Awe-Inspiring Examples Of Info About Cash Flow And Budget

Pretax free cash flow is expected at a negative of about €1 billion.

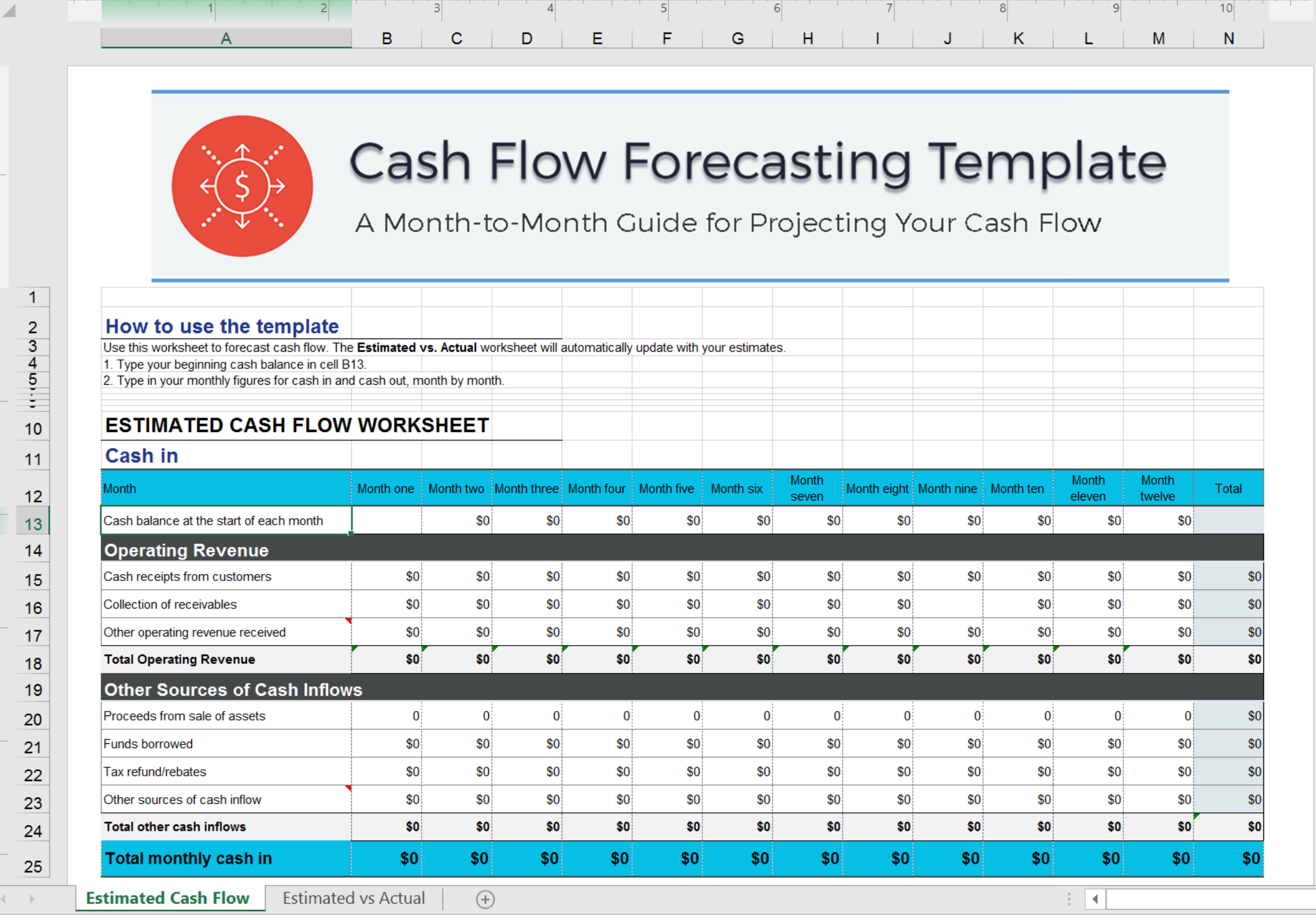

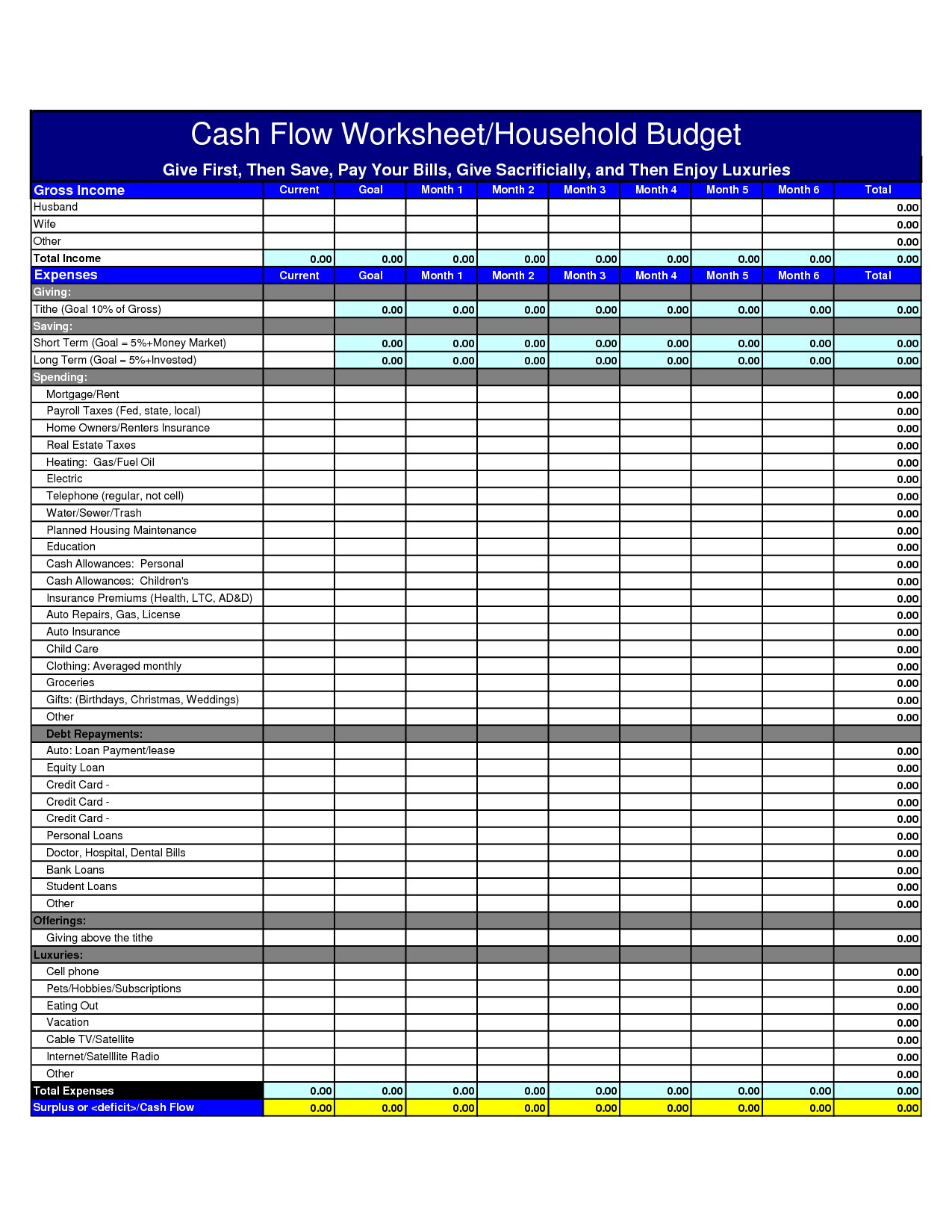

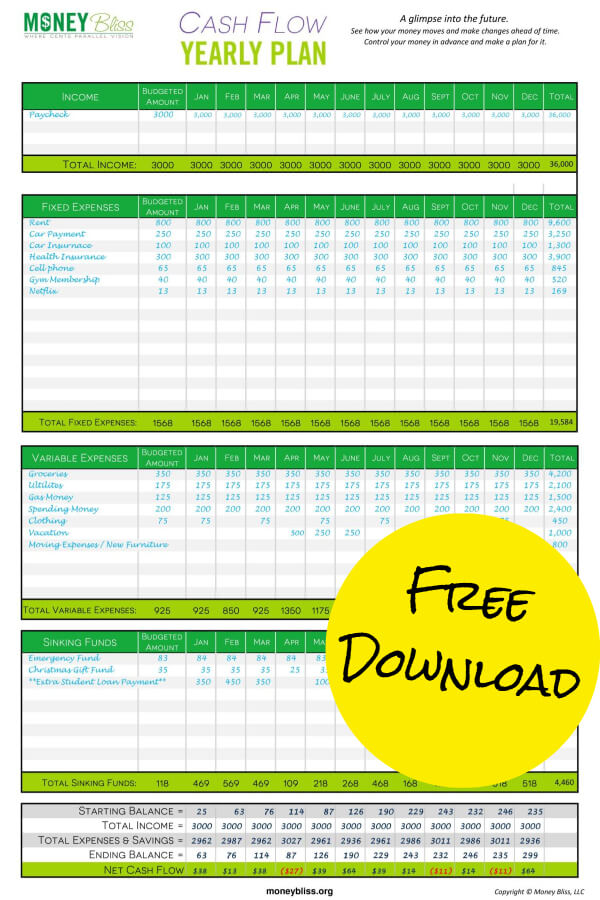

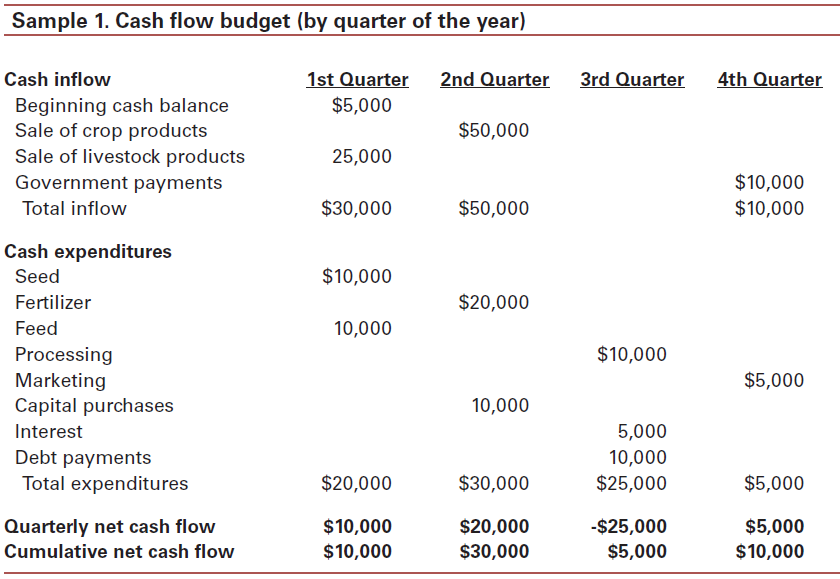

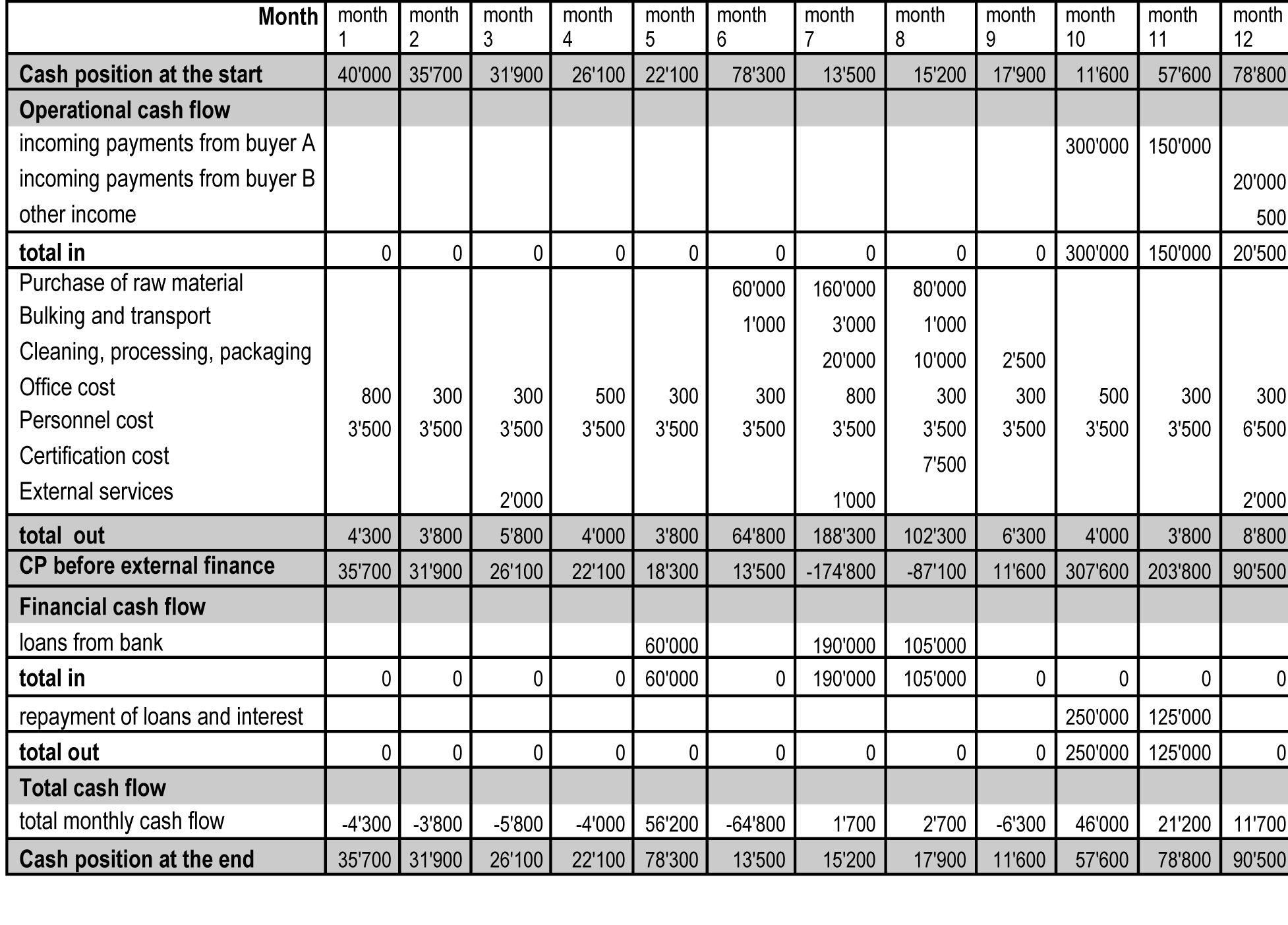

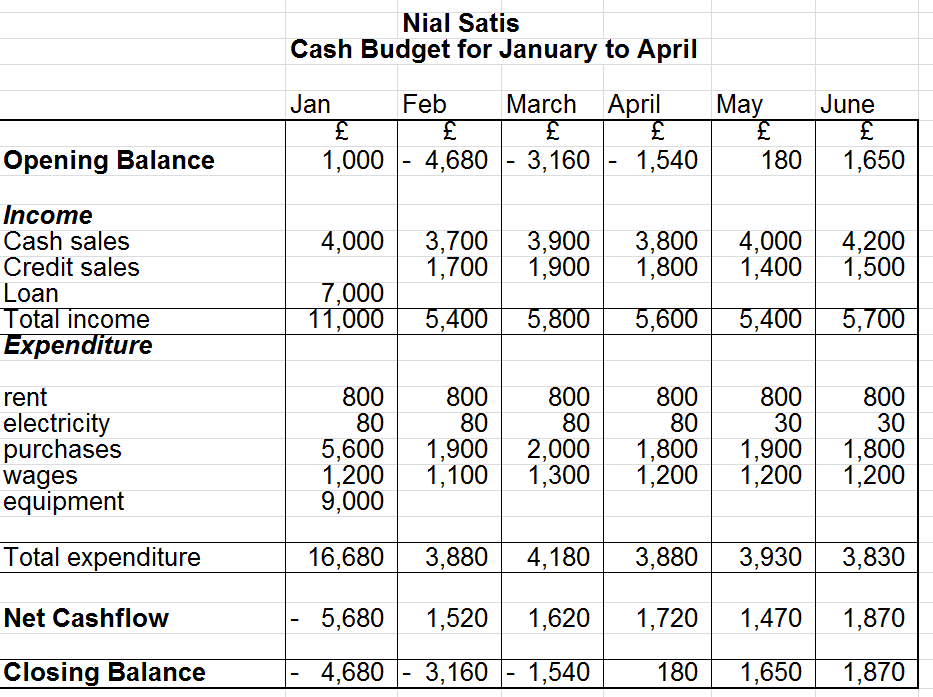

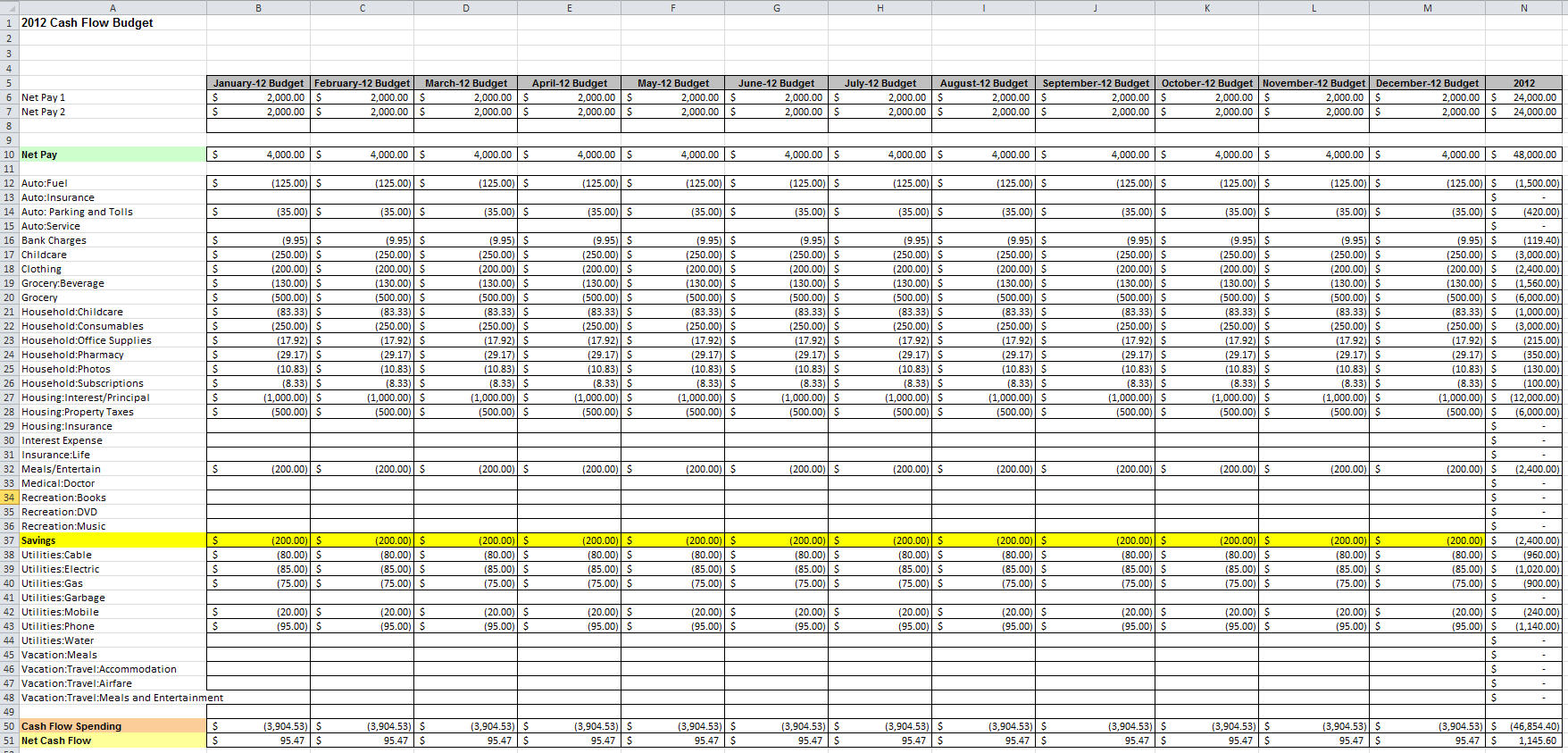

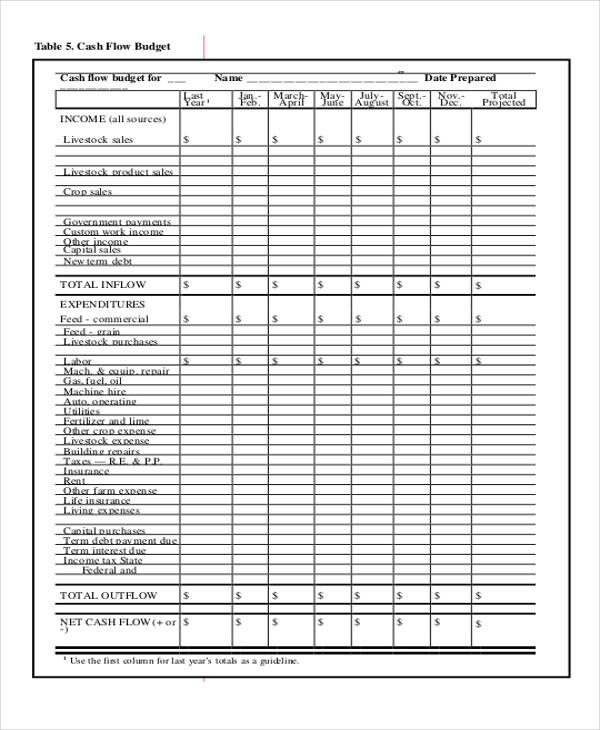

