Perfect Info About Cost Balance Sheet

A capitalized cost is an expense added to the cost basis of a fixed asset on a.

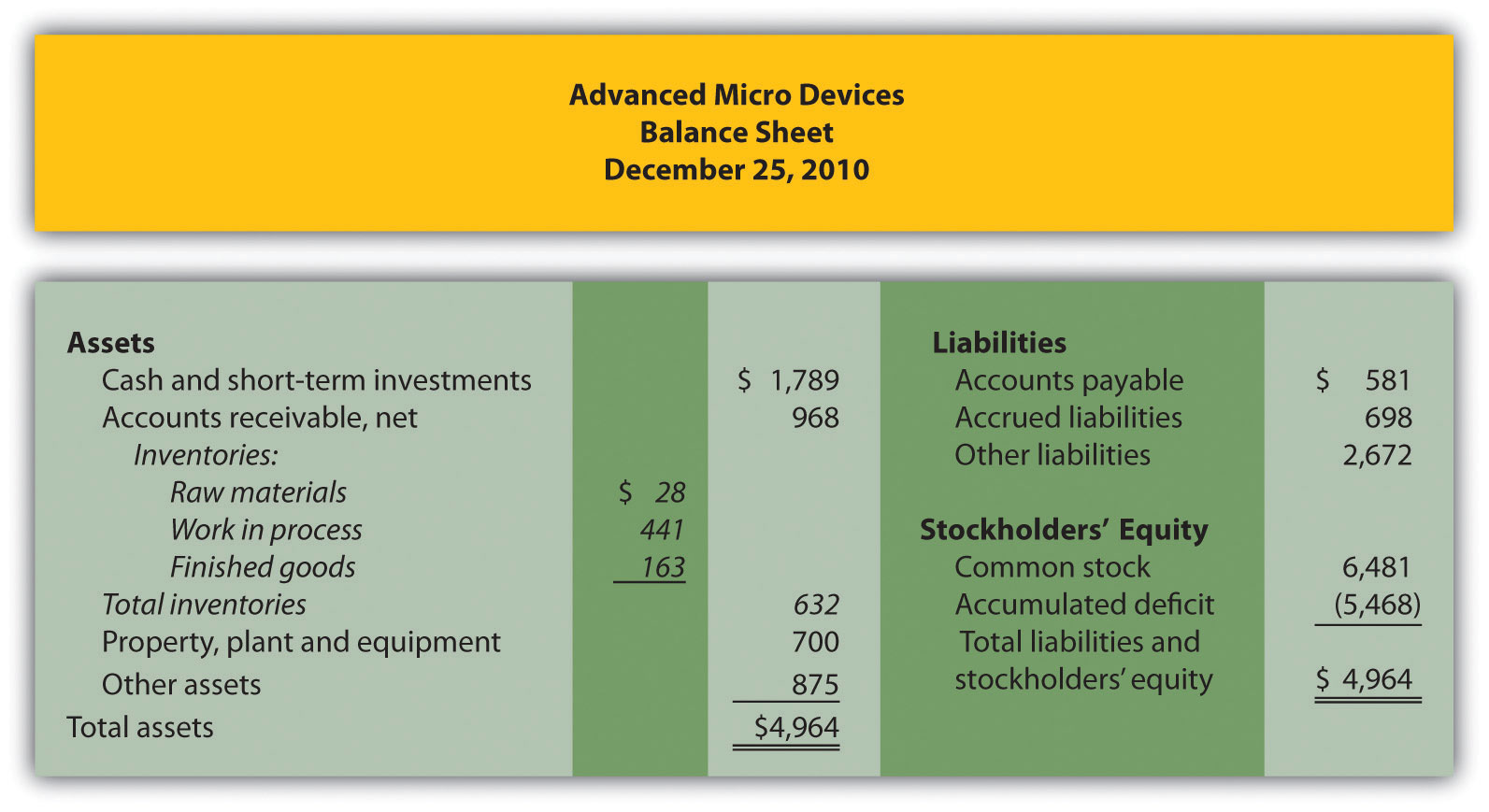

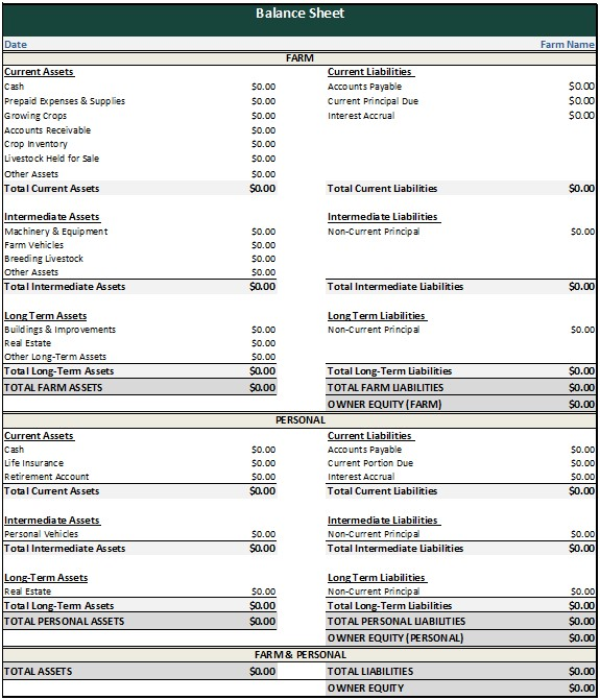

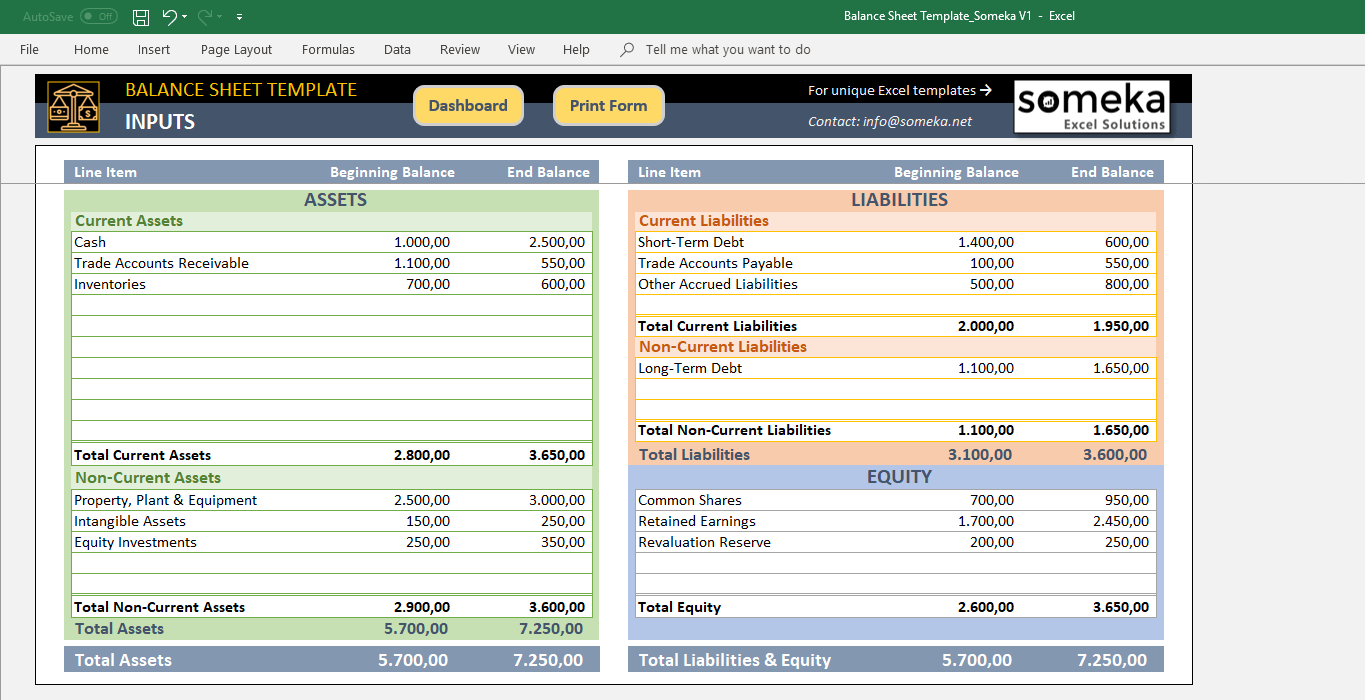

