Fun Info About Cost Of Goods Sold Statement Example

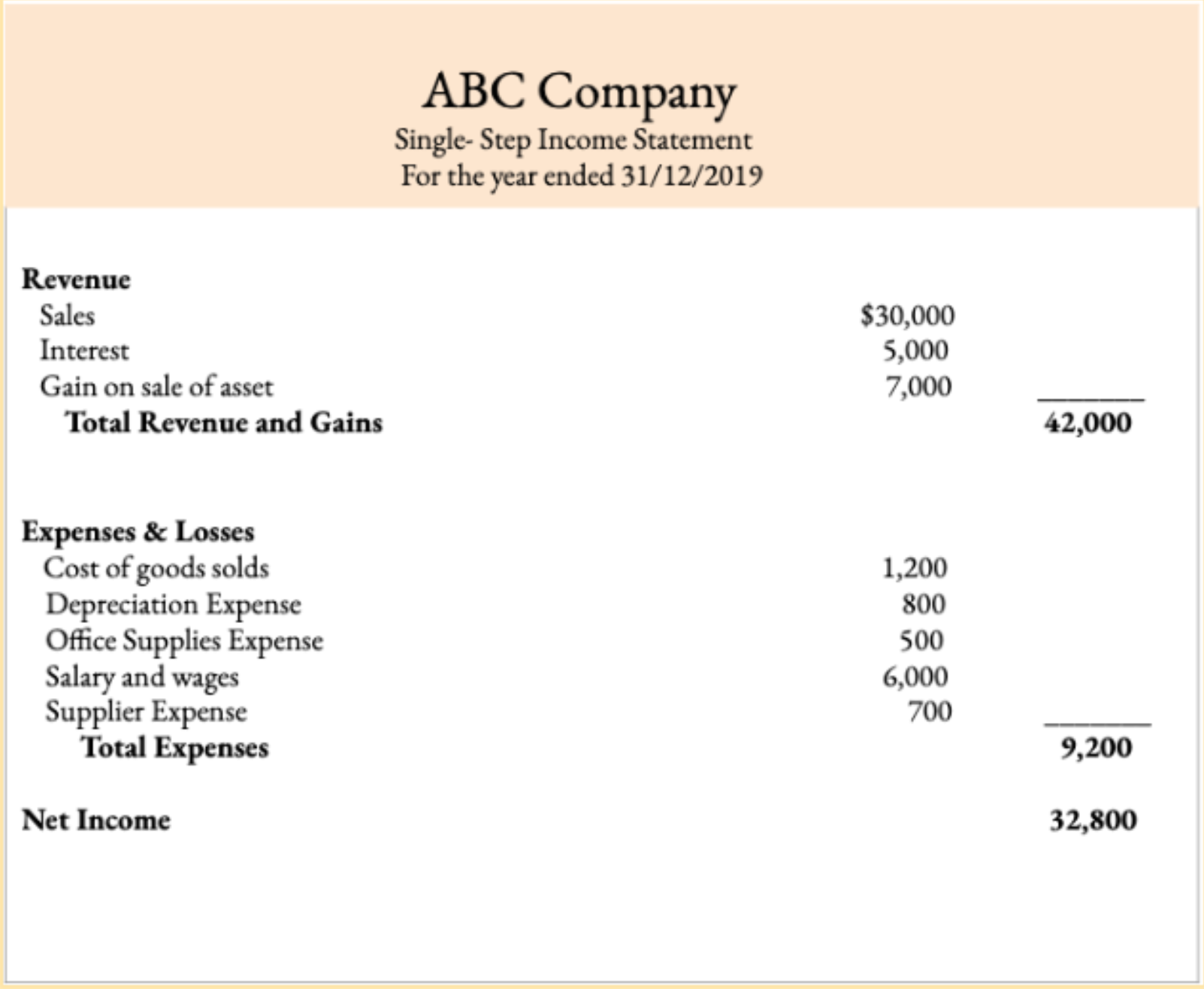

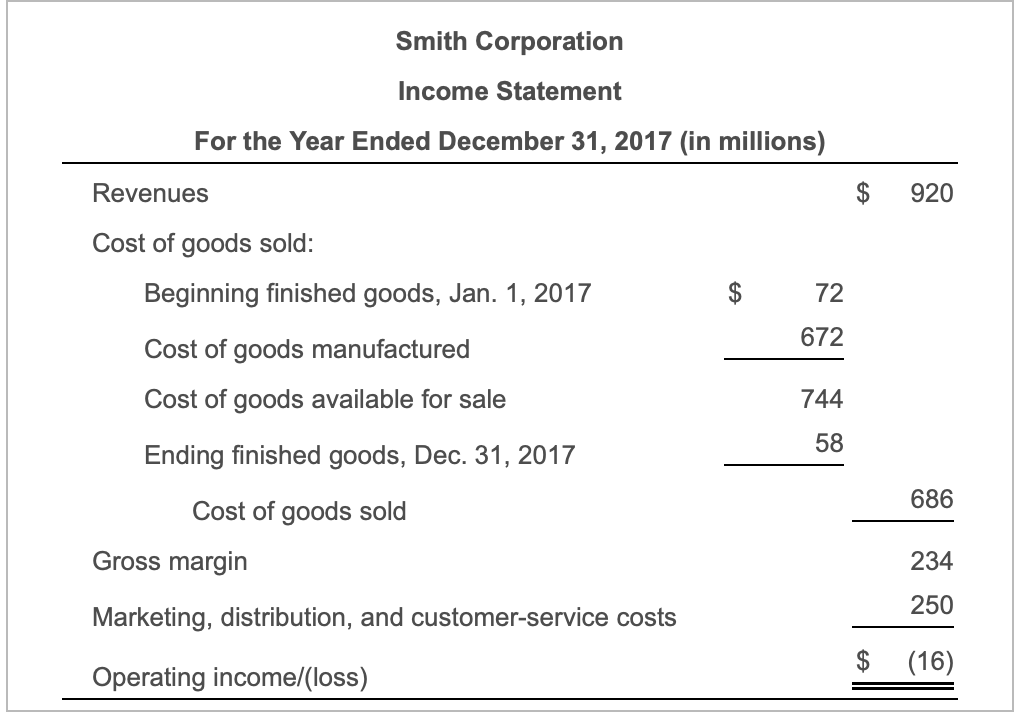

Therefore, the cost of goods sold for this manufacturer in that particular year is $1,200,000.

Cost of goods sold statement example. The cost of sending the cars. Per unit cost = cost of goods manufactured / units manufactured. Cost of goods sold (cogs) template.

If you own a pizza parlor, for example, your cost of goods sold would include the amount of money you spend purchasing such items as flour, tomato sauce, and the boxes you use to keep the pizzas safe during delivery. It includes the costs of the materials, storage and manufacturing labour, but not indirect costs such as distribution, marketing and management salaries. How to calculate cost of goods sold.

