Who Else Wants Tips About Balance Sheet Of A Startup

The balance sheet is one of the three core financial statements that are used to.

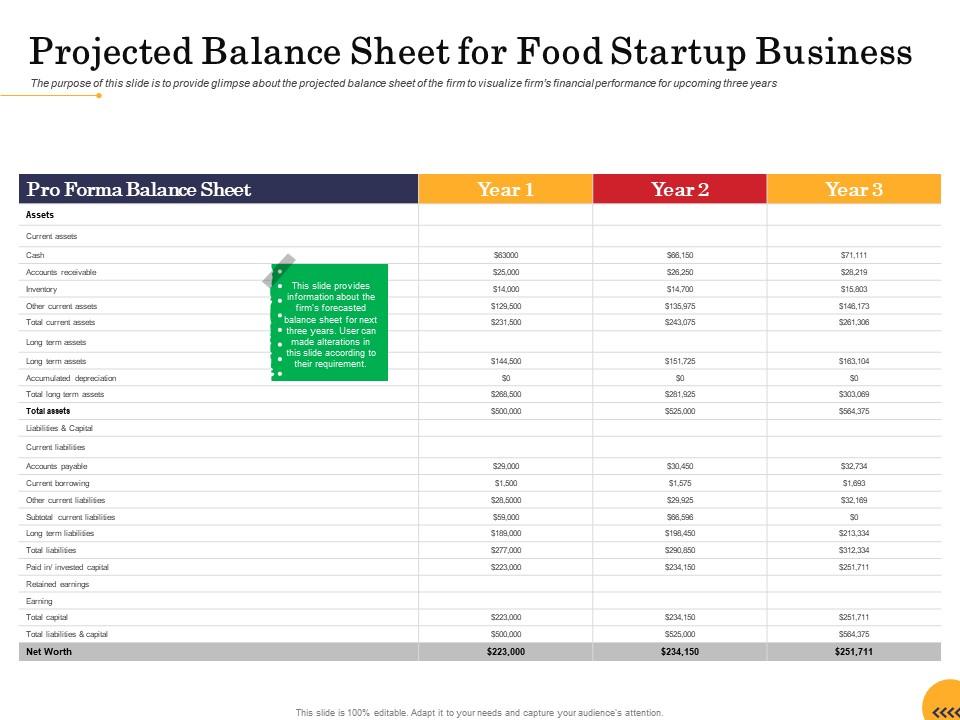

Balance sheet of a startup. The balance sheet is calculated at specific points in time, such as at a business startup, at the end of each month, quarter, or year, and at the end of the business. Apart from this, the balance sheet shows the startup owner’s equity, which represents the total assets of a business that owners can claim. The startup maintained a private.

Determine a date to create an initial balance sheet when writing your business plan. An analysis of cash and cash equivalents flowing in and out of your business; Less than 12 hours later, conrad signed a term sheet for $500 million from greenoaks, an early investor that banked elsewhere, ensuring paychecks would go out.