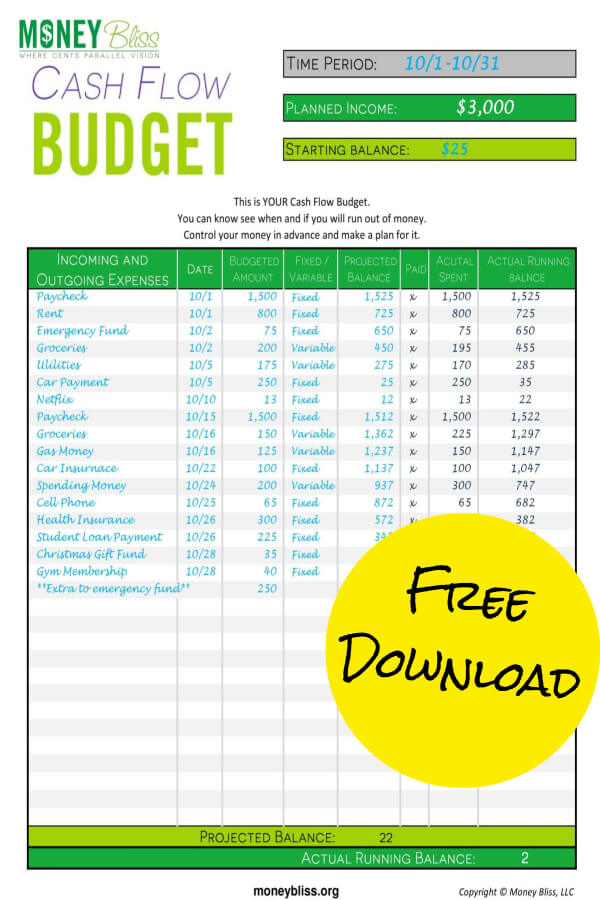

Cash flow and cash budget. A cash flow budget is an important tool for business owners who want to monitor and manage their short term financial stability. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger. A cash budget is an estimation of the cash flowsof a business over a specific period of time. this could be for a weekly, monthly, quarterly, or annual budget.