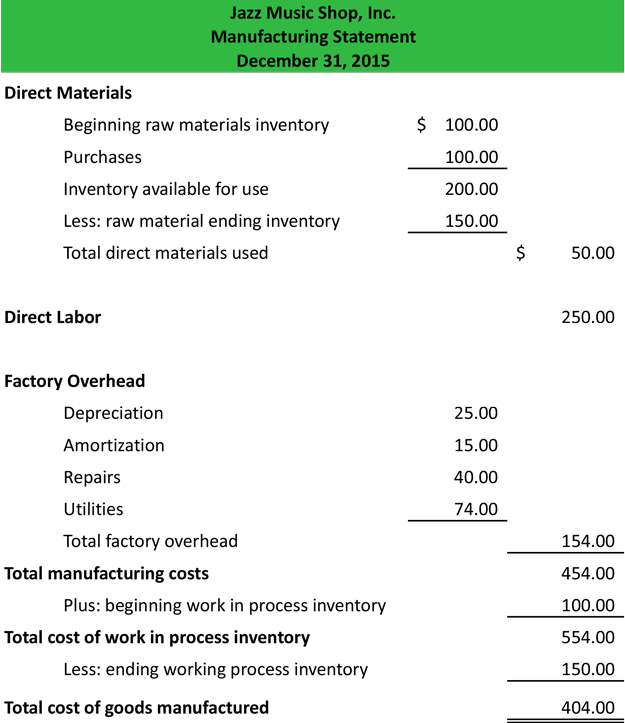

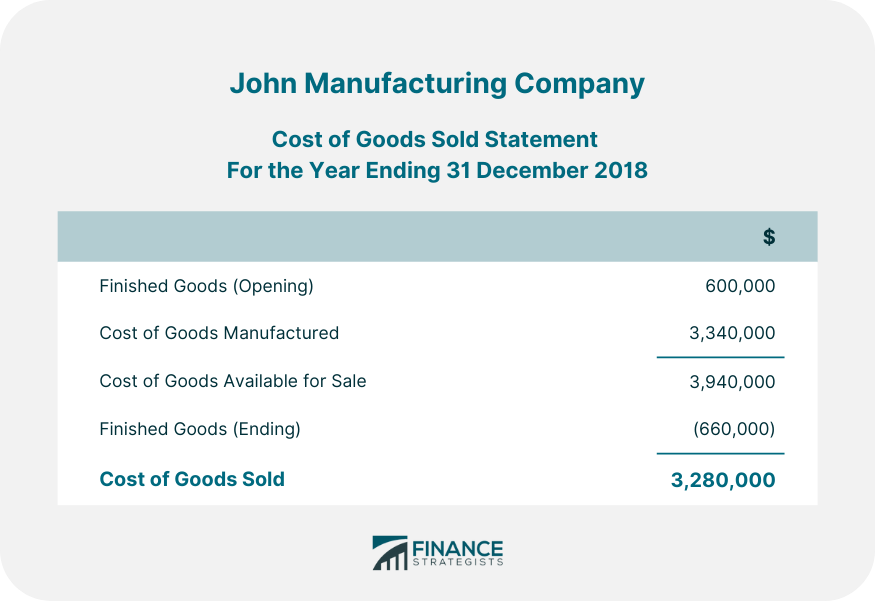

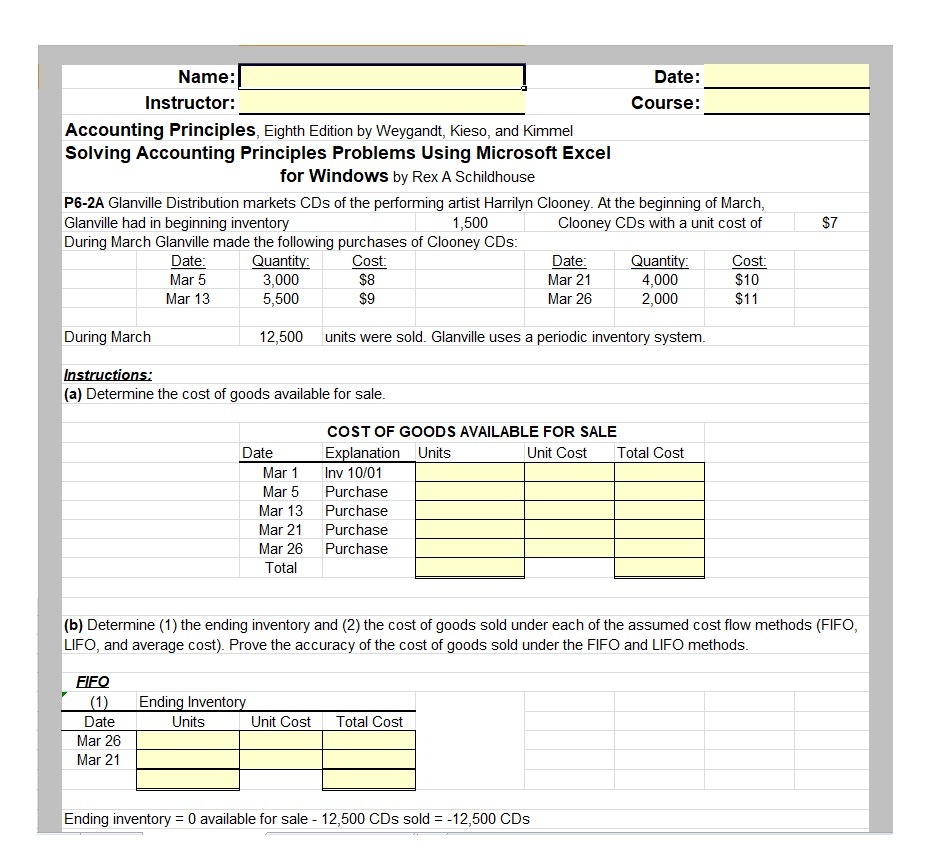

Knowing the cost of goods sold can help you calculate your business’s profits. Example john manufacturing company, a manufacturer of soda bottles, had the following inventory balances at the beginning and end of 2018: In this case, since the operations were only started during the current year, there will.

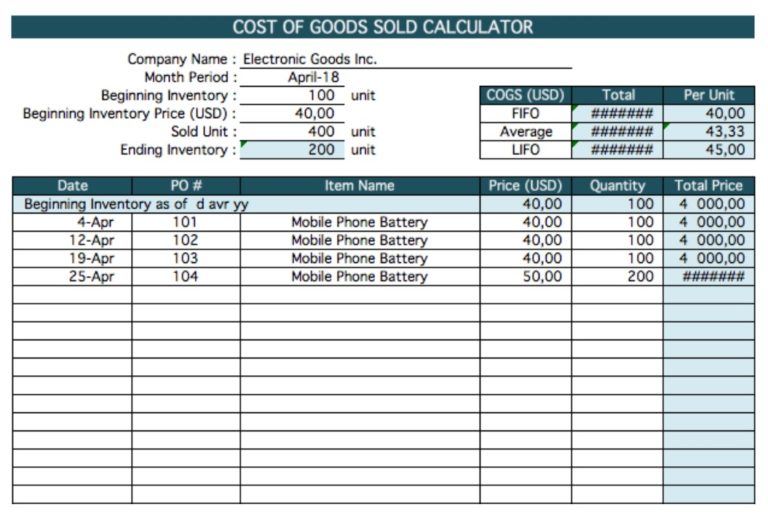

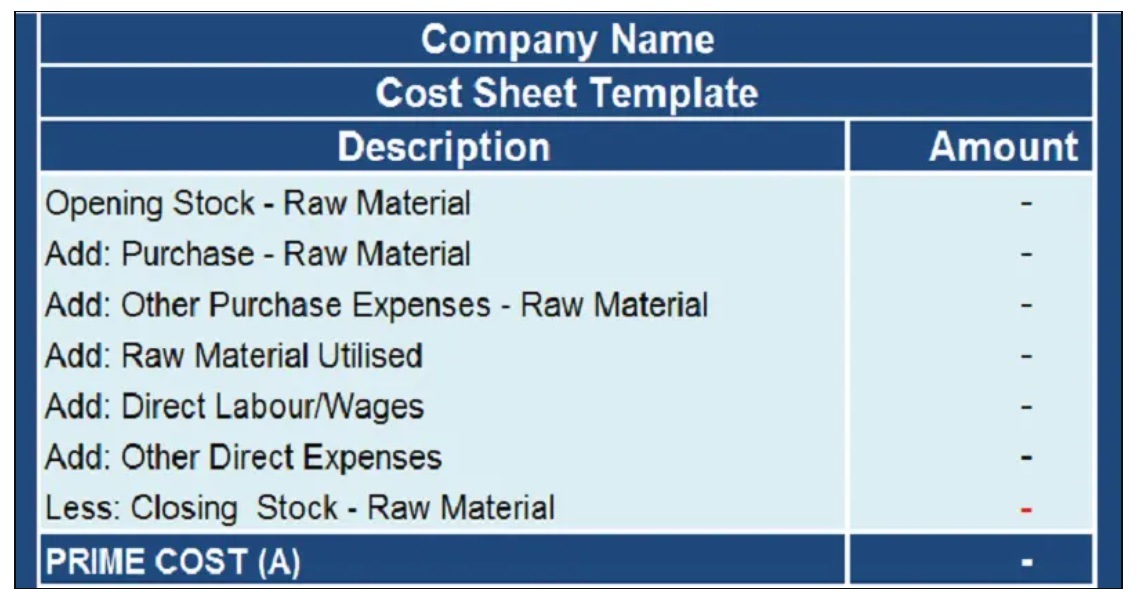

Download the free excel template. To calculate cogs, take the cost of initial inventory and add additional direct costs during the period you are measuring. The cost of goods sold is considered an expense in accounting.

Cogs is considered a business expense and impacts your profit — the higher your cogs, the lower your profit margin. Total per unit cost = 1.96 + 1.98 + 1.952 = 5.892 >>> read cost of goods sold However, due to rising material prices, the last unit costs $10 to produce.

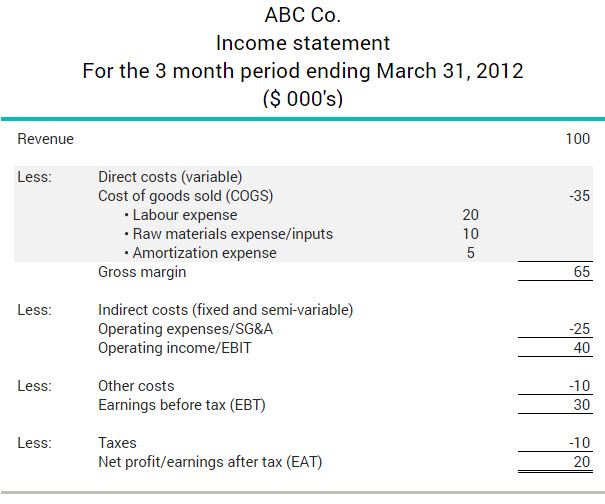

Cost of goods sold is the direct cost incurred in the production of any goods or services. Cost of goods sold statement for the year ended. This amount includes the cost of the materials used to create the good and the direct labor costs used to produce the good.

It’s essential to note that these examples are simplified for clarity. Per unit cost of foh = 48,800 / 25,000 = 1.952. Cost of goods sold for the period:

Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. In the subsequent period, the company sold three units. Here’s how calculating the cost of goods sold would work in this simple example:

Then, subtract the value of the inventory yet to be sold. For example, cogs for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together. So, cogs is an important concept to grasp.

Cogs can also inform a proper price point for an item or service. Get the excel template! Let us say that you are selling bath soaps.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)