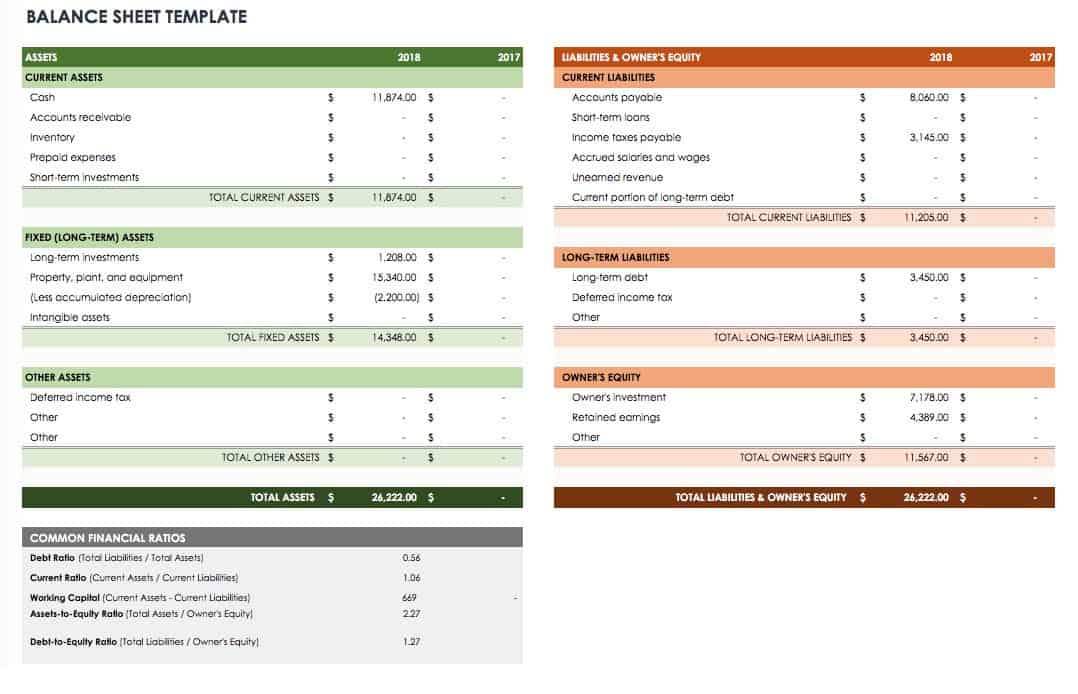

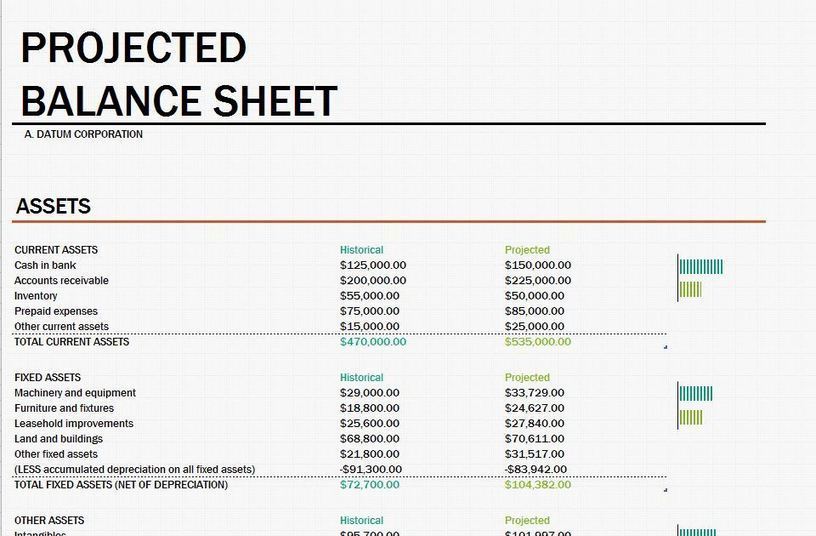

Add total liabilities to total shareholders’ equity and compare to assets. The main goal of this would be to. An overview of total costs compared to income

Owner’s equity what is a balance sheet? Fed minutes suggest officials are seeking smallest balance sheet possible. Develop a comprehensive financial plan and budget for your startup.

