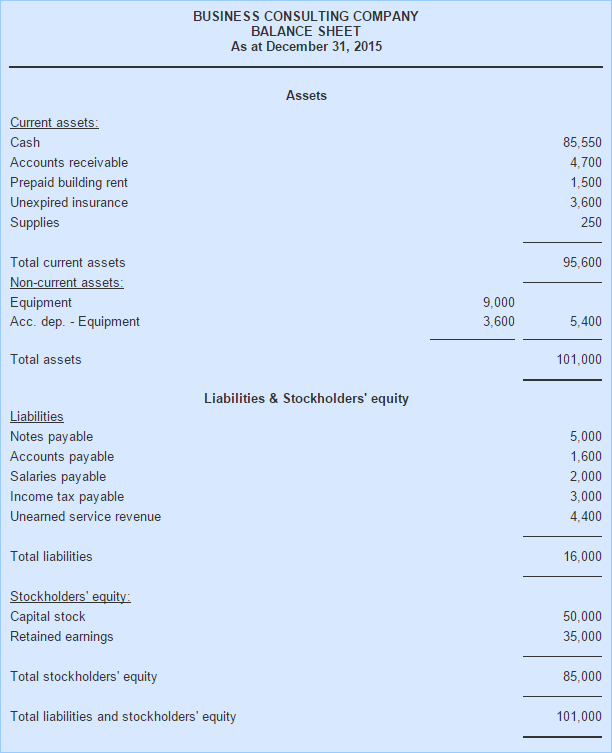

A general ledger account which serves to summarize similar transactions. Use a clearing account in your general. You must take four core steps to ensure your balance sheet is accurate and presentable.

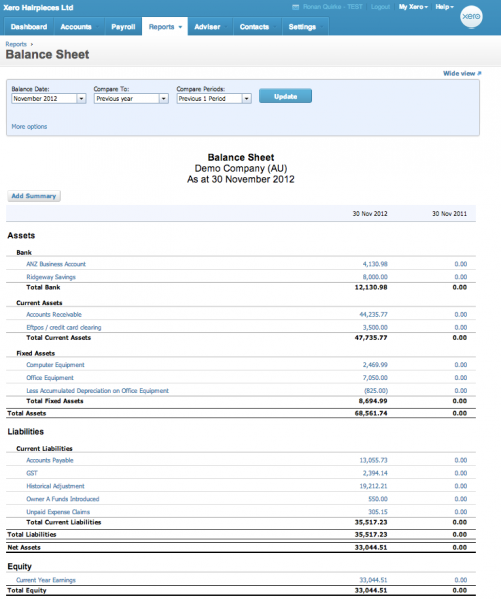

It involves comparing the balances in the balance. Finance your business what is a clearing account in accounting? Another way to achieve a clean balance sheet is to undergo a bankruptcy or liquidation process.

