Painstaking Lessons Of Info About Cra T2125 Guide

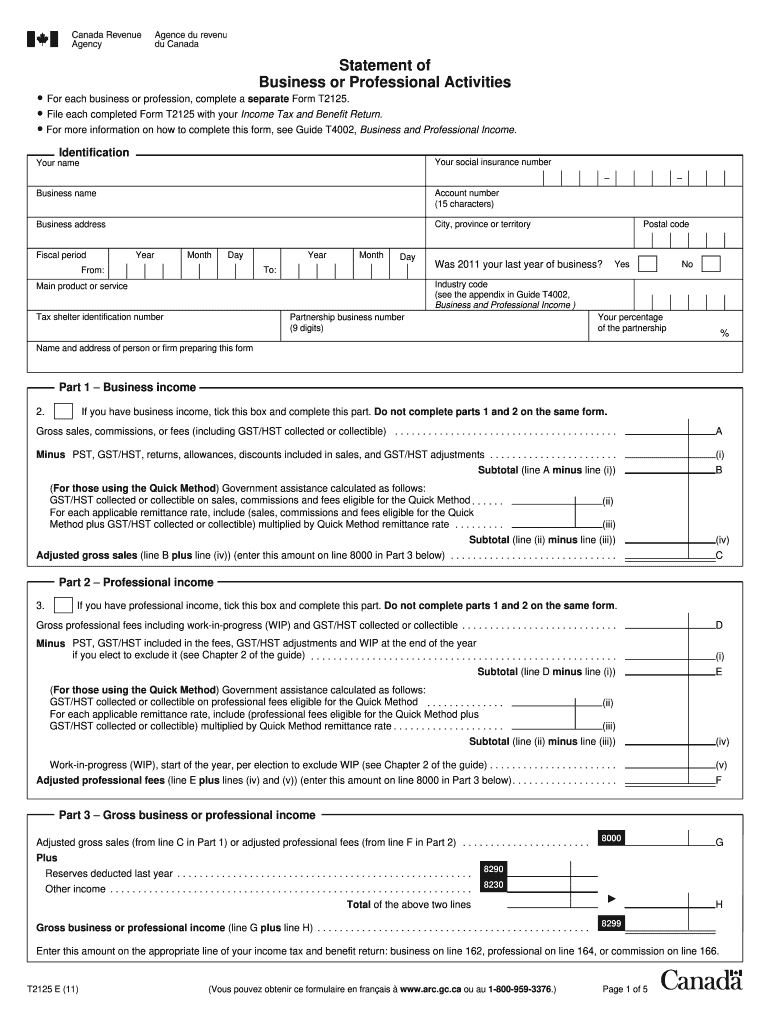

It enables the canada revenue agency (cra) to accurately evaluate how much money you made.

Cra t2125 guide. You can use form t2125, statement of business or professional activities, to report your business and professional income and expenses. T2125 statement of business or professional activities t4003 farming and fishing income t4004 fishing income date modified: The t2125 form is part of the canadian government’s t1 income tax package.

Farming income fishing income sole proprietorships if you are a sole proprietor, fill in all of the applicable areas and lines of: This form can help you calculate your income and expenses for income tax purposes. Business or professional income on form t2125,.

Form t2125, statement of business or professional activities. With a new business comes new tax responsibilities—including filing a t2125 form along with the regular t1 (personal tax documents) each year. You can use the t2125 to report your income and expenses.

We encourage you to use. T2125, also called the statement of business or professional activities, is the form that sole proprietors and partnerships use to report the income their business. Working through this guide will allow persons to fill out cra form t2125 “statement of business or professional activities” on which professional or business income and.

What is cra form t2125? 7 rows the t2125 form is available online via the canada revenue agency (cra) website. Form t2125, statement of business or professional activities form gst34, goods and services tax/harmonized sales tax return for registrants date modified:

Interest and penalties you paid on your income tax. Are there special rules for partnerships? This form combines the two previous forms, t2124, statement of business activities, and.

:max_bytes(150000):strip_icc()/CRAFormT2125-a3f2076202c546f1b72af673d094e89b.png)

/delipaperworktax-56a82fab3df78cf7729ce02e.jpg)