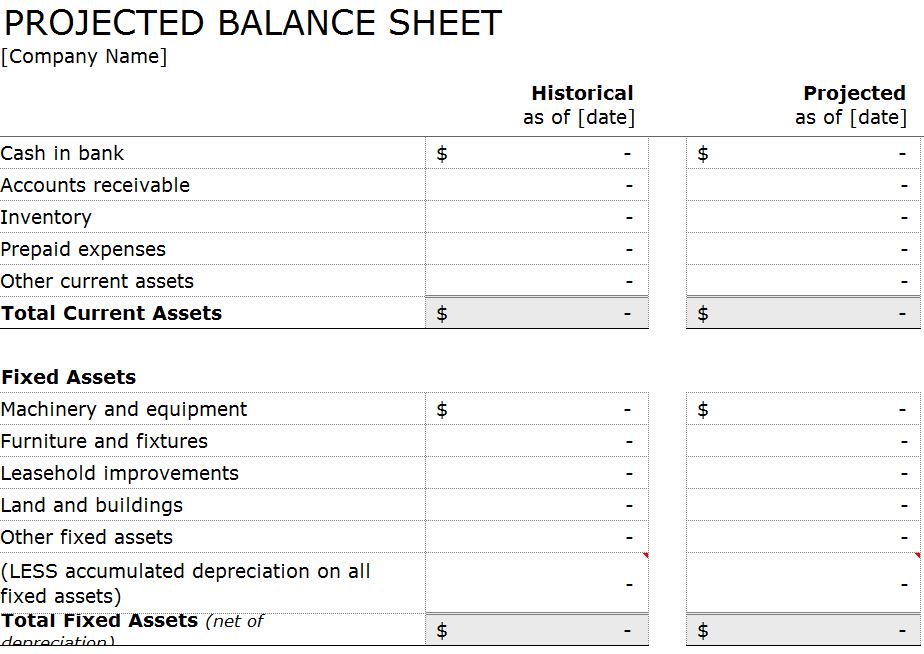

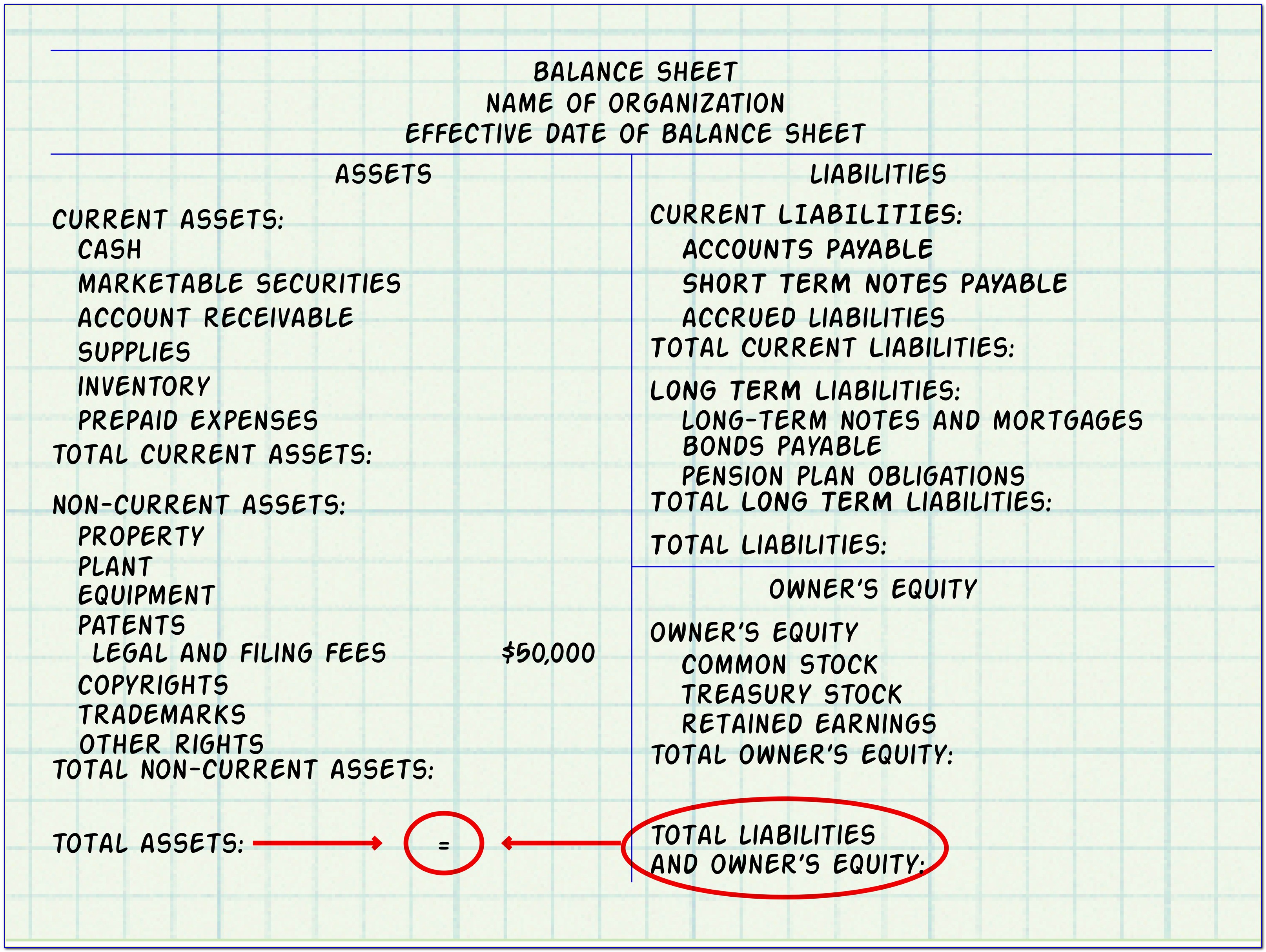

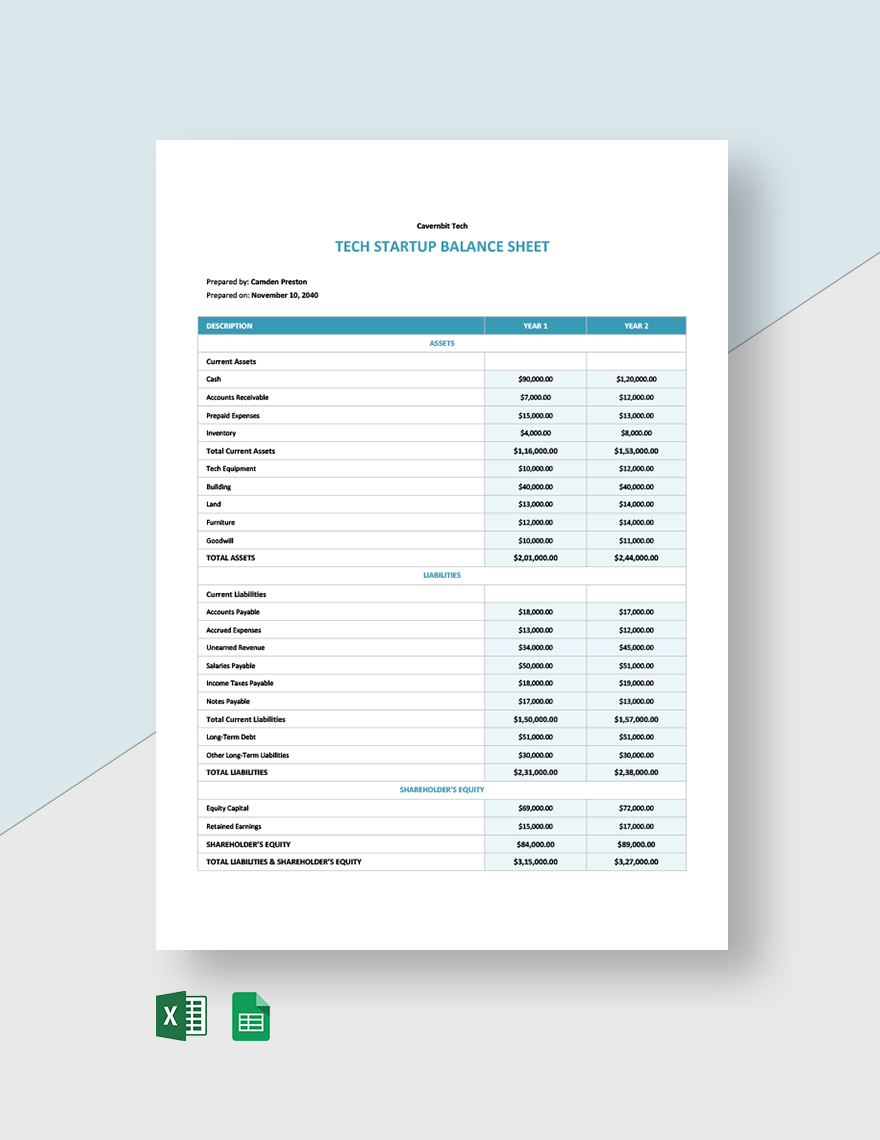

That’s higher than the level seen. A startup balance sheet or projected balance sheet is a financial statement highlighting a business startup's assets, liabilities, and owners' equity. Companies are required to create three financial reports quarterly and annually:

