Have A Info About Suspense Account In Balance Sheet

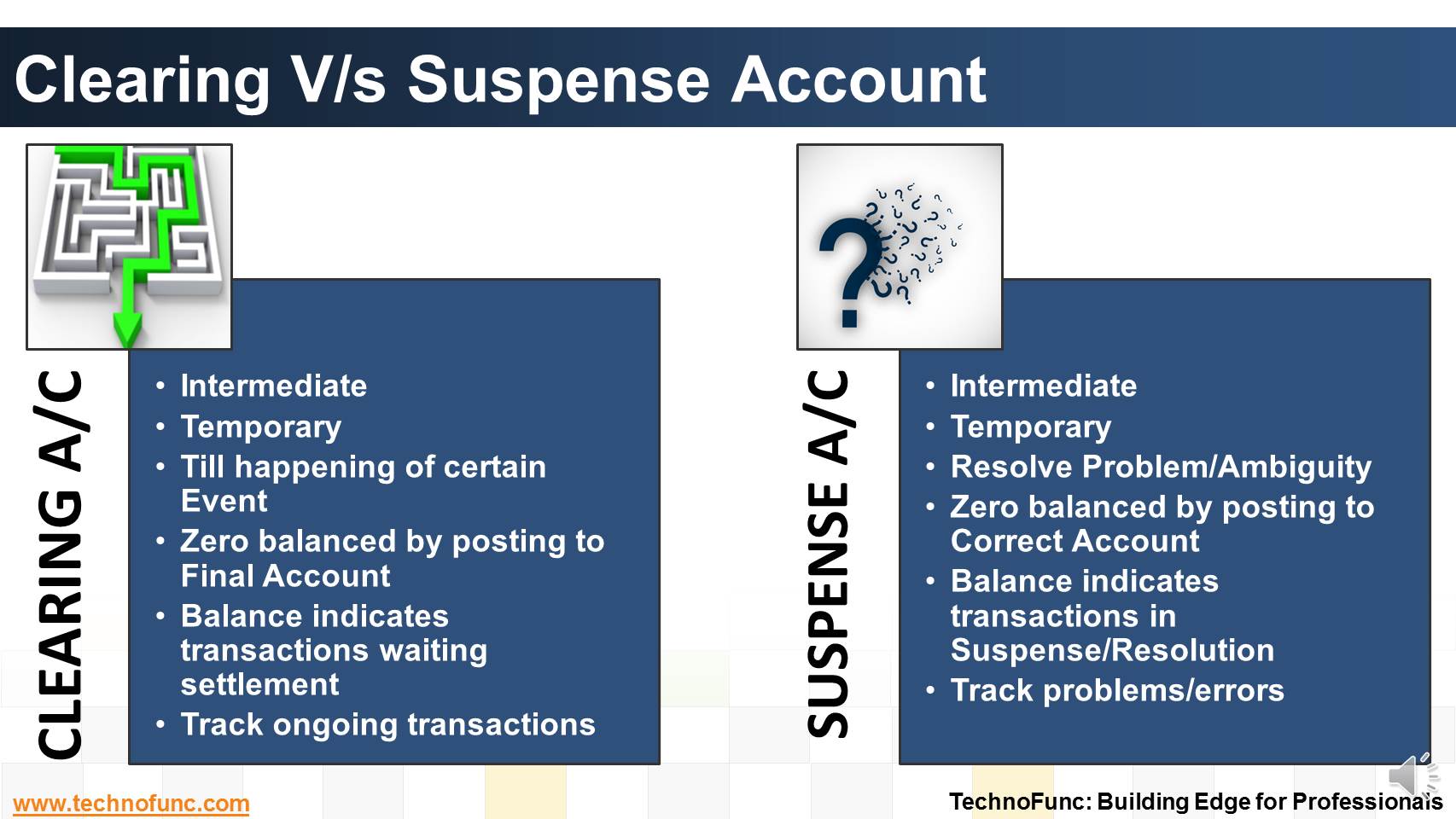

Suspense account is a holding account used in accounting and finance to temporarily record financial transactions until they are transferred to their designated destination, including entries that are unclassified, unallocated,.