You can use the information to see if you have enough cash. A budget differs from cash flow statement because a budget both projects how you expect to allocate the cash flow and records how the cash flow was actually. Project all cash outflows for the period.

The main difference between a budget and a cash flow forecast is based on two things: Here’s how to do a cash flow budget: When you decide to make a new.

Losses at gamesa are expected at around €2 billion before special items. A cash flow budget is an integral part of your cash flow management strategy. Project all cash inflows for the period.

However, a cash flow budget. Understand budgets vs cash flow forecasts. Use it to estimate your cash flow over a given period (usually a week, month, quarter or even.

You can also use this method to project future cash flow. Provides information about various sources of cash receipts and the use of cash. A cash flow budget is an estimation of the flow of cash into and out of a business over a set period of time.

This budget is used to assess whether the entity has sufficient cash to continue operating over the given time frame. The cash flow budget formula is expressed as follows: Cash flow = cash from operating activities + cash from investing activities + cash from financing activities + beginning.

The key to making great decisions is found in managing your future budgets and forecasting future cash flow. It is a set of records, usually in. Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a simple.

Cash flow budgeting 101. A cash budget is a detailed financial document that outlines the estimate of cash inflows (income) and outflows (expenses) for a specific period of time,. They can be weekly, monthly, quarterly or an annual.

The following are the merits of the cash budget: The cash budget provides a company.