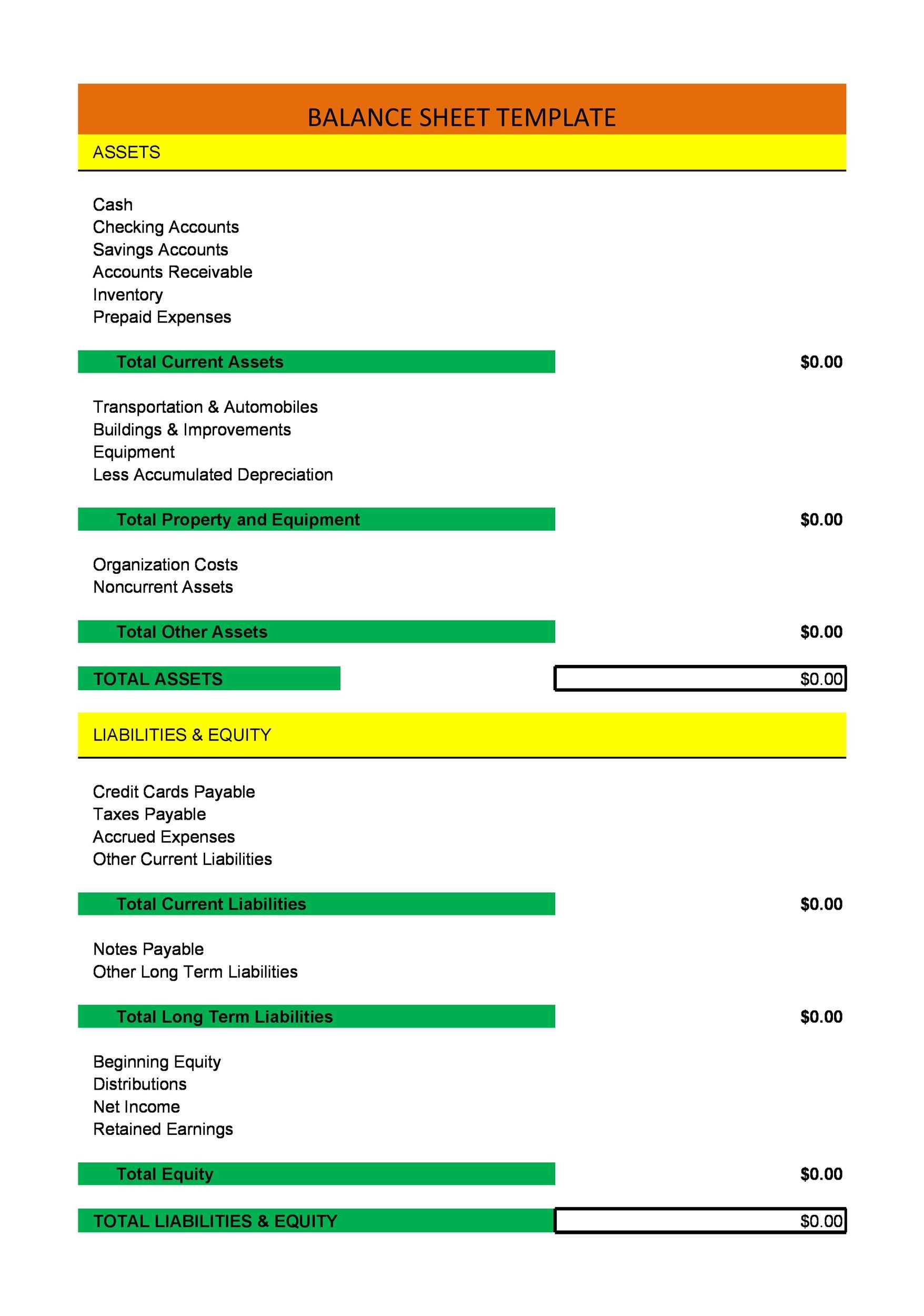

Cost balance sheet. To do this, you’ll need to add liabilities and shareholders’ equity together. Add total liabilities to total shareholders’ equity and compare to assets. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

The runoff of the bond portfolio has brought the total size. Most of a company's expenses fall into the following categories: It means that the actual costs are higher than the standard costs and the company's profit will be $50 less than planned unless some action is taken.