Suspense account in balance sheet. The suspense account is situated on the general ledger and is used to temporarily store specific transaction amounts. What is a suspense account? This money can be recorded under the suspense account.

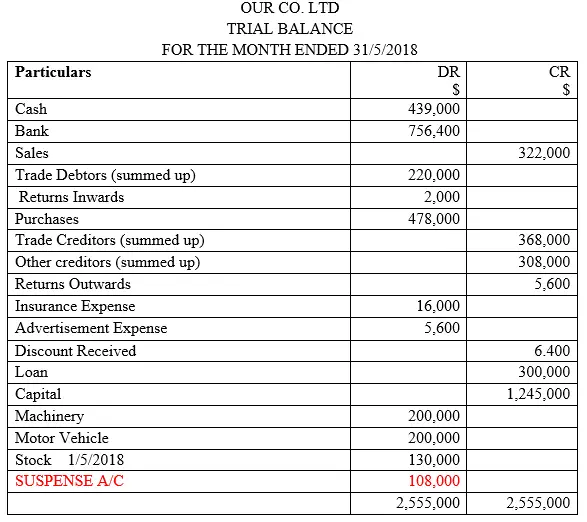

A suspense account is a general ledger account prepared in the following situations; The aim of a suspense account in balance sheet terms is always to be a balance of zero, as this means that everything has been correctly recorded, and there are no anomalies unaccounted for. They will then insert a suspense account, which records and temporarily stores these discrepancies.

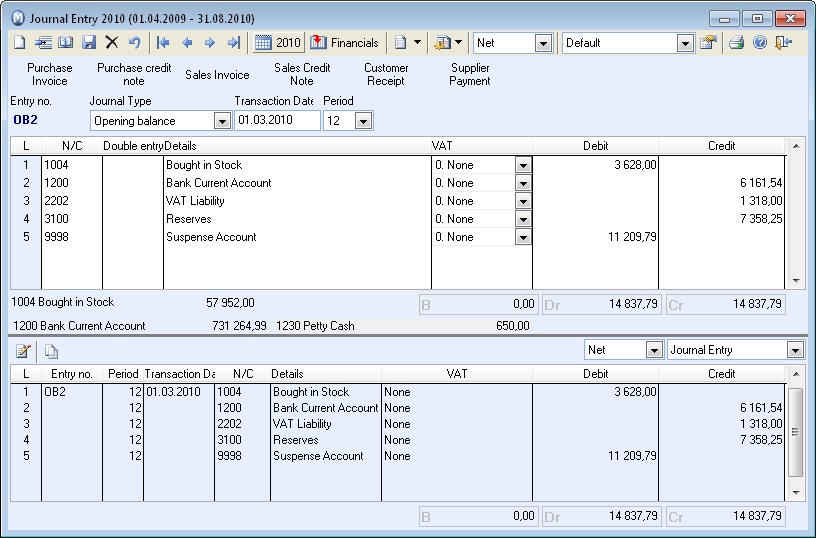

The account temporarily stores entries while you decide how to categorise them. Later, you can decide to record it under a relevant sales account. A suspense account is an account used to temporarily store transactions for which there is uncertainty about where they should be recorded.

