First Class Tips About Define Accounting Ratio

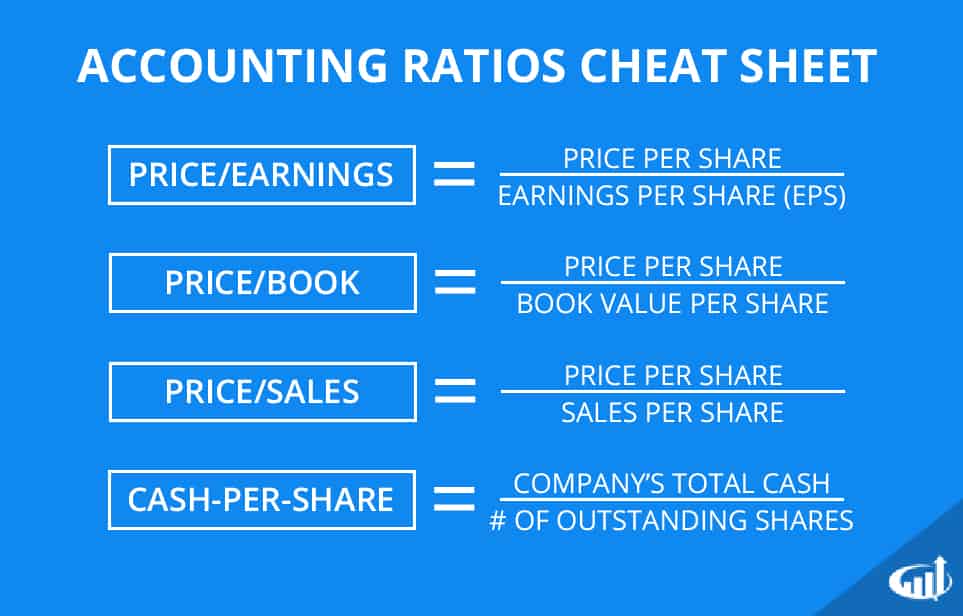

A ratio may take any of the following forms:

Define accounting ratio. Accounting ratios can be defined as mathematical expressions that compare different financial variables to determine the relationship between them. A ratio is a mathematical relation between two quantities expressed as a. Shareholders, creditors and other such stakeholders of.

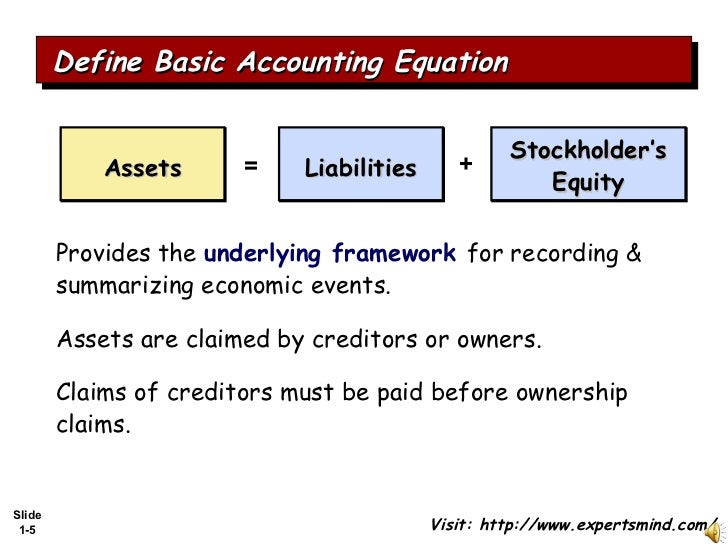

Liquidity, profitability, debt, operating performance, cash flow, and investment valuation. The balance sheet provides accountants with a snapshot of a company’s capital structure, one of. They are applied to calculate the profitability and performance of a business on the grounds of its financial statements.

The income statement contains information about company sales, expenses, and net. Accounting ratio is the comparison of two or more financial data which are used for analyzing the financial statements of companies. Financial ratio sources could be the balance sheet, income statement, or.

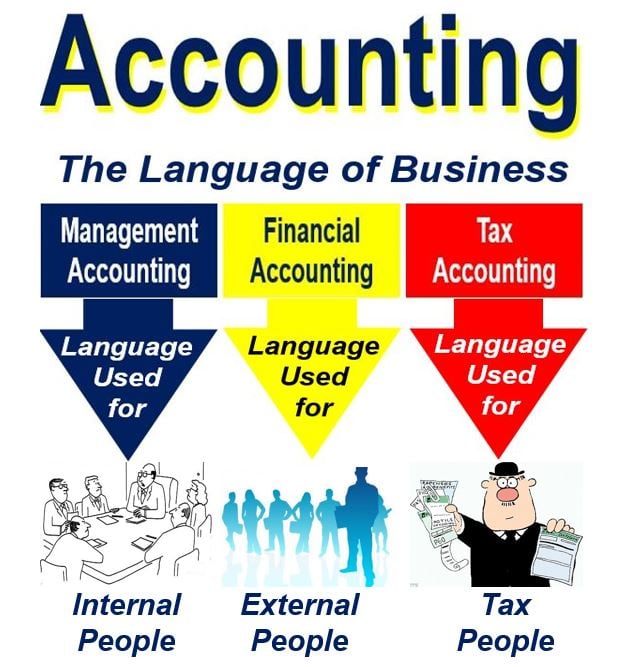

What are accounting ratios? Accounting ratios measure your organization’s profitability and liquidity and can show if it’s experiencing financial problems. Accounting ratios are an excellent tool to help us determine the financial health.

Arr is calculated as average annual profit / initial investment. Complete list of all the major accounting ratios, their formulas and definitions. The operating cash flow ratio is a measure of the number of times a company can pay off current liabilities with the cash generated in a given period:

What are accounting ratios? This type of analysis is particularly useful to analysts outside of a business, since their primary source of. The accounting ratios or ratios in management accounting have four ratios:

There are mainly 4 different types of accounting ratios to perform a financial statement analysis; First of all, what is a ratio? We calculate the majority of ratios from data that the firm’s financial statements provide.

Net income divided by (fixed assets plus net working capital). By analyzing these ratios, stakeholders can gain a deeper. It is an effective tool used by the shareholders, creditors and all kinds of stakeholders to understand the profitability, strength and financial status of companies.

To calculate a ratio, therefore, one needs two figures. These ratios are derived from a company’s financial statements, such as the balance sheet, income statement, and cash flow statement. The accounting rate of return (arr) formula is helpful in determining the annual percentage rate of return of a project.

Types of accounting ratios gross margin and operating margin. Accounting ratios, also known as financial ratios signify the relationships between figures of the balance sheet and the profit & loss account. Return on net assets (rona):

/GettyImages-1165045615-3989ced2efa44ab28634ac73786b8121.jpg)