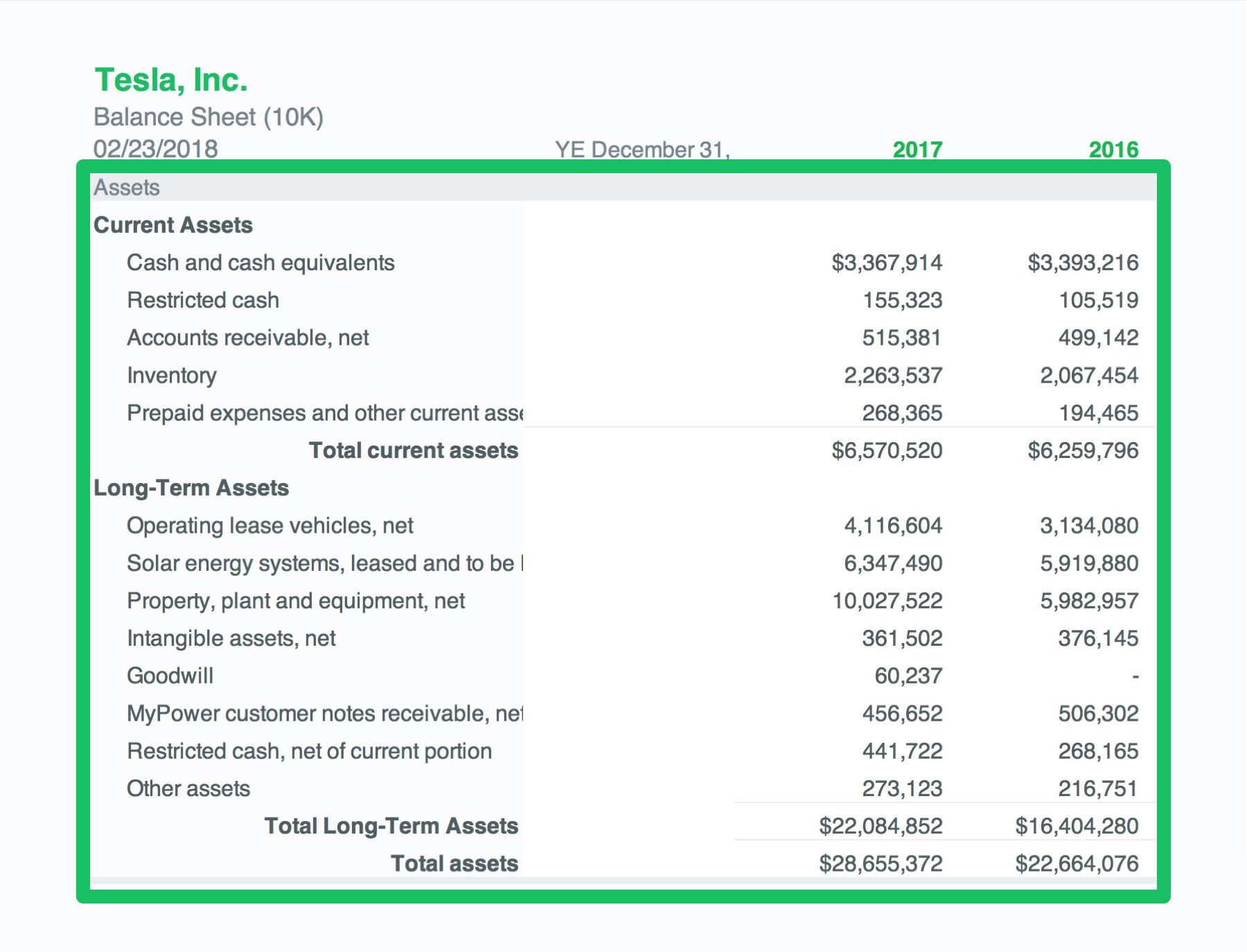

Compare the cost of any two periods and ascertain the inefficiencies if any. The balance sheet displays the company’s total assets and how the assets are. Is the cost of goods sold on the balance sheet?