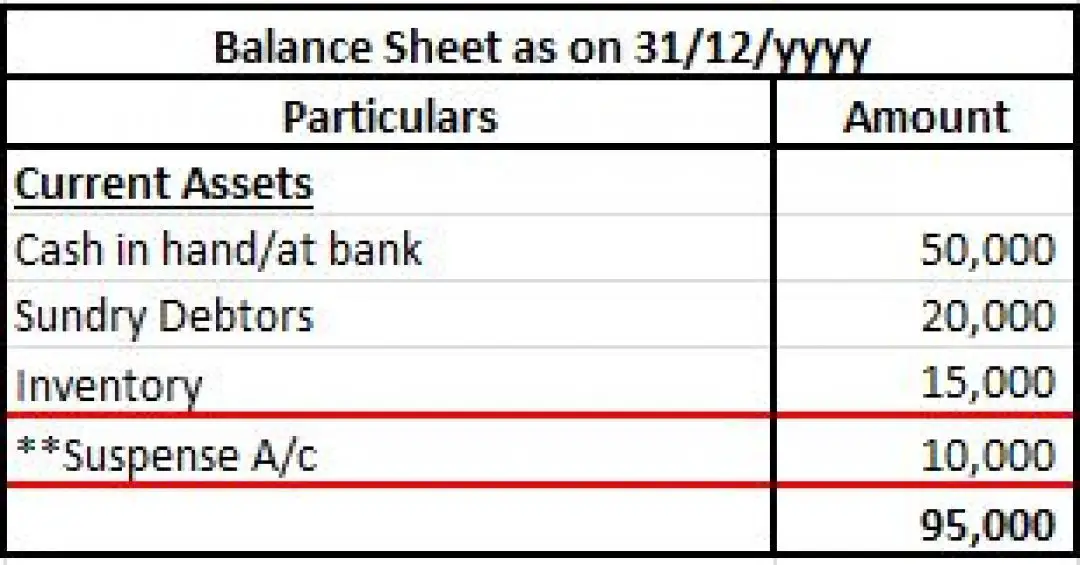

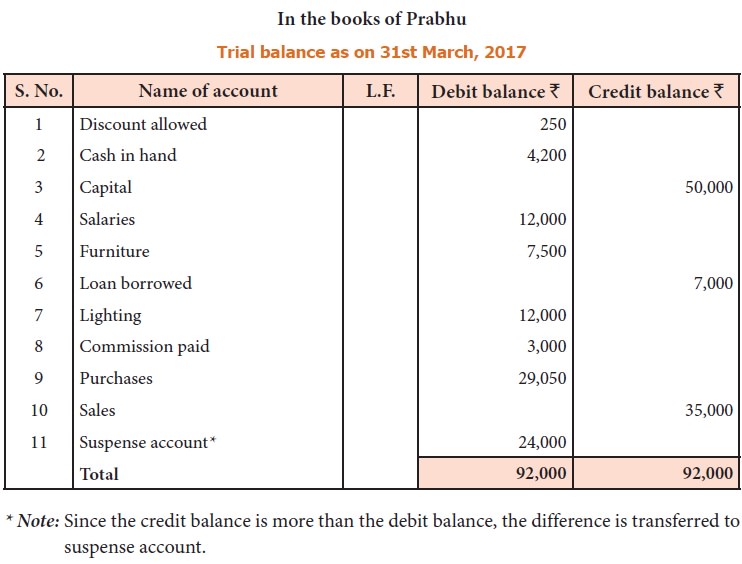

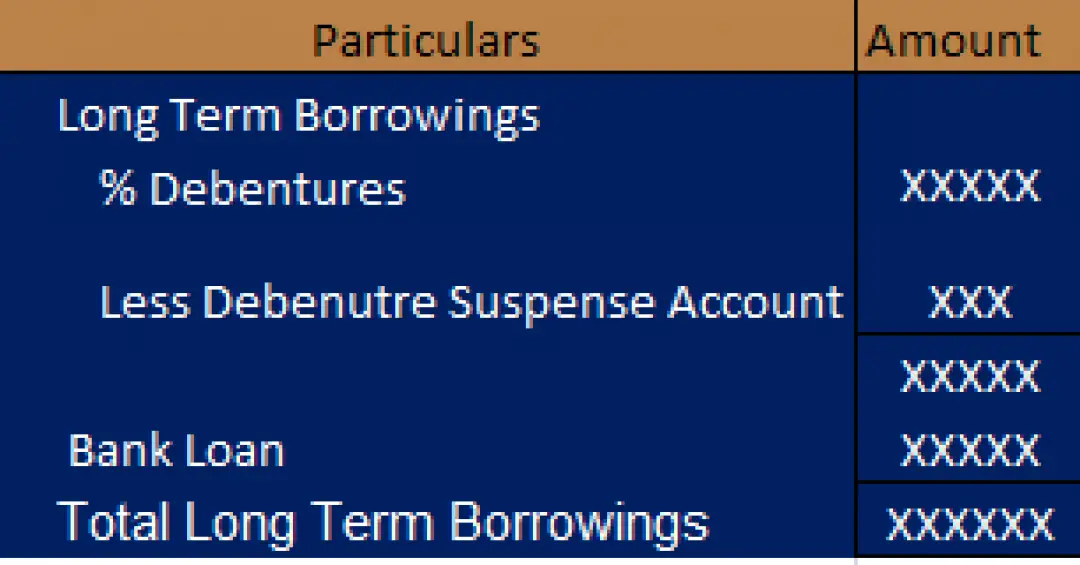

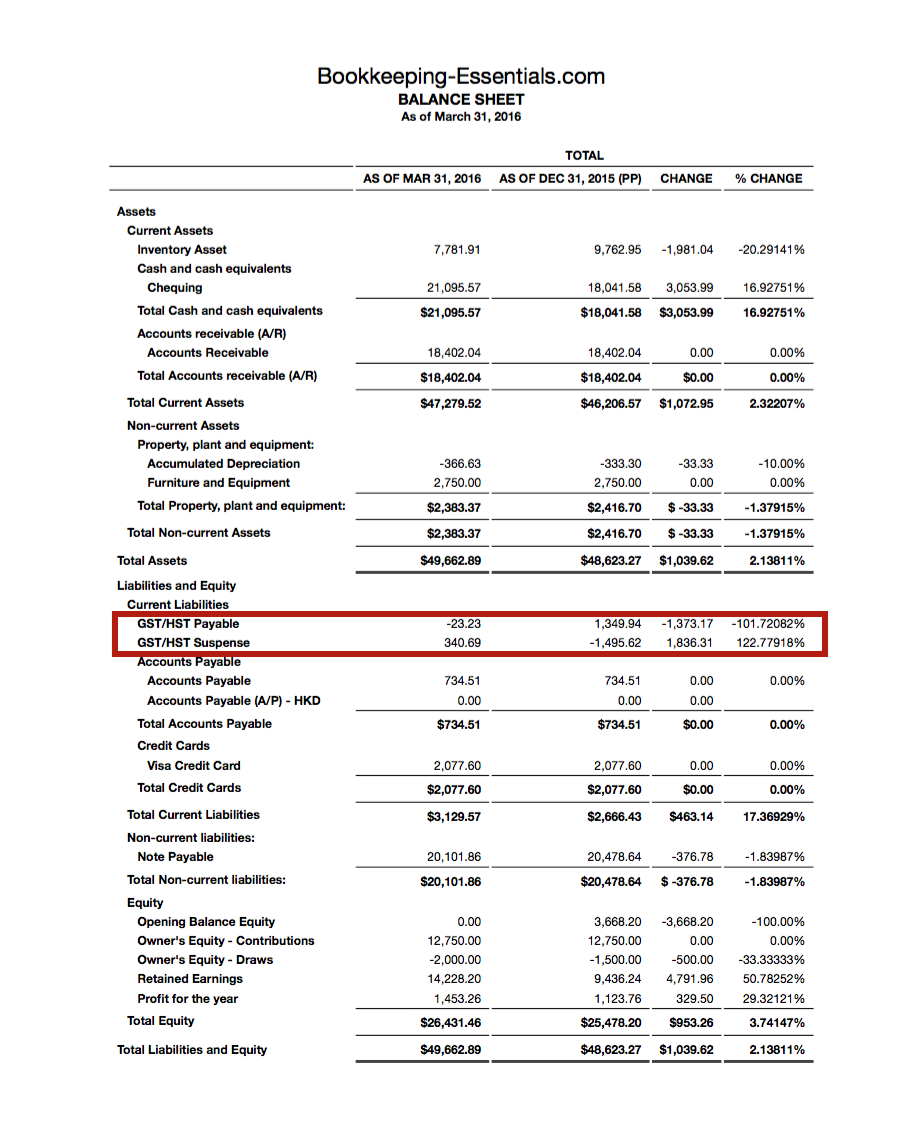

If the balance of suspense account shows the credit balance , it is recorded on a liability side in the balance sheet. As you gather more data, a suspense account also can hold information about discrepancies. A company can use a suspense account to record ambiguous entries on its.

If you get a payment, but you don’t know who has sent it, you may need to place the amount in a suspense account. If the balance of suspense account shows the debit balance, it is recorded on an asset side in the balance sheet. As the name suggests, a suspense account is an account that temporarily records amounts that are yet to have their proper accounts determined.