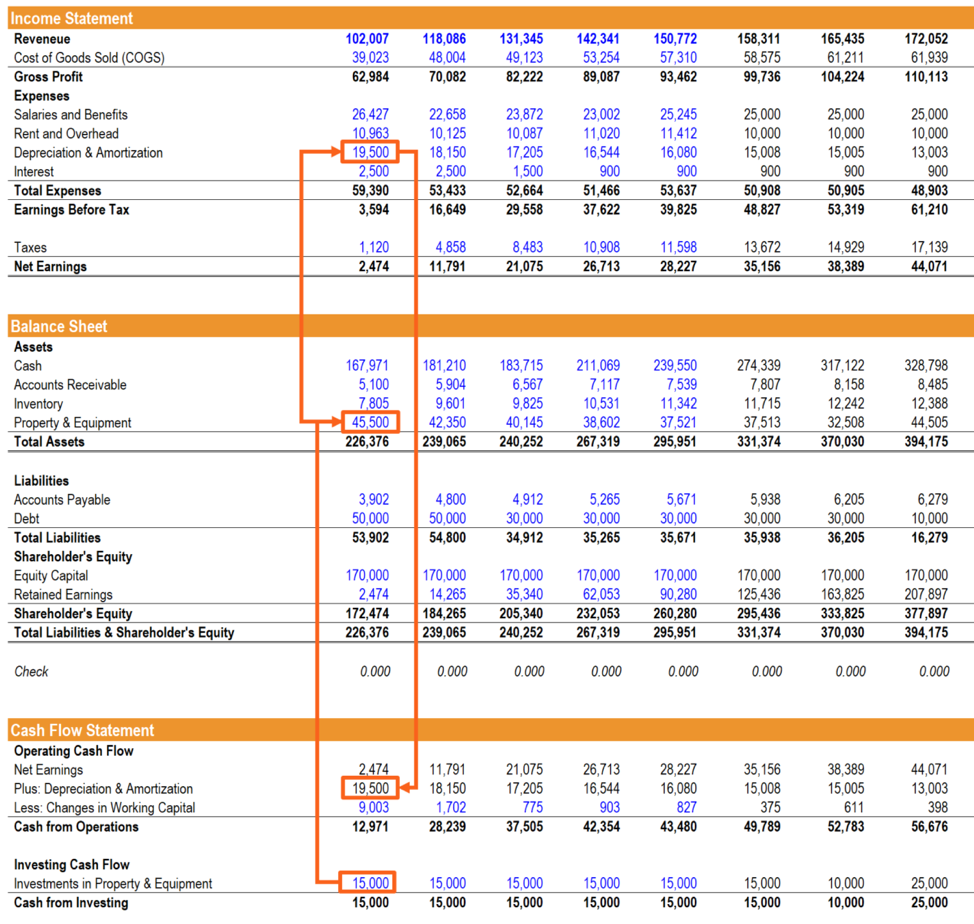

Get a head start on drafting financial statements The balance sheet is designed to give you a quick look at your company’s assets, liabilities, and equity situation (past, present, and forecasted). Our templates provide an illustrative financial statement example for tech and life sciences startups to help you prepare.

A balance sheet is a financial statement that outlines everything your business owns, owes, and has earned in the past. European markets heidelberg materials balance sheet improves as building sector recovers. Assets have declined by about $1.3 trillion since june 2022.

It's calculated at specific points in time, such as when your business is in the startup phase then at the end of each month, quarter, year, and at the end of the business. A broad overview of your company’s assets, liabilities, and equity; A balance sheet is the real indicator of your startup's financial position, it tells a story on what your startup owns and owes.

Policymakers said slower qt could ease shift to ample. Imagine being at the helm of a ship; This balance sheet template simplifies the balance sheet process by asking plain language questions and then a balanced balance sheet will be generated from those answers.

The balance sheet is an overview of everything a company owns (its assets) and owes (its liabilities) at a specific point in time. A balance sheet is a summary of your startup’s assets, liabilities, and equity to convey your company’s financial position. You can see that, similar to how we rolled up numbers from custom detail tabs for the income statement, right out of the gate in cell c4 here we need to calculate the expected cash at the end of.