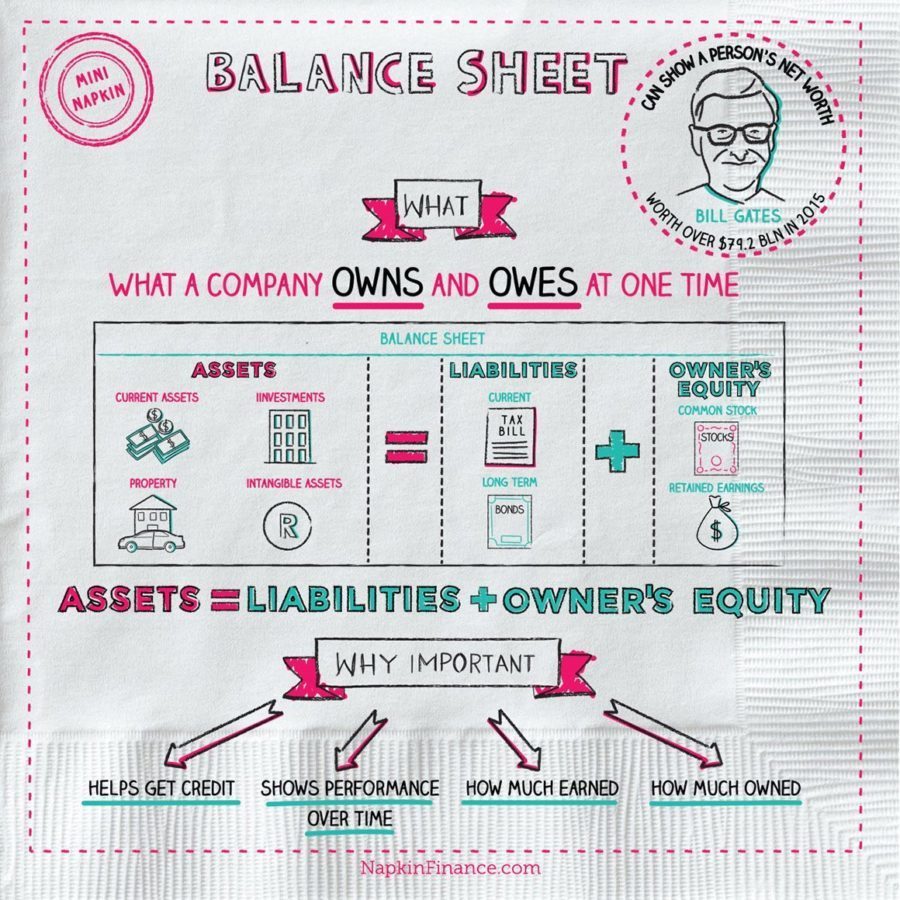

To learn more, launch our accounting courses online! The resources belonging to the company) must’ve all been funded somehow, and the two funding sources available. A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment.