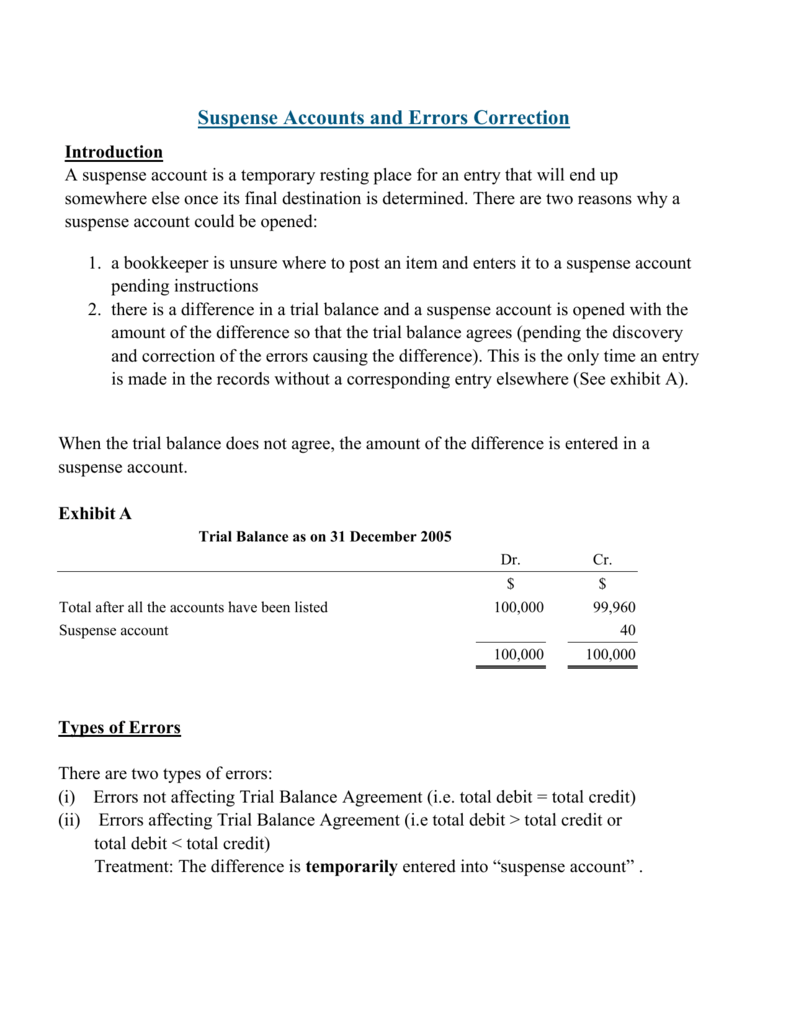

A bookkeeper is unsure where to post an item and enters it to a suspense account pending instructions Let’s say you receive money from a customer called john for delivering him goods without an invoice. Suspense accounts are temporarily classified as a balance sheet account, usually under the heading of current assets or current liabilities depending on the normal balance.

It is good business practice to record all transactions. Asset liability revenue expense examples of suspense accounts assume that a company receives cash of $500 but cannot readily determine the reason why. In case a suspense a/c is not closed at the end of an accounting period, the balance in suspense account is shown on the asset side of a balance sheet if it is a “debit balance”.

The suspense account is used because the appropriate general ledger account could not be determined at the time that the transaction was recorded. A suspension account is an account used for any expenditure or balance that can not be established temporarily. Transactions are unidentified or unclassified at the time of occurrence, or 2.

A suspense account is used to address errors and uncertainties in the ledger. Once the accounting staff investigates and clarifies the purpose of this type of transaction, it shifts the transaction out of the suspense account and into the correct account (s). In case of a “credit balance”, it is shown on the liability side of a balance sheet.

Any amount posted to the suspense account will only be present temporarily, as this amount will be investigated and posted to the appropriate account. A suspense account is one that temporarily records transactions that have yet to be assigned to their proper accounts. Having said that, any sums recorded in this account will ultimately be transferred to another.

:max_bytes(150000):strip_icc()/SuspenseAccount_Final2_4188324-6c29db3daed14b529188df3910d2931c.png)