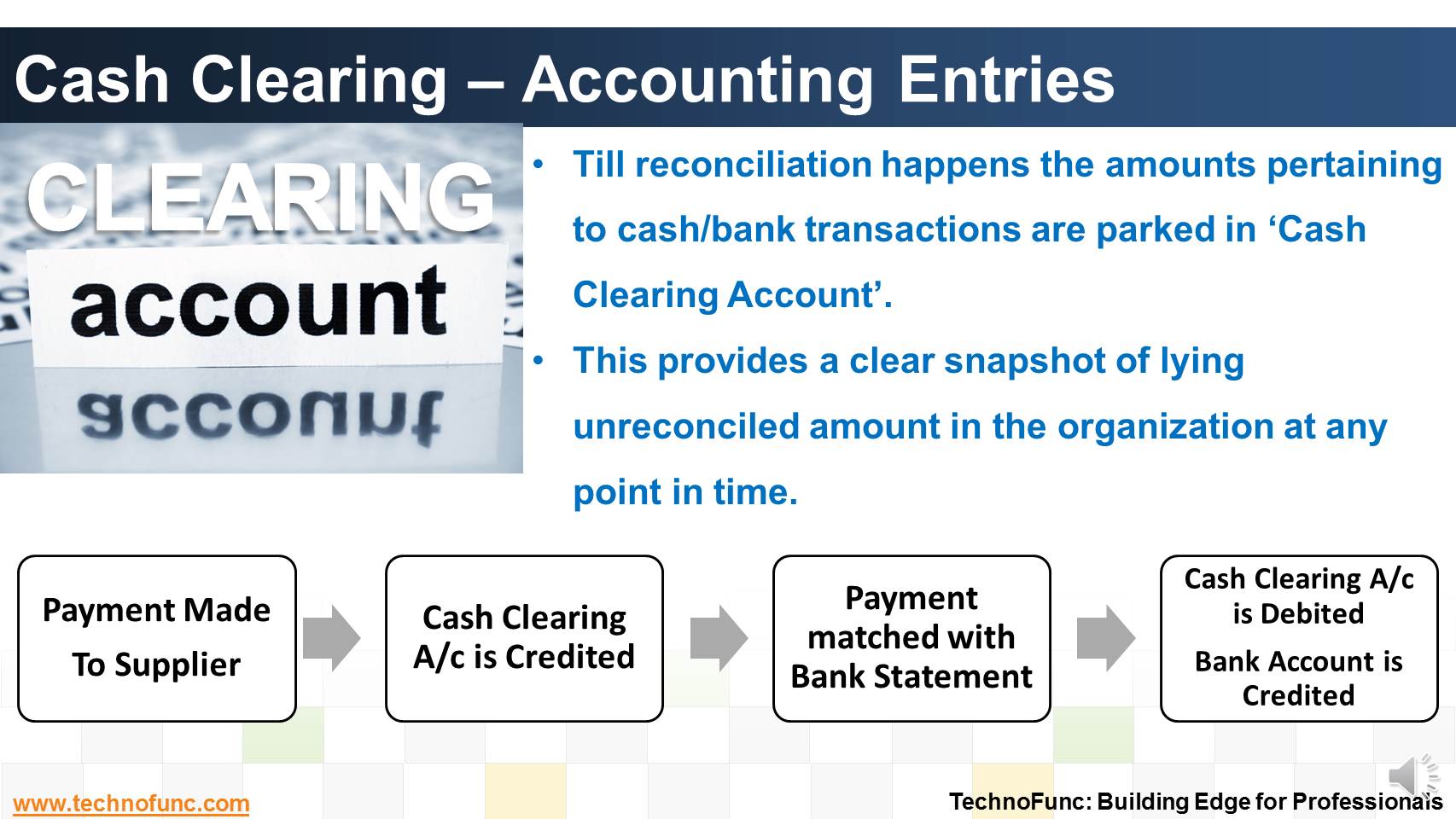

November 10, 2022 the main purpose of clearing accounts clearing accounts provide time to review and confirm each item before moving them to their correct locations. Balance sheet reconciliation is simply a process that ensures the accuracy of a company’s financial statements. How does a clearing account work?

A clearing account is a general ledger, which helps businesses and accountants to keep the details about financial transactions on a temporary basis. A steady stream of income can be difficult to keep track of, especially if customers do not attach an invoice or otherwise. For example, all of the closing entries involving operating expenses might.

To allocate expenses to overhead or class using a. A clearing account is a general ledger account that is used to temporarily aggregate the amounts being transferred from other temporary accounts. Quickbooks online (qbo) is currently unable to delete accounts from your chart of accounts.

A clearing account is a general ledger that allows accountants to maintain transaction details temporarily. Generally, you open a clearing account because you cannot classify the funds directly and must wait for more information. The balance of the clearing account at the end of the month would be made up of two amounts.

The first point is that the financial health highlighted in the clearing account is not in use in the balance sheets. Its purpose is to record income. Clearing account on the balance sheet represents a temporary account used to record transactions that need to be reconciled or settled before being transferred to their.

Jay, mba, who has written. By steffani cameron published on 7 jun 2018 it’s easy to fall under the misapprehension. A viewer asked about reconciling clearing accounts.

Typically, companies with a high volume of funds coming in or going out use clearing accounts. Run a balance sheet to see it. Companies can use a chapter 11 reorganization to shed debt and.