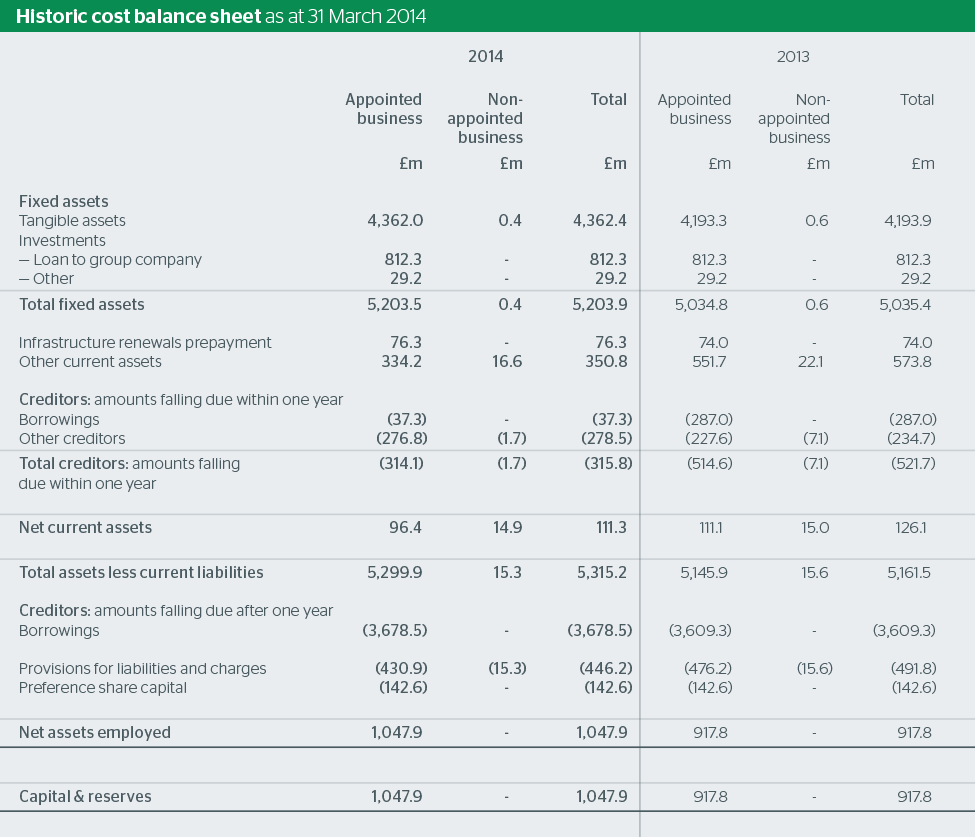

This made the older, lower. A historical cost is a measure of value used in accounting in which the value of an asset on the balance sheet is recorded at its original cost when acquired by the company. Since june 2022, the central bank has allowed more than $1.3 trillion in treasurys and.

What is the balance sheet? Updated may 01, 2023 reviewed by michael j boyle fact checked by vikki velasquez what is a capitalized cost? On june 1 your company receives an additional 3,000 yards of denim at an actual cost of $2.92 per yard for a total of $8,760 due in 30 days.

Based on provisional unaudited data. Currency in usd follow 2w 10w 9m 724.51 +2.33 (+0.32%) at close: Cogs do not comprise any overhead expenses such as rent, security charges, communication charges, etc.

That $95 billion pace is nearly double the peak rate of $50 billion the last time the fed trimmed its balance sheet, from 2017 to 2019. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. The cost concept of accounting states that all acquisitions of items (e.g., assets or items needed for expending) should be recorded and retained in books at cost.

Total cost and cost per unit for a product. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Conceptually, the assets of a company (i.e.

The investment is recorded at historical cost in the asset section of the balance sheet. The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. Yahoo finance